Big Wall Street Comeback: Bear Market Bets Upended

Table of Contents

Unexpected Economic Resilience

The foundation of this surprising market recovery rests on a stronger-than-expected economic performance, defying many bearish predictions. Two key elements stand out:

Inflation Cooling Faster Than Expected

The recent decline in inflation rates has significantly boosted market sentiment. Lower-than-projected Consumer Price Index (CPI) figures suggest that the aggressive interest rate hikes implemented by the Federal Reserve are starting to yield positive results.

- Lower-than-projected CPI figures: Several consecutive months of decelerating inflation have demonstrated a clear trend, exceeding the expectations of many economists.

- Federal Reserve policy adjustments: While interest rates remain elevated, the possibility of a pause or even rate cuts in the near future is being increasingly discussed, impacting investor confidence.

- Impact on consumer confidence: As inflation cools, consumer spending power increases, leading to improved consumer confidence and increased demand for goods and services. This positive feedback loop supports economic growth.

This inflation slowdown and the resulting adjustments in Fed interest rates have significantly impacted consumer spending and other key economic indicators, fueling the "Big Wall Street Comeback."

Stronger-Than-Anticipated Corporate Earnings

Positive surprises from corporate earnings reports have also played a crucial role. Many companies have exceeded analysts' expectations, signaling robust profitability despite economic headwinds.

- Examples of companies exceeding expectations: Several major corporations across diverse sectors have reported stronger-than-expected earnings, demonstrating resilience and adaptability.

- Sectors driving growth: Technology, healthcare, and consumer staples have been among the leading sectors driving growth, showcasing the strength and diversity of the market recovery.

- Impact on investor confidence: These positive earnings reports have significantly boosted investor confidence, leading to increased buying activity and higher stock valuations. The overall market capitalization has experienced substantial growth.

Shifting Investor Sentiment

The dramatic market reversal is also fueled by a significant shift in investor sentiment.

The Flight from "Safety"

Investors are moving away from traditionally "safe" haven assets, reflecting a growing risk appetite.

- Decreased demand for government bonds: The rising interest rates and expectation of potential rate cuts have reduced the appeal of government bonds as a safe haven.

- Reduced investment in gold: Gold, typically a safe haven asset during times of uncertainty, has seen reduced investment as investors seek higher returns in riskier assets.

- Increased risk appetite: This shift towards riskier assets is a clear indication of increasing confidence in the market's overall strength and future prospects. This "risk-on sentiment" has significantly contributed to the upward momentum.

This flight away from safe haven assets like government bonds and the decline in gold prices highlight the changing bond yields and the overall risk-on sentiment driving the market.

Aggressive Buying by Institutional Investors

Large institutional investors have played a pivotal role in driving the market upward.

- Increased buying activity by hedge funds, pension funds, and mutual funds: These large players have significantly increased their buying activity, reflecting their bullish outlook.

- Their strategies and motivations: Many institutional investors are adjusting their strategies to capitalize on the market's resurgence, betting on continued growth. This increased buying pressure further fuels the market manipulation (though not necessarily malicious) currently underway.

The aggressive buying pressure from institutional investors, including hedge fund activity, is a significant factor contributing to the upward trajectory and represents a clear shift in market sentiment.

Technological Advancements Fueling Growth

Technological innovations are another crucial factor behind the "Big Wall Street Comeback."

AI and its Market Impact

Artificial intelligence (AI) and related technologies are driving significant market growth.

- Investment in AI startups: Massive investments are pouring into AI startups, reflecting the enormous potential of this technology.

- AI's impact on various sectors (e.g., healthcare, finance): AI is transforming numerous industries, boosting efficiency, productivity, and innovation, contributing to strong corporate earnings in related sectors.

- Future projections: The long-term growth potential of AI is immense, driving further investment and fueling the market's upward trend.

The surge in AI stocks and the overall impact of artificial intelligence on numerous sectors highlight the role of technological innovation and disruptive technologies in driving market growth.

Emerging Tech Sectors Leading the Charge

Other emerging technologies are also making substantial contributions.

- Examples of sectors like renewable energy, biotech, and space exploration: These sectors represent significant growth potential, attracting substantial investment and driving market expansion.

- Renewable energy stocks, strong investments in biotech, and the emergence of innovative space exploration companies are fueling this market growth.

These emerging markets represent further opportunities for growth and investment, strengthening the overall market comeback.

Conclusion

The unexpected "Big Wall Street Comeback" signifies a major shift in market dynamics. While uncertainty remains, the combination of cooling inflation, strong corporate earnings, shifting investor sentiment, and technological advancements has undeniably fueled this remarkable reversal of bear market predictions. Investors must carefully reassess their strategies in light of this unexpected turn. Don't get left behind – understand the implications of this "Big Wall Street Comeback" and adapt your investment approach accordingly. Stay informed about the latest economic indicators and market trends to navigate this evolving landscape. Learn more about adapting your investment strategy to a potentially stronger bull market and capitalize on this Big Wall Street Comeback.

Featured Posts

-

Ou Voir Chantal Ladesou En Spectacle

May 11, 2025

Ou Voir Chantal Ladesou En Spectacle

May 11, 2025 -

Tennessee Baseball Alberto Osuna Remains Ineligible After Injunction Denied

May 11, 2025

Tennessee Baseball Alberto Osuna Remains Ineligible After Injunction Denied

May 11, 2025 -

Win Tickets To Sold Out Tales From The Track Relay Event

May 11, 2025

Win Tickets To Sold Out Tales From The Track Relay Event

May 11, 2025 -

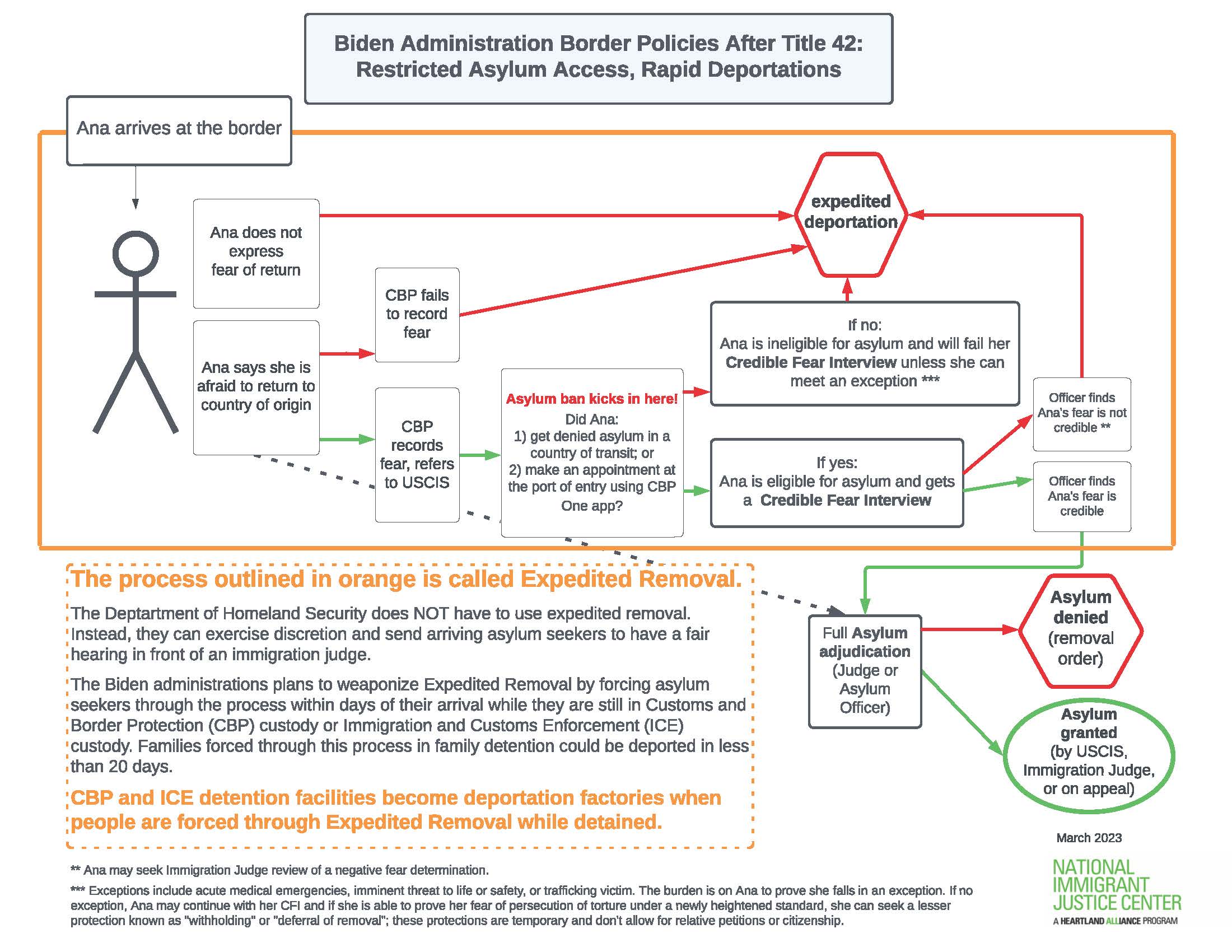

Asylum Minster Defends Decision To Bypass Inspectorate On Legal Opinions

May 11, 2025

Asylum Minster Defends Decision To Bypass Inspectorate On Legal Opinions

May 11, 2025 -

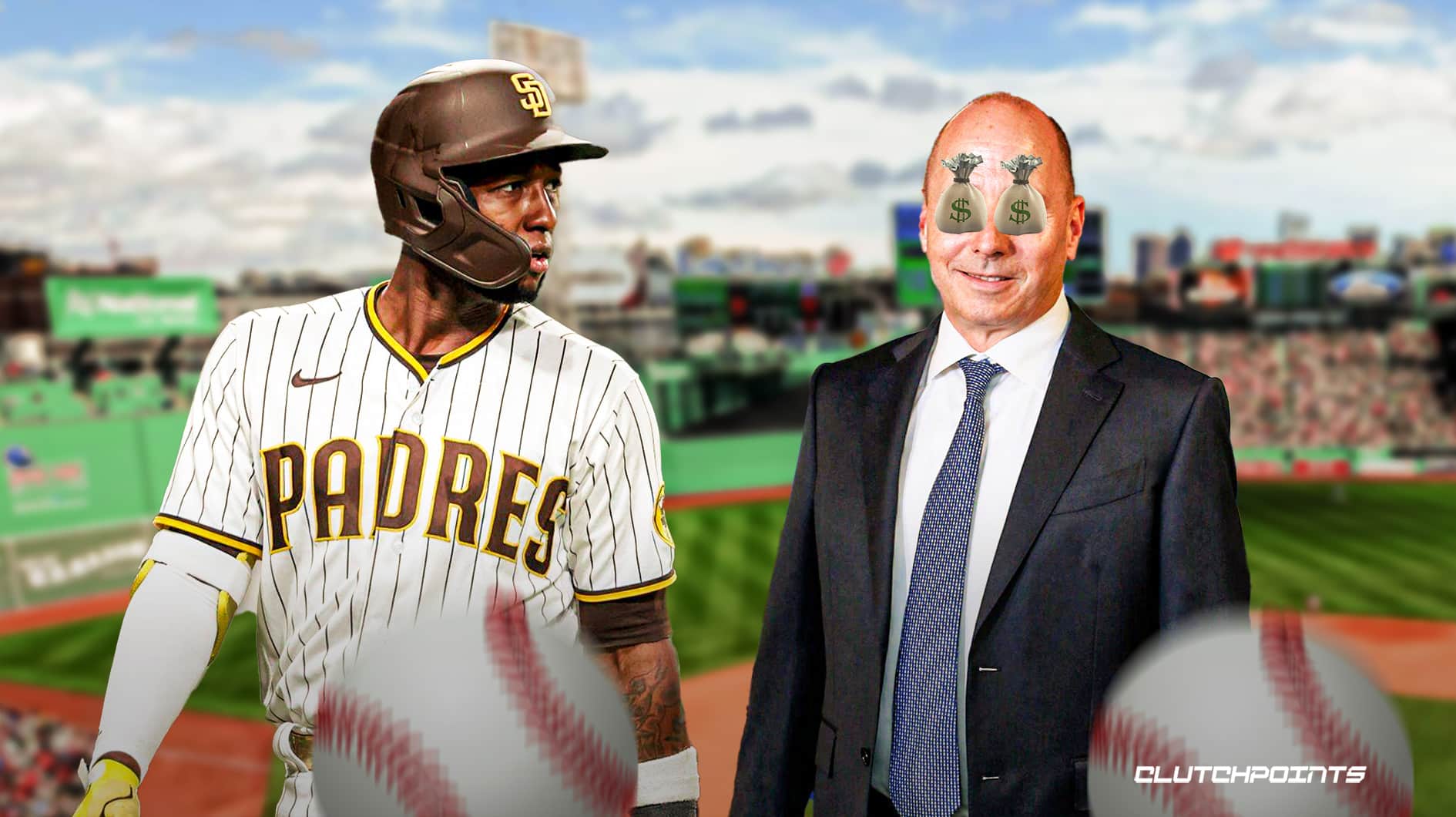

The Jurickson Profar Ped Suspension A Timeline And Explanation

May 11, 2025

The Jurickson Profar Ped Suspension A Timeline And Explanation

May 11, 2025