BigBear.ai Holdings, Inc. (BBAI) Stock Crash: 17.87% Plunge Explained

Table of Contents

Analyzing the Market Sentiment Surrounding BBAI

The BigBear.ai (BBAI) stock crash didn't occur in a vacuum. Several factors contributed to the negative market sentiment surrounding the company. The broader market downturn, coupled with sector-specific concerns about the competitive landscape in the artificial intelligence and data analytics space, created a challenging environment for BBAI. Investor sentiment towards BigBear.ai and its technology was already fragile before the crash, potentially exacerbated by:

- Negative news coverage impacting investor confidence: Negative media portrayals, highlighting challenges or setbacks, can significantly erode investor trust and lead to selling pressure. Any perceived weakness in the company's technology or market strategy could fuel negative sentiment.

- Changes in analyst ratings and price targets: Downgrades from financial analysts and reduced price targets often signal a shift in expectations, influencing investor behavior and contributing to price drops. A cascade of negative ratings can accelerate a decline.

- Impact of competitor actions on BBAI's market position: Increased competition from established players or emerging rivals in the AI and data analytics sector could put pressure on BBAI's market share and revenue growth, impacting investor confidence and leading to a sell-off.

Impact of Financial Results and Earnings Reports on BBAI Stock Price

BigBear.ai's recent financial performance played a critical role in the stock price crash. While specific details require access to official financial reports, any underperformance against analyst expectations regarding revenue growth, profitability, or future guidance would have significantly impacted investor sentiment.

- Revenue growth or decline: A slowdown or decline in revenue growth, particularly if unexpected, can signal underlying issues within the business and lead to a negative market reaction.

- Profitability (or lack thereof): Consistent losses or a widening gap between revenue and expenses can erode investor confidence, particularly in a growth-oriented sector like AI and data analytics.

- Guidance for future performance: Management's outlook for future performance is crucial. If the company provides disappointing guidance, indicating lower-than-expected revenue or profits, it can trigger a significant sell-off.

- Comparison to analyst expectations: Falling short of analyst expectations in any of the above areas can severely damage investor confidence and lead to a sharp decline in the stock price.

The Role of Specific News and Events in the BBAI Stock Decline

Specific news and events can act as catalysts for a stock market crash. In the case of BBAI, several factors could have played a significant role:

- Contract wins or losses: The loss of a major contract or failure to secure anticipated deals can have a disproportionately negative impact on the stock price, particularly for companies heavily reliant on government or large enterprise contracts.

- Regulatory changes impacting the company: New regulations or changes in existing laws affecting the AI or data analytics industry can impact the company's operations and profitability, leading to investor concern and a stock price decline.

- Leadership changes or internal issues: Any instability at the top leadership level or internal conflicts can create uncertainty and trigger a sell-off.

- Any unexpected announcements or disclosures: Negative surprises, such as unexpected write-downs, investigations, or lawsuits, can severely impact investor confidence and trigger a rapid decline in the stock price.

Technical Analysis of the BBAI Stock Chart

A technical analysis of the BBAI stock chart before and during the crash would likely reveal indicators suggesting a potential downturn. While avoiding overly complex jargon, we can mention general patterns:

- Chart patterns (e.g., head and shoulders, bearish flags): These classic chart patterns often signal a shift in momentum and predict a potential price decline.

- Volume analysis: Increased trading volume during the decline confirms the strength of the selling pressure.

- Moving average crossovers: A bearish crossover of short-term and long-term moving averages can indicate a trend reversal and predict further declines. The breakdown of key support levels would further confirm this bearish trend.

Long-Term Outlook and Investment Implications for BBAI Stock

The long-term outlook for BigBear.ai remains uncertain following the crash. While the company possesses promising technology and operates in a high-growth sector, several risks remain:

- Potential catalysts for future growth: Successful contract wins, technological breakthroughs, and strong financial performance could lead to a recovery.

- Risks and uncertainties facing the company: Continued competition, regulatory hurdles, and execution risks could hinder growth and further depress the stock price.

- Investment strategies for navigating the volatility: Investors should carefully consider their risk tolerance and diversify their portfolios to mitigate potential losses.

Conclusion: Understanding and Navigating the BigBear.ai (BBAI) Stock Crash

The BigBear.ai (BBAI) stock crash resulted from a confluence of factors: negative market sentiment, disappointing financial performance, and specific news events. Understanding the interplay of these elements is crucial for navigating the volatility of the stock market. Remember, before making any investment decisions related to BigBear.ai (BBAI) stock, conduct thorough research, analyzing market sentiment, financial statements, and future growth prospects. For further insights, explore detailed BigBear.ai Stock Analysis, review the BBAI Stock Outlook from various reputable sources, and consider seeking professional financial advice before investing in BBAI.

Featured Posts

-

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025 -

The Goldbergs A Guide For New And Returning Viewers

May 21, 2025

The Goldbergs A Guide For New And Returning Viewers

May 21, 2025 -

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 21, 2025

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 21, 2025 -

Record Breaking Run Man Completes Fastest Australia Foot Crossing

May 21, 2025

Record Breaking Run Man Completes Fastest Australia Foot Crossing

May 21, 2025 -

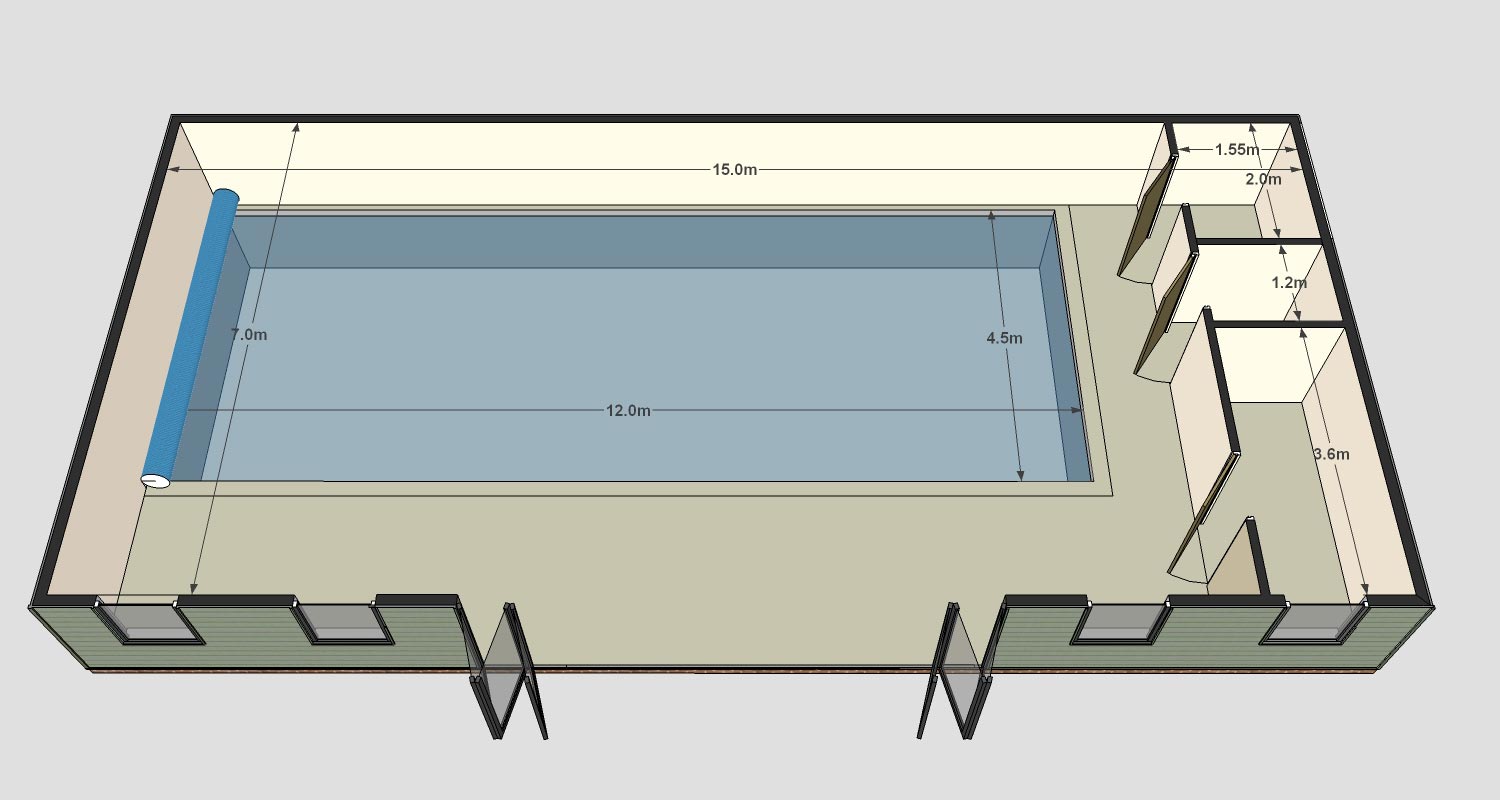

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 21, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 21, 2025