BigBear.ai (BBAI): Deep Dive Into The Recent Stock Market Decline

Table of Contents

Macroeconomic Factors Affecting BBAI Stock Price

Rising Interest Rates and Inflationary Pressures

Broader economic conditions significantly impact tech stocks like BBAI, especially those heavily reliant on government contracts. The current inflationary environment and the Federal Reserve's response through rising interest rates create a challenging landscape.

- Reduced Government Spending: Inflation erodes the purchasing power of government budgets, potentially leading to reduced spending on contracts like those held by BBAI. This decreased government spending directly impacts BBAI's revenue streams.

- Increased Borrowing Costs: Higher interest rates increase the cost of borrowing for BBAI, impacting its operational expenses and potentially hindering future growth initiatives. This increased debt burden can negatively affect profitability and investor confidence.

- Shifting Investor Sentiment: Rising interest rates often lead investors to shift away from riskier assets like growth stocks, including those in the technology sector, in favor of safer, higher-yielding investments. This shift in sentiment contributes to the overall downward pressure on BBAI's stock price.

Geopolitical Uncertainty and its Influence

Global instability and geopolitical uncertainty can significantly impact investor confidence, triggering sell-offs across various sectors, including technology.

- Impact of Global Events: [Mention specific geopolitical events, e.g., the war in Ukraine, tensions with China, etc., and explain their potential indirect impact on BBAI's contracts or investor outlook. For example, supply chain disruptions or shifts in government priorities due to geopolitical events can affect BBAI's performance.]

- Investor Risk Aversion: Uncertainty often leads investors to become more risk-averse, resulting in a sell-off of stocks perceived as more volatile, such as BBAI. This contributes to increased selling pressure and a further decline in the BBAI stock price.

Company-Specific Factors Contributing to the BBAI Decline

Recent Earnings Reports and Financial Performance

Analyzing BBAI's recent financial performance provides crucial insights into the stock decline. Negative trends or missed expectations can significantly impact investor confidence.

- Key Financial Metrics: [Insert data from recent earnings reports, citing sources. Compare revenue, earnings, and debt figures to previous quarters and analyst expectations. Highlight any significant discrepancies and explain their implications.] For example: "Q3 2023 revenue fell short of analyst projections by X%, indicating potential challenges in securing new contracts or executing existing ones."

- Profitability and Growth: [Analyze BBAI's profitability margins and revenue growth compared to previous periods and industry benchmarks. Discuss any concerning trends that might explain the stock decline.]

Contract Wins/Losses and Their Market Impact

The awarding or loss of major government contracts significantly impacts BBAI's valuation.

- Recent Contract Announcements: [Discuss specific contract wins and losses. Quantify their financial impact on BBAI's revenue projections and explain how these announcements have been interpreted by the market.] For instance: "The loss of the [Contract Name] contract, valued at [Dollar Amount], negatively impacted investor sentiment and contributed to the BBAI stock price drop."

- Pipeline of Future Contracts: [Analyze the health and size of BBAI's contract pipeline. Discuss whether the pipeline suggests potential future revenue growth or further challenges.]

Management Changes and Investor Confidence

Changes in leadership or internal issues can erode investor confidence and negatively affect stock performance.

- Leadership Transitions: [Mention any recent management changes and their potential impact on investor sentiment. Analyze whether these changes have created uncertainty or signaled a shift in company strategy.]

- Internal Challenges: [If any internal issues, such as regulatory investigations or internal restructuring, have been reported, discuss their potential influence on the BBAI stock price.]

Technical Analysis of the BBAI Stock Chart

Identifying Key Support and Resistance Levels

Analyzing the BBAI stock chart using technical indicators can reveal critical price points influencing the decline.

- Support and Resistance Levels: [Describe key support and resistance levels identified on the chart. Explain how these levels have been breached, and what this implies for future price movement.]

- Moving Averages: [Analyze the behavior of moving averages (e.g., 50-day, 200-day) and how they correlate with the price action. Explain their significance in predicting future trends.] [Include charts if possible.]

Trading Volume and its Significance

Trading volume offers insights into the intensity of buying and selling pressure during the decline.

- High Volume Sell-offs: [Identify periods of high trading volume coinciding with significant price drops. Explain what these periods reveal about the strength of selling pressure.]

- Low Volume Consolidation: [Analyze periods of low trading volume and explain their significance in identifying potential support or resistance levels.]

Conclusion: Navigating the Future of BBAI Stock

The BBAI stock market decline stems from a combination of macroeconomic headwinds, including rising interest rates and inflationary pressures, geopolitical uncertainties, and company-specific factors such as recent earnings reports, contract wins/losses, and potential management-related concerns. Technical analysis of the stock chart further supports this observation, highlighting key support and resistance levels and the intensity of selling pressure. While the outlook remains uncertain, monitoring BBAI's future financial performance, contract announcements, and broader macroeconomic conditions is crucial. Investors should closely follow reputable financial news sources and analyst reports to stay informed and make informed investment decisions regarding BigBear.ai (BBAI) stock. Understanding the factors influencing BBAI's stock price is crucial for strategic investment decisions.

Featured Posts

-

Eurovision 2025 Artists A Preview Of The Contestants

May 20, 2025

Eurovision 2025 Artists A Preview Of The Contestants

May 20, 2025 -

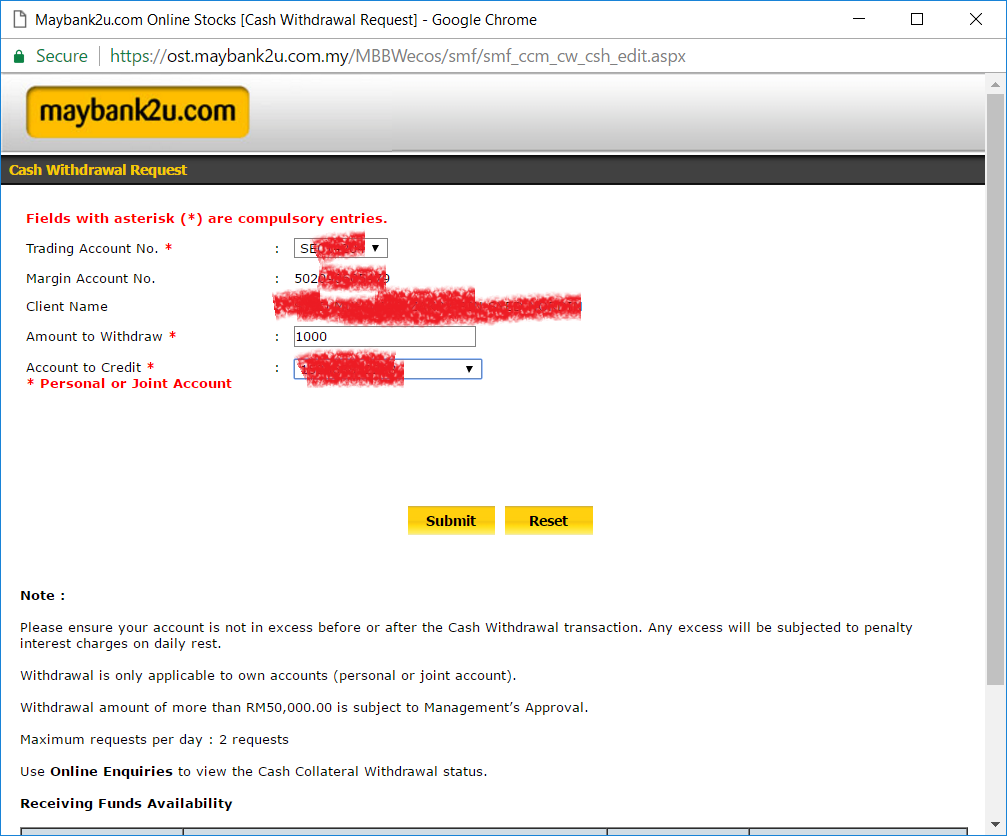

Maybanks 545 Million Economic Zone Investment Boost

May 20, 2025

Maybanks 545 Million Economic Zone Investment Boost

May 20, 2025 -

Jennifer Lawrences New Film A Critical Review

May 20, 2025

Jennifer Lawrences New Film A Critical Review

May 20, 2025 -

Un Nou Membru In Familia Schumacher Legendarul Pilot Devine Bunic

May 20, 2025

Un Nou Membru In Familia Schumacher Legendarul Pilot Devine Bunic

May 20, 2025 -

Nea Stoixeia Fotizoyn Aneksixniasta Tampoy

May 20, 2025

Nea Stoixeia Fotizoyn Aneksixniasta Tampoy

May 20, 2025