Bitcoin Chart Analysis: May 6th Signals Potential Rally Initiation

Table of Contents

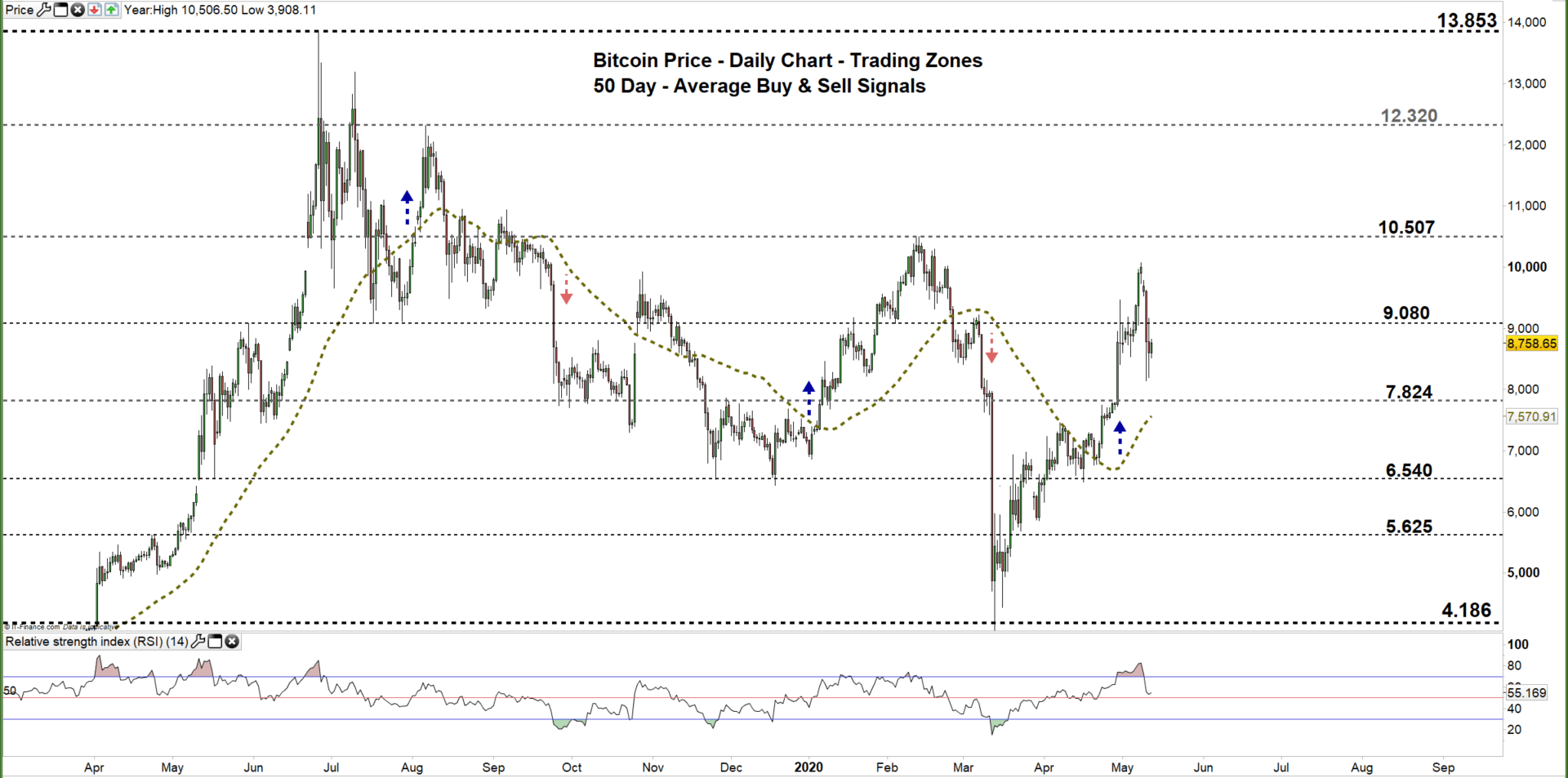

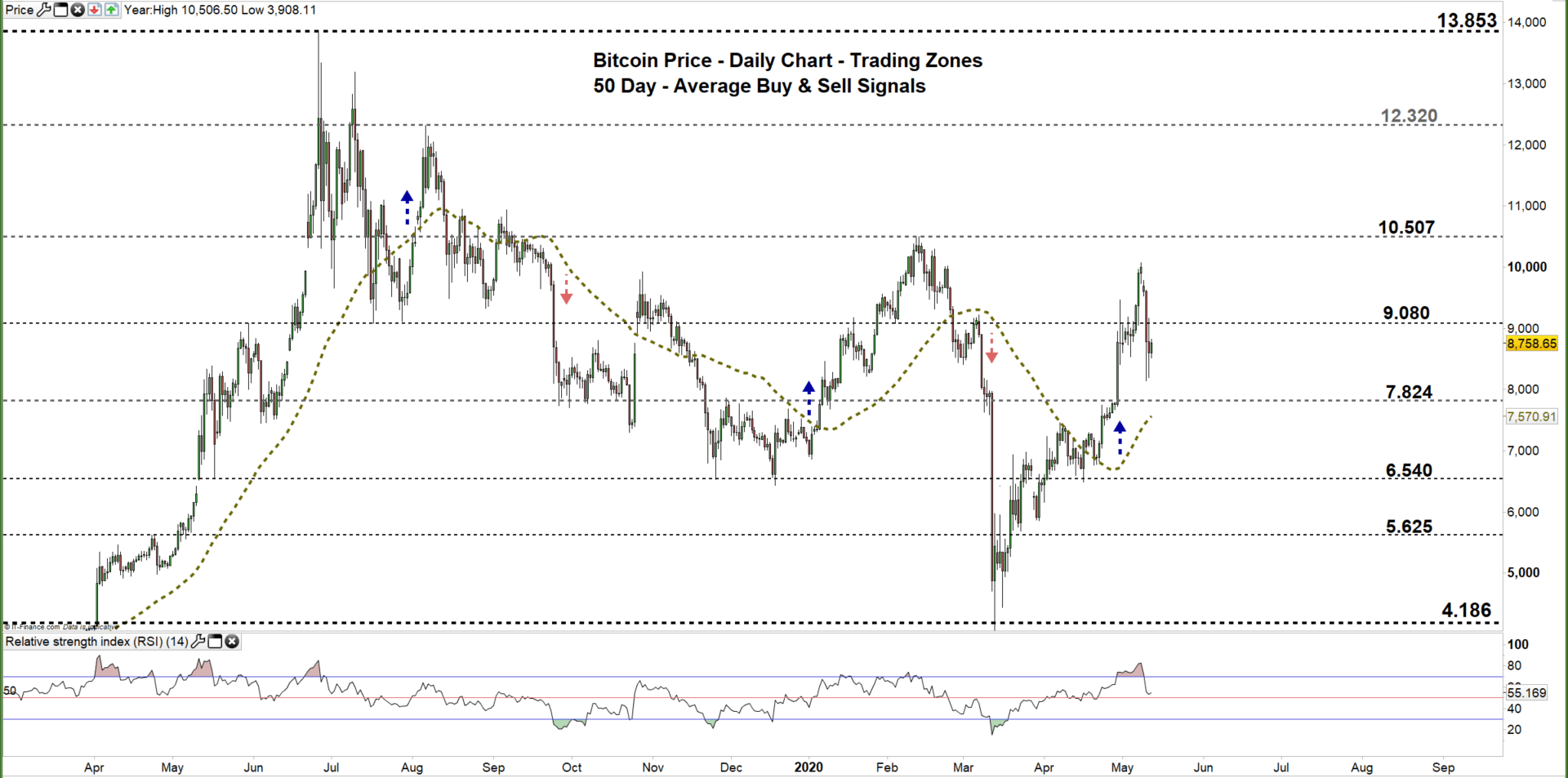

Technical Indicators Suggesting a Potential Bitcoin Rally

Technical analysis plays a vital role in predicting potential price movements. Several key indicators, as of May 6th, point towards a potential Bitcoin rally.

Moving Averages Convergence

The convergence of key moving averages, such as the 50-day and 200-day moving averages, is a classic bullish signal. Historically, when these averages converge in Bitcoin's price chart, it often precedes a significant price increase. This convergence suggests a potential shift in momentum. Combining this with the convergence of other indicators like the RSI and MACD strengthens the bullish signal.

- Past Convergence Events: Analysis of past Bitcoin price charts reveals that similar moving average convergences in [insert specific dates/years] were followed by substantial price rallies of [insert percentage] within [insert timeframe].

- RSI and MACD Convergence: A simultaneous convergence of the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) further strengthens the bullish signal from the moving average crossover. These indicators suggest a shift from bearish to bullish momentum.

- Keyword integration: Bitcoin moving averages, technical analysis Bitcoin, Bitcoin price prediction, Bitcoin chart patterns

Relative Strength Index (RSI) Breakout

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A breakout above a key RSI level (e.g., 50 or 70) can signal a potential bullish trend. On May 6th, the Bitcoin RSI showed [specify the RSI level and the context of the breakout – e.g., a breakout above 50 after a period of consolidation].

- RSI Levels and Confirmation: The RSI breakout was confirmed by increasing trading volume, suggesting strong buying pressure.

- Potential Overbought Conditions: While a breakout is bullish, it's crucial to monitor for potential overbought conditions (RSI above 70). This could indicate a temporary pullback before a continuation of the uptrend.

- Keyword integration: Bitcoin RSI, Bitcoin technical indicators, Bitcoin trading signals, Bitcoin momentum

Support Levels Holding

Analyzing the Bitcoin price chart reveals key support levels that have held during recent price fluctuations. These support levels act as a "floor" for the price, preventing further significant declines. The ability of the price to bounce off these levels indicates strong buying pressure and a potential for a rally.

- Key Support Levels: [Insert specific support levels with visual aids (charts if possible)]. These levels are significant because they represent previous price bottoms or psychological barriers.

- Significance of Support Levels: The fact that these support levels have held suggests strong buyer confidence and a willingness to accumulate Bitcoin at these price points.

- Keyword integration: Bitcoin support and resistance, Bitcoin price floor, Bitcoin chart patterns, Bitcoin price action

On-Chain Metrics Supporting a Bullish Outlook

On-chain metrics provide insights into the underlying behavior of Bitcoin's network. Several metrics suggest a potential bullish outlook.

Increased Bitcoin Network Activity

Increased network activity, measured by transaction volume and active addresses, is a positive sign. Higher transaction volume indicates greater user engagement and demand for Bitcoin. An increase in active addresses signifies growing user participation. On May 6th, [insert data points showing increased network activity, e.g., a 15% increase in daily transactions].

- Correlation with Price Movements: Historically, periods of increased Bitcoin network activity have often preceded price increases.

- Data Points: [Insert specific data points illustrating increased transaction volume and active addresses, linking to credible sources].

- Keyword integration: Bitcoin on-chain analysis, Bitcoin transaction volume, Bitcoin network activity, Bitcoin user engagement

Accumulation Trends

On-chain data may also suggest accumulation trends, indicating that large investors ("whales") are buying Bitcoin. This accumulation could signal a belief in future price appreciation and contribute to upward pressure.

- Metrics Indicating Accumulation: [Specify relevant on-chain metrics, e.g., large transaction volumes at specific price levels, changes in exchange balances].

- Interpretation: This accumulation could be interpreted as a bullish signal, suggesting that large investors anticipate future price increases.

- Keyword integration: Bitcoin whale activity, Bitcoin accumulation, Bitcoin investor sentiment, Bitcoin exchange flow

Potential Risks and Considerations

While the indicators suggest a potential rally, it's crucial to acknowledge potential risks.

Macroeconomic Factors

External factors can significantly influence Bitcoin's price. Regulatory announcements, overall market sentiment, and global economic conditions can all play a role.

- Potential Risks: [Identify potential negative impacts, e.g., increased regulatory scrutiny, a broader market downturn].

- Impact on Predicted Rally: These factors could potentially dampen or even negate the predicted rally.

- Keyword integration: Bitcoin regulation, Bitcoin market volatility, macroeconomic factors affecting Bitcoin, Bitcoin market sentiment

Resistance Levels to Overcome

Even with positive indicators, Bitcoin's price faces resistance levels that could hinder a sustained rally.

- Potential Resistance Levels: [Identify key resistance levels on the chart, explaining their significance].

- Strategies for Overcoming Resistance: Strategies to overcome resistance might include a breakout with high volume or a period of consolidation before another upward move.

- Keyword integration: Bitcoin resistance levels, Bitcoin price ceiling, Bitcoin breakout, Bitcoin price targets

Conclusion

The Bitcoin chart analysis for May 6th reveals a confluence of technical and on-chain indicators suggesting a potential rally initiation. The convergence of moving averages, a bullish RSI breakout, and holding support levels, combined with increased network activity and potential accumulation trends, paint a positive picture. However, macroeconomic factors and resistance levels pose potential challenges. This Bitcoin chart analysis should not be taken as financial advice. The cryptocurrency market remains inherently volatile. Conduct thorough research and manage your risk appropriately before making any investment decisions. Continue monitoring the Bitcoin chart analysis for further developments and updates. Remember to always conduct your own research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

First Look At Andor A Major Star Wars Event Finally Revealed

May 08, 2025

First Look At Andor A Major Star Wars Event Finally Revealed

May 08, 2025 -

The Definitive Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025

The Definitive Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025 -

Superman Extended Cinema Con Footage Reveals Kryptos Role

May 08, 2025

Superman Extended Cinema Con Footage Reveals Kryptos Role

May 08, 2025 -

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025 -

Ethereum Cross X Signals Strong Buy Institutional Accumulation Fuels 4 000 Price Target

May 08, 2025

Ethereum Cross X Signals Strong Buy Institutional Accumulation Fuels 4 000 Price Target

May 08, 2025