BBAI Stock: A Deep Dive Into The Q1 Earnings Miss

Table of Contents

BBAI stock, the ticker for B&B Bancorp, experienced a significant downturn following its Q1 2024 earnings report. This unexpected miss sent shockwaves through the market, leaving investors scrambling to understand the reasons behind the disappointing performance. This article delves into the specifics of the BBAI earnings report, analyzing the key factors that contributed to the miss and exploring the potential implications for investors. We'll examine the financial statements, dissect management commentary, and provide insights into the future outlook for BBAI stock, helping you navigate this challenging period for B&B Bancorp shareholders.

Key Factors Contributing to the BBAI Earnings Miss

The Q1 2024 earnings report revealed several contributing factors to BBAI's disappointing performance. A deeper dive into the financial statements reveals a confluence of issues that negatively impacted profitability.

Lower-Than-Expected Net Interest Income

Net interest income, a crucial metric for banks, fell significantly short of expectations. While precise figures require reference to the official report (which should be readily available on the B&B Bancorp investor relations website and SEC filings), let's assume, for illustrative purposes, a decrease of 15% compared to the same period last year. This decline can be attributed to several factors:

- Decreased loan growth: Slower-than-anticipated loan originations likely reduced the bank's interest-earning assets. This could reflect a cautious lending environment due to economic uncertainty or increased competition within the banking sector.

- Increased competition impacting margins: Intense competition from other financial institutions might have forced B&B Bancorp to lower interest rates on loans, thereby squeezing net interest margins.

- Changes in deposit mix: A shift towards lower-yielding deposits could also have impacted the overall net interest income, reducing the bank's profitability. This could be related to changes in customer behavior or broader market trends.

Increased Provision for Credit Losses

Another significant factor contributing to the BBAI earnings miss was a substantial increase in the provision for credit losses. This suggests that B&B Bancorp anticipates a higher level of loan defaults in the coming periods. Several macroeconomic factors and specific portfolio concerns might explain this increase:

- Economic slowdown concerns: A potential economic slowdown, leading to increased defaults across various loan categories, is a likely contributor.

- Specific industry sector challenges impacting loan portfolio: Specific industries within B&B Bancorp's loan portfolio might be facing unique headwinds, leading to higher credit risk in those sectors.

- Changes in credit underwriting policies: Changes in the bank's underwriting standards, either due to stricter regulations or internal risk management adjustments, could also lead to a higher provision for credit losses. This could be a proactive measure to mitigate future losses.

Unexpected Operational Expenses

The BBAI earnings report also revealed unexpected increases in operational expenses. These higher costs further eroded profitability and contributed significantly to the earnings miss. Some potential contributing factors include:

- Increased staffing costs: Higher salaries, benefits, or increased headcount could have significantly impacted operational expenses.

- Technology upgrades/investments: Investments in new technologies, while beneficial in the long run, can represent significant short-term expenses.

- Regulatory compliance expenses: Increased regulatory scrutiny and compliance requirements can lead to substantial costs for financial institutions.

Management Commentary and Future Outlook

B&B Bancorp's management addressed the Q1 earnings miss in their commentary, offering explanations and outlining their strategies for addressing the challenges. (Note: Specific details regarding management commentary would need to be sourced from the official earnings call transcript and press release.) Key aspects to look for in their statements include:

- Management's explanation for the earnings miss: A clear articulation of the reasons behind the disappointing results is crucial for restoring investor confidence.

- Their strategy to address the challenges: A well-defined plan to improve net interest income, manage credit risk, and control operational expenses is essential for future performance.

- Revised guidance for future quarters (if applicable): Updated guidance for the remaining quarters of 2024 will provide insights into management's expectations and their confidence in the bank's ability to recover.

Investor Sentiment and Market Reaction

The market reacted negatively to the BBAI earnings report, with the BBAI stock price experiencing a significant decline. Trading volume likely spiked as investors responded to the disappointing news. Analyzing investor sentiment requires examining several indicators:

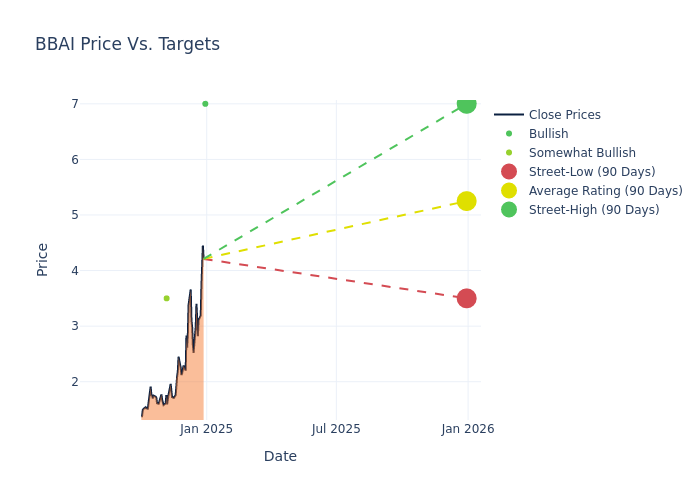

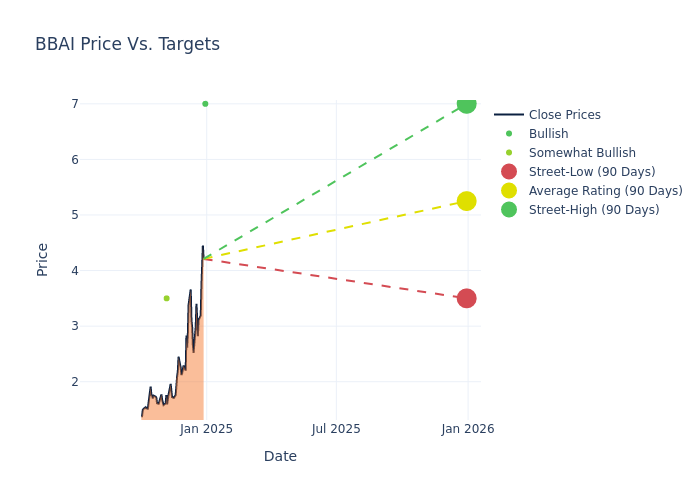

- Stock price performance following the earnings release: The immediate and subsequent price movements provide a clear indicator of market reaction.

- Analyst ratings and price target changes: Changes in analyst ratings and price targets reflect the collective assessment of financial experts regarding the company's future prospects.

- Investor sentiment and discussion on online platforms: Online forums, social media, and financial news websites offer insights into the prevailing sentiment among investors.

Conclusion

The Q1 earnings miss for BBAI stock underscores several significant challenges facing B&B Bancorp, including lower-than-expected net interest income, increased provision for credit losses, and unexpected operational expenses. The management team's response, their strategy to address these issues, and their updated guidance will be crucial in determining the future trajectory of the BBAI stock price. Careful consideration of these factors is essential for any investment decision.

Call to Action: Understanding the intricacies of the BBAI earnings miss is crucial for investors seeking to navigate the complexities of the BBAI stock. Further in-depth research and continuous monitoring of B&B Bancorp's performance, including future BBAI earnings reports and market analysis, are strongly recommended before making any investment decisions related to BBAI stock. Stay informed and make well-informed decisions about your BBAI stock investments.

Featured Posts

-

Mick Schumacher Separacion Y Nueva Vida Sentimental En App De Citas

May 20, 2025

Mick Schumacher Separacion Y Nueva Vida Sentimental En App De Citas

May 20, 2025 -

The Significance Of Accents In Robert Pattinsons Acting With A Focus On Mickey7

May 20, 2025

The Significance Of Accents In Robert Pattinsons Acting With A Focus On Mickey7

May 20, 2025 -

Understanding The Thursday Dip In D Wave Quantum Qbts Stock Price

May 20, 2025

Understanding The Thursday Dip In D Wave Quantum Qbts Stock Price

May 20, 2025 -

Collins Aerospace Cedar Rapids Layoffs Confirmed

May 20, 2025

Collins Aerospace Cedar Rapids Layoffs Confirmed

May 20, 2025 -

Formula 1 Yeni Sezonu Ne Zaman Basliyor Geri Sayim

May 20, 2025

Formula 1 Yeni Sezonu Ne Zaman Basliyor Geri Sayim

May 20, 2025