Bank Of Canada Holds Rates: What Economists Say (FP Video)

Table of Contents

The Bank of Canada's recent decision to hold interest rates has sent ripples through the Canadian economy, leaving businesses and consumers alike wondering what's next. This article delves into the expert opinions and market analyses following this crucial announcement, offering insights gleaned from a recent Financial Post (FP) video. We'll explore the reasoning behind the hold, potential future rate adjustments, and their implications for consumers and businesses, focusing on the implications of Bank of Canada interest rates.

Reasons Behind the Bank of Canada's Rate Hold

The Bank of Canada's decision to maintain interest rates was a complex one, influenced by several key economic factors.

Inflationary Pressures

- Easing inflation: While inflation remains a concern, recent data suggests a slowing trend, offering some relief.

- Core inflation still elevated: However, underlying inflationary pressures, as reflected in core inflation, remain stubbornly high. This persistent pressure necessitates careful monitoring.

- Impact of global economic slowdown: The global economic slowdown is also influencing the Bank of Canada's approach, adding a layer of complexity to their decision-making process.

The current inflation rate in Canada is a critical factor. While headline inflation (the overall rate) may be showing signs of easing, the Bank of Canada closely watches core inflation, which strips out volatile components like food and energy prices. This provides a clearer picture of underlying price pressures. The difference between headline and core inflation is crucial in understanding the true state of inflation and guiding monetary policy decisions related to Bank of Canada interest rates.

Economic Growth Concerns

- Slowing GDP growth: Canada's GDP growth is exhibiting signs of deceleration, raising concerns about a potential economic slowdown.

- Potential recession risks: The risk of a recession, though not imminent, cannot be dismissed, influencing the Bank's cautious approach to interest rate adjustments.

- Impact of high interest rates: The cumulative effect of previous interest rate hikes is still working its way through the economy, potentially dampening growth further.

The Bank of Canada faces the challenge of balancing inflation control with the need to support economic growth. Aggressive interest rate hikes, while effective in curbing inflation, could also trigger a recession. This delicate balancing act is central to their monetary policy decisions concerning Bank of Canada interest rates.

Labour Market Dynamics

- Unemployment rate: The unemployment rate provides valuable insights into the health of the economy and the potential for wage pressures.

- Wage growth: Strong wage growth, while positive for workers, can fuel inflation if it outpaces productivity gains.

- Labour market tightness: A tight labour market, characterized by low unemployment, can contribute to upward pressure on wages and prices.

The relationship between employment data and inflation is crucial. A strong labour market can lead to higher wages and increased consumer spending, potentially driving inflation. The Bank of Canada carefully analyzes employment data to assess inflationary risks and guide their decisions on Bank of Canada interest rates.

Economist Predictions for Future Interest Rate Changes

Economists offer diverse predictions regarding future Bank of Canada interest rate changes.

Diverse Opinions Among Experts

- Further rate hikes: Some economists predict further interest rate hikes, citing persistent inflationary pressures. [Quote from FP video expert, if available].

- Rate cuts: Others anticipate rate cuts later in the year, believing the economic slowdown necessitates easing monetary policy. [Quote from FP video expert, if available].

- Holding steady: A significant portion expects the Bank of Canada to hold rates steady for an extended period, monitoring economic data closely. [Quote from FP video expert, if available].

The divergence in opinion underscores the uncertainty surrounding the economic outlook and the complexity of predicting future Bank of Canada interest rates. Different economists emphasize various economic indicators and weigh their relative importance differently.

Factors Influencing Future Decisions

- Upcoming economic data releases: Key economic indicators like inflation data, GDP growth figures, and employment reports will heavily influence future decisions.

- Global economic outlook: International economic conditions and global inflation trends play a significant role.

- Inflation targets: The Bank of Canada's commitment to its inflation targets remains a cornerstone of its decision-making process.

The Bank of Canada’s future decisions on interest rates hinge on the evolution of these factors. Close monitoring of upcoming economic data and global trends is critical to making informed adjustments to monetary policy.

Impact on the Canadian Dollar

- Potential strengthening or weakening of the CAD: Changes in Bank of Canada interest rates can impact the value of the Canadian dollar (CAD) relative to other currencies.

- Impact on imports and exports: A stronger CAD can make imports cheaper but exports more expensive, impacting businesses and trade balances.

The value of the Canadian dollar is sensitive to changes in interest rates. Higher interest rates, generally speaking, can attract foreign investment, strengthening the CAD. Conversely, lower rates might weaken the currency. This has significant consequences for Canadian businesses engaged in international trade.

Implications for Consumers and Businesses

The Bank of Canada's rate decisions have significant implications for consumers and businesses alike.

Impact on Borrowing Costs

- Mortgage rates: Changes in the Bank of Canada's policy rate directly impact mortgage rates, affecting the affordability of housing.

- Business loans: Interest rates for business loans also fluctuate, influencing investment decisions and business expansion plans.

- Consumer spending: Higher interest rates can dampen consumer spending by making borrowing more expensive.

The cost of borrowing is directly influenced by Bank of Canada interest rates. Higher rates increase the cost of mortgages, business loans, and other forms of credit, impacting both consumer and business finances.

Effect on Investment and Economic Activity

- Business investments: Higher borrowing costs can discourage business investments, potentially slowing economic growth.

- Consumer confidence: Uncertainty about future interest rates can impact consumer confidence and spending patterns.

- Economic growth forecasts: The overall impact on economic growth forecasts depends on the interplay of various factors including inflation, consumer confidence, and business investment.

Conclusion

The Bank of Canada's decision to hold interest rates reflects a complex interplay of inflationary pressures, economic growth concerns, and labour market dynamics. Economists offer a range of predictions for future rate changes, highlighting the uncertainty surrounding the economic outlook. The impact of Bank of Canada interest rates is far-reaching, affecting borrowing costs, investment decisions, and overall economic activity.

Call to Action: Stay informed about the evolving economic landscape and the Bank of Canada's future interest rate decisions. Watch the full Financial Post (FP) video for a comprehensive analysis and to understand the implications of Bank of Canada interest rates on your finances. Learn more about Bank of Canada interest rates and how they affect you!

Featured Posts

-

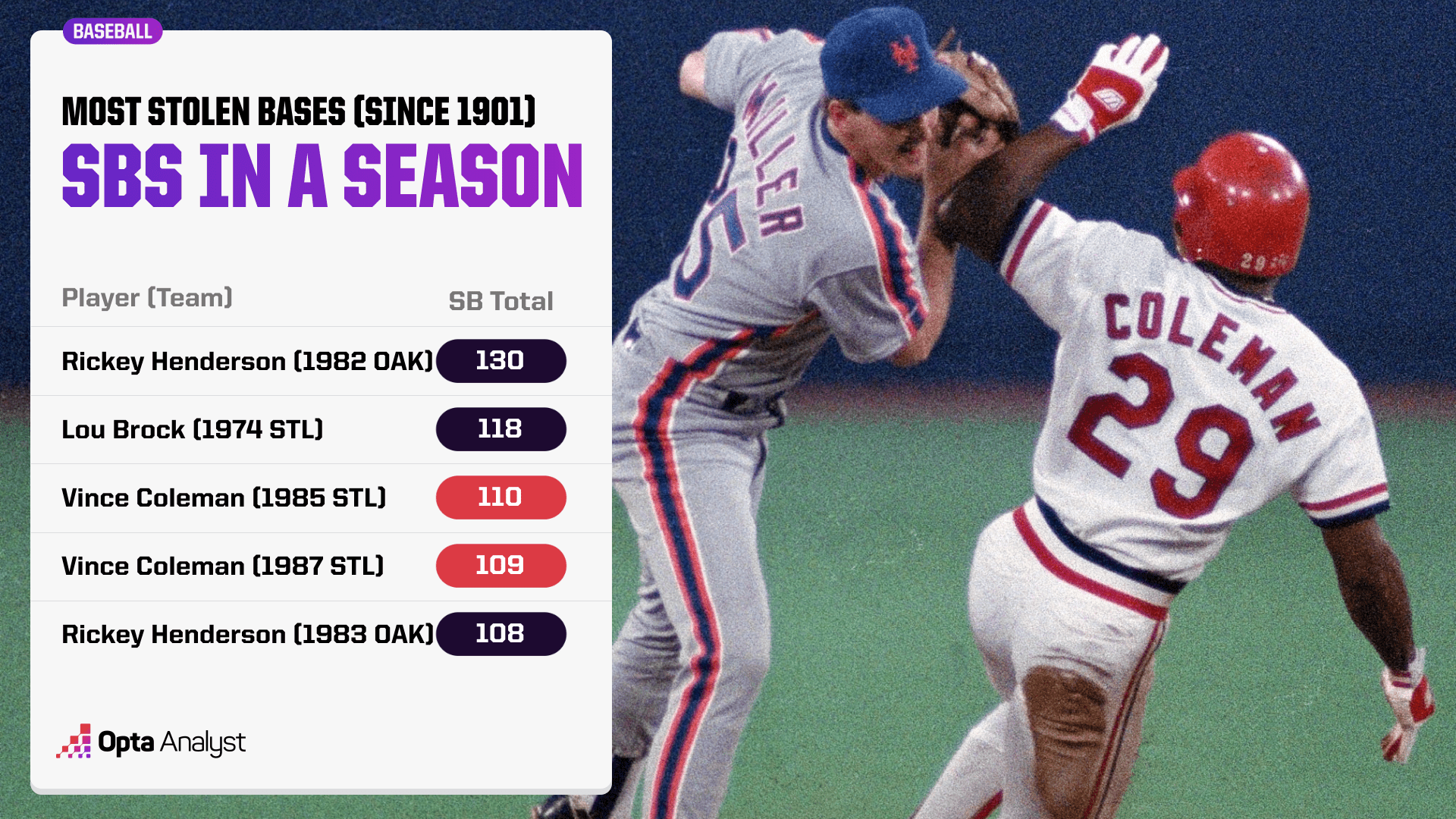

Nine Stolen Bases Milwaukees Record Setting First Four Innings

Apr 23, 2025

Nine Stolen Bases Milwaukees Record Setting First Four Innings

Apr 23, 2025 -

Pascal Boulanger Et La Fpi L Avenir Du Secteur Immobilier

Apr 23, 2025

Pascal Boulanger Et La Fpi L Avenir Du Secteur Immobilier

Apr 23, 2025 -

Amandine Gerard Et La Complexite Des Relations Commerciales Euro Marches

Apr 23, 2025

Amandine Gerard Et La Complexite Des Relations Commerciales Euro Marches

Apr 23, 2025 -

Primbon Jawa Pernikahan Weton Jumat Wage Dan Senin Legi Apakah Harmonis

Apr 23, 2025

Primbon Jawa Pernikahan Weton Jumat Wage Dan Senin Legi Apakah Harmonis

Apr 23, 2025 -

Harvard Lawsuit A Showdown With The Trump Administration

Apr 23, 2025

Harvard Lawsuit A Showdown With The Trump Administration

Apr 23, 2025