BigBear.ai Stock: A Comprehensive Investment Guide

Table of Contents

Understanding BigBear.ai and its Business Model

BigBear.ai's core strength lies in its development and application of sophisticated AI-powered solutions. The company operates across both government and commercial sectors, providing cutting-edge technologies to address complex challenges.

Core Technologies and Services

BigBear.ai offers a diverse range of AI solutions, primarily focused on:

- Data analytics: The company utilizes advanced algorithms to analyze massive datasets, extracting valuable insights for clients in various sectors. This includes predictive analytics, anomaly detection, and pattern recognition.

- Cybersecurity: BigBear.ai provides AI-driven cybersecurity solutions to protect sensitive data and infrastructure from evolving threats. This involves threat detection, vulnerability assessment, and incident response.

- Geospatial intelligence: Leveraging AI and machine learning, BigBear.ai processes and analyzes geospatial data to provide actionable insights for defense, intelligence, and commercial applications.

- National security solutions: A significant portion of BigBear.ai's work involves providing AI-powered solutions for national security agencies, focusing on intelligence gathering, analysis, and decision support.

BigBear.ai has established key partnerships and secured numerous contracts with government agencies and private sector clients, strengthening its market position and revenue streams. The company's focus on high-value, mission-critical applications provides a strong foundation for future growth. The sophisticated BigBear.ai technology and services demonstrate a clear commitment to innovation within the AI solutions market.

Competitive Landscape and Market Position

BigBear.ai operates in a competitive landscape, facing established players and emerging startups in the AI and technology sectors. However, the company's focus on niche markets, particularly within national security and specialized data analytics, provides a competitive advantage. Its deep expertise and strong relationships with government agencies differentiate it from many competitors. While precise market share data can be challenging to obtain in this sector, BigBear.ai is actively gaining recognition and market traction within its chosen areas of expertise. The potential for market expansion within both the public and private sectors offers significant growth potential for this AI stock.

BigBear.ai Stock Performance and Financial Analysis

Analyzing the performance of BigBear.ai stock requires a careful examination of its historical trends and key financial indicators.

Stock Price History and Volatility

The BigBear.ai stock price (BBAI) has shown considerable volatility, reflecting the inherent risks associated with investing in a growth-stage technology company. Analyzing historical stock charts reveals periods of significant price swings. This volatility is influenced by various factors, including market sentiment towards AI stocks, news related to contracts and partnerships, and overall economic conditions. Investors should carefully consider this volatility before making an investment. Accessing reliable BigBear.ai stock price charts and historical data is essential for informed decision-making.

Key Financial Metrics and Indicators

Evaluating the financial health of BigBear.ai requires a close examination of several key metrics:

- Revenue growth: Analyzing revenue growth rates provides insights into the company's ability to expand its business and secure new contracts.

- Profitability: Assessing profitability (or lack thereof) through metrics like gross margin and net income is crucial for evaluating the company’s financial sustainability.

- Debt levels: Examining debt-to-equity ratios and other debt indicators helps to understand the company's financial leverage and risk profile.

- Earnings per share (EPS): Tracking EPS growth can offer insight into the return on investment for shareholders. BigBear.ai financials should be carefully scrutinized for trends and anomalies. A thorough financial analysis is imperative before investing in BBAI.

Future Outlook and Investment Considerations

Investing in BigBear.ai stock involves considering both the potential for significant returns and the associated risks.

Growth Potential and Future Projections

BigBear.ai's future growth prospects are closely tied to the continued expansion of the AI market and its ability to secure new contracts and partnerships. Several potential catalysts could drive future stock price appreciation:

- New contracts: Securing large contracts with government agencies and private sector clients can significantly boost revenue and profitability.

- Technological advancements: Continuous innovation and the development of new AI technologies will be critical for maintaining a competitive edge.

- Industry trends: The overall growth of the AI and data analytics markets will undoubtedly impact BigBear.ai's prospects. Careful consideration of these market trends is critical for projecting future growth.

Risks and Challenges

Investing in BBAI stock carries several inherent risks:

- Competition: The AI market is intensely competitive, and BigBear.ai faces the risk of losing market share to larger, more established players.

- Financial performance: The company's financial performance can be volatile, and achieving sustained profitability may be challenging.

- Regulatory hurdles: Navigating the regulatory landscape, particularly in the government contracting space, can pose significant challenges.

- Dependence on government contracts: BigBear.ai’s revenue is partly dependent on government contracts, making it vulnerable to changes in government spending and priorities. Market downturns can severely impact the valuation of AI stocks, including BBAI.

How to Invest in BigBear.ai Stock

Investing in BigBear.ai stock typically involves opening a brokerage account with a reputable online broker. The process involves:

- Opening a brokerage account: Choose a broker that offers access to the stock market and provides the necessary tools for investing.

- Funding your account: Deposit funds into your brokerage account to purchase BBAI stock.

- Placing an order: Use your broker's platform to place an order to buy BigBear.ai shares.

Consider your investment timeline (long-term vs. short-term) and risk tolerance when investing. Remember that diversification is essential to mitigate risk; don't put all your eggs in one basket.

Conclusion

BigBear.ai stock presents a compelling investment opportunity within the rapidly expanding AI market. The company's focus on high-value AI solutions for national security and commercial applications offers potential for significant growth. However, investors must carefully consider the inherent risks associated with investing in a growth-stage technology company, including stock price volatility, competition, and dependence on government contracts. Before investing in BigBear.ai stock or any other security, conduct thorough due diligence and consider consulting a qualified financial advisor. Remember, a well-diversified portfolio is key to managing risk effectively. Carefully evaluate your personal risk tolerance before considering a BigBear.ai investment.

Featured Posts

-

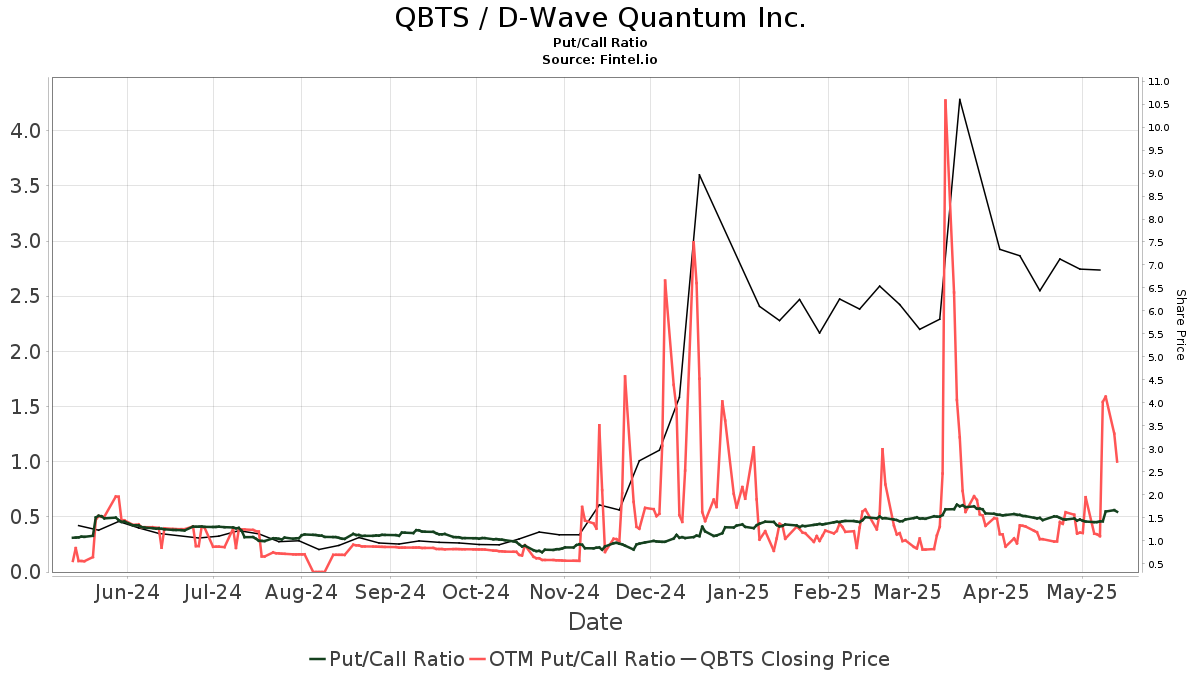

Analyzing The D Wave Quantum Qbts Stock Decrease On Thursday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Decrease On Thursday

May 20, 2025 -

Federal Charges Filed Crook Made Millions From Executive Office 365 Hacks

May 20, 2025

Federal Charges Filed Crook Made Millions From Executive Office 365 Hacks

May 20, 2025 -

Concerning Matheus Cunha Update What A Journalist Revealed About Man Uniteds Interest

May 20, 2025

Concerning Matheus Cunha Update What A Journalist Revealed About Man Uniteds Interest

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

Bbai Stock Buy Rating Maintained Implications For Investors

May 20, 2025

Bbai Stock Buy Rating Maintained Implications For Investors

May 20, 2025