Assessing Trump's Tax Bill: Challenges And Path To Passage.

Table of Contents

Political Challenges to Trump's Tax Bill

The political hurdles faced by Trump's Tax Bill were substantial, stemming from both internal divisions and external opposition.

Party Divisions and Intra-Party Conflicts

Reaching consensus within the Republican party itself proved surprisingly difficult. Specific tax provisions sparked heated debates:

- Corporate Tax Rates: Disagreements arose over the optimal corporate tax rate, with some advocating for a lower rate than others to stimulate economic growth. Conservative factions pushed for significant cuts, while more moderate Republicans expressed concern about the potential fiscal impact.

- Individual Deductions: The elimination or limitation of certain individual deductions, such as state and local tax (SALT) deductions, caused friction between different factions of the party, particularly those representing high-tax states.

- Lobbying Efforts: Powerful lobbying groups representing various industries exerted considerable influence, attempting to shape the bill to their advantage. This resulted in compromises and amendments that further complicated the legislative process.

Securing enough votes required numerous compromises, ultimately resulting in a bill that did not fully satisfy all Republican factions.

Opposition from the Democratic Party

The Democratic party uniformly opposed Trump's Tax Bill, arguing that it would exacerbate income inequality and balloon the national debt. Their arguments centered on:

- Increased National Debt: Democrats predicted the tax cuts, particularly for corporations and high-income earners, would significantly increase the national debt without generating sufficient economic growth to offset the cost.

- Benefit Cuts: Concerns were raised that to offset the revenue losses from the tax cuts, future spending cuts, potentially impacting social programs, would be necessary.

- Legislative Maneuvers: Democrats employed various legislative tactics to delay or obstruct the bill's passage, including filibusters and public pressure campaigns.

Public Opinion and Political Backlash

Public opinion polls revealed mixed reactions to Trump's Tax Bill. While some segments of the population supported the tax cuts, others expressed deep reservations. This division in public opinion led to:

- Public Protests: Significant public protests and demonstrations erupted across the country, fueled by concerns about the bill's impact on various segments of society.

- Grassroots Campaigns: Various grassroots campaigns emerged, aiming to influence public opinion and put pressure on lawmakers to vote against the bill.

- Impact on Lawmakers: The public outcry undoubtedly influenced the decisions of some lawmakers, particularly those in closely contested districts or facing re-election.

Economic Challenges and Consequences of Trump's Tax Bill

The economic implications of Trump's Tax Bill were intensely debated, with experts offering widely differing predictions.

Impact on the National Debt

A major concern centered on the bill's potential to drastically increase the national debt. Economic models produced varying projections:

- Increased Deficit: Most economic forecasts predicted a significant increase in the federal budget deficit as a result of the tax cuts.

- Long-Term Consequences: The long-term economic consequences of a significantly increased national debt remain a subject of ongoing debate, with potential implications for interest rates and economic growth.

- Credit Rating Downgrades: There were concerns that the increased debt could lead to credit rating downgrades, increasing borrowing costs for the US government.

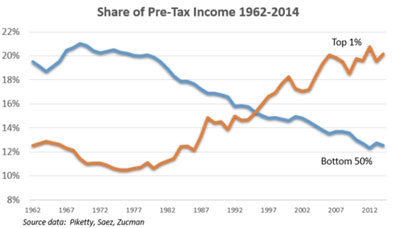

Effects on Income Inequality

The bill's impact on income inequality was another point of contention.

- Beneficial for High Earners: Critics argued that the tax cuts disproportionately benefited high-income earners and corporations, exacerbating existing income inequality.

- Trickle-Down Economics: Supporters countered that the tax cuts would stimulate economic growth, ultimately benefiting all income levels through "trickle-down" economics.

- Empirical Evidence: The long-term effects on income inequality are still being studied and debated, with empirical evidence yet to fully support either side's claim.

International Implications

The international ramifications of Trump's Tax Bill were also significant.

- Impact on Global Trade: The bill's provisions regarding international taxation potentially altered the landscape of global trade and investment.

- Retaliatory Measures: Some countries considered retaliatory measures, fearing the bill would disadvantage their businesses.

- US Competitiveness: The bill's impact on US competitiveness in the global market was a subject of ongoing analysis and concern.

Path to Passage and Potential Amendments

The passage of Trump's Tax Bill involved a complex legislative process.

Legislative Process and Timeline

The bill navigated the typical legislative process:

- Committee Hearings: The bill underwent numerous committee hearings, where various amendments were proposed and debated.

- House and Senate Votes: The bill faced numerous votes in both the House of Representatives and the Senate, often involving close margins.

- Reconciliation: Because of the close margins, reconciliation procedures were utilized to expedite the passage of the bill through the Senate.

Potential Amendments and Compromises

Numerous compromises and amendments were made to secure passage:

- Corporate Tax Rate: The final corporate tax rate was set at 21%, a compromise between different factions within the Republican party.

- Individual Tax Rates: Similarly, compromises were reached on individual tax rates and deductions.

- Impact of Amendments: These amendments ultimately altered the bill's original intent and potential effects.

Conclusion

Trump's Tax Bill faced significant political and economic challenges on its path to passage. Party divisions, strong Democratic opposition, public concerns, and predictions of a ballooning national debt all contributed to its controversial journey. Understanding these complexities is crucial for comprehending its long-term impact. Continued monitoring of the economic and social effects resulting from Trump's Tax Bill is vital for informed civic participation. Stay informed about the ongoing consequences of Trump's Tax Bill and its lasting effects on the US economy and society.

Featured Posts

-

Appeal Rejected Councillors Wifes Social Media Post About Migrants

May 22, 2025

Appeal Rejected Councillors Wifes Social Media Post About Migrants

May 22, 2025 -

Core Weave Crwv Stock Decline Thursday Understanding The Market Reaction

May 22, 2025

Core Weave Crwv Stock Decline Thursday Understanding The Market Reaction

May 22, 2025 -

Beenie Mans New York Takeover An It A Stream Event

May 22, 2025

Beenie Mans New York Takeover An It A Stream Event

May 22, 2025 -

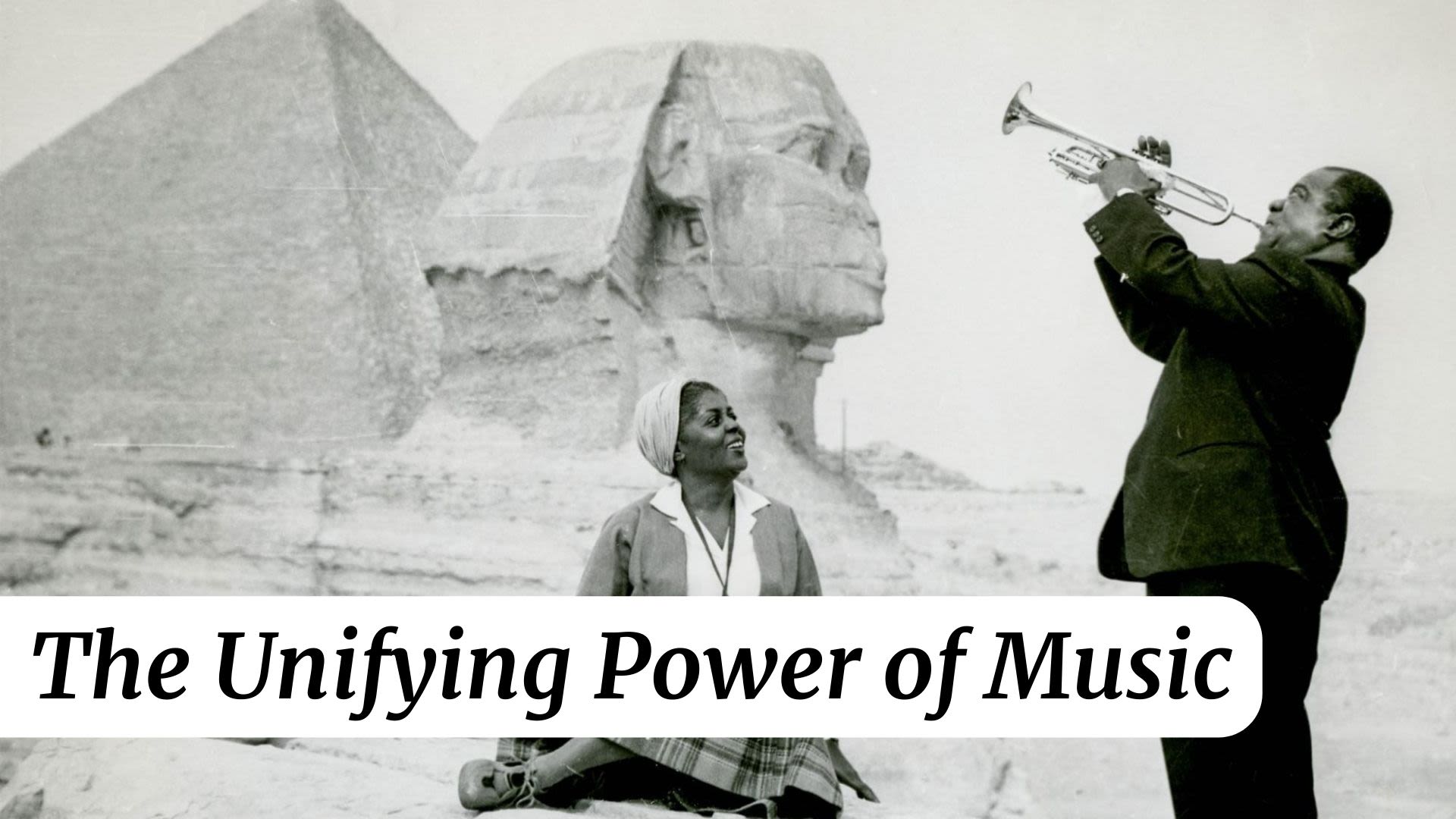

Musics Unifying Power Defining The Sound Perimeter

May 22, 2025

Musics Unifying Power Defining The Sound Perimeter

May 22, 2025 -

Cwd Confirmed At Jackson Hole Elk Feedground Implications For Wildlife Management

May 22, 2025

Cwd Confirmed At Jackson Hole Elk Feedground Implications For Wildlife Management

May 22, 2025