Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Prediction and its Rationale

Desjardins' economic outlook anticipates a further easing of monetary policy by the Bank of Canada, predicting three more interest rate cuts in the coming months. While the exact timeline remains unspecified, this forecast reflects a growing concern among economists about the potential for a slowdown in economic growth and the need to stimulate the economy. Their reasoning centers on several key economic indicators.

-

Explanation of Desjardins' Reasoning: Desjardins cites softening inflation, weakening consumer spending, and a potential increase in unemployment as key factors driving their prediction. They believe that further rate cuts are necessary to prevent a significant economic downturn.

-

Key Economic Indicators Supporting their Forecast: The forecast is underpinned by data showing a moderation in inflation, although still above the Bank of Canada's target, coupled with slower-than-expected GDP growth and a softening labor market.

-

Comparison to Other Economic Forecasts and Analyst Predictions: While not all analysts agree on the magnitude or timing of future rate cuts, Desjardins' prediction aligns with a growing consensus among some economists who see a need for further monetary easing. However, others remain cautious, highlighting the risks associated with aggressive rate cuts.

-

Potential Risks and Uncertainties Associated with the Prediction: The prediction is not without its uncertainties. Unforeseen global economic events, changes in inflation trends, or shifts in consumer and business confidence could alter the Bank of Canada's course.

Impact on Mortgage Rates and Borrowing Costs

The predicted Bank of Canada rate cuts will undoubtedly influence mortgage rates and borrowing costs across Canada. This will have a significant effect on both homeowners and those considering taking out new loans.

-

Projected Changes in Mortgage Rates Based on Desjardins' Prediction: Each Bank of Canada rate cut typically translates to a decrease in both variable and fixed mortgage rates, although the extent of the reduction can vary depending on lender policies and market conditions.

-

Impact on Monthly Mortgage Payments for Homeowners: Lower mortgage rates will lead to reduced monthly payments for homeowners with variable-rate mortgages. Even those with fixed-rate mortgages might find refinancing opportunities to secure lower rates.

-

Opportunities for Borrowers to Leverage Lower Interest Rates: Lower borrowing costs create an attractive opportunity for consumers and businesses to make large purchases, refinance existing debts, or invest in expansion projects.

-

Potential Challenges for Lenders: Reduced interest rates can squeeze lender profit margins, potentially leading to adjustments in lending criteria or a decrease in the availability of certain loan products.

Implications for the Canadian Economy

The predicted rate cuts have far-reaching implications for the Canadian economy. While intended to stimulate growth, they also carry potential risks.

-

Positive Impacts of Rate Cuts on Economic Growth: Lower interest rates can incentivize consumer spending and business investment, boosting economic activity and potentially increasing GDP growth.

-

Potential Negative Consequences, such as Increased Inflation: While stimulating economic activity, rate cuts can also fuel inflation if demand outpaces supply. The Bank of Canada will need to carefully monitor inflation levels to avoid this risk.

-

Analysis of the Effectiveness of Rate Cuts as a Monetary Policy Tool: The effectiveness of rate cuts depends on various factors, including consumer and business confidence, global economic conditions, and the overall health of the financial system.

-

Long-Term Economic Outlook in Light of These Predictions: The long-term outlook will depend on the success of the rate cuts in stimulating the economy without igniting excessive inflation. Careful monitoring and adaptive policy adjustments will be crucial.

Alternative Perspectives and Potential Risks

While Desjardins' prediction holds significant weight, it's crucial to consider alternative perspectives and potential risks. The economic future is inherently uncertain.

-

Views of Other Financial Institutions and Economists: Not all financial institutions share Desjardins' optimistic view. Some economists express concerns about the potential for increased inflation or a prolonged period of slow economic growth.

-

Risks Associated with Aggressive Rate Cuts: Aggressive rate cuts, if misjudged, could lead to unwanted inflationary pressures, weakening the Canadian dollar, and potentially destabilizing the financial system.

-

Discussion of Potential Inflation or Deflationary Pressures: The balance between stimulating growth and controlling inflation is a delicate one. The Bank of Canada must carefully assess the risk of both inflationary and deflationary pressures.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts presents a complex picture for the Canadian economy. While lower interest rates offer potential benefits for homeowners and borrowers, they also carry risks, including increased inflation. Understanding these potential Bank of Canada rate cuts and their implications is crucial for making informed financial decisions. Stay informed about future announcements from the Bank of Canada, consult with a financial advisor to discuss your personal financial strategies, and utilize resources like the Bank of Canada website to track interest rate changes and economic forecasts. Proactive financial planning is key in navigating the evolving economic landscape.

Featured Posts

-

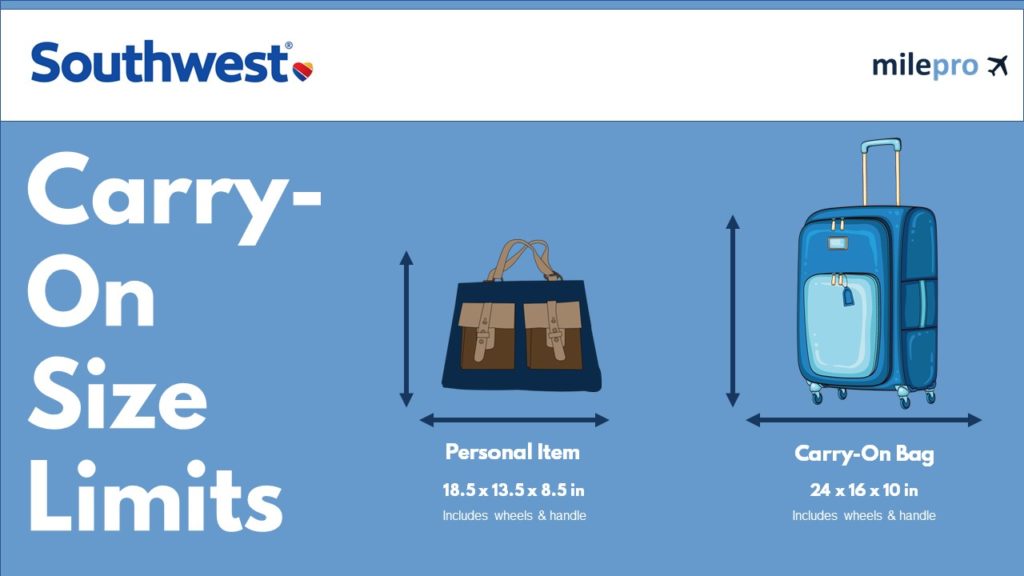

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025 -

Rybakina Tekuschaya Forma I Plany Na Buduschee

May 24, 2025

Rybakina Tekuschaya Forma I Plany Na Buduschee

May 24, 2025 -

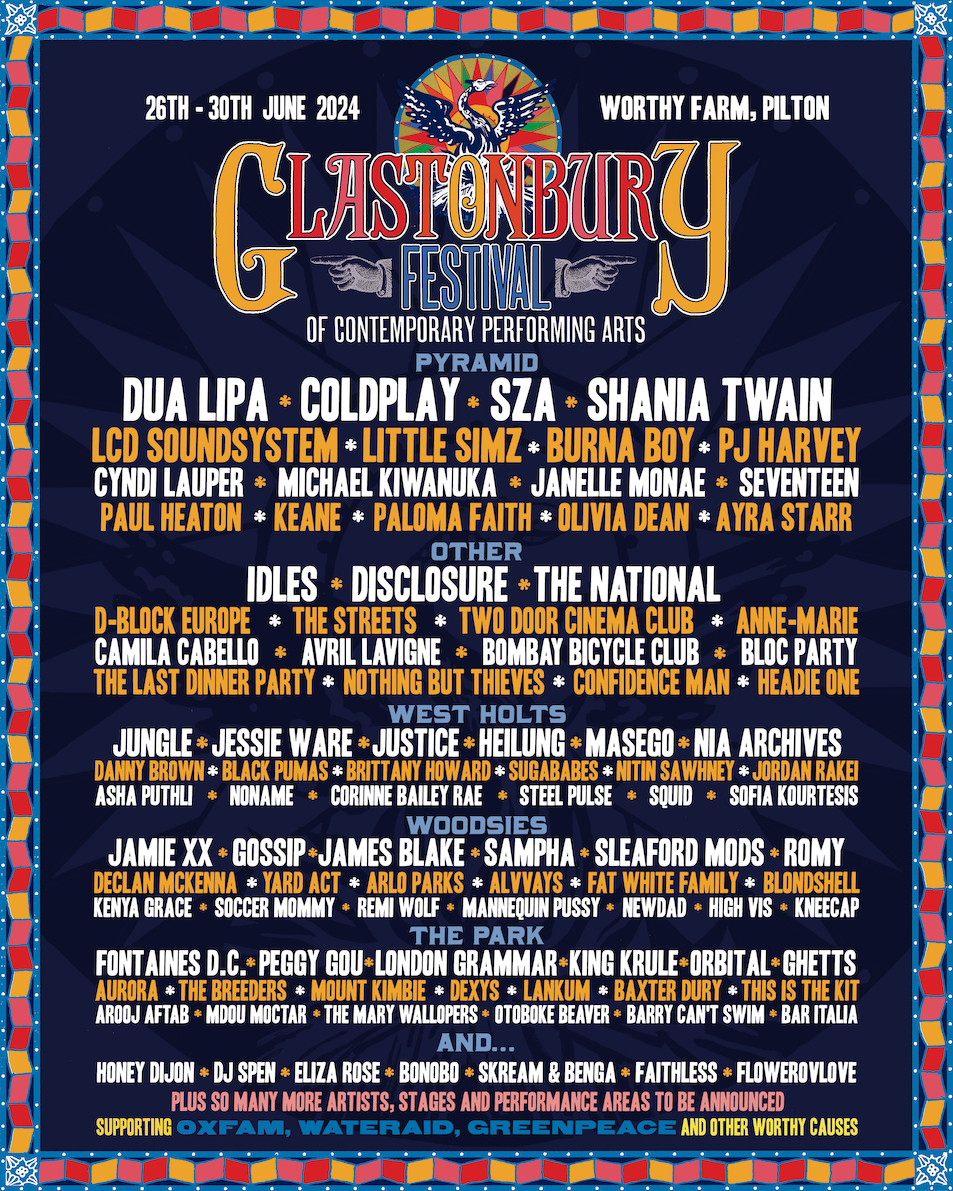

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025 -

The Future Of Family Planning Examining The Role Of Over The Counter Birth Control After Roe V Wade

May 24, 2025

The Future Of Family Planning Examining The Role Of Over The Counter Birth Control After Roe V Wade

May 24, 2025 -

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025

Latest Posts

-

A Couples Fight Joe Jonass Response

May 24, 2025

A Couples Fight Joe Jonass Response

May 24, 2025 -

Joe Jonas And The Couples Unexpected Dispute

May 24, 2025

Joe Jonas And The Couples Unexpected Dispute

May 24, 2025 -

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025 -

Neal Mc Donoughs Impact On The Last Rodeo

May 24, 2025

Neal Mc Donoughs Impact On The Last Rodeo

May 24, 2025 -

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025