BigBear.ai Holdings (BBAI) Stock Plunge In 2025: Reasons And Analysis

Table of Contents

Macroeconomic Factors Contributing to the BBAI Stock Plunge

Several macroeconomic headwinds significantly impacted the performance of BBAI stock in 2025. These broad market forces played a crucial role in the overall decline experienced by many tech stocks, including BBAI.

Broad Market Downturn

2025 witnessed a considerable correction in the stock market, affecting various sectors, including technology. The S&P 500 and Nasdaq experienced significant declines, reflecting a broader economic slowdown.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks to combat inflation significantly impacted investor sentiment and increased borrowing costs for companies, reducing investment and impacting valuations like BBAI's. This led to a decrease in overall market liquidity and a flight to safety, pushing down growth stock prices like BBAI.

- Recessionary Fears: Growing fears of a global recession dampened investor confidence, leading to a sell-off across various asset classes, including technology stocks like BBAI. The uncertainty surrounding the economic outlook made investors more risk-averse, triggering widespread selling.

- Market Volatility: The combination of inflation, rising interest rates, and geopolitical instability led to increased market volatility. This volatility made investors reluctant to hold onto potentially risky assets such as BBAI, leading to further price declines.

Geopolitical Instability

Escalating geopolitical tensions and unforeseen global events played a significant role in the overall market downturn.

- International Conflicts: Ongoing international conflicts created uncertainty in the global economy and impacted investor confidence. This uncertainty led to a risk-off sentiment in the market, which negatively affected BBAI's valuation.

- Supply Chain Disruptions: Global supply chain disruptions continued to impact businesses, increasing costs and hindering growth. These disruptions particularly affected companies heavily reliant on global supply chains, potentially impacting BBAI's operational efficiency and profitability.

- Trade Wars: The threat of renewed trade tensions between major global powers added another layer of uncertainty to the economic landscape, contributing to market volatility and reducing investor appetite for riskier assets.

Company-Specific Factors Impacting BBAI Stock Performance

Beyond macroeconomic headwinds, several company-specific factors contributed to the BBAI stock price decline in 2025. Analyzing these factors is crucial for understanding the full scope of the issue.

Financial Performance

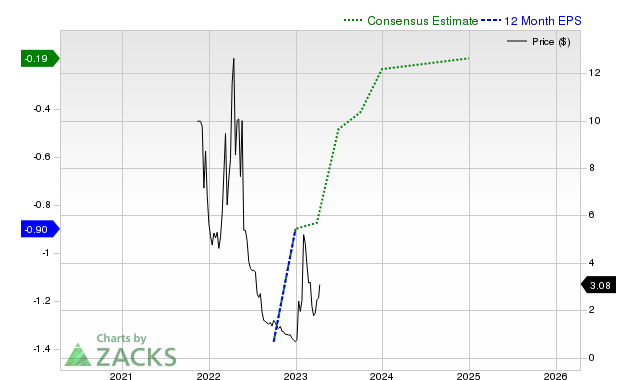

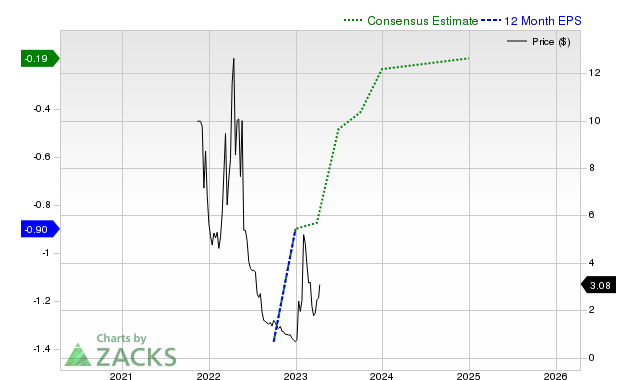

BBAI's financial performance in 2025 fell short of expectations, contributing significantly to the stock's decline.

- Missed Earnings: The company reported lower-than-expected earnings, resulting in a negative reaction from investors. This missed earnings projection indicated potential problems with BBAI's revenue generation or cost management.

- Decreased Revenue Growth: Slower-than-anticipated revenue growth fueled investor concerns about the company's long-term prospects. This sluggish revenue growth raised questions about BBAI's market position and its ability to compete effectively.

- High Debt Levels: High debt levels could have made BBAI more vulnerable to market downturns and increased investor concerns about its financial stability. High debt can also impact a company's ability to invest in growth and innovation.

Competitive Landscape

The competitive landscape also played a role in BBAI’s stock performance decline.

- Increased Competition: The emergence of new competitors and the improved performance of existing rivals intensified competition within the market. This increased competition squeezed BBAI's market share and margins.

- Loss of Market Share: A decline in BBAI's market share reflected a loss of competitiveness, indicating that the company might be struggling to adapt to market changes or offer superior products/services. This market share erosion negatively impacted investor confidence.

- Technological Disruption: Rapid technological advancements might have rendered some of BBAI’s products or services obsolete, leading to a decrease in demand and revenue. The inability to adapt to these disruptions further contributed to the stock’s decline.

Management and Leadership Changes

Internal issues and management changes added to the challenges faced by BBAI in 2025.

- Leadership Turnover: Significant changes in leadership created uncertainty and potentially disrupted the company's strategic direction. This leadership instability could have further eroded investor confidence.

- Internal Conflicts: Reports of internal conflicts or disagreements among senior management could have negatively impacted the company's operational efficiency and overall effectiveness.

- Lack of Transparency: A perceived lack of transparency regarding the company’s strategy and financial performance could have fueled speculation and uncertainty among investors.

Investor Sentiment and Market Speculation

Negative investor sentiment and market speculation further exacerbated the decline in BBAI’s stock price.

Analyst Ratings and Recommendations

Several analysts downgraded BBAI’s stock rating, contributing to negative investor sentiment.

- Negative Ratings: Negative ratings from influential financial analysts fueled selling pressure as investors reacted to the pessimistic outlook. These ratings can significantly influence investor decisions and contribute to price declines.

- Lower Price Targets: Lower price targets set by analysts further lowered expectations, signaling potential for further price decreases and impacting investor confidence.

- Reduced Investment Recommendations: Analysts' recommendations to sell or hold the stock instead of buy contributed to the selling pressure.

Short Selling and Market Manipulation

The possibility of short selling and market manipulation cannot be entirely ruled out.

- Unusual Trading Activity: Unusual trading patterns might have indicated the involvement of short sellers or other market manipulators. Investigation into such activity is crucial for a full understanding of the decline.

- Increased Short Interest: A significant increase in short interest might suggest that a substantial number of investors were betting against the stock, contributing to downward pressure on the price.

Conclusion: Navigating the Future of BigBear.ai Holdings (BBAI) Stock

The BBAI stock plunge in 2025 resulted from a complex interplay of macroeconomic factors, company-specific issues, and negative investor sentiment. The broad market downturn, geopolitical instability, disappointing financial performance, increased competition, and internal issues all contributed to the decline. While the situation presents significant risks, it also offers potential opportunities for long-term investors willing to conduct thorough due diligence. It's crucial to remember that this analysis is for informational purposes only and does not constitute financial advice. Before making any investment decisions related to BigBear.ai Holdings (BBAI) stock, conduct further research, consult with a qualified financial advisor, and carefully analyze the company's financial statements and future prospects. Continue your due diligence on BigBear.ai (BBAI) stock before making any investment decisions.

Featured Posts

-

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 21, 2025 -

Rediscovering Culinary History The Manhattan Forgotten Foods Festival

May 21, 2025

Rediscovering Culinary History The Manhattan Forgotten Foods Festival

May 21, 2025 -

Us Navy Admiral Robert Burke Guilty Verdict In Bribery Scandal

May 21, 2025

Us Navy Admiral Robert Burke Guilty Verdict In Bribery Scandal

May 21, 2025 -

Mntkhb Alwlayat Almthdt Thlathyt Jdydt Tzhr Lawl Mrt Tht Qyadt Bwtshytynw

May 21, 2025

Mntkhb Alwlayat Almthdt Thlathyt Jdydt Tzhr Lawl Mrt Tht Qyadt Bwtshytynw

May 21, 2025 -

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 21, 2025

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 21, 2025