BigBear.ai (BBAI) Retains Buy Rating Amidst Growing Defense Investments

Table of Contents

BigBear.ai's Strong Position in the Growing Defense AI Market

The defense sector is experiencing a massive surge in AI adoption, driven by the need for enhanced national security and more efficient operations. BigBear.ai is exceptionally well-positioned to capitalize on this growth. Their specialized AI and data analytics solutions are specifically designed to meet the unique challenges faced by government agencies and defense contractors. This competitive advantage is reflected in their impressive track record of securing lucrative government contracts.

-

Recent Contract Wins: BigBear.ai has consistently secured significant contracts, demonstrating their value proposition within the defense AI market. These contracts translate directly into substantial revenue streams, fueling the company’s growth and reinforcing the buy rating. Analysis of these contract wins reveals a significant contribution to BBAI's financial stability and future projections.

-

Unique Technological Capabilities: BBAI's proprietary AI technologies provide superior capabilities in areas such as predictive analytics, real-time threat assessment, and complex data analysis. This cutting-edge technology gives them a clear advantage over competitors, providing a strong foundation for future success.

-

Competitive Landscape: While competitors exist in the defense AI space, BigBear.ai distinguishes itself through its focus on highly specialized solutions and a strong track record of delivering results. This niche specialization allows them to command premium pricing and maintain a competitive edge.

-

Future Projections: The global defense AI market is projected to experience substantial growth in the coming years. BigBear.ai, with its strong foothold and technological prowess, is uniquely positioned to benefit significantly from this expanding market, reinforcing the long-term potential of BBAI stock.

Maintaining the Buy Rating: A Deeper Dive into Analyst Opinions

The continued buy rating for BBAI isn’t based solely on speculation. Multiple financial analysts have issued buy recommendations based on their comprehensive assessments of BigBear.ai's performance, growth potential, and overall market position.

-

Key Analyst Reports: Numerous reputable analysts have published reports highlighting BBAI's strong fundamentals, including positive revenue growth, strategic acquisitions, and a robust pipeline of future projects. These reports form the basis of the widespread buy rating.

-

Projected Growth Rate: Analysts generally project a healthy growth rate for BBAI, further supporting the buy rating. These predictions are based on the company's consistent contract wins, technological advancements, and the overall growth trajectory of the defense AI market.

-

Potential Risks and Mitigating Factors: While any investment carries inherent risk, analysts have identified potential challenges and mitigating factors. These include market volatility and competition. However, BBAI’s strong position in the defense sector and its focus on high-value contracts help to mitigate many of these risks.

-

Comparative Valuation: Compared to its competitors in the AI and defense sectors, BigBear.ai presents a compelling valuation, bolstering the case for a buy rating and positioning it as an attractive investment opportunity.

Addressing Market Volatility and its Impact on BBAI

Market volatility is a reality, and BBAI stock price is not immune to fluctuations. However, the underlying strength of the company and its position within the rapidly expanding defense AI market suggests a resilience to these fluctuations.

-

Recent Market Trends: Although broader market trends may influence BBAI's stock price, its performance is largely driven by its operational success and contract wins within the defense sector, mitigating overall market impact.

-

BBAI's Resilience: BigBear.ai has demonstrated a degree of resilience to market downturns, thanks to its strong financial position and consistent contract wins. This resilience adds to investor confidence.

-

Factors Contributing to Volatility: While the company's success drives its stock price, external factors such as overall market sentiment and geopolitical events may contribute to volatility.

-

Managing Risk: Investors should always consider diversification and a long-term investment strategy to manage the inherent risks associated with market volatility.

BigBear.ai's Long-Term Growth Potential and Technological Advantages

BigBear.ai's long-term growth potential extends beyond the immediate defense sector. Their core technologies in AI and data analytics have applications across various industries, offering significant potential for future expansion and diversification.

-

Core Technologies and Applications: BigBear.ai's advanced AI and data analytics capabilities are applicable in diverse sectors, providing opportunities for future growth and revenue streams.

-

Expansion into New Markets: The company's technologies are adaptable across various sectors, offering opportunities to broaden their customer base and revenue streams beyond the defense sector.

-

R&D Efforts: BigBear.ai consistently invests in research and development, ensuring their technological edge and driving innovation to sustain long-term growth and competitive advantage.

-

Intellectual Property: A strong portfolio of intellectual property rights provides a crucial competitive advantage, protecting BBAI's innovative solutions and securing its position in the market.

Conclusion

BigBear.ai (BBAI) maintains a strong buy rating despite market volatility. This stems from its robust position in the burgeoning defense AI market, its proven technological superiority, and overwhelmingly positive analyst predictions. The company's commitment to innovation and its potential for expansion beyond the defense sector solidify its long-term growth prospects. Invest in BigBear.ai (BBAI) today, but remember to conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. Learn more about BBAI stock by exploring their financial reports and the latest analyst predictions. Analyze the BigBear.ai investment opportunity and determine if it aligns with your personal investment strategy.

Featured Posts

-

Will Mass Layoffs At Abc News Lead To Show Cancellations

May 21, 2025

Will Mass Layoffs At Abc News Lead To Show Cancellations

May 21, 2025 -

Exploring Paulina Gretzkys Life Wife Of Dustin Johnson Mother And Career

May 21, 2025

Exploring Paulina Gretzkys Life Wife Of Dustin Johnson Mother And Career

May 21, 2025 -

Peppa Pigs New Baby When Will We Meet The Newborn

May 21, 2025

Peppa Pigs New Baby When Will We Meet The Newborn

May 21, 2025 -

Bucharest Open Flavio Cobolli Claims Maiden Atp Title

May 21, 2025

Bucharest Open Flavio Cobolli Claims Maiden Atp Title

May 21, 2025 -

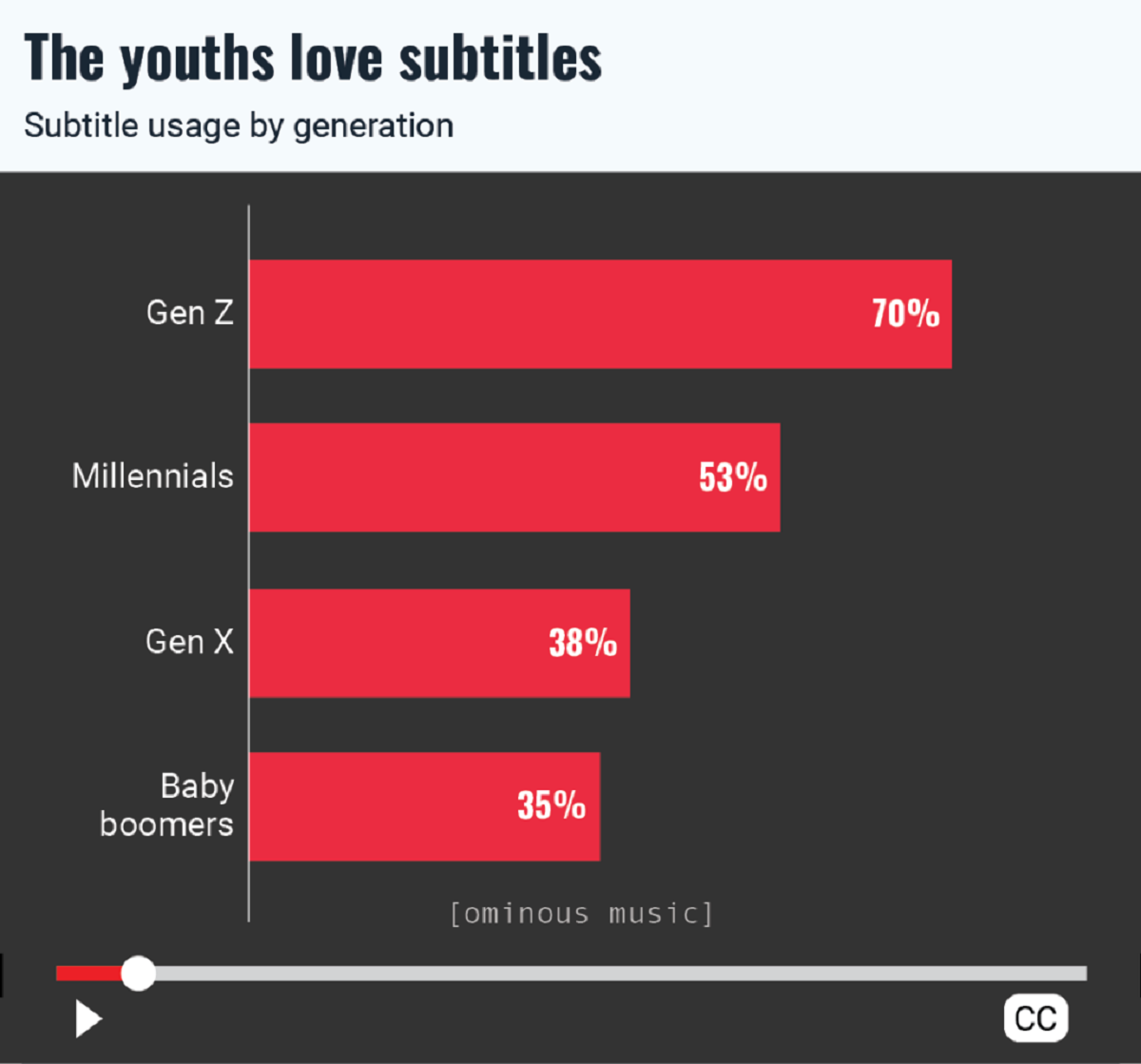

Why Does Gen Z Love Little Britain Despite Its Cancellation

May 21, 2025

Why Does Gen Z Love Little Britain Despite Its Cancellation

May 21, 2025