BigBear.ai Stock Investment: Pros, Cons, And Should You Buy?

Table of Contents

BigBear.ai Stock: Potential Upsides and Growth Opportunities

BigBear.ai's stock presents several attractive potential upsides driven by its presence in a booming sector and unique business model.

Strong Growth Potential in the AI Market

BigBear.ai operates within the burgeoning artificial intelligence market, focusing on mission-critical applications for national security and intelligence. This niche provides a strong foundation for growth.

- Advanced AI Technologies: BigBear.ai utilizes cutting-edge technologies like machine learning, deep learning, and natural language processing to deliver advanced analytics and decision support systems.

- Booming AI Market: The global AI market is projected to experience explosive growth, with forecasts exceeding hundreds of billions of dollars in the coming years. BigBear.ai is well-positioned to capture a significant share of this expanding market.

- Competitive Advantages: BigBear.ai's proprietary algorithms, extensive data sets, and experienced team offer considerable competitive advantages in securing and executing large-scale government contracts.

Government Contracts and Revenue Streams

A significant portion of BigBear.ai's revenue comes from government contracts, offering a degree of stability. However, reliance on this sector also introduces certain risks.

- Long-Term Government Contracts: The company secures multi-year contracts that provide a predictable revenue stream. These contracts often involve complex systems integrations and ongoing support.

- Potential for Budget Cuts: Government funding can be subject to fluctuations depending on budget cycles and shifts in political priorities. This introduces uncertainty.

- Diversification Efforts: BigBear.ai is actively seeking to diversify its revenue streams beyond government contracts, reducing its reliance on a single sector and mitigating some risk.

Technological Innovation and Intellectual Property

BigBear.ai's success hinges on its continuous innovation and intellectual property.

- Proprietary Algorithms and Platforms: The company holds several patents and proprietary technologies that provide a competitive edge.

- Future Revenue Potential: These technologies have the potential to be applied across various sectors, creating new revenue streams and further expansion opportunities.

- Technological Leadership: Continued investments in research and development are vital for maintaining this leadership position.

BigBear.ai Stock: Risks and Potential Downsides

While the growth potential of BigBear.ai is significant, several risks and downsides warrant consideration before investing.

Volatility and Market Sentiment

Investing in BigBear.ai stock carries inherent risks due to the volatility of the stock market, particularly for companies in the growth stage.

- Economic Downturns: A broader economic downturn could negatively impact investor sentiment and reduce demand for BigBear.ai's services.

- Missed Earnings Expectations: Failure to meet or exceed earnings expectations can lead to sharp drops in the stock price.

- Project Delays: Delays in project delivery can impact revenue recognition and potentially negatively affect the stock price.

Dependence on Government Contracts

The reliance on government contracts presents a key risk factor.

- Contract Loss: The loss of a major government contract could significantly impact revenue and profitability.

- Competitive Bidding: BigBear.ai faces competition from other firms in the bidding process for government contracts.

- Changing Government Priorities: A shift in government priorities could result in reduced funding for specific projects.

Competition in the AI Industry

The AI industry is highly competitive, with both established players and new entrants vying for market share.

- Established Competitors: BigBear.ai faces competition from large technology companies with significant resources and established market presence.

- New Entrants: The AI field is attracting numerous startups, increasing competition.

- Technological Disruption: Rapid technological advancements could render existing technologies obsolete, necessitating constant innovation.

Should You Invest in BigBear.ai Stock? A Balanced Perspective

Deciding whether to invest in BigBear.ai requires weighing the potential upsides against the inherent risks. The suitability of a BigBear.ai stock investment depends largely on your risk tolerance and investment goals. Conservative investors might find the volatility too high, while more aggressive investors might see the potential for significant returns. Consider comparing BigBear.ai to other companies in the AI sector before making a decision. Thorough due diligence is paramount before investing in any stock, and BigBear.ai is no exception.

Conclusion: Making Informed Decisions about BigBear.ai Stock Investment

Investing in BigBear.ai presents both exciting opportunities and considerable risks. The company operates in a high-growth sector, but its reliance on government contracts and competitive landscape introduce uncertainty. Remember to carefully consider all factors – including your risk tolerance, investment goals, and a comprehensive analysis of the company's financials and competitive position – before making any BigBear.ai stock investment. Conduct your own thorough research and seek professional financial advice if needed. Remember to consult BigBear.ai's investor relations page and relevant financial news sources for up-to-date information.

Featured Posts

-

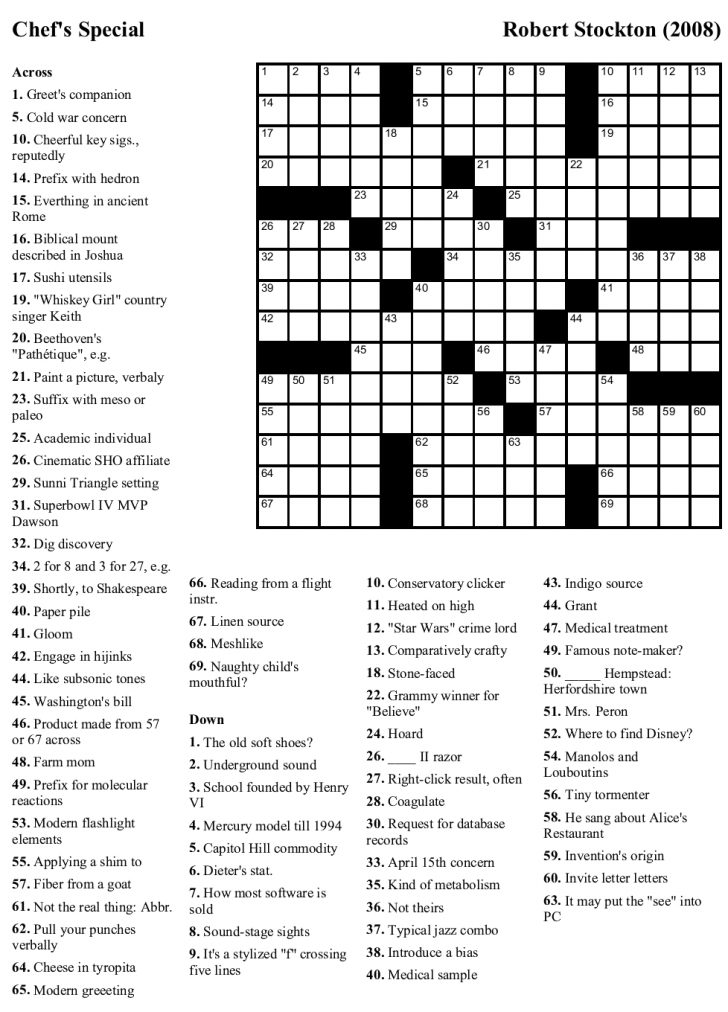

Solve The Nyt Mini Crossword Answers For March 13 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 13 2025

May 20, 2025 -

Vnuk Mikhaelya Shumakhera Podrobnosti O Popolnenii V Seme

May 20, 2025

Vnuk Mikhaelya Shumakhera Podrobnosti O Popolnenii V Seme

May 20, 2025 -

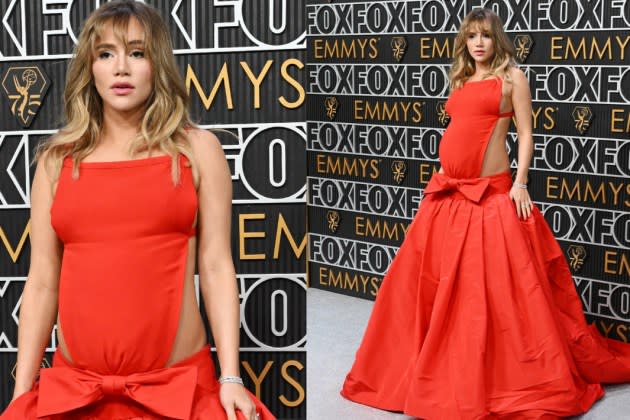

Suki Waterhouse Grandma Chic Style In Valentino

May 20, 2025

Suki Waterhouse Grandma Chic Style In Valentino

May 20, 2025 -

Kaellman Ja Hoskonen Laehdoet Puolalaisseurasta

May 20, 2025

Kaellman Ja Hoskonen Laehdoet Puolalaisseurasta

May 20, 2025 -

Exploring Themes Of Redemption And Pragmatism In Nigeria Through The Lens Of The Kite Runner

May 20, 2025

Exploring Themes Of Redemption And Pragmatism In Nigeria Through The Lens Of The Kite Runner

May 20, 2025