BigBear.ai (BBAI): Evaluating This AI Penny Stock's Potential

Table of Contents

Understanding BigBear.ai's Business Model and Target Market

BigBear.ai provides cutting-edge AI solutions to both government and commercial clients. Its success hinges on its ability to navigate these distinct markets, each demanding specialized capabilities and presenting unique challenges.

Government Contracts and National Security Applications

BBAI's significant involvement in government contracts highlights its expertise in applying AI to national security challenges. The company leverages its advanced AI capabilities to support critical missions for various agencies.

- Examples: While specific contract details may be confidential, BBAI's work often involves data analytics, predictive modeling, and cybersecurity solutions for national defense.

- Government Agencies: Potential partnerships and contracts involve agencies such as the Department of Defense, intelligence agencies, and other federal organizations.

- Future Growth: The continued demand for sophisticated AI solutions within the government sector presents significant potential for future contract wins and substantial revenue growth for BBAI. Successfully securing large-scale contracts could be a catalyst for significant stock price appreciation.

Commercial AI Solutions and Market Penetration

Beyond government contracts, BBAI is actively pursuing opportunities in the commercial sector. However, this market is highly competitive, with numerous established players vying for market share.

- Commercial Applications: BBAI's AI solutions are applicable across several commercial industries, including finance, healthcare, and logistics, providing services such as fraud detection, risk assessment, and supply chain optimization.

- Market Share and Growth: Penetration of the commercial market is crucial for long-term growth. BBAI needs to effectively differentiate its offerings and demonstrate a clear value proposition to attract and retain clients in this competitive landscape. Strategic partnerships and acquisitions could accelerate market penetration.

- Potential Partnerships/Acquisitions: Strategic alliances or acquisitions of smaller AI companies could broaden BBAI's product portfolio and expand its reach within the commercial sector.

Analyzing BigBear.ai's Financial Performance and Valuation

A thorough analysis of BBAI's financial performance is essential for assessing its investment potential. Evaluating key metrics provides insights into its current financial health and future prospects.

Revenue Growth and Profitability

Understanding revenue trends and profitability is crucial for assessing the company's financial stability.

- Key Financial Metrics: Investors should carefully examine BBAI's revenue growth, net income (or losses), operating margins, debt-to-equity ratio, and cash flow statements. A trend analysis over several quarters is vital to gauge the long-term trajectory.

- Comparison to Competitors: Comparing BBAI's financial performance against its competitors helps establish its relative position within the AI industry and determine its competitiveness. Benchmarking against similar companies provides a more comprehensive evaluation.

Stock Valuation and Price-to-Earnings Ratio

Determining the fair value of BBAI stock requires considering several valuation metrics and acknowledging the inherent uncertainties of penny stocks.

- Current Stock Price & Market Capitalization: The current market price reflects investor sentiment and expectations for future growth. Market capitalization provides a measure of the company's overall size.

- P/E Ratio (if applicable): If BBAI is profitable, the price-to-earnings ratio helps gauge the market's valuation relative to its earnings. However, for companies with negative earnings, other valuation methods may be more appropriate.

- Risks and Uncertainties: Penny stocks are inherently volatile, and BBAI is no exception. Investors must carefully consider the risks associated with investing in a company with a potentially high degree of uncertainty.

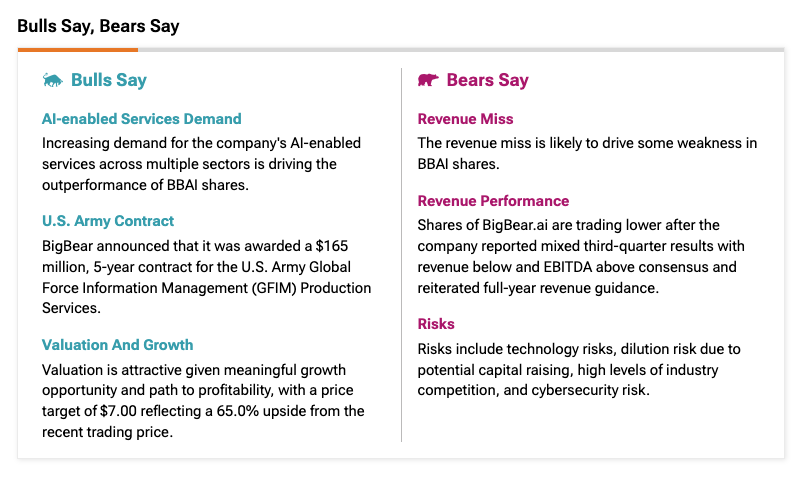

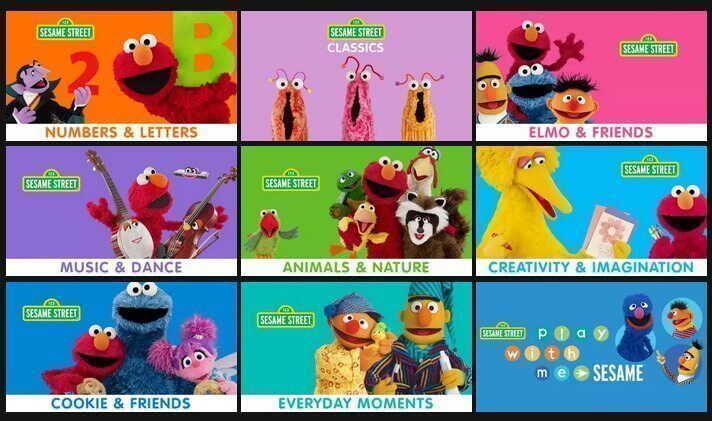

Assessing the Risks and Rewards of Investing in BBAI

Investing in BBAI, or any penny stock, involves substantial risks, but the potential rewards could be significant if the company executes its strategy successfully.

Volatility and Market Sentiment

The inherent volatility of penny stocks makes BBAI's price susceptible to significant swings based on market sentiment and news events.

- Factors Impacting Stock Price: News regarding contract wins or losses, regulatory changes affecting the AI industry, competitive pressures, and overall market conditions can dramatically impact BBAI's stock price.

- Positive Catalysts: Successful contract renewals, expansion into new markets, technological breakthroughs, or positive earnings surprises could trigger significant price increases.

Competition in the AI Market

The AI market is intensely competitive, with both established tech giants and emerging startups vying for market share.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of BBAI's competitors is essential for assessing its competitive advantage. This analysis should include both direct and indirect competitors in both government and commercial sectors.

Long-Term Growth Potential

BBAI's long-term growth hinges on several factors, including technological innovation, market expansion, and the effectiveness of its management team.

- Technological Advancements: Continuous investment in research and development is crucial for maintaining a competitive edge in the rapidly evolving AI landscape.

- Market Expansion: Successfully penetrating new markets and expanding its customer base are essential for achieving significant revenue growth.

- Strategic Partnerships: Collaborations with other companies can provide access to new technologies, markets, and resources, accelerating BBAI's growth trajectory.

Conclusion: BigBear.ai (BBAI) Investment Outlook and Call to Action

Investing in BigBear.ai (BBAI) presents a potentially lucrative opportunity but also entails considerable risk. While the company's focus on AI solutions for government and commercial clients offers significant growth potential, the volatile nature of penny stocks, the competitive landscape, and inherent financial uncertainties must be carefully considered. Our analysis highlights the need for thorough due diligence before investing.

The information provided here is for educational purposes only and does not constitute financial advice. Before making any investment decisions regarding BigBear.ai (BBAI) or any other AI penny stock, conduct your own thorough research, consult with a qualified financial advisor, and review the company's SEC filings. Understanding the inherent risks associated with penny stock investments is paramount to making informed decisions. Remember, always invest responsibly and only with capital you can afford to lose.

Featured Posts

-

The Old North State Report Highlights From May 9 2025

May 21, 2025

The Old North State Report Highlights From May 9 2025

May 21, 2025 -

A Family Legacy The Traversos And The Cannes Film Festival

May 21, 2025

A Family Legacy The Traversos And The Cannes Film Festival

May 21, 2025 -

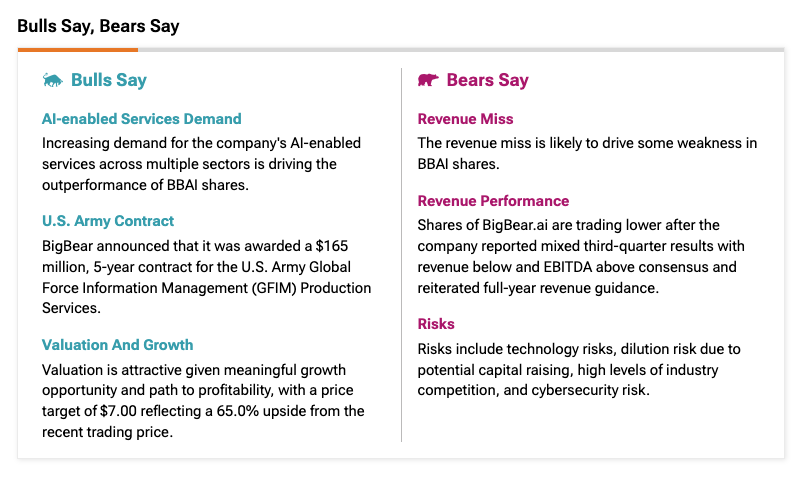

Is Sesame Street Coming To Netflix Heres What We Know

May 21, 2025

Is Sesame Street Coming To Netflix Heres What We Know

May 21, 2025 -

Ohio Train Disaster Persistence Of Toxic Chemicals In Structures

May 21, 2025

Ohio Train Disaster Persistence Of Toxic Chemicals In Structures

May 21, 2025 -

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025