Betting On Uber's Driverless Future: ETFs That Could Pay Off

Table of Contents

Understanding the Autonomous Vehicle Market and Uber's Role

The autonomous vehicle market is experiencing explosive growth. Analysts predict a massive expansion in the coming years, with projections suggesting a multi-billion dollar market by the end of the decade. This growth is fueled by advancements in artificial intelligence (AI), sensor technology, and mapping capabilities. Uber, with its massive network and existing infrastructure, is well-positioned to capitalize on this opportunity. Uber's Advanced Technologies Group (ATG) is heavily invested in developing self-driving technology, and the company has formed strategic partnerships to accelerate its progress.

However, Uber faces stiff competition from established players like Waymo (Alphabet's self-driving car company) and Tesla, as well as numerous other emerging startups. The race to dominate the autonomous vehicle market is fierce.

- Market size projections for autonomous vehicles: Estimates vary, but some predict a market value exceeding $1 trillion by 2030.

- Uber's strategic advantages and disadvantages in the race for autonomous driving: Advantages include its existing ride-sharing network and user base; disadvantages include the high cost of R&D and intense competition.

- Key milestones achieved by Uber in autonomous driving technology: These include successful test deployments in select cities and ongoing partnerships with technology providers.

Identifying Relevant ETFs for Investing in the Autonomous Vehicle Revolution

ETFs offer a diversified and convenient way to invest in the autonomous vehicle sector. Instead of investing in individual companies, which carries higher risk, ETFs allow you to spread your investment across multiple companies involved in various aspects of the industry. This diversification mitigates risk and potentially enhances returns.

ETFs related to this sector can be categorized into technology ETFs, transportation ETFs, and robotics ETFs. Each has a different focus and weighting scheme. For example, some technology ETFs heavily invest in companies developing AI, LiDAR sensors, and other crucial technologies for autonomous vehicles. Transportation ETFs may include companies involved in the manufacturing and deployment of self-driving vehicles. Robotics ETFs may focus on companies developing the robotic systems that power autonomous driving.

Several ETFs offer exposure to companies involved in autonomous driving technology, including:

- Technology ETFs: (Examples of specific ETFs with tickers should be inserted here; research current market ETFs suitable for this sector and include their tickers. Always check the latest information before investing). These ETFs often include companies developing AI, mapping technologies, and sensor systems.

- Transportation ETFs: (Examples of specific ETFs with tickers should be inserted here). These might include companies manufacturing autonomous vehicle components or developing autonomous driving systems for various transportation modes.

- Robotics ETFs: (Examples of specific ETFs with tickers should be inserted here). These often focus on companies involved in the development and implementation of robotics technologies relevant to autonomous systems.

When evaluating ETFs, consider their holdings, expense ratios (fees), and historical performance. Understand the ETF's weighting scheme – how it allocates its investments across different companies.

Analyzing Risk and Reward in Autonomous Vehicle ETF Investments

Investing in emerging technologies like autonomous vehicles comes with inherent risks. Regulatory hurdles, technological challenges, and intense competition could negatively impact the performance of related investments. Regulatory approvals for self-driving technology vary widely across jurisdictions, creating uncertainty. Technological setbacks and unforeseen issues in the development and deployment of autonomous vehicles could also lead to financial losses.

Despite these risks, the potential rewards are significant. The long-term growth potential of the autonomous vehicle market is substantial, offering investors the chance to participate in a transformative technological shift.

- Potential regulatory roadblocks affecting the adoption of autonomous vehicles: These include safety regulations, liability issues, and data privacy concerns.

- Technological risks associated with the development and deployment of self-driving cars: These involve unforeseen software glitches, sensor failures, and unexpected environmental challenges.

- Factors to consider when assessing the risk-reward profile of an ETF: These include the ETF's holdings, expense ratio, historical performance, and the overall market outlook for autonomous vehicles.

Diversification Strategies for Minimizing Risk

To mitigate risks, diversify your investments across different ETFs. Don't put all your eggs in one basket. A balanced portfolio approach, combining investments in various ETFs that cover different segments of the autonomous vehicle industry and even broader technology sectors, helps to reduce the impact of any single negative event. Furthermore, adopting a long-term investment horizon allows you to ride out short-term market fluctuations and potentially benefit from the long-term growth potential of the sector.

Conclusion

Investing in the future of autonomous vehicles, specifically through ETFs that offer exposure to companies like those involved in Uber's driverless future, presents a compelling opportunity. By carefully selecting ETFs and employing a diversified investment strategy, investors can potentially capitalize on the significant growth expected in this sector. However, remember that investing in emerging technologies carries inherent risks. Thorough due diligence, understanding the risk-reward profile, and considering a long-term investment horizon are crucial. Before making any investment decisions, conduct your own research and consult with a qualified financial advisor. Start exploring the possibilities of Betting on Uber's Driverless Future: ETFs today.

Featured Posts

-

Ny Knicks Vs Brooklyn Nets Free Live Stream April 13 2025 Time Tv Channel And Nba Season Finale Details

May 17, 2025

Ny Knicks Vs Brooklyn Nets Free Live Stream April 13 2025 Time Tv Channel And Nba Season Finale Details

May 17, 2025 -

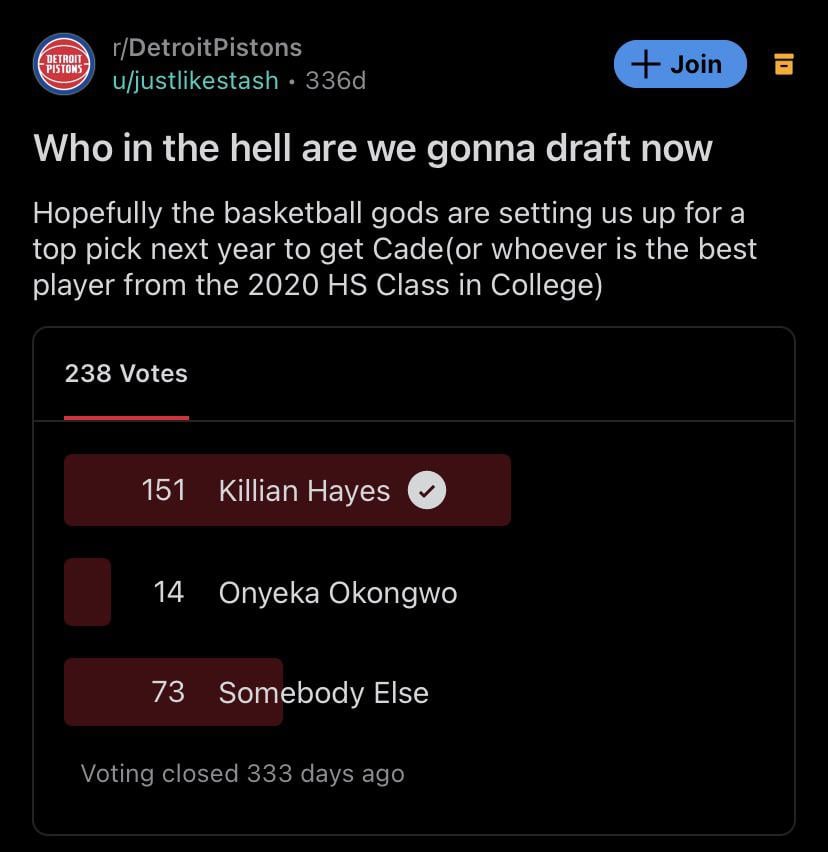

Crew Chief Admits Wrong Call Cost Detroit Pistons Game

May 17, 2025

Crew Chief Admits Wrong Call Cost Detroit Pistons Game

May 17, 2025 -

Austins Autonomous Future Exploring Uber And Waymos Robotaxi Services

May 17, 2025

Austins Autonomous Future Exploring Uber And Waymos Robotaxi Services

May 17, 2025 -

Ex Vasco Brilha Nos Emirados Arabes Com A Camisa 10 E Sonha Com A Copa Do Mundo

May 17, 2025

Ex Vasco Brilha Nos Emirados Arabes Com A Camisa 10 E Sonha Com A Copa Do Mundo

May 17, 2025 -

Jack Bit Your Best Bitcoin Casino Choice In 2025

May 17, 2025

Jack Bit Your Best Bitcoin Casino Choice In 2025

May 17, 2025