BigBear.ai Holdings (NYSE: BBAI) Q1 Results Undershoot Expectations, Leading To Stock Decline

Table of Contents

BigBear.ai Q1 Earnings Miss Analyst Expectations

BigBear.ai's Q1 2024 earnings significantly missed analyst expectations, triggering the substantial BigBear.ai stock decline. The company reported a revenue shortfall and lower-than-projected earnings per share (EPS), raising serious questions about its financial health and future prospects.

- Revenue: The reported revenue was significantly below the consensus analyst estimate of [Insert Analyst Estimate Here], falling short by approximately [Insert Percentage or Dollar Amount Here].

- Earnings Per Share (EPS): BigBear.ai's EPS came in at [Insert EPS Figure Here], a considerable drop compared to the anticipated [Insert Analyst Estimate Here] and the previous quarter's performance. This EPS decline directly contributed to the negative investor sentiment and the subsequent BBAI stock price fall.

- Significance of the Miss: This substantial revenue shortfall and EPS decline indicate a significant challenge for BigBear.ai in meeting its projected growth targets. The miss raises concerns about the company's ability to effectively manage its resources and secure future contracts, further fueling the BigBear.ai stock decline.

Factors Contributing to BigBear.ai's Underperformance

Several factors contributed to BigBear.ai's disappointing Q1 results and the subsequent BigBear.ai stock decline.

Challenges in Government Contracts

BigBear.ai's primary revenue stream comes from government contracts, particularly within the national security sector. However, the company faced notable challenges in this area during Q1:

- Contract Delays: Several anticipated contract awards were delayed, leading to a shortfall in expected revenue and impacting the BBAI stock price.

- Increased Competition: Fierce competition for government contracts from established players and emerging AI companies intensified the pressure on BigBear.ai's ability to secure new business. This increased competition is a significant factor in the broader AI market competition.

- Contract Execution Challenges: Difficulties in executing existing contracts, including potential cost overruns or logistical hurdles, further hampered the company's performance. The complexities of government contracting processes contributed to the overall revenue shortfall.

Increased Competition in the AI Market

The AI market is rapidly evolving, with numerous companies vying for market share. BigBear.ai faces stiff competition from both established tech giants and emerging AI startups, resulting in:

- Pricing Pressure: The competitive landscape led to pressure on pricing, potentially reducing BigBear.ai's profit margins and contributing to the BBAI stock price drop.

- Market Share Erosion: The company might have experienced a loss in market share due to the aggressive strategies employed by competitors.

- Difficulty in Differentiation: BigBear.ai needs to effectively differentiate its offerings to remain competitive in this rapidly evolving landscape.

Rising Operating Costs

BigBear.ai's operating expenses appear to have increased, negatively impacting profit margins and contributing to the BigBear.ai stock decline. This includes:

- Research and Development (R&D): Investments in R&D, while necessary for long-term growth, can significantly impact short-term profitability.

- Sales and Marketing: Increased spending on sales and marketing to secure new contracts might not have yielded immediate returns.

- General and Administrative Expenses: Overheads could have exceeded projections, contributing to the overall squeeze on profit margins. Effective cost management is crucial for future profitability.

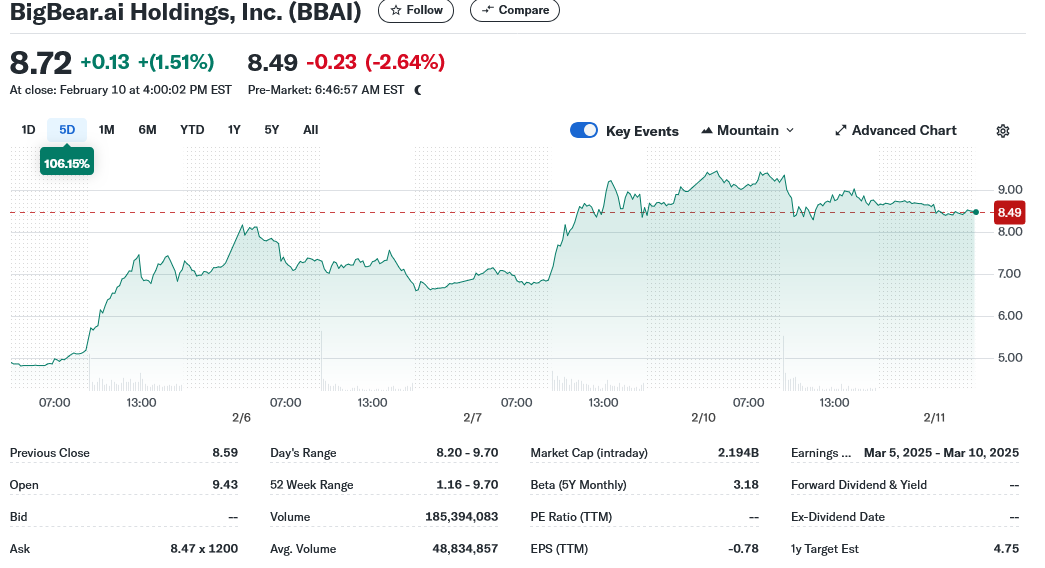

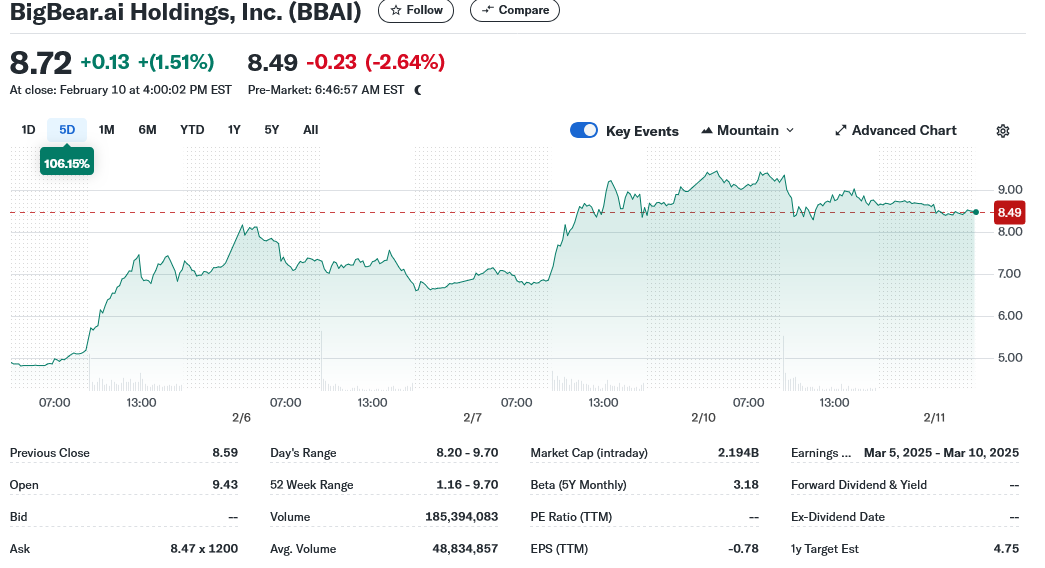

Market Reaction and BigBear.ai Stock Price Decline

The release of the disappointing Q1 earnings report immediately impacted the BBAI stock price, causing a significant drop of [Insert Percentage Here] in a single trading session. This was accompanied by:

- High Trading Volume: The increased trading volume reflected the heightened investor interest and concern following the earnings announcement.

- Negative Investor Sentiment: The market reacted negatively, indicating a loss of investor confidence in BigBear.ai's ability to deliver on its growth projections.

- Stock Price Volatility: The BBAI stock price exhibited significant volatility in the days following the earnings release, reflecting the uncertainty surrounding the company's future.

BigBear.ai's Management Response and Future Outlook

BigBear.ai's management addressed the disappointing Q1 results in an official statement, acknowledging the challenges and outlining plans to address them. Key aspects of their response include:

- Revised Guidance: The company provided revised guidance for the remainder of the year, reflecting the impact of the Q1 underperformance.

- Strategic Initiatives: Management highlighted several strategic initiatives aimed at improving operational efficiency, securing new contracts, and strengthening the company's market position.

- Focus on Cost Reduction: Measures to reduce operating expenses and improve cost management were emphasized to enhance profitability.

Analyzing the BigBear.ai Stock Decline and Future Implications

The BigBear.ai stock decline is a direct consequence of disappointing Q1 earnings, primarily driven by challenges in government contracts, increased competition, and rising operating costs. While the short-term outlook might be uncertain, BigBear.ai's long-term prospects in the rapidly growing AI sector remain a point of discussion. The company's strategic initiatives and management's response will be crucial in determining its ability to recover and regain investor confidence. Careful monitoring of the BigBear.ai stock and BBAI stock price, alongside a thorough understanding of its strategic actions, will be essential for investors. Stay informed about the future of BigBear.ai and its impact on the AI sector. Further research into the company's strategic plans and market developments is recommended before making any investment decisions.

Featured Posts

-

Najbolja Kombinacija Vanja I Sime U Novim Fotografijama S Gospodinom Savrsenim

May 21, 2025

Najbolja Kombinacija Vanja I Sime U Novim Fotografijama S Gospodinom Savrsenim

May 21, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 21, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 21, 2025 -

Rediscovering Culinary History The Manhattan Forgotten Foods Festival

May 21, 2025

Rediscovering Culinary History The Manhattan Forgotten Foods Festival

May 21, 2025 -

Retired Navy Admirals Bribery Conviction 30 Year Sentence

May 21, 2025

Retired Navy Admirals Bribery Conviction 30 Year Sentence

May 21, 2025 -

Abn Amro Analyse Van De Sterke Groei In De Occasionmarkt

May 21, 2025

Abn Amro Analyse Van De Sterke Groei In De Occasionmarkt

May 21, 2025