Bitcoin Price Prediction: 1,500% Growth In 5 Years?

Table of Contents

Factors Potentially Fueling a 1500% Bitcoin Price Surge

Several factors could contribute to a significant Bitcoin price increase, though a 1500% surge in five years remains a highly ambitious prediction.

Increased Institutional Adoption

Growing interest from major corporations and investment firms is a key driver of Bitcoin's price. The Grayscale Bitcoin Trust, for example, has significantly influenced market sentiment, and its assets under management are a key indicator of institutional confidence. The potential approval of Bitcoin Exchange-Traded Funds (ETFs) in major markets could further boost liquidity and accessibility, attracting even more institutional investors.

- More institutional players mean larger trading volumes and increased price stability (potentially). Larger trades tend to smooth out short-term volatility.

- However, increased institutional involvement could also lead to greater price volatility in the short term. Large buy or sell orders can cause dramatic price swings.

Global Economic Uncertainty and Inflation

Bitcoin is increasingly viewed as a hedge against inflation and economic instability. During periods of economic downturn or high inflation, investors may flock to Bitcoin as a store of value, driving up demand and price.

- Safe-haven asset status could drive significant price appreciation. This is a key factor in Bitcoin's appeal to many investors.

- This scenario is heavily dependent on macroeconomic factors outside Bitcoin's direct control. Global economic events will significantly influence Bitcoin's price regardless of its intrinsic value.

Technological Advancements and Network Upgrades

The ongoing development and implementation of technologies like the Lightning Network are crucial. The Lightning Network aims to improve transaction speed and scalability, addressing one of Bitcoin's main limitations – slow transaction times and high fees. Second-layer solutions like this are essential for Bitcoin's mass adoption.

- Improved efficiency and usability could attract a wider user base. Easier and cheaper transactions make Bitcoin more appealing to everyday users.

- Successful upgrades are crucial for maintaining network security and attracting new investors. Security and stability are paramount for continued growth.

Challenges and Risks Hindering a 1500% Bitcoin Price Increase

Despite the bullish potential, several challenges could hinder such dramatic price appreciation.

Regulatory Uncertainty and Government Intervention

Varying regulatory frameworks across different countries pose a significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and stricter regulations could negatively impact Bitcoin's price.

- Uncertain regulatory environments can impact investor confidence. Clear and consistent regulations are essential for attracting mainstream investors.

- Negative regulations could significantly suppress price growth. Bans or excessive restrictions could severely limit Bitcoin's adoption and price.

Market Volatility and Price Corrections

Bitcoin's price history is characterized by significant volatility and periodic corrections. Unforeseen events, such as macroeconomic shocks or regulatory changes, can trigger sharp price drops.

- Sudden price drops can wipe out substantial investment gains. Investing in Bitcoin involves a high degree of risk.

- Risk tolerance and diversification are crucial when investing in Bitcoin. Never invest more than you can afford to lose.

Competition from Alternative Cryptocurrencies

The cryptocurrency landscape is constantly evolving, with new cryptocurrencies emerging that offer potentially superior technology or features. This competition for investor attention and market share could divert investment away from Bitcoin.

- New competitors could divert investment away from Bitcoin. The cryptocurrency market is dynamic and competitive.

- Bitcoin's first-mover advantage might not always guarantee dominance. Technological innovation in the crypto space is rapid.

Conclusion

A 1500% Bitcoin price surge in five years is a bold prediction, dependent on a confluence of positive factors and the absence of significant headwinds. While institutional adoption, economic uncertainty, and technological advancements could contribute to substantial price growth, regulatory hurdles, market volatility, and competition from rival cryptocurrencies pose considerable challenges. Before investing in Bitcoin, carefully weigh the potential rewards against the inherent risks, conducting thorough research and considering your risk tolerance. Remember that any Bitcoin price prediction, including a 1500% increase, remains speculative. Conduct your own due diligence before making any investment decisions regarding Bitcoin price predictions and always remember to diversify your portfolio.

Featured Posts

-

Sergio Hernandez Dirigira Al Flamengo En Brasil

May 08, 2025

Sergio Hernandez Dirigira Al Flamengo En Brasil

May 08, 2025 -

Stream The Most Intense War Films Your Amazon Prime Guide

May 08, 2025

Stream The Most Intense War Films Your Amazon Prime Guide

May 08, 2025 -

Yevrokubki Ps Zh Proti Aston Villi Detalniy Analiz Matchiv

May 08, 2025

Yevrokubki Ps Zh Proti Aston Villi Detalniy Analiz Matchiv

May 08, 2025 -

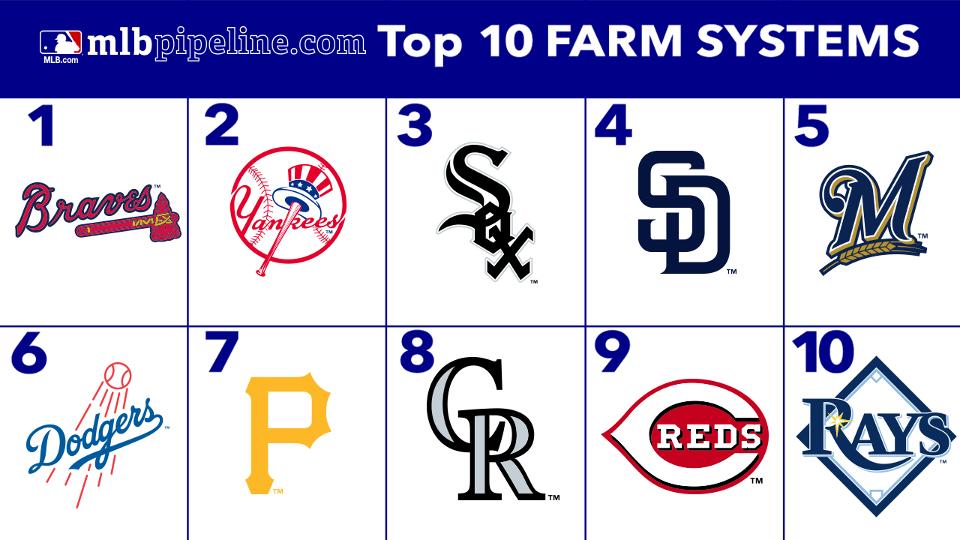

Mlb Experts Rank Angels Farm System Among The Worst

May 08, 2025

Mlb Experts Rank Angels Farm System Among The Worst

May 08, 2025 -

Texas Spring Football Injury News And Updates From Coach Sarkisian

May 08, 2025

Texas Spring Football Injury News And Updates From Coach Sarkisian

May 08, 2025