Bank Of Canada Rate Decision: Retail Sales Data Plays Key Role

Table of Contents

The Significance of Retail Sales Data in Monetary Policy Decisions

Retail sales data serves as a powerful barometer of consumer spending, a major driver of economic growth in Canada. This data provides invaluable insights into consumer confidence and the overall health of the economy. Strong retail sales figures typically indicate robust consumer demand and a healthy economy. However, this can also be a double-edged sword.

- Retail sales data provides insights into consumer confidence and demand. A surge in retail sales suggests consumers are feeling optimistic and are willing to spend, indicating a strong economy.

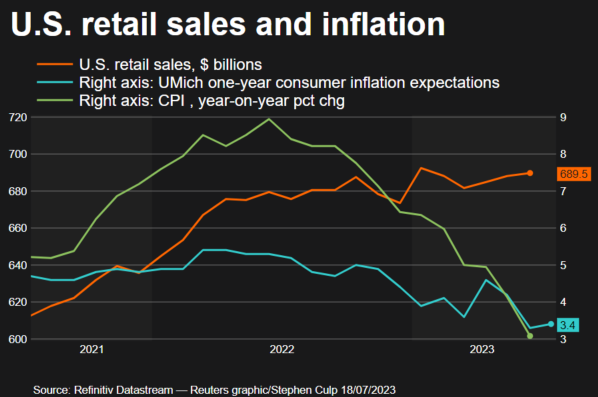

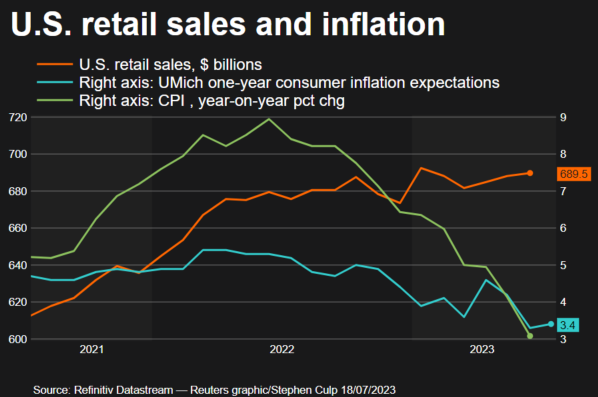

- Increased consumer spending can fuel inflation, prompting interest rate hikes. When demand outpaces supply, prices rise, leading to inflationary pressures. To combat inflation, the Bank of Canada often raises interest rates to cool down the economy and curb excessive spending.

- Weak retail sales might signal an economic slowdown, influencing rate decisions. Conversely, a decline in retail sales suggests weakening consumer demand and potential economic contraction. This could lead the Bank of Canada to consider lowering interest rates to stimulate economic activity.

The correlation between retail sales and inflation is particularly crucial for the Bank of Canada. Strong retail sales, indicating robust consumer demand, often contribute to inflationary pressures, forcing the central bank to consider adjusting interest rates upwards.

Analyzing Recent Retail Sales Figures in Canada

Statistics Canada recently released the latest retail sales figures for [Insert Month and Year], revealing [Insert Key Statistic, e.g., a 0.5% increase]. This [Insert Description: increase/decrease] represents a [Insert Comparison: year-over-year growth/decline] compared to the same period last year. While the overall figure suggests [Insert Interpretation: positive/negative/mixed] momentum, a closer look reveals some interesting sector-specific trends.

- Specific numbers and percentage changes in retail sales: [Insert Specific Data from Statistics Canada Report, with links to the source].

- Mention any significant sector-specific trends: For example, we observed a significant increase in sales of durable goods like appliances, potentially reflecting pent-up demand, while sales of non-essential items remained relatively flat.

- Comparison to previous periods and analyst expectations: Analysts had predicted a [Insert Analyst Prediction] growth rate, indicating that the actual result was [Insert Comparison: above/below/in line with] expectations.

Potential Implications of Retail Sales Data on the Bank of Canada's Decision

The upcoming Bank of Canada interest rate decision is heavily influenced by the latest retail sales data. Several scenarios are possible:

- Strong retail sales: Robust retail sales, combined with persistent inflationary pressures, significantly increase the likelihood of an interest rate hike. The Bank of Canada may aim to cool down the economy to prevent inflation from spiraling out of control.

- Weak retail sales: If retail sales figures are weak, signaling a potential economic slowdown, the Bank of Canada may opt for a rate pause or even a rate cut. A rate cut aims to stimulate economic activity by making borrowing cheaper.

- Mixed retail sales: A mixed picture, with some sectors performing well while others struggle, may lead to a more nuanced decision. The Bank will likely consider other economic indicators alongside retail sales data before making a final determination.

Beyond Retail Sales: Other Factors Influencing the Bank of Canada's Decision

While retail sales data is a crucial indicator, the Bank of Canada considers a range of other economic indicators when making interest rate decisions:

- Inflation rate (CPI) and its components: The Consumer Price Index (CPI) is a key measure of inflation, and its various components provide insights into the sources of inflationary pressures.

- Unemployment rate: A low unemployment rate often suggests a strong economy but can also contribute to wage inflation.

- Housing market data: Housing prices and mortgage rates are closely monitored, as the housing sector significantly impacts the overall economy.

- Global economic conditions: International economic events and global financial market conditions also play a role in the Bank's decision-making process. These factors can influence the Canadian economy through trade and investment flows.

Conclusion

Retail sales data plays a pivotal role in shaping the Bank of Canada's interest rate decisions. Recent retail sales figures [summarize key findings] significantly impact the potential for an interest rate hike, pause, or cut. Understanding the interplay between retail sales and other economic indicators is crucial for predicting the Bank's actions. To stay informed about the Bank of Canada's upcoming interest rate decision and its impact on your finances, regularly check reputable financial news sources for analysis of Bank of Canada rate decisions and the latest retail sales data. Making informed financial decisions requires staying abreast of these crucial economic indicators.

Featured Posts

-

Exclusive Update Taylor Swift And Blake Livelys Response To The It Ends With Us Lawsuit

May 27, 2025

Exclusive Update Taylor Swift And Blake Livelys Response To The It Ends With Us Lawsuit

May 27, 2025 -

Ligue 1 Les Moments Cles De La Victoire Du Laso Chlef Face A L Usma

May 27, 2025

Ligue 1 Les Moments Cles De La Victoire Du Laso Chlef Face A L Usma

May 27, 2025 -

Ps Fusion Contre Faure Au Congres Du Parti Socialiste

May 27, 2025

Ps Fusion Contre Faure Au Congres Du Parti Socialiste

May 27, 2025 -

Billionaires Bid For Hudsons Bay Leases Shakes Up B C Retail

May 27, 2025

Billionaires Bid For Hudsons Bay Leases Shakes Up B C Retail

May 27, 2025 -

Five Arrested On Drug And Weapons Charges

May 27, 2025

Five Arrested On Drug And Weapons Charges

May 27, 2025