Bitcoin Price Prediction: Could Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Economic Policies and Their Impact on Bitcoin

Trump's past actions have undeniably shaken financial markets. His pronouncements on trade, regulation, and fiscal policy have often sent shockwaves through global economies. His potential return to power naturally sparks speculation about how his policies might affect Bitcoin.

Regulatory Uncertainty and Bitcoin

The regulatory landscape surrounding cryptocurrencies is notoriously complex and volatile. A Trump administration could bring about significant changes:

- Increased Regulation: More stringent regulations could stifle innovation and reduce institutional investment, potentially leading to a decrease in Bitcoin's price. Increased regulatory scrutiny might make it harder for smaller investors to participate, dampening demand.

- Decreased Regulation: Conversely, a more lenient regulatory approach could boost investor confidence, attract institutional capital, and drive up the Bitcoin price. Reduced barriers to entry could lead to wider adoption and increased demand.

- Impact on Institutional Investment: The stance on regulation heavily influences institutional investment decisions. Clear, consistent rules are crucial for attracting large investors who often prefer less regulatory uncertainty. A favorable regulatory environment under Trump could attract more institutional investors, potentially pushing Bitcoin’s price higher.

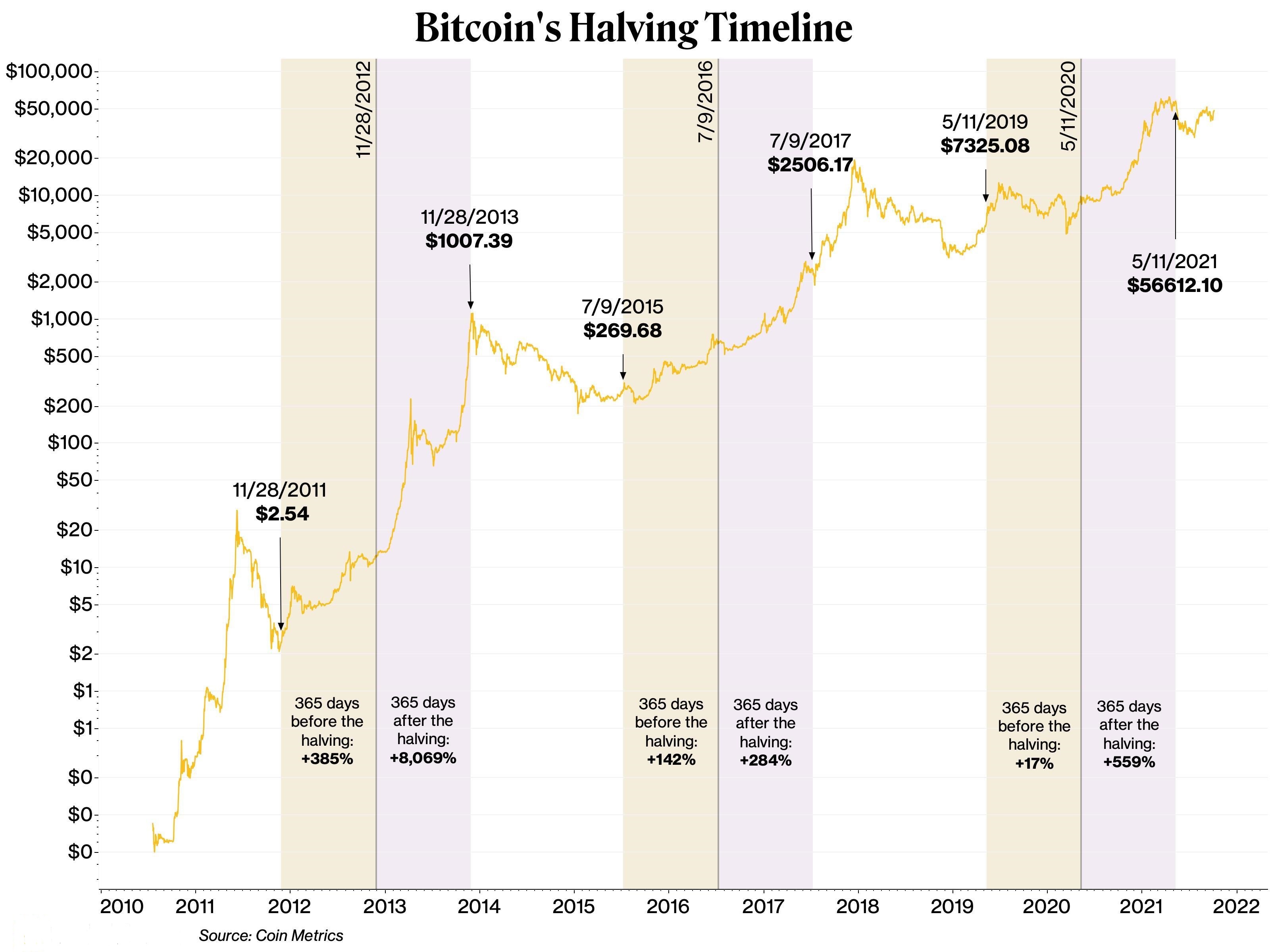

Historically, periods of regulatory uncertainty have often been accompanied by price volatility in the Bitcoin market. The 2017 bull run, for example, was followed by a period of regulatory crackdown in various jurisdictions, leading to a significant price correction.

Macroeconomic Factors & Bitcoin

Trump's potential fiscal policies, such as tax cuts and increased government spending, could significantly impact the macroeconomic environment. This, in turn, could affect Bitcoin's value:

- Inflationary Pressures: Expansionary fiscal policies could lead to increased inflation. Bitcoin, often viewed as a hedge against inflation, might see increased demand if the dollar weakens.

- Flight to Safety: Geopolitical instability or economic uncertainty could trigger a "flight to safety," potentially driving investors towards Bitcoin as a decentralized, less-correlated asset.

- Impact on USD Value: The strength or weakness of the US dollar directly influences Bitcoin's price, typically expressed in USD. Trump's policies could affect the dollar's value, influencing Bitcoin indirectly.

Expert opinions vary widely regarding the potential impact of Trump's policies on inflation and the broader economy. Some analysts believe his fiscal policies could fuel inflation, benefiting Bitcoin, while others warn of potential economic instability.

Geopolitical Uncertainty and Bitcoin

Trump's foreign policy stances are known for unpredictability. This geopolitical uncertainty could affect Bitcoin's price:

- Increased Global Uncertainty: Periods of international tension often lead investors to seek safe haven assets, potentially boosting Bitcoin's demand.

- Bitcoin as a Safe Haven Asset: Bitcoin's decentralized nature and independence from traditional financial systems could make it an attractive safe haven during times of global instability.

- Potential for Increased Adoption: Increased geopolitical uncertainty could drive the adoption of Bitcoin in countries with unstable currencies or political systems.

Past geopolitical events have shown a correlation between heightened global uncertainty and increased Bitcoin adoption and price appreciation. The 2014 Crimean crisis, for example, coincided with a period of increased interest in Bitcoin.

Technical Analysis and Bitcoin Price Targets

Beyond fundamental analysis, technical indicators provide insights into potential price movements.

Chart Patterns and Indicators

Technical analysis utilizes various chart patterns and indicators to predict future price action.

- Support and Resistance Levels: Identifying key price levels where buying or selling pressure is expected to be strong can help predict potential price reversals.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can indicate trends and potential trend changes.

- RSI (Relative Strength Index): This momentum indicator helps gauge whether Bitcoin is overbought or oversold, potentially signaling buying or selling opportunities.

- MACD (Moving Average Convergence Divergence): This trend-following momentum indicator helps identify potential buy or sell signals based on the convergence and divergence of moving averages.

[Insert relevant charts and graphs here]

On-Chain Analysis

Analyzing on-chain data offers valuable insights into market sentiment and potential price movements.

- Whale Activity: Monitoring large transactions by significant Bitcoin holders ("whales") can provide clues about their intentions.

- Adoption Rates: Tracking metrics like new addresses and transaction volume can indicate the level of adoption and overall network activity.

- Network Growth: Analyzing the growth of the Bitcoin network, such as the increase in nodes and hashrate, can reflect the health and resilience of the network.

Data from blockchain explorers like Blockchain.com and Glassnode can be used to analyze these metrics.

Market Sentiment and Bitcoin's Future

Gauging market sentiment is crucial for forming a Bitcoin price prediction.

Public Opinion and Media Coverage

Analyzing news sentiment and social media activity provides insights into overall market psychology.

- Positive vs. Negative News: Positive media coverage and social media sentiment generally correlate with rising prices, while negative sentiment can lead to price corrections.

- Social Media Sentiment: Platforms like Twitter and Reddit offer valuable real-time sentiment data regarding Bitcoin.

- Mainstream Media Coverage: Increased mainstream media coverage often fuels broader adoption and price increases.

Institutional Investor Interest

Institutional investors' involvement is a key driver of Bitcoin's price.

- Increased Adoption by Institutional Investors: Large-scale investments from institutional players like investment firms and corporations can significantly influence the price.

- Potential for Large-Scale Investment: The entry of major institutional investors could lead to a substantial increase in demand, pushing the price higher.

Conclusion: Bitcoin Price Prediction and the Trump Factor – A Final Word

The potential impact of a Trump administration on Bitcoin's price is a complex issue, influenced by factors ranging from regulatory uncertainty and macroeconomic conditions to geopolitical events and market sentiment. While the possibility of Bitcoin surpassing $100,000 under specific favorable conditions exists, it’s crucial to acknowledge the inherent uncertainty in any price prediction. A multitude of factors beyond Trump's influence, such as technological advancements, regulatory changes in other countries, and overall market trends, will play a significant role. Therefore, forming a robust Bitcoin price prediction requires a holistic approach considering multiple perspectives. Do your own research, stay informed about developments in both the Bitcoin market and potential Trump administration policies, and form your own informed Bitcoin Price Prediction. Consider following reputable crypto news sources and analyzing on-chain data to stay updated on market trends.

Featured Posts

-

Indian Stock Market Update Sensex Nifty Close Higher

May 09, 2025

Indian Stock Market Update Sensex Nifty Close Higher

May 09, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizing Firefighters And Other Public Servants

May 09, 2025

Living Legends Of Aviation Awards Ceremony Recognizing Firefighters And Other Public Servants

May 09, 2025 -

Is A Trump Britain Trade Agreement Finally Coming

May 09, 2025

Is A Trump Britain Trade Agreement Finally Coming

May 09, 2025 -

Su Viec Bao Mau Bao Hanh Tre Em Tien Giang Bai Hoc Canh Tinh Ve An Toan Tre Nho

May 09, 2025

Su Viec Bao Mau Bao Hanh Tre Em Tien Giang Bai Hoc Canh Tinh Ve An Toan Tre Nho

May 09, 2025 -

Ukraina S Sh A I Germaniya Prognozy Po Migratsionnomu Potoku Bezhentsev

May 09, 2025

Ukraina S Sh A I Germaniya Prognozy Po Migratsionnomu Potoku Bezhentsev

May 09, 2025