Bitcoin Price Prediction: Evaluating The Potential Of A Trump-Fueled Bull Run To $100k

Table of Contents

Trump's Policies and Their Potential Impact on Bitcoin

Trump's economic policies, particularly his history of deregulation and fiscal stimulus, could significantly influence Bitcoin's trajectory. Understanding this impact is crucial for accurate Bitcoin price prediction.

-

Deregulation: A less regulated financial environment could be incredibly favorable for cryptocurrency adoption. Reduced regulatory burdens could lead to increased institutional investment, potentially driving up demand and the Bitcoin price. This increased institutional interest is a key element in many Bitcoin price prediction models. Historically, periods of lighter crypto regulation have often correlated with price increases.

-

Fiscal Stimulus: Increased government spending, a hallmark of Trump's economic approach, could lead to inflation. Bitcoin, often viewed as a hedge against inflation, might become a more attractive investment during such times. This inflation hedge characteristic is frequently cited in Bitcoin price prediction analyses. The potential for increased inflation significantly influences many Bitcoin price prediction algorithms.

-

Anti-establishment Sentiment: Trump's populist appeal resonates with those distrustful of traditional financial systems. This sentiment could translate into increased support for Bitcoin as a decentralized alternative, potentially boosting demand and influencing Bitcoin price prediction. The narrative of Bitcoin as a rebellion against traditional finance, a narrative often echoed by Trump himself, reinforces this potential correlation.

Historical Bitcoin Price Performance During Periods of Political Uncertainty

Analyzing Bitcoin's past performance during periods of political and economic uncertainty can offer valuable insights for future Bitcoin price prediction.

-

2016 US Election: The 2016 US presidential election saw considerable Bitcoin price volatility. A comparison of that period's price movements with the current political climate can provide valuable data points for developing more accurate Bitcoin price predictions.

-

Global Economic Crises: Bitcoin's behavior during past global economic crises, such as the 2008 financial crisis, is highly relevant. Determining whether it acts as a safe haven asset or a risky investment during such periods is crucial for refining Bitcoin price prediction models.

-

Regulatory Changes: Tracking Bitcoin's price fluctuations following significant regulatory changes (positive or negative) across different countries is essential. This analysis helps gauge Bitcoin's sensitivity to political actions and policy decisions, a pivotal factor in Bitcoin price prediction.

Challenges and Risks: Factors That Could Inhibit a Bitcoin Bull Run to $100k

Despite the potential for a Trump-fueled bull run, several factors could significantly impede Bitcoin's rise to $100,000. These risk factors are vital considerations in any realistic Bitcoin price prediction.

-

Regulatory Uncertainty: Increased government scrutiny of cryptocurrencies worldwide could dampen investor enthusiasm. Stringent regulations on trading and exchanges would likely negatively impact the Bitcoin price. Negative regulatory actions represent a major risk factor in most Bitcoin price prediction scenarios.

-

Market Volatility: The cryptocurrency market's inherent volatility means unexpected events could trigger sharp price drops. This inherent volatility presents a major challenge to accurate Bitcoin price prediction.

-

Competition: The emergence of new cryptocurrencies and blockchain technologies poses a competitive threat, potentially diverting investment away from Bitcoin. Analyzing the competitive landscape is essential for a comprehensive Bitcoin price prediction.

Conclusion: Navigating the Bitcoin Price Prediction Landscape

Predicting Bitcoin's price remains a complex and inherently speculative endeavor. While a Trump-fueled bull run to $100,000 is possible, driven by potential factors such as deregulation, fiscal stimulus, and anti-establishment sentiment, considerable challenges and risks exist. Regulatory uncertainty, market volatility, and competition all pose substantial threats. Therefore, thorough research, a diversified investment strategy, and a clear understanding of the risks are crucial before making any Bitcoin investment decisions. This article provides information only and does not constitute financial advice. Conduct your own thorough research and consult a financial professional before investing. Stay updated on the latest developments in Bitcoin price prediction to make informed choices. Remember to carefully consider all factors when formulating your own Bitcoin price prediction.

Featured Posts

-

Enhancing Crime Control Through Targeted Directives

May 08, 2025

Enhancing Crime Control Through Targeted Directives

May 08, 2025 -

Lotto Plus Results All The Latest Winning Numbers For Lotto Plus 1 And 2

May 08, 2025

Lotto Plus Results All The Latest Winning Numbers For Lotto Plus 1 And 2

May 08, 2025 -

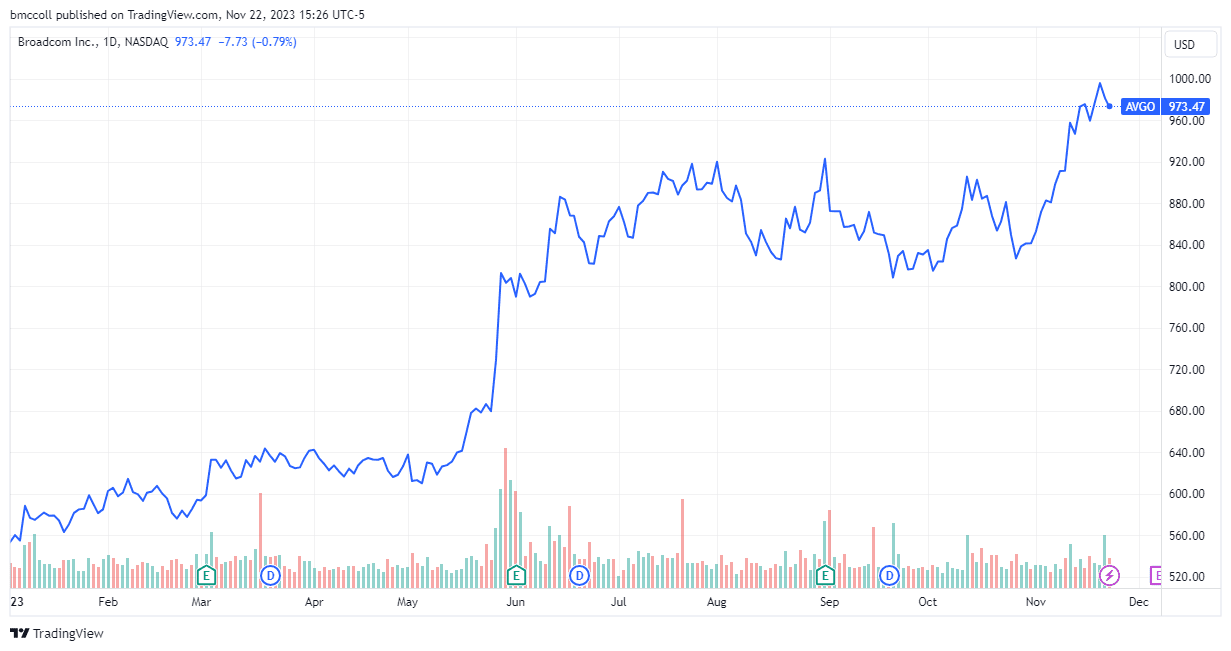

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025 -

Update On Jayson Tatums Wrist What The Celtics Coach Said

May 08, 2025

Update On Jayson Tatums Wrist What The Celtics Coach Said

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025