Bitcoin Bullish On Renewed US-China Trade Optimism

Table of Contents

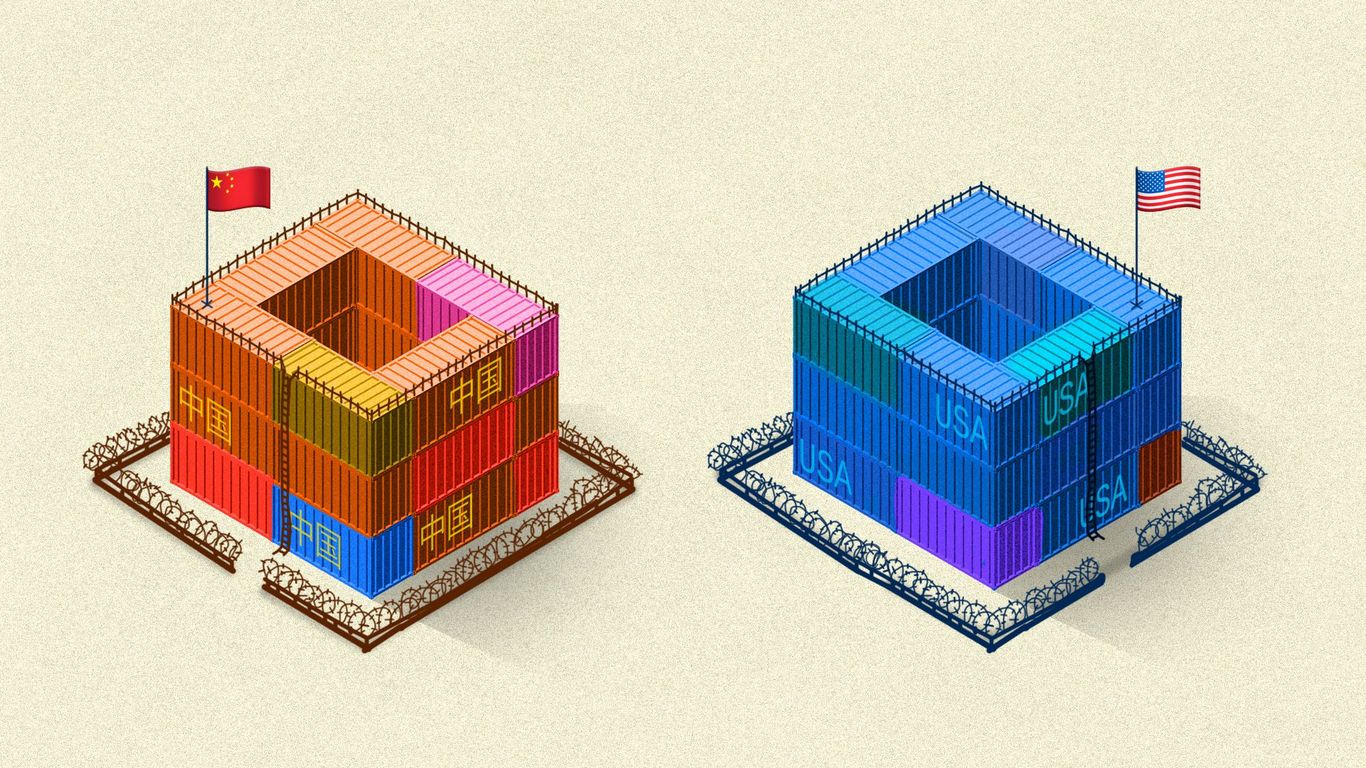

Easing Trade Tensions and Reduced Global Uncertainty

Decreased anxieties surrounding the US-China trade war have significantly boosted investor confidence, positively impacting risk assets, including Bitcoin. Reduced uncertainty encourages investment in higher-risk, higher-reward assets. This shift away from safer havens like gold towards potentially more lucrative investments like Bitcoin is a key driver of the current bullish trend.

- Reduced uncertainty leads to increased investment in riskier assets: With less fear of widespread economic disruption, investors are more willing to allocate capital to assets with potentially higher returns, even if they carry more risk.

- Investors shift from safe havens (like gold) to potentially higher-yielding assets like Bitcoin: Gold, traditionally a safe haven asset, sees reduced demand when investor sentiment improves. This capital often flows into assets perceived to have higher growth potential, such as Bitcoin.

- Positive trade news signals improved global economic outlook: Easing trade tensions suggest a healthier global economy, bolstering investor confidence and encouraging further investment in various markets, including cryptocurrency.

- Supporting Evidence: Recent reports from the International Monetary Fund (IMF) and various financial news outlets highlight the positive impact of reduced trade friction on global growth projections. (Insert links to relevant news sources here)

Increased Institutional Investment in Bitcoin

Positive global economic forecasts, fueled by the easing of US-China trade tensions, are emboldening institutional investors to allocate a larger portion of their portfolios to Bitcoin. This increased institutional participation significantly contributes to the bullish Bitcoin price.

- Grayscale Bitcoin Trust (GBTC) inflows as an indicator: The substantial inflows into GBTC, a publicly traded Bitcoin investment vehicle, indicate increasing institutional interest in Bitcoin.

- Other institutional investors entering the crypto market: Several major financial institutions are now actively exploring and investing in Bitcoin and other cryptocurrencies. (Include examples and links to relevant articles here)

- Regulatory clarity (or lack thereof) influencing institutional investment: Although regulatory uncertainty remains a concern, some jurisdictions are becoming more crypto-friendly, which encourages institutional adoption.

- Examples of Institutional Bitcoin Investment: (Include specific examples and links to articles showcasing institutional Bitcoin investment)

The Safe-Haven Narrative and Bitcoin's Role

While traditionally considered a high-risk asset, Bitcoin is increasingly viewed by some as a potential hedge against economic uncertainty. This perception is partly fueled by its decentralized nature.

- Bitcoin's decentralized nature makes it less susceptible to geopolitical events than traditional markets: Unlike traditional assets tied to specific governments or economies, Bitcoin's decentralized structure makes it relatively immune to the impacts of specific geopolitical events.

- Bitcoin's performance compared to gold during periods of trade uncertainty: Analyzing Bitcoin's price movements relative to gold during periods of trade uncertainty can provide insights into its role as a potential safe haven asset. (Include comparative charts or data here)

- Limitations of the safe-haven narrative: It's crucial to acknowledge that Bitcoin's price remains highly volatile, making it a less reliable safe haven compared to gold in some circumstances.

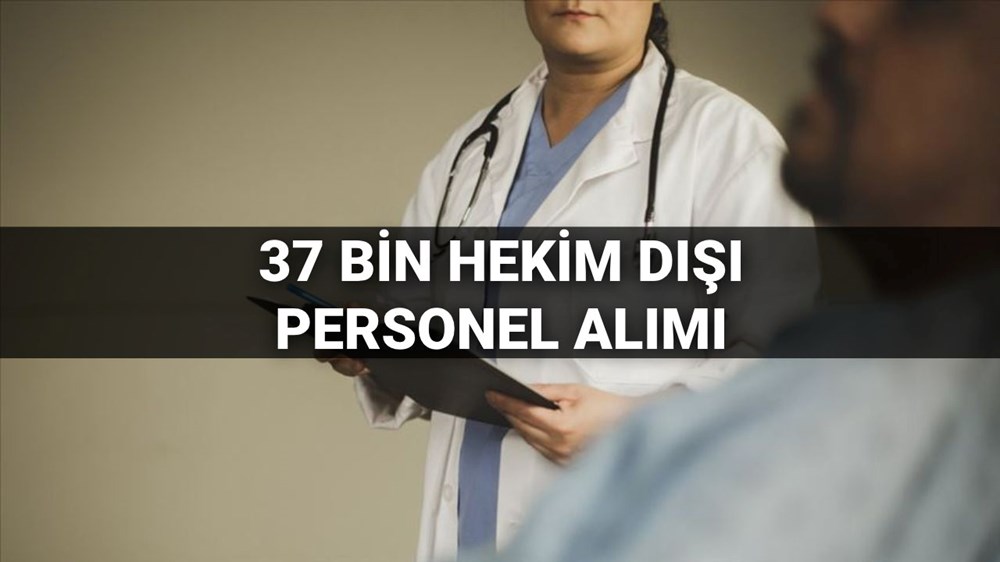

Technical Analysis Supporting the Bitcoin Bullish Trend

Technical analysis of Bitcoin's price charts reveals indicators supporting the current bullish trend. While not a foolproof prediction method, technical analysis provides valuable insights into potential future price movements.

- Specific technical indicators (e.g., moving averages, RSI, MACD): (Explain these indicators and their implications for Bitcoin's price. Include charts and graphs illustrating these technical patterns here.)

- Implications for future price movement: Based on these indicators, the bullish trend might continue, but this is not guaranteed.

- Cautionary note: Technical analysis is not a crystal ball. It is one tool among many to assess market trends.

Potential Risks and Challenges

Despite the positive outlook, several risks and challenges could impact Bitcoin's price.

- Regulatory uncertainty and potential government crackdowns: Government regulations on cryptocurrencies remain volatile and could negatively impact Bitcoin's price.

- Volatility inherent in the cryptocurrency market: Bitcoin is inherently volatile, and sudden price drops are possible.

- Competition from other cryptocurrencies: The cryptocurrency market is competitive, and new cryptocurrencies could potentially draw investment away from Bitcoin.

- Environmental concerns surrounding Bitcoin mining: The energy consumption associated with Bitcoin mining remains a significant concern for some investors.

Conclusion: Bitcoin's Future Tied to US-China Trade Relations

Renewed US-China trade optimism has significantly contributed to the current bullish Bitcoin trend. This positive sentiment, coupled with increased institutional investment and supportive technical analysis, has driven the price upward. However, the relationship between macroeconomic factors and Bitcoin's price remains dynamic. Closely monitoring ongoing US-China trade developments is crucial for understanding Bitcoin's potential future price movements. Stay updated on Bitcoin's price movements and learn more about Bitcoin investing to make informed decisions. Track the impact of US-China trade on Bitcoin and adapt your investment strategy accordingly.

Featured Posts

-

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Kisilik Bueyuek Alim

May 08, 2025

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Kisilik Bueyuek Alim

May 08, 2025 -

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025 -

Is This The Planet Star Wars Has Teased For Nearly 50 Years

May 08, 2025

Is This The Planet Star Wars Has Teased For Nearly 50 Years

May 08, 2025 -

The Potential Of Xrp Etfs 800 Million In First Week Flows Upon Sec Approval

May 08, 2025

The Potential Of Xrp Etfs 800 Million In First Week Flows Upon Sec Approval

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps Announcements

May 08, 2025

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps Announcements

May 08, 2025