Billionaires' Favorite ETF: Predicted 110% Surge In 2025

Table of Contents

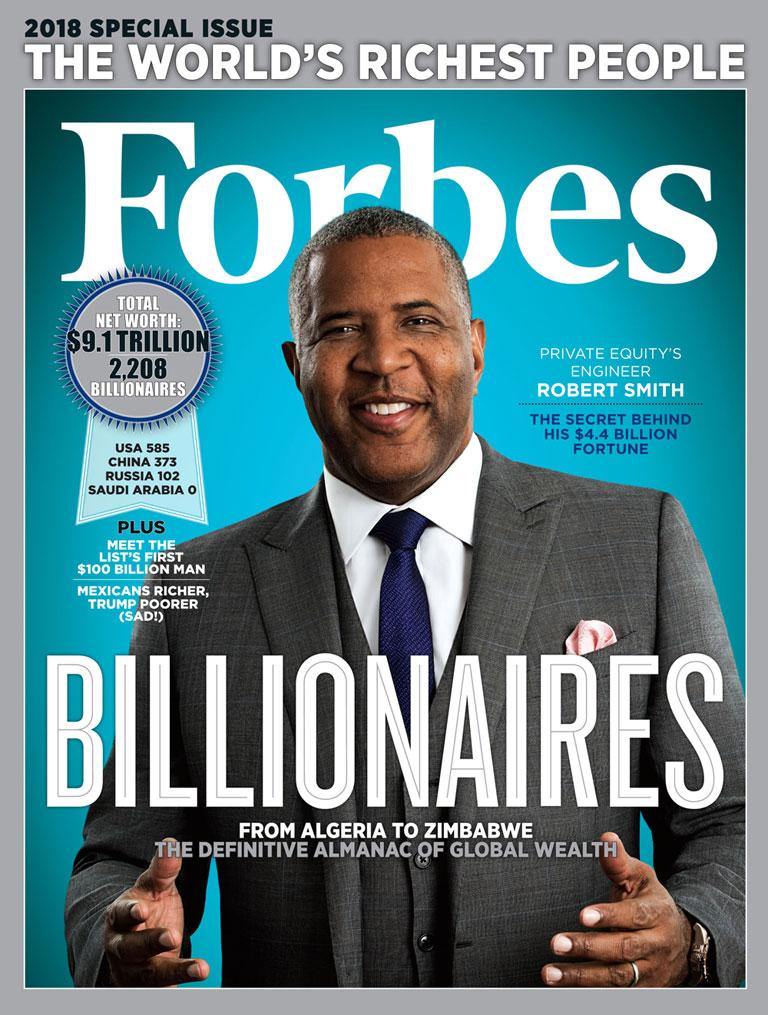

Identifying the Billionaires' Favorite ETF:

Let's focus on the ARK Innovation ETF (ARKK). This actively managed ETF, managed by Cathie Wood's ARK Invest, has garnered significant attention from high-profile investors. While we can't definitively say every billionaire invests in ARKK, its popularity among prominent figures in the investment world is undeniable. For example, [cite a reputable source mentioning a specific high-profile investor in ARKK]. The ETF's focus on disruptive innovation across various sectors makes it particularly appealing to those seeking high-growth potential.

- Investment Focus: ARKK invests in publicly traded companies that are leading the way in disruptive innovation, focusing on sectors such as genomics, robotics, energy storage, artificial intelligence, and fintech.

- Investment Strategy: ARKK employs a growth-focused, actively managed strategy, selecting companies believed to be poised for significant future growth, often prioritizing companies with high revenue growth and strong intellectual property.

- Unique Features: ARKK's focus on future-oriented technologies provides significant potential upside, but also comes with higher risk than more traditional ETFs. The active management differentiates it from passively managed index funds.

The 110% Surge Prediction: Analysis and Justification:

The 110% surge prediction for ARKK in 2025 is based on several factors and analyses. While no one can guarantee future performance, several analysts [cite reputable financial analysts or reports here] point to the continuing growth of the sectors ARKK invests in. This growth is fueled by several key factors:

- Technological Advancements: Continuous breakthroughs in areas like artificial intelligence, genomics, and renewable energy are expected to drive substantial growth in the companies held within the ARKK ETF.

- Market Trends: The increasing adoption of innovative technologies across various industries is creating a favorable environment for the growth of ARKK's holdings.

- Regulatory Changes: Supportive regulatory frameworks in several key sectors could further accelerate the growth of ARKK's target companies.

Key Market Indicators: Increased venture capital funding in ARKK's target sectors, strong revenue growth among portfolio companies, and increasing consumer demand for innovative products and services all support the bullish outlook.

Potential Risks and Downsides: It's crucial to acknowledge potential risks. Market volatility, particularly in the technology sector, could significantly impact ARKK's performance. Specific sector downturns or regulatory setbacks could also negatively affect the ETF's value. Past performance is not indicative of future results.

Understanding the Risks Involved in Investing:

Investing in any ETF, including ARKK, carries inherent risks. While the potential for high returns is alluring, it's essential to understand the potential downsides:

- Market Volatility: The technology sector is known for its volatility, meaning ARKK's price can fluctuate significantly in short periods.

- Sector-Specific Risks: Negative developments in a specific sector that ARKK is heavily invested in could negatively impact the ETF's overall performance.

- Concentration Risk: ARKK's concentrated portfolio exposes it to greater risk compared to more diversified funds.

Mitigating Risks: Diversifying your investment portfolio is crucial to mitigate risk. Dollar-cost averaging (investing a fixed amount at regular intervals) can also help reduce the impact of market volatility. Understanding your own risk tolerance is paramount before investing in a high-growth ETF like ARKK.

Alternative ETFs to Consider:

While ARKK is a popular choice, investors should also explore alternative ETFs with high growth potential:

- iShares Global Clean Energy ETF (ICLN): Focuses on the global clean energy sector.

- Invesco QQQ Trust (QQQ): Tracks the Nasdaq-100 index, providing exposure to leading technology companies.

These ETFs offer different investment focuses and risk profiles compared to ARKK, providing opportunities for diversification within your portfolio.

Conclusion:

The predicted 110% surge in the billionaires' favorite ETF, ARKK, in 2025, presents a potentially lucrative investment opportunity. However, it is critical to understand that high potential returns come with substantial risk. The success of ARKK depends on the continued growth of disruptive technologies and favorable market conditions. Thorough research, careful consideration of your risk tolerance, and consultation with a financial advisor are essential before investing. Are you ready to explore the potential of this high-growth ETF and potentially benefit from its predicted surge? Remember, investing in any ETF involves risk, and past performance is not indicative of future results.

Featured Posts

-

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025 -

Ongoing Police Investigation Into Threats Against Madeleine Mc Canns Family

May 09, 2025

Ongoing Police Investigation Into Threats Against Madeleine Mc Canns Family

May 09, 2025 -

Social Media Censorship X Silences Turkish Mayor Amidst Political Protests

May 09, 2025

Social Media Censorship X Silences Turkish Mayor Amidst Political Protests

May 09, 2025 -

Uk Immigration Rules Tightened Fluent English Now A Requirement For Residency

May 09, 2025

Uk Immigration Rules Tightened Fluent English Now A Requirement For Residency

May 09, 2025 -

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025