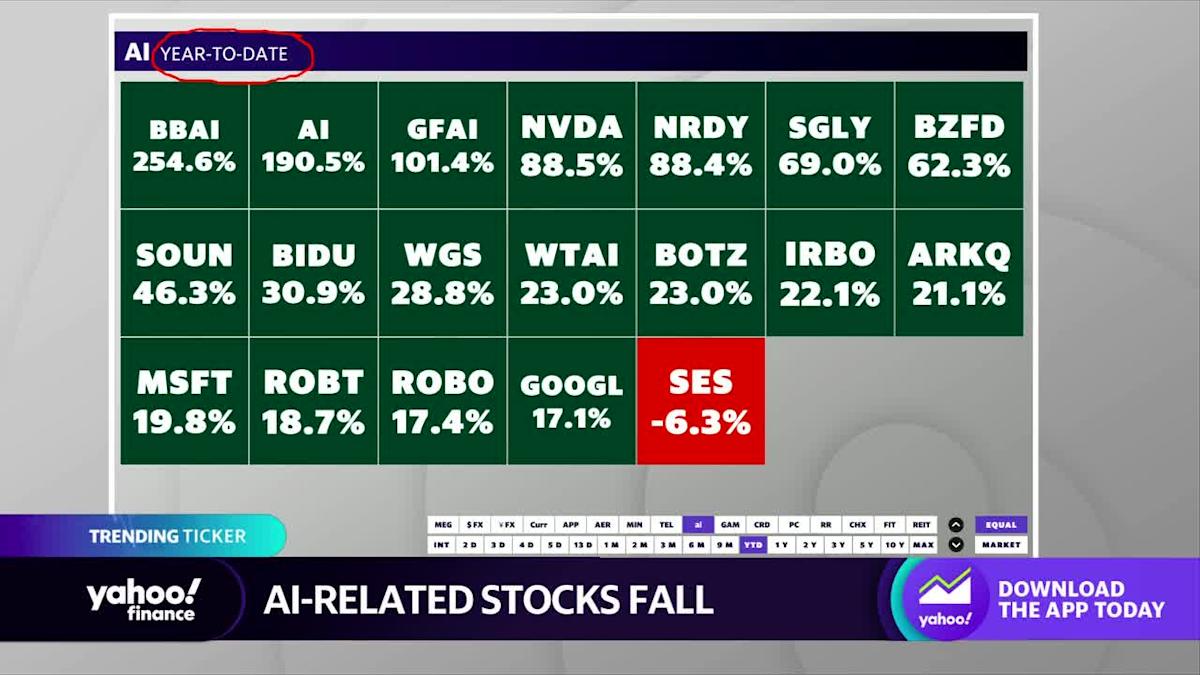

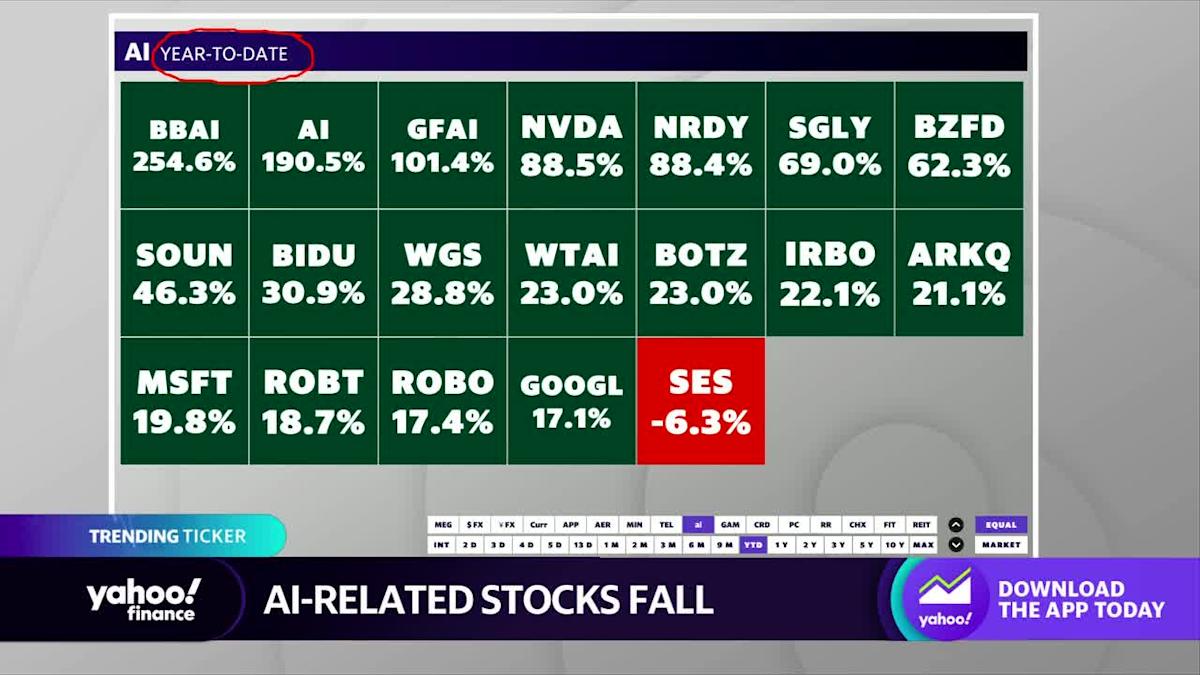

BigBear.ai Stock Takes A Hit After Below-Forecast Q1 Earnings

Table of Contents

Q1 Earnings Miss Expectations: Key Figures and Shortfalls

BigBear.ai's Q1 2024 earnings report revealed a significant miss on both revenue and earnings per share (EPS), triggering the BBAI stock price plunge. The reported EPS was significantly lower than analyst expectations, and revenue fell short of projections by a considerable margin. These disappointing BBAI financials sent shockwaves through the investment community.

- Reported EPS: (Insert actual reported EPS figure here). This was substantially lower than the consensus analyst estimate of (Insert analyst estimate here).

- Revenue Miss: BigBear.ai reported revenue of (Insert actual revenue figure here), falling short of the projected (Insert projected revenue figure here). This represents a (Calculate percentage difference) shortfall.

- Segment Underperformance: (Specify which segments of the business underperformed and quantify the underperformance). This suggests potential issues in specific areas of BigBear.ai's operations.

- Company Explanation: BigBear.ai attributed the shortfall to (Insert the company's official explanation for the poor performance. Be sure to cite the source). This explanation, however, failed to fully satisfy investors.

Market Reaction and Investor Sentiment Following the Earnings Report

The market reacted swiftly and negatively to BigBear.ai's disappointing Q1 earnings report. The BBAI stock price plummeted (Insert percentage drop) immediately following the announcement. This sell-off was accompanied by high trading volume, indicating significant investor activity and uncertainty.

- Stock Price Drop: The sharp decline in BigBear.ai's stock price reflects the market's disappointment with the financial results.

- Trading Volume Surge: Trading volume on the day of the earnings announcement was (Insert trading volume data), significantly higher than the average daily volume, highlighting the market's intense reaction.

- Analyst Downgrades: Several analysts downgraded their ratings and price targets for BBAI stock, further fueling the negative sentiment. (Include specific examples if available).

- Investor Sentiment: Overall investor sentiment towards BigBear.ai shifted dramatically from cautiously optimistic to deeply pessimistic following the release of the Q1 figures. This negativity significantly impacts future investment decisions.

Analysis of Underlying Factors Contributing to the Poor Performance

The disappointing Q1 performance of BigBear.ai can be attributed to a combination of factors, including operational challenges, competitive pressures, and potentially macroeconomic influences.

- Operational Challenges: (Discuss specific operational issues BigBear.ai encountered. This could include issues with project execution, delays in contract awards, or internal restructuring.)

- Competitive Landscape: The rapidly evolving artificial intelligence market is highly competitive. BigBear.ai faces stiff competition from established players and emerging startups, impacting its ability to secure and retain contracts. (Mention key competitors and their market share).

- Growth Strategy Effectiveness: A critical assessment of BigBear.ai's growth strategy is necessary. Is the company's approach to market penetration effective in this competitive environment? Are there any strategic missteps that contributed to the Q1 shortfall?

- Macroeconomic Factors: The current macroeconomic environment might have played a role, with factors like inflation and potential economic slowdown impacting technology spending.

BigBear.ai's Future Outlook and Potential Recovery

Despite the setbacks, BigBear.ai's future is not necessarily bleak. The company operates in a rapidly growing sector with significant long-term potential. However, a successful recovery depends on several key factors.

- Future Outlook: BigBear.ai's management provided guidance for future quarters. (Discuss the guidance provided and its implications). This guidance should be carefully scrutinized for realistic expectations.

- Strategic Initiatives: Are there any new strategic initiatives planned to address the weaknesses identified in Q1? The implementation of effective strategies is crucial for future growth and stock price recovery.

- Long-Term Prospects: BigBear.ai's long-term prospects remain tied to its ability to innovate and compete in the AI market. The company’s success hinges on its capacity to adapt to the rapidly changing technological landscape.

- Catalysts for Recovery: Potential catalysts for stock price recovery include successful contract wins, new product launches, or evidence of improved operational efficiency.

Conclusion

This article examined the factors contributing to the significant drop in BigBear.ai (BBAI) stock following the company's disappointing Q1 earnings report. The analysis covered the key financial figures, the market's sharp reaction, underlying challenges, and the company's future outlook. While the immediate outlook for BigBear.ai stock may seem uncertain, investors should carefully assess the long-term prospects of the company within the rapidly expanding artificial intelligence market. Continue to monitor BigBear.ai stock (BBAI) and stay informed on its future developments to make informed investment decisions. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to BigBear.ai stock or any other AI stock.

Featured Posts

-

Understanding The Aimscap World Trading Tournament Wtt

May 21, 2025

Understanding The Aimscap World Trading Tournament Wtt

May 21, 2025 -

Kroyz Azoyl Ston Teliko Champions League I Syneisfora Toy Giakoymaki

May 21, 2025

Kroyz Azoyl Ston Teliko Champions League I Syneisfora Toy Giakoymaki

May 21, 2025 -

Sabalenkas Superiority Madrid Open Last 16 Victory Over Mertens

May 21, 2025

Sabalenkas Superiority Madrid Open Last 16 Victory Over Mertens

May 21, 2025 -

Freepoint Eco Systems And Ing Partner On New Project Finance Initiative

May 21, 2025

Freepoint Eco Systems And Ing Partner On New Project Finance Initiative

May 21, 2025 -

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025