As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

Professional Investor Behavior During Market Swoons

Professional investors, managing vast sums of money, employ sophisticated strategies to mitigate risk and protect their clients' investments. Their actions during a market correction significantly influence overall market trends.

Reasons for Professional Selling

During a market swoon, professional selling is often driven by several factors:

- Risk aversion: Professionals prioritize preserving capital, especially during periods of heightened uncertainty. Risk management is paramount.

- Hedging strategies: They may employ hedging techniques, such as using derivatives, to offset potential losses in their portfolios.

- Profit-taking: Some professionals may take profits on investments that have performed well, locking in gains before a potential further downturn.

- Meeting client redemption requests: Institutional investors often face client withdrawals, forcing them to liquidate assets to meet these demands.

- Portfolio rebalancing: To maintain a desired asset allocation, professionals might sell overweighted positions and buy undervalued ones, leading to selling pressure during a market correction. This is a core component of portfolio optimization.

Selling Techniques Employed by Pros

Professional investors utilize various techniques to execute their selling strategies effectively:

- Programmatic selling: Algorithmic trading allows for the automated execution of large trades, minimizing market impact and maximizing efficiency.

- Block trades: These large, privately negotiated trades allow institutions to offload significant positions without significantly affecting the public market price. This is especially relevant during periods of low market depth.

- Derivatives usage: Sophisticated derivatives strategies allow for hedging against market risk and potentially profiting from market declines. High-frequency trading firms often utilize these tools.

Individual Investor Behavior During Market Swoons

In contrast to the measured approach of professionals, individual investors often exhibit markedly different behavior during market swoons.

The "Fear of Missing Out" (FOMO) Factor

Psychological factors significantly influence individual investor decisions during market dips:

- Emotional decision-making: Fear and panic can lead to impulsive buying or selling, often resulting in poor investment outcomes.

- Contrarian investing (mistakenly believing the bottom has been reached): Some individuals may incorrectly assume that a market bottom has been reached, leading them to buy aggressively at potentially high prices. This is a risky aspect of behavioral finance.

- Chasing bargains: While the concept is sound, the execution often lacks the necessary market analysis and risk assessment, leading to flawed decisions. Market sentiment plays a large role here.

Access to Information and Trading Platforms

The ease of accessing information and trading platforms significantly impacts individual investor behavior:

- Increased access to financial news and data: The proliferation of financial news sources and data platforms provides seemingly readily available information, but not all of it is accurate or reliable.

- Ease of online trading: User-friendly online brokerage accounts and trading apps make it easier than ever to buy and sell investments, potentially fueling impulsive decisions.

- Influence of social media: Social media platforms can amplify market sentiment, influencing individual investors' decisions based on often unreliable information spread by retail investors.

Analyzing the Market Impact of Divergent Investor Behaviors

The contrasting behaviors of professional and individual investors have significant implications for market dynamics.

Short-Term vs. Long-Term Market Consequences

The interplay between professional selling and individual buying creates a complex market environment:

- Increased market volatility in the short term: The conflicting actions can lead to significant short-term price swings and increased market volatility.

- Potential for higher returns (or losses) in the long term: Depending on the market's subsequent direction, the actions of individual investors can either result in long-term gains if the market recovers strongly or substantial losses if the downturn continues. Long-term investment strategies are crucial in such scenarios. Market recovery depends on a multitude of factors.

Identifying Potential Opportunities and Risks

Understanding these divergent investor strategies offers both opportunities and risks:

- Opportunities for contrarian investors: Professionals' selling can create opportunities for shrewd contrarian investors who can identify undervalued assets. This requires a sophisticated investment strategy.

- Risks of buying high and selling low: Individual investors' emotional reactions can lead them to buy high during a market swoon and sell low later, resulting in significant losses. Risk tolerance is key.

- Importance of diversification: A diversified portfolio can help mitigate the risks associated with market volatility and contrasting investor behaviors. A well-diversified portfolio is essential for long-term success.

Conclusion

In summary, professional investors often sell during a market swoon due to risk management strategies, while individual investors may buy due to FOMO and easier access to markets. This contrasting behavior significantly impacts market dynamics, creating both short-term volatility and potential long-term opportunities and risks. Understanding the dynamics of a market swoon is crucial for navigating market fluctuations effectively. Learn more about developing a robust investment strategy tailored to your risk tolerance and long-term financial goals, helping you to better weather future market downturns and market swoons.

Featured Posts

-

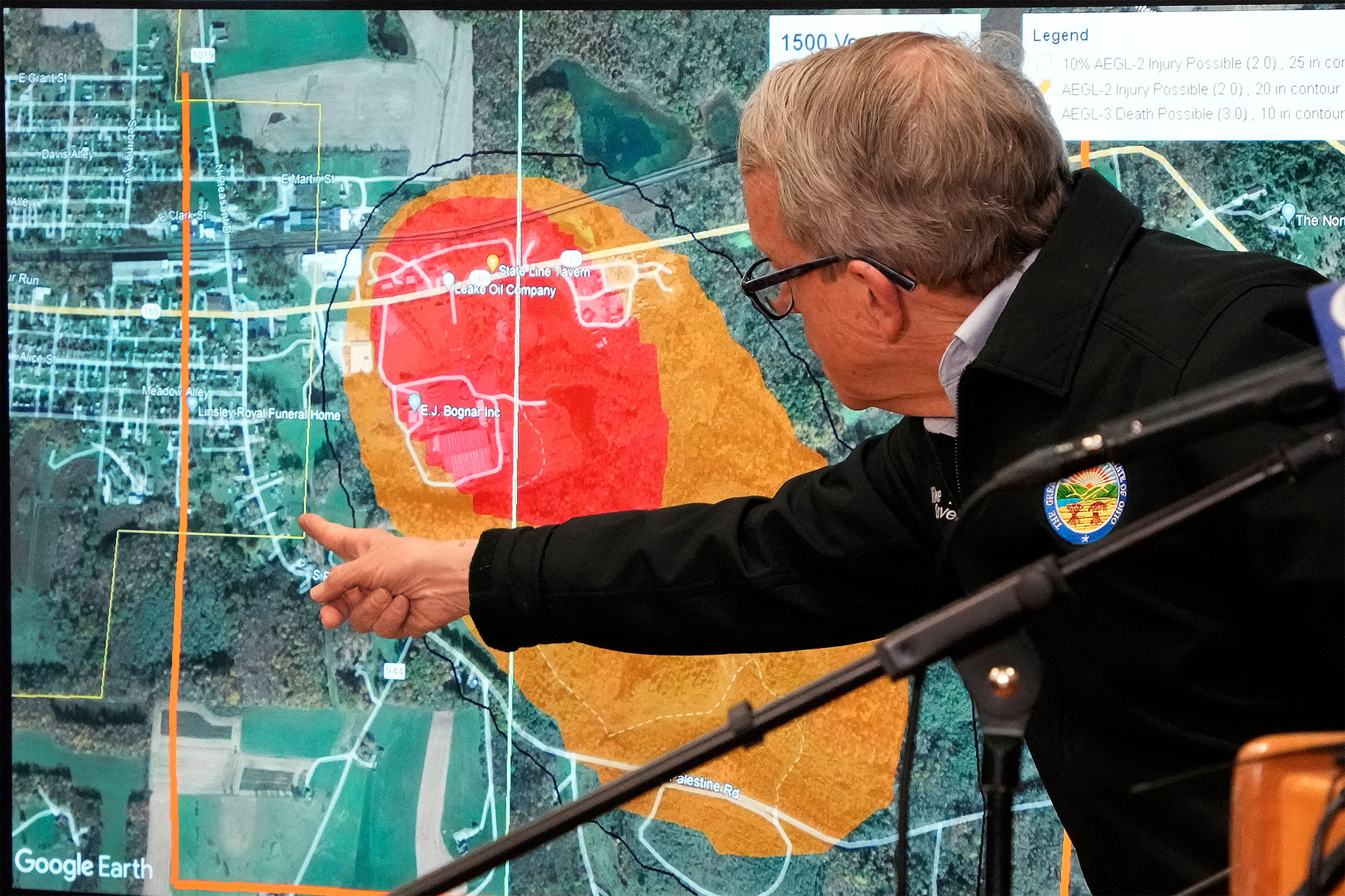

Investigation Into Lingering Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025

Investigation Into Lingering Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025 -

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025 -

Aaron Judge Welcomes Child With Samantha Bracksieck

Apr 28, 2025

Aaron Judge Welcomes Child With Samantha Bracksieck

Apr 28, 2025 -

Federal Judge To Hear Case Of 2 Year Old Us Citizen Facing Deportation

Apr 28, 2025

Federal Judge To Hear Case Of 2 Year Old Us Citizen Facing Deportation

Apr 28, 2025 -

Red Sox Breakout Identifying The Next Big Star

Apr 28, 2025

Red Sox Breakout Identifying The Next Big Star

Apr 28, 2025

Latest Posts

-

Nba Betting Cavaliers Vs Knicks Game Predictions And Best Odds February 21

May 12, 2025

Nba Betting Cavaliers Vs Knicks Game Predictions And Best Odds February 21

May 12, 2025 -

Cavaliers Vs Knicks Prediction Betting Odds And Expert Picks Feb 21

May 12, 2025

Cavaliers Vs Knicks Prediction Betting Odds And Expert Picks Feb 21

May 12, 2025 -

February 21st Nba Cavaliers Vs Knicks Expert Picks And Odds Analysis

May 12, 2025

February 21st Nba Cavaliers Vs Knicks Expert Picks And Odds Analysis

May 12, 2025 -

Combat Ufc 315 Montreal Zahabi Aldo Attentes Et Pronostics

May 12, 2025

Combat Ufc 315 Montreal Zahabi Aldo Attentes Et Pronostics

May 12, 2025 -

Ufc 315 Fight Card Preview What To Expect Tonight

May 12, 2025

Ufc 315 Fight Card Preview What To Expect Tonight

May 12, 2025