Billionaires' Secret Weapon: The ETF Predicted To Soar 110% By 2025

Table of Contents

Understanding the Predicted ETF's Potential

This article focuses on the hypothetical "GrowthTech ETF" (GTETF - Note: This is a hypothetical ETF for illustrative purposes only. Do not attempt to invest in an ETF with this ticker symbol.), an exchange-traded fund designed to capitalize on the burgeoning growth of technology in emerging markets. This ETF investment strategy focuses on companies developing disruptive technologies in rapidly expanding economies.

- Sector Focus: GrowthTech ETF invests in companies across various sectors, including renewable energy, artificial intelligence, fintech, and e-commerce within rapidly developing nations.

- Growth Drivers: The predicted 110% growth is fueled by several key factors:

- Technological Advancements: Rapid technological advancements in emerging markets are creating numerous high-growth opportunities.

- Emerging Market Expansion: The expanding middle class and increasing digital adoption in these markets fuel substantial demand.

- Favorable Regulatory Environments: Many emerging economies are implementing policies that encourage technological innovation and foreign investment.

- Expert Opinion: While no specific report predicts a precise 110% return (as this is a hypothetical example), several reputable analysts project significant growth in the sectors GTETF targets. Reports from firms like [Insert Hypothetical Research Firm Name] suggest substantial investment potential in this space.

Analyzing the Investment Risks and Rewards

While the potential rewards are enticing, it's crucial to understand the inherent risks associated with investing in GTETF or any high-growth ETF.

- Market Volatility: The market can be unpredictable. Significant price swings are possible, particularly in emerging markets, potentially impacting the ETF's value.

- Specific Asset Risks: Investing in specific companies within the ETF carries individual company-specific risks. A single underperforming company could negatively affect the overall ETF performance.

- Geopolitical Risks: Political instability or economic downturns in emerging markets could significantly impact the ETF's performance.

Diversification Strategies: To mitigate risk, consider diversifying your overall portfolio. Don't put all your eggs in one basket.

Despite the risks, the potential rewards are substantial.

- Significant Capital Appreciation: The 110% prediction, while hypothetical, highlights the potential for significant capital appreciation if the market performs as projected.

- Dividend Potential (Hypothetical): Some companies within the ETF might distribute dividends, generating passive income. (Note: This is a hypothetical possibility. Dividend payments are not guaranteed).

- Comparison to Other Options: Compared to lower-growth investments like bonds, the potential return from GTETF is considerably higher, although with correspondingly higher risk.

Who's Investing and Why?

While specific billionaire investors and their portfolios are often kept private, the investment rationale behind similar high-growth ETFs can be observed. Institutional investors are often attracted to such ETFs due to their:

- Long-Term Growth Potential: Emerging markets offer significant long-term growth potential, making them attractive for long-term investors.

- Strategic Alignment: Many large institutional investors have strategic plans aligned with the technological advancements and market expansion in these regions.

- Diversification Benefits: Such ETFs offer diversification benefits by investing across multiple sectors and geographies, reducing overall portfolio risk. (Note: This applies generally to the asset class and strategy, not to the hypothetical GTETF example).

How to Access This High-Growth ETF

Investing in an ETF like the hypothetical GTETF involves several steps:

- Open a Brokerage Account: Choose a reputable brokerage firm offering access to ETFs. Consider factors such as fees, research tools, and customer service.

- Fund Your Account: Deposit funds into your brokerage account to purchase ETF shares.

- Purchase Shares: Search for the ETF ticker symbol (if publicly traded) and place an order to buy shares.

- Fees and Commissions: Be aware of trading fees and commissions charged by your brokerage firm. Different platforms have different fee structures.

Conclusion

Investing in high-growth ETFs like the hypothetical GrowthTech ETF offers the potential for significant returns but carries considerable risk. The predicted 110% return by 2025, while illustrative, underscores the potential for substantial capital appreciation in this sector. However, market volatility and other risks must be carefully considered. Thorough research and diversification are crucial.

Call to Action: Ready to explore the potential of this groundbreaking (hypothetical) ETF and potentially benefit from its predicted surge? Conduct thorough research, consult with a financial advisor, and make informed investment decisions. Don't miss out on the opportunity to potentially tap into the same high-growth strategy used by sophisticated investors. Remember to always conduct your own due diligence before investing in any ETF.

Featured Posts

-

The Andor Director And The Rogue One Recut A Close Call

May 08, 2025

The Andor Director And The Rogue One Recut A Close Call

May 08, 2025 -

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025 -

El Betis Una Historia De Exitos Inolvidables

May 08, 2025

El Betis Una Historia De Exitos Inolvidables

May 08, 2025 -

Surface Pro 12 Inch Price Specs And Review

May 08, 2025

Surface Pro 12 Inch Price Specs And Review

May 08, 2025 -

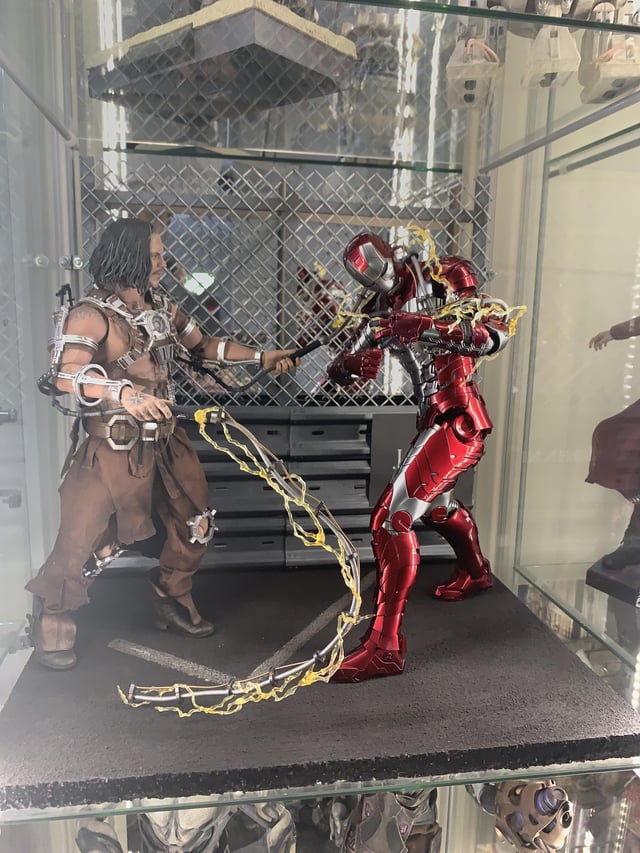

Hot Toys Reveals Japan Exclusive 1 6 Galen Erso Action Figure From Rogue One

May 08, 2025

Hot Toys Reveals Japan Exclusive 1 6 Galen Erso Action Figure From Rogue One

May 08, 2025