B.C. Billionaire's Pursuit Of Hudson's Bay Leases: A Real Estate Power Play

Table of Contents

The Billionaire's Profile and Investment Strategy

Who is the B.C. Billionaire?

While the identity of the B.C. billionaire remains partially shrouded in secrecy for now (let's call him Mr. X for the purposes of this article), his reputation precedes him. Mr. X is known for:

- A history of shrewd investments in large-scale real estate projects across Western Canada.

- A preference for prime downtown locations with significant redevelopment potential.

- A long-term investment strategy focused on substantial capital appreciation.

- A track record of successfully navigating complex real estate transactions.

His past successes include the acquisition and revitalization of several landmark properties in Vancouver, solidifying his reputation as a visionary in the Canadian real estate market. His investment philosophy appears to favor projects with strong potential for future growth and long-term value.

Analyzing the Billionaire's Investment Motives

Mr. X's interest in the Hudson's Bay leases likely stems from several factors:

- Diversification: Expanding his portfolio beyond existing holdings to mitigate risk.

- Strategic Land Acquisition: Securing prime real estate in key Canadian cities for future development.

- Long-Term Appreciation: Capitalizing on the anticipated increase in property values over the coming decades.

- Synergy with Existing Holdings: Potential for synergies with his existing portfolio, creating a larger, more powerful real estate empire.

The Hudson's Bay leases represent a significant opportunity for substantial financial returns, given their prime locations and potential for redevelopment.

The Value and Significance of Hudson's Bay Leases

Prime Locations and Development Potential

The Hudson's Bay Company's real estate portfolio boasts a collection of highly desirable properties across Canada. These leases include:

- Flagship department stores in major city centers, offering unparalleled visibility and foot traffic.

- Properties located in areas experiencing significant population growth and urban renewal.

- Buildings with potential for conversion into mixed-use developments, incorporating residential, commercial, and retail spaces.

These locations offer significant potential for redevelopment and value creation, attracting considerable interest from investors.

Historical Significance and Market Impact

The Hudson's Bay Company holds a significant place in Canadian history, and its real estate holdings are equally iconic. The acquisition of these leases has the potential to:

- Reshape the Canadian retail landscape.

- Trigger a wave of redevelopment projects in key urban centers.

- Significantly impact property values in surrounding areas.

The scale of this transaction, coupled with the prestige of the Hudson's Bay brand, makes it a defining moment in the Canadian real estate market.

The Competitive Landscape and Potential Challenges

Other Bidders and Market Competition

The allure of the Hudson's Bay leases has attracted significant interest from other potential bidders, creating a competitive landscape. This includes:

- Other high-net-worth individuals and investment firms.

- Large real estate development companies with extensive experience in urban revitalization.

A bidding war is highly likely, potentially driving the final sale price significantly higher than initial estimates.

Regulatory Hurdles and Potential Obstacles

The acquisition process is not without its challenges. Mr. X will likely encounter:

- Complex legal and regulatory approvals.

- Environmental assessments and community consultations.

- Negotiations with existing tenants and stakeholders.

Navigating these hurdles successfully will be crucial to the successful completion of the acquisition.

Conclusion: The Future of Hudson's Bay Leases and the B.C. Billionaire's Real Estate Empire

The B.C. billionaire's pursuit of the Hudson's Bay leases represents a significant real estate power play with far-reaching implications. The acquisition, if successful, will solidify his position as a major player in the Canadian real estate market and reshape the landscape of several key cities. The outcome of this acquisition remains uncertain, with a competitive bidding process and potential regulatory hurdles to overcome. However, the potential rewards are substantial, promising significant returns and the creation of a remarkable real estate empire. Stay tuned for further updates on the B.C. billionaire's pursuit of Hudson's Bay leases and other major developments in this dynamic sector of the Canadian economy. This real estate power play is one to watch closely!

Featured Posts

-

Live Stock Market Updates Dow S And P 500 And Nasdaq For May 26

May 27, 2025

Live Stock Market Updates Dow S And P 500 And Nasdaq For May 26

May 27, 2025 -

Zamfara Bandit Kingpin Eliminated In Police Operation

May 27, 2025

Zamfara Bandit Kingpin Eliminated In Police Operation

May 27, 2025 -

Msabqt Twzyf Bryd Aljzayr 1446 H Dlyl Shaml Lltsjyl

May 27, 2025

Msabqt Twzyf Bryd Aljzayr 1446 H Dlyl Shaml Lltsjyl

May 27, 2025 -

Miami Beach Rescue Dylan Efrons Act Of Bravery

May 27, 2025

Miami Beach Rescue Dylan Efrons Act Of Bravery

May 27, 2025 -

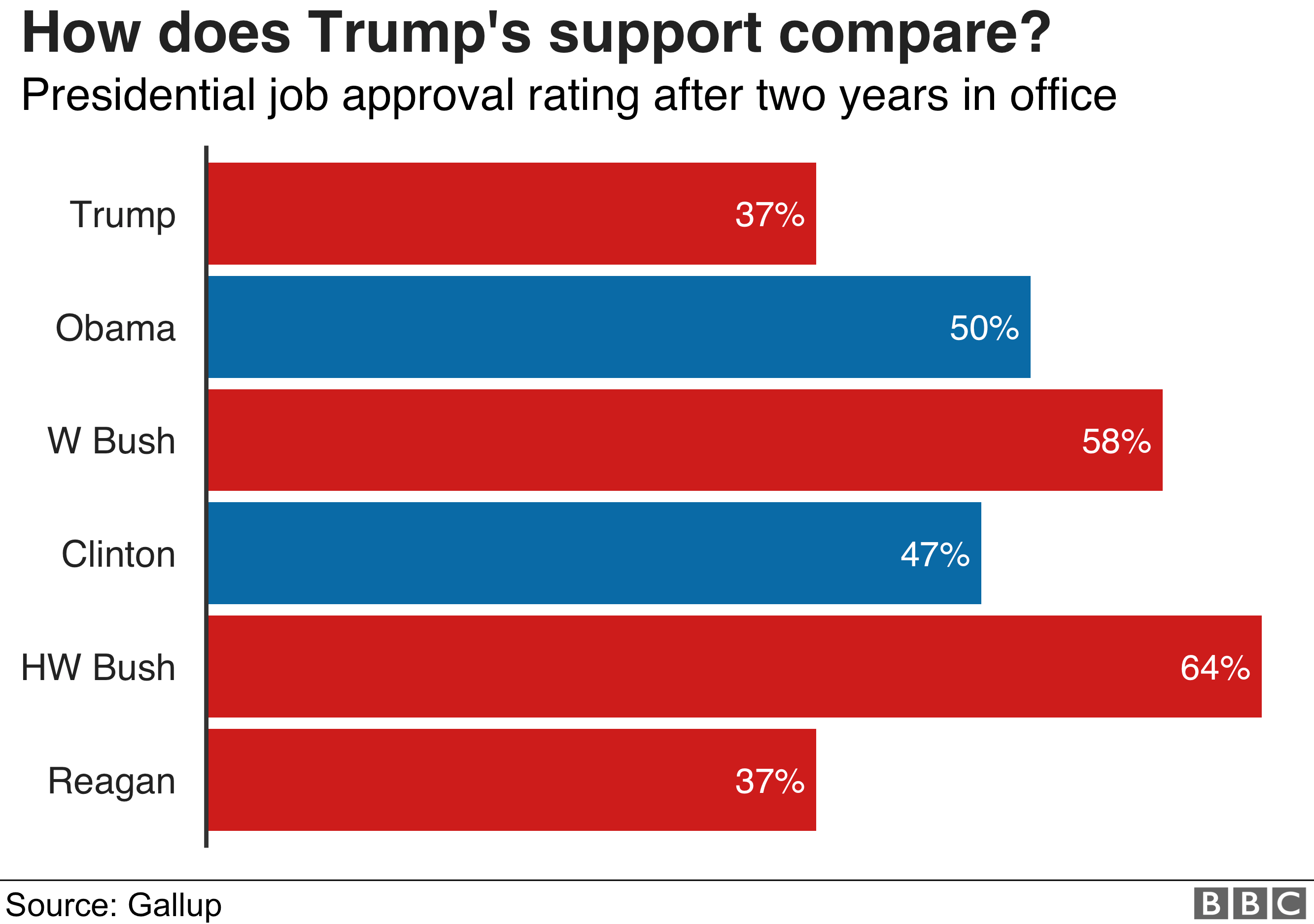

Gops Ambitious Agenda Key Bills Passed During Trumps Presidency

May 27, 2025

Gops Ambitious Agenda Key Bills Passed During Trumps Presidency

May 27, 2025