Bank Of Canada's Inflation Dilemma: Rising Core Prices Force Tough Choices

Table of Contents

Understanding the Persistence of Core Inflation

The Bank of Canada's mandate is to maintain price stability, targeting 2% inflation. However, persistent core inflation presents a significant challenge.

What is Core Inflation?

Core inflation measures the rate of price increases excluding volatile components like food and energy. This provides a clearer picture of underlying inflationary pressures than headline inflation (which includes these volatile elements). The Bank of Canada uses various measures of core inflation, including the trimmed mean and the median CPI.

- Excluding volatile components: Energy and food prices are subject to significant short-term fluctuations due to factors like global supply disruptions and weather events. Excluding these allows for a more accurate assessment of persistent inflationary trends.

- Predictive power: Core inflation is considered a better predictor of future inflation than headline inflation because it filters out temporary price shocks. Its persistence indicates broader, more entrenched inflationary pressures within the economy.

Factors Driving Persistent Core Inflation in Canada

Several factors contribute to Canada's persistent core inflation:

- Supply chain disruptions: Global supply chain bottlenecks continue to impact the availability and cost of goods, leading to increased prices across various sectors.

- Wage pressures: Strong labor demand and wage increases are contributing to higher production costs for businesses, which are often passed on to consumers in the form of higher prices. This wage-price spiral is a significant concern for the Bank of Canada.

- Strong consumer demand: Robust consumer spending, fueled by factors like government stimulus and pent-up demand from the pandemic, puts upward pressure on prices.

- Global factors: The war in Ukraine, energy price shocks, and global supply chain issues significantly impact Canada's inflation rate, adding complexity to the Bank of Canada's policy decisions. Domestic factors like housing shortages and strong demand for certain services also play a role. These factors directly relate to the Bank of Canada’s mandate to maintain price stability, making the current situation particularly challenging.

The Bank of Canada's Policy Response: A Balancing Act

To combat inflation, the Bank of Canada has implemented a series of interest rate hikes.

Interest Rate Hikes and Their Impact

The Bank of Canada has aggressively raised interest rates to cool down the economy and curb inflation. However, the impact of these hikes is not immediate.

- Lag effect: Interest rate changes take time to fully impact inflation. There's a significant lag between policy adjustments and their effect on prices and economic activity.

- Negative consequences: Higher interest rates can slow economic growth, potentially leading to job losses and a recession. This is a delicate balancing act for the Bank, requiring careful consideration of the potential trade-offs.

Alternative Monetary Policy Tools

Beyond interest rate adjustments, the Bank of Canada has other tools at its disposal:

- Quantitative tightening (QT): QT involves reducing the Bank's balance sheet by allowing government bonds to mature without reinvestment. This reduces the money supply, potentially curbing inflation.

- Communication: Clear communication of the Bank's intentions and assessment of the economic situation is a crucial tool to manage expectations and influence market behavior. The Bank utilizes press conferences, reports, and other channels to this end. The effectiveness of these tools in the face of unforeseen global events requires careful monitoring.

Economic Outlook and Potential Scenarios

The Bank of Canada regularly publishes inflation forecasts and analyzes various economic scenarios.

Forecasting Inflation and Growth

The Bank of Canada's forecasts are crucial for guiding monetary policy decisions. However, there's considerable uncertainty around the future path of inflation and economic growth.

- Soft landing: A scenario where inflation gradually declines to the 2% target without causing a significant recession.

- Recession: A scenario where aggressive interest rate hikes trigger a contraction in economic activity, leading to job losses and reduced consumer spending.

- Stagflation: A scenario combining slow economic growth with high inflation, a particularly challenging scenario for policymakers. The risks associated with each scenario are significant, requiring a nuanced approach by the Bank of Canada.

The Impact on Canadian Households and Businesses

Persistent high inflation and higher interest rates have significant consequences:

- Higher borrowing costs: Increased interest rates make borrowing more expensive for households and businesses, impacting investment and consumer spending. This can dampen economic activity and exacerbate the inflation dilemma.

- Reduced consumer spending: High inflation erodes purchasing power, leading to decreased consumer spending, which can further slow economic growth.

- Vulnerable sectors: Some sectors, like the housing market, are particularly vulnerable to higher interest rates, potentially experiencing significant price corrections.

Conclusion

The Bank of Canada’s inflation dilemma presents a significant challenge. Balancing the need to control persistent core inflation with the goal of maintaining economic stability requires careful navigation. The effectiveness of past interest rate hikes, the potential for alternative policy tools, and the evolving economic outlook will all shape future decisions. Understanding the intricacies of this situation is crucial for Canadian citizens and businesses alike. Stay informed about the Bank of Canada's ongoing efforts to manage inflation and its impact on the Canadian economy. Continue to monitor the Bank of Canada’s announcements and analysis concerning their approach to the ongoing inflation dilemma and the evolving landscape of core inflation in Canada.

Featured Posts

-

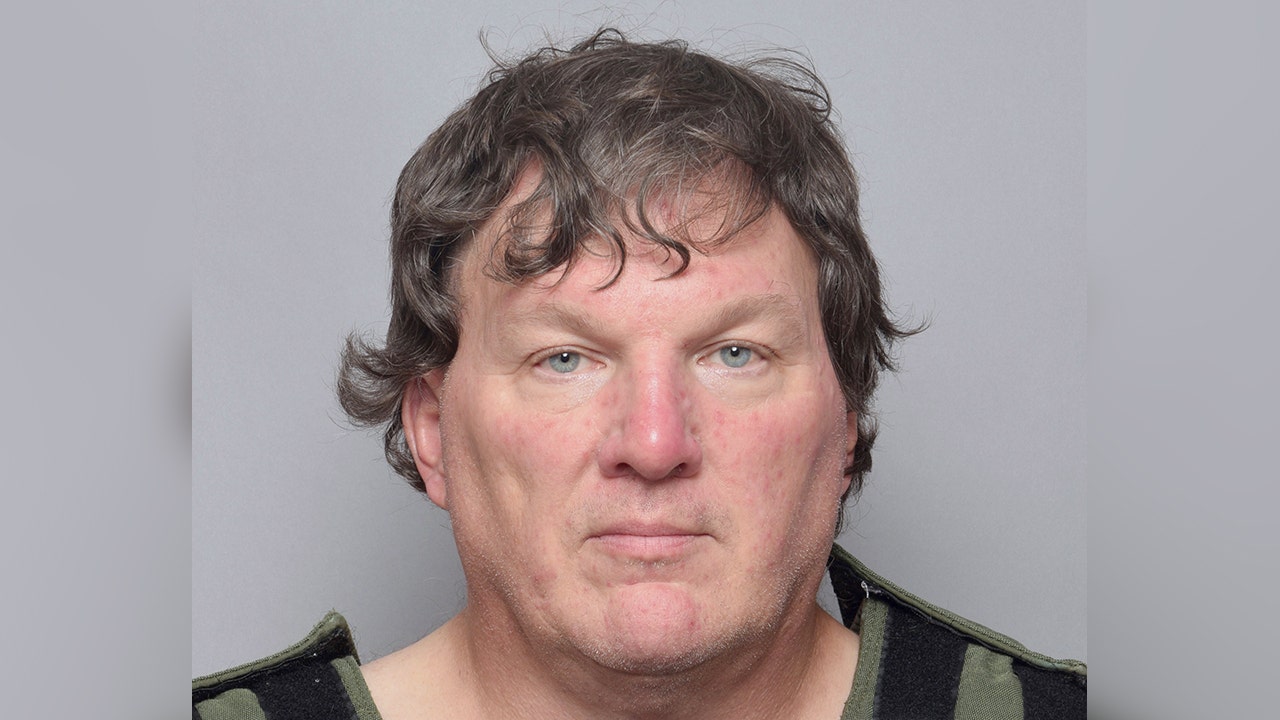

Embassy Employee Murders Suspect Apprehended

May 22, 2025

Embassy Employee Murders Suspect Apprehended

May 22, 2025 -

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligine Yeni Bakis

May 22, 2025

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligine Yeni Bakis

May 22, 2025 -

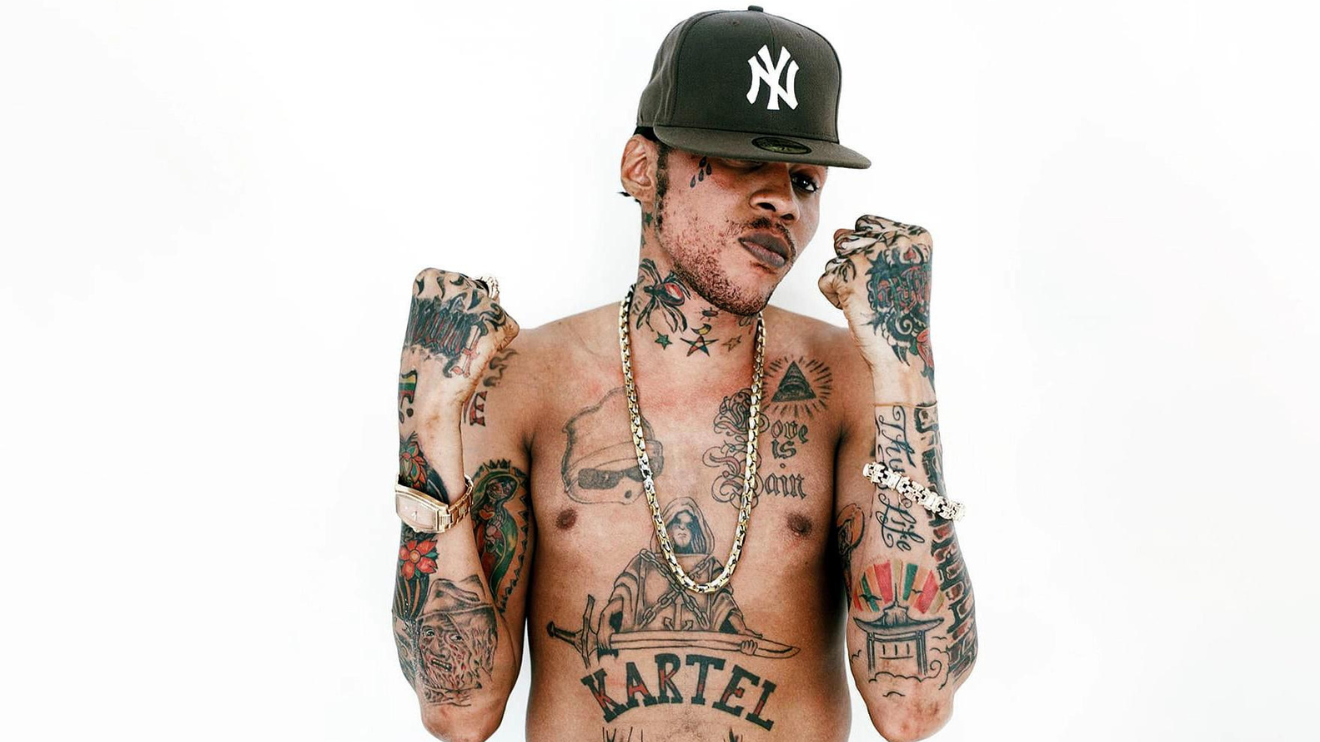

Exclusive Vybz Kartel On Prison Freedom And His New Music

May 22, 2025

Exclusive Vybz Kartel On Prison Freedom And His New Music

May 22, 2025 -

Is This The End David Walliams And Simon Cowells Bgt Feud

May 22, 2025

Is This The End David Walliams And Simon Cowells Bgt Feud

May 22, 2025 -

Vtorinni Sanktsiyi Proti Rosiyi Senat Skhvalit Propozitsiyu Grema

May 22, 2025

Vtorinni Sanktsiyi Proti Rosiyi Senat Skhvalit Propozitsiyu Grema

May 22, 2025