Bitcoin Price Prediction: Analyst Highlights Potential Rally Starting Point (06/05 Chart)

Table of Contents

Analyst's Methodology and Key Indicators

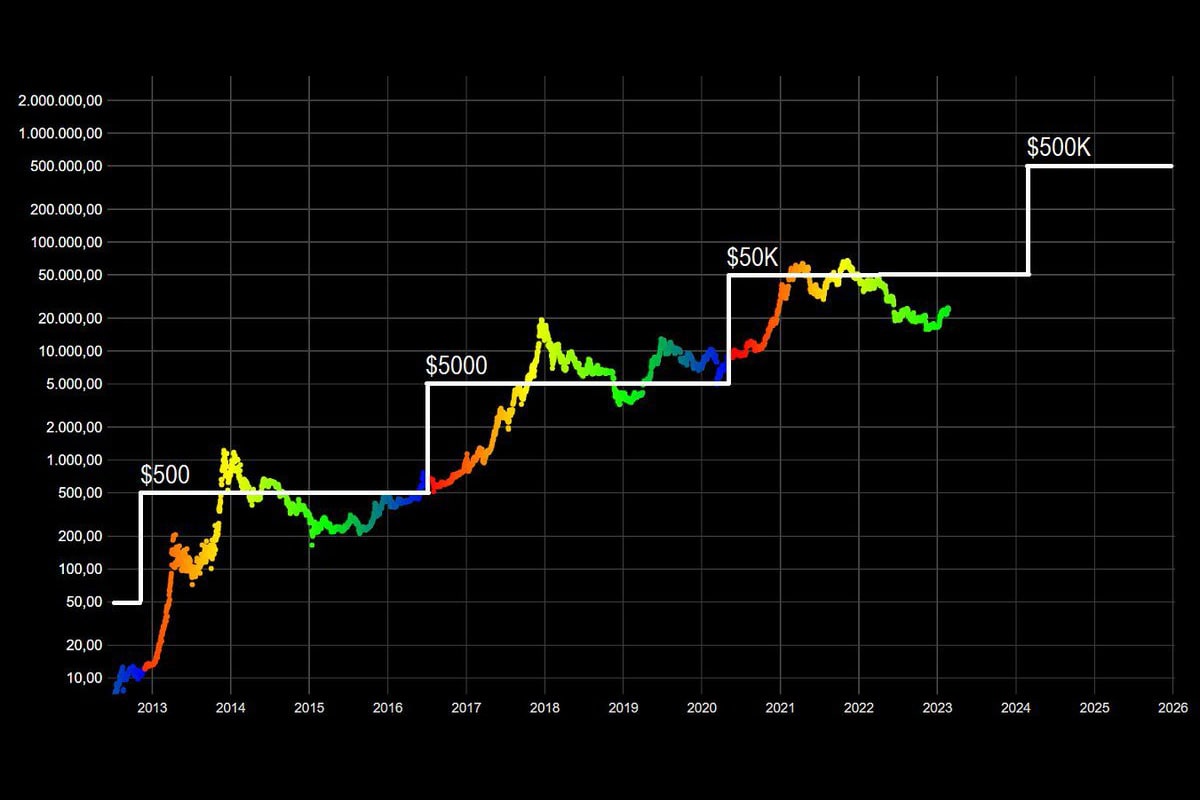

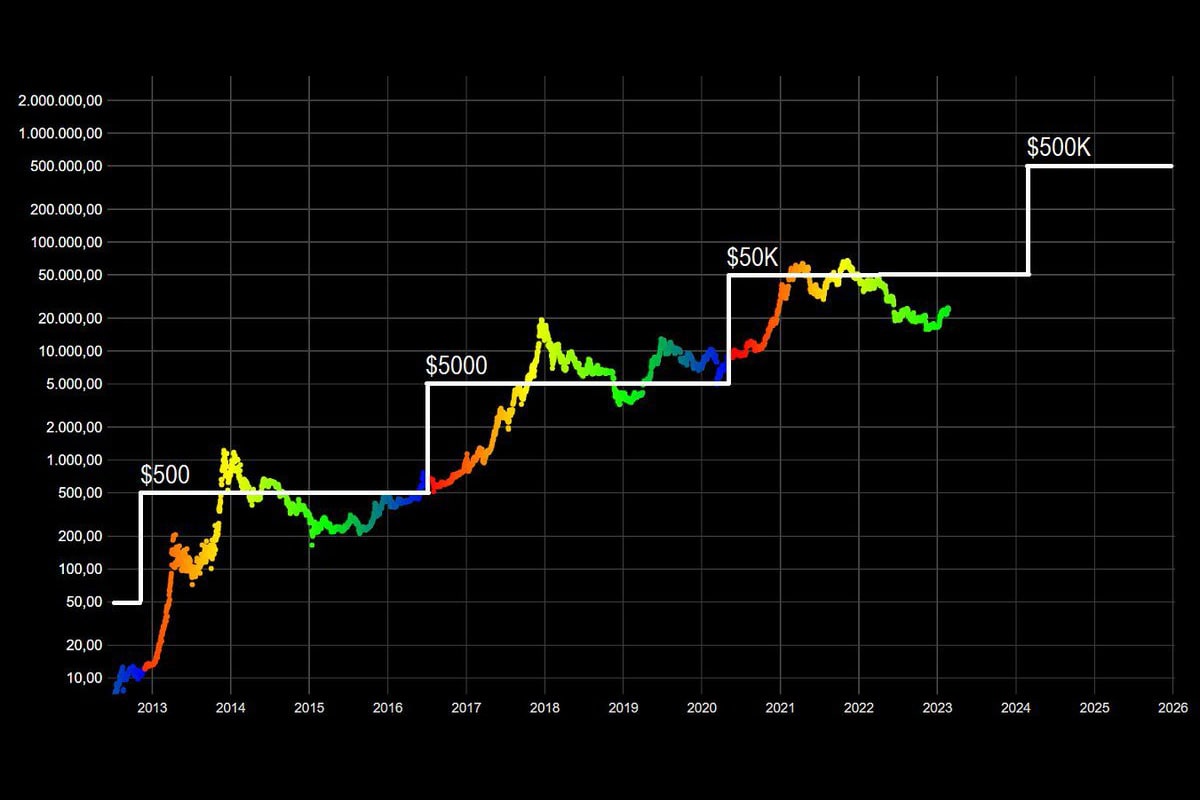

This Bitcoin price prediction utilizes a multifaceted approach combining technical analysis, on-chain metrics, and a consideration of macroeconomic factors. The analyst, whose name will remain undisclosed for neutrality, bases their prediction heavily on the June 5th chart, which they believe shows a significant shift in market sentiment.

- Specific technical indicators used: The analysis incorporates moving averages (specifically, the 50-day and 200-day moving averages), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). These indicators help identify potential trend reversals and momentum shifts.

- On-chain data points considered: Transaction volume, mining difficulty, and the number of active addresses are key on-chain metrics utilized. High transaction volume coupled with increasing mining difficulty often suggests growing network activity and potential price appreciation.

- Macroeconomic factors influencing the prediction: Inflation rates, regulatory announcements concerning cryptocurrency, and overall global economic sentiment are all considered. Positive regulatory shifts or a decrease in inflation could fuel a Bitcoin bull run.

- Significance of the June 5th chart: The June 5th chart, according to the analyst, displays a confluence of positive signals from the technical indicators mentioned above. This convergence, combined with the on-chain data, suggests a potential bottom formation and the beginning of a sustained upward trend. (Insert chart or graph of June 5th data here)

Potential Rally Starting Point and Price Targets

The analyst identifies a price point of approximately $X (replace X with the actual price point from the analyst's prediction) as the potential starting point for a Bitcoin rally.

- Rationale behind the price point: This price point aligns with key support levels identified through technical analysis, coinciding with a period of relatively low transaction volume and a positive shift in the RSI and MACD indicators.

- Potential price targets: The analyst suggests a short-term target of $Y (replace Y with the short-term target), a mid-term target of $Z (replace Z with the mid-term target), and a long-term target of $W (replace W with the long-term target). These targets are based on Fibonacci retracement levels and historical price action.

- Factors that could accelerate or hinder the rally: Positive news concerning Bitcoin adoption by institutional investors, a decrease in regulatory uncertainty, and positive macroeconomic trends could accelerate the rally. Conversely, negative regulatory changes, a significant market correction, or worsening macroeconomic conditions could hinder the rally.

Factors Supporting the Bullish Outlook

Several factors contribute to a positive outlook for Bitcoin's price:

- Institutional adoption of Bitcoin: Increasing numbers of institutional investors, including hedge funds and corporations, are adding Bitcoin to their portfolios, driving demand.

- Growing adoption of Bitcoin as a payment method: More merchants are accepting Bitcoin as a form of payment, increasing its utility and driving demand.

- Positive regulatory developments: Clearer regulatory frameworks in some jurisdictions are creating a more favorable environment for Bitcoin investment.

- Developments in Bitcoin’s underlying technology: Ongoing development and improvements to the Bitcoin network, such as the Lightning Network, enhance scalability and efficiency.

Potential Risks and Challenges

Despite the bullish outlook, several risks and challenges could impact the Bitcoin price:

- Regulatory uncertainty and potential crackdowns: Changes in government regulations regarding cryptocurrencies could negatively impact Bitcoin's price.

- Market volatility and potential price corrections: The cryptocurrency market is inherently volatile, and significant price corrections are possible.

- Competition from other cryptocurrencies: The emergence of new cryptocurrencies with innovative features could divert investment away from Bitcoin.

- Macroeconomic factors: A global recession or other major economic events could negatively impact Bitcoin's price.

Comparison with Other Bitcoin Price Predictions

This Bitcoin price prediction aligns with some, but not all, other prominent predictions. Some analysts share a similar bullish outlook, while others remain more cautious.

- Similarities and differences: While price targets vary, many predictions point to a potential upward trend for Bitcoin in the coming months. The differences mainly lie in the timing and magnitude of the predicted rally.

- Overall market consensus: There's a growing sense of optimism in the market, although considerable uncertainty remains.

- Links to other predictions: (Insert links to reputable sources of other Bitcoin price predictions here, with proper attribution)

Conclusion

This analysis offers a potential Bitcoin price prediction based on an analyst's interpretation of the June 5th chart, utilizing technical indicators, on-chain data, and macroeconomic factors. The predicted rally starting point is approximately $X, with potential targets ranging from $Y (short-term) to $Z (mid-term) and $W (long-term). While several positive factors support a bullish outlook, significant risks and challenges remain.

Call to Action: While this Bitcoin price prediction offers valuable insights, remember that cryptocurrency investments are inherently risky. Conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions based on this or any Bitcoin price prediction. Stay informed about the latest developments in the crypto market to make educated decisions regarding your Bitcoin investments. Remember to always diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Zanimljiv Obicaj Zasto Dzordan I Jokic Dele Tri Poljupca

May 08, 2025

Zanimljiv Obicaj Zasto Dzordan I Jokic Dele Tri Poljupca

May 08, 2025 -

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025 -

Deandre Dzordan I Nikola Jokic Istina O Trostrukom Poljupcu

May 08, 2025

Deandre Dzordan I Nikola Jokic Istina O Trostrukom Poljupcu

May 08, 2025 -

The Best War Film Crown Contested Saving Private Ryans Legacy Questioned

May 08, 2025

The Best War Film Crown Contested Saving Private Ryans Legacy Questioned

May 08, 2025 -

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025