Assessing Stock Market Valuations: BofA's Rationale For Investor Confidence

Table of Contents

BofA's Key Valuation Metrics and Their Interpretation

BofA, like other financial institutions, likely employs a range of valuation metrics to assess the health and potential of the stock market. These indicators provide a multifaceted view, going beyond simple price movements to reveal deeper insights into underlying value. Let's break down these key indicators and how BofA might interpret the data:

-

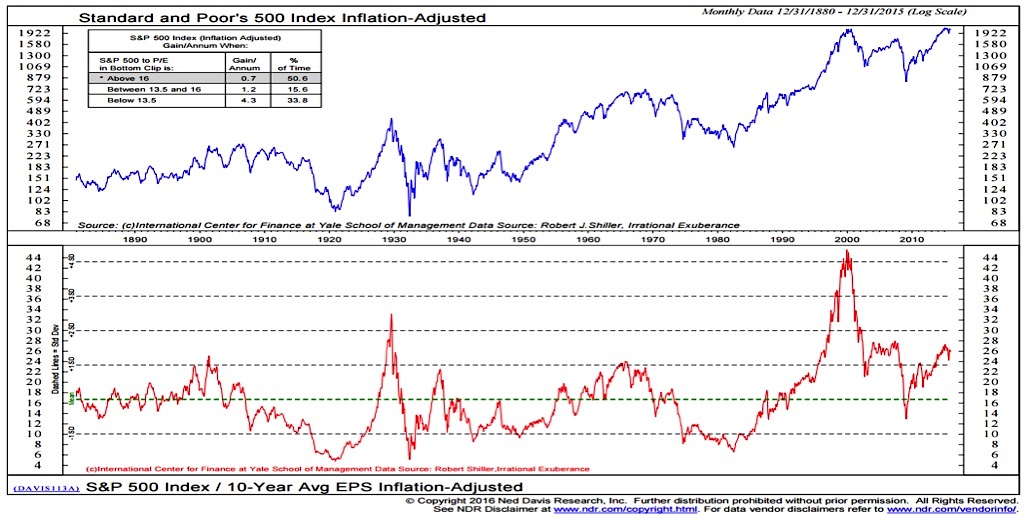

Price-to-earnings ratio (P/E): BofA probably compares the current market P/E ratio to historical averages. A higher-than-average P/E might suggest the market is overvalued, while a lower P/E might signal undervaluation. They would also likely analyze sector-specific P/E ratios, recognizing that different industries have varying growth potential and thus different justifiable valuation multiples. For instance, high-growth technology stocks often command higher P/E ratios than more mature sectors.

-

Price-to-sales ratio (P/S): The P/S ratio offers a valuable perspective, especially for companies with low or negative earnings. BofA would consider the P/S ratio in relation to revenue growth prospects. Rapid revenue expansion can justify a higher P/S, while stagnant or declining revenue might indicate an overvalued company or sector. Industry comparisons are crucial here – a high P/S ratio might be acceptable in a fast-growing industry but problematic in a slow-growing one.

-

Dividend yield: Dividend yields provide insights into investor sentiment and potential returns. A higher dividend yield might suggest that the market anticipates lower future growth, potentially implying undervaluation. BofA likely weighs dividend yields against other valuation metrics to form a comprehensive view. This is particularly pertinent for value-oriented investors seeking income streams.

-

Market capitalization: BofA's analysis would undoubtedly incorporate market capitalization – the total value of all outstanding shares – in relation to overall economic growth and corporate earnings. A rapidly expanding market cap relative to earnings might suggest an overvalued market.

-

Valuation multiples: BofA likely utilizes a suite of valuation multiples, comparing current market valuations to those of other major global markets. This provides crucial context, allowing for a relative assessment of market attractiveness. Are US equities more or less expensive than their European or Asian counterparts? This comparative analysis is vital for investment strategy.

Macroeconomic Factors Influencing BofA's Perspective

Macroeconomic trends are inextricably linked to stock market valuations. BofA's assessment wouldn't be complete without a thorough evaluation of these factors:

-

Inflation: High inflation erodes corporate profitability and impacts consumer spending, thus impacting investor confidence. BofA would analyze inflation's effect on corporate earnings and its implications for future growth expectations.

-

Interest rates: Interest rate hikes increase borrowing costs for companies, affecting their investment decisions and potentially slowing economic growth. BofA's outlook would consider the impact of interest rate changes on company valuations and future earnings.

-

Economic growth: Robust economic growth generally fuels stock market performance. BofA’s analysts would examine economic growth forecasts, factoring in GDP growth, employment data, and consumer confidence indices to assess the market’s potential.

-

Geopolitical risks: Geopolitical instability introduces uncertainty and can trigger market volatility. BofA would assess the potential impact of geopolitical events (e.g., wars, trade disputes) on market stability and valuations.

-

Consumer spending: Consumer spending forms a significant portion of economic activity. BofA would evaluate consumer spending patterns and their direct influence on corporate revenues and overall market sentiment.

BofA's Sector-Specific Analysis and Outlooks

BofA’s assessment extends beyond a broad market overview. They likely provide a detailed sector-specific analysis, identifying pockets of opportunity and risk:

-

Sector rotation: BofA probably identifies sectors poised for outperformance based on their valuation analysis and macroeconomic outlook, suggesting potential sector rotation strategies.

-

Growth vs. Value: BofA's analysts likely differentiate between growth and value stocks, explaining their preferences based on the current market environment. High-growth tech stocks might be favored during periods of expansion, while value stocks could be prioritized during economic uncertainty.

-

Specific sector analyses: In-depth analyses of key sectors like technology and healthcare – examining their unique challenges and opportunities – would contribute to the overall market assessment. This granular approach allows for nuanced stock picking strategies.

Addressing Potential Risks and Uncertainties

While BofA might express confidence, acknowledging potential risks is crucial:

-

Market corrections: BofA would likely assess the probability and potential depth of a market correction, identifying factors that could trigger a downturn.

-

Recession risk: The possibility of a recession and its impact on stock valuations is a significant concern. BofA's analysis would likely include recessionary scenarios and their potential implications.

-

Geopolitical instability: The ongoing influence of geopolitical instability on market sentiment requires careful consideration. BofA's assessment would include potential risks associated with global conflicts or political upheavals.

-

Inflation uncertainty: The unpredictable nature of inflation poses a significant risk. BofA would address the uncertainties surrounding inflation and its potential long-term effects on corporate profits and stock valuations.

Conclusion

This article explored BofA's rationale for maintaining investor confidence in current stock market valuations. By analyzing key valuation metrics like P/E ratios and P/S ratios, macroeconomic factors such as inflation and interest rates, sector-specific outlooks, and potential risks, we gained valuable insight into their assessment. Understanding stock market valuations is crucial for making informed investment decisions. Continue your research on stock market valuations and consider consulting with a financial advisor to build a diversified investment strategy aligned with your risk tolerance and financial goals. Learn more about how BofA's analysis can inform your own assessment of stock market valuations, enabling you to navigate the complexities of the equity market with greater confidence.

Featured Posts

-

Court Approves Hudsons Bays Request To Extend Creditor Protection

May 16, 2025

Court Approves Hudsons Bays Request To Extend Creditor Protection

May 16, 2025 -

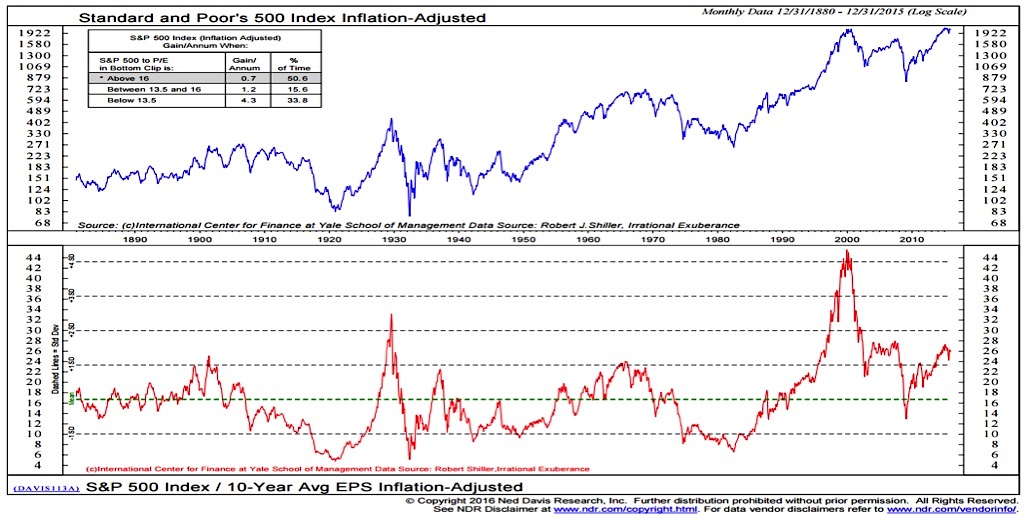

Padres Aim For Sweep Arraez And Heyward Starting Against Opponent

May 16, 2025

Padres Aim For Sweep Arraez And Heyward Starting Against Opponent

May 16, 2025 -

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym V Chest Rekorda

May 16, 2025

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym V Chest Rekorda

May 16, 2025 -

Unexpected Defeat Paddy Pimbletts 35 Second Loss Explained

May 16, 2025

Unexpected Defeat Paddy Pimbletts 35 Second Loss Explained

May 16, 2025 -

Vont Weekend 104 5 The Cat April 4 6 2025 In Five Pictures

May 16, 2025

Vont Weekend 104 5 The Cat April 4 6 2025 In Five Pictures

May 16, 2025