Bitcoin Price Rebound: A Look At The Potential For Future Growth

Table of Contents

Analyzing the Recent Bitcoin Price Rebound

Technical Analysis of the Rebound

Technical analysis provides valuable insights into short-term price movements. By examining charts, we can identify patterns that might predict future price action. In the recent Bitcoin rebound, we've observed several key indicators:

- Support Levels: The price has found support at key levels, indicating buying pressure.

- Resistance Levels: Overcoming resistance levels signals growing bullish sentiment.

- Moving Averages: The convergence or divergence of moving averages (like the 50-day and 200-day MA) can be indicative of price trends.

- RSI (Relative Strength Index): This indicator helps gauge the momentum of price changes, signaling overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator identifies changes in momentum by comparing two moving averages.

Key Price Movements: The recent rebound saw a sharp increase in Bitcoin's price, surpassing previous resistance levels. Trading Volume Changes: Increased trading volume during the rebound suggests strong conviction behind the price increase. This volume is a crucial indicator to confirm the sustainability of the upward trend.

Fundamental Factors Contributing to the Rebound

Beyond technical indicators, fundamental factors significantly influence Bitcoin's price.

- Institutional Adoption: Increased interest from major financial institutions like BlackRock and Fidelity is a powerful driver of price appreciation. Their entrance signifies a move towards mainstream acceptance.

- Regulatory Developments: While regulatory uncertainty remains, some positive developments, such as clearer guidelines in certain jurisdictions, can boost investor confidence. Conversely, overly restrictive regulations can negatively impact the Bitcoin price.

- Limited Supply: Bitcoin's fixed supply of 21 million coins contributes to its scarcity value, driving potential for long-term price appreciation. This inherent scarcity acts as a deflationary pressure, making it a hedge against inflation.

Examples of Institutional Adoption: Several major firms are now offering Bitcoin-related services, further enhancing legitimacy and demand. Regulatory Changes: The evolving regulatory landscape, while uncertain, is gradually becoming clearer, reducing some of the risks associated with Bitcoin investment.

Factors that Could Drive Future Bitcoin Growth

Several factors suggest the potential for continued Bitcoin price growth:

Increased Institutional Investment

The growing interest of large financial institutions in Bitcoin is a significant catalyst for future growth.

- ETFs (Exchange-Traded Funds): The potential approval of Bitcoin ETFs in major markets could significantly increase institutional investment, driving demand.

- Investment Vehicles: The development of diverse investment vehicles makes it easier for institutional investors to allocate capital to Bitcoin.

Examples of Institutional Investors: The participation of established players reduces the perception of Bitcoin as a purely speculative asset. Predictions for Future Investment: Analysts forecast a substantial influx of institutional capital into the Bitcoin market in the coming years.

Growing Global Adoption and Usage

The increasing use of Bitcoin for payments and transactions globally fuels its growth potential.

- Merchant Adoption: A growing number of merchants are accepting Bitcoin as payment, making it a more practical alternative.

- Payment Processors: The expansion of Bitcoin payment processors simplifies transactions and boosts user experience.

- El Salvador's adoption: Countries like El Salvador adopting Bitcoin as legal tender are significant milestones.

Examples of Countries Embracing Bitcoin: The growing number of countries exploring or implementing Bitcoin-related policies signifies wider acceptance. Increasing Merchant Adoption: More and more businesses see the value proposition of accepting Bitcoin.

Technological Advancements in the Bitcoin Ecosystem

Continuous technological improvements enhance Bitcoin's functionality and scalability.

- Lightning Network: This second-layer payment protocol improves transaction speeds and reduces fees, making Bitcoin more user-friendly.

- Improved Scalability: Ongoing developments aim to enhance Bitcoin's ability to handle a larger volume of transactions.

Examples of New Technologies: The constant innovation within the Bitcoin ecosystem addresses limitations and enhances its capabilities.

Potential Risks and Challenges to Bitcoin Growth

Despite the positive outlook, several risks and challenges could impact Bitcoin's growth:

Regulatory Uncertainty and Volatility

Government regulations and the inherent volatility of the cryptocurrency market pose significant risks.

- Government Regulations: Stringent regulations could stifle Bitcoin's growth and impact its price.

- Market Volatility: The cryptocurrency market is inherently volatile, exposing investors to significant price fluctuations.

Examples of Regulatory Actions: Government actions, be it bans or stringent regulations, can significantly influence the price and adoption of Bitcoin.

Competition from other Cryptocurrencies

The competitive landscape of the cryptocurrency market presents another challenge.

- Altcoins: The emergence of competing cryptocurrencies (altcoins) could potentially diminish Bitcoin's market dominance.

- Innovation in other cryptocurrencies: Developments in other cryptocurrencies might offer superior features, attracting investors away from Bitcoin.

Examples of Competing Cryptocurrencies: Other cryptocurrencies with faster transaction speeds or other innovative features might pose a challenge to Bitcoin's dominance.

Conclusion: Investing in the Bitcoin Price Rebound – A Look Ahead

The recent Bitcoin price rebound presents a fascinating case study. While several factors suggest strong potential for future Bitcoin growth—namely increased institutional investment, growing global adoption, and ongoing technological advancements—it's crucial to acknowledge the inherent risks associated with the cryptocurrency market, such as regulatory uncertainty and competition. The analysis highlights the importance of a balanced perspective, weighing potential gains against inherent risks. Therefore, before investing in Bitcoin, conduct thorough research, understand the potential risks, and consider your own risk tolerance. The Bitcoin price potential remains substantial, with opportunities for long-term growth, but responsible investment strategies are paramount. Explore the Bitcoin investment opportunities, but remember that the Bitcoin future growth is not guaranteed. Proceed with caution and always do your own due diligence before investing.

Featured Posts

-

Intriguing Theory High Potential David And Morgans Vulnerability

May 09, 2025

Intriguing Theory High Potential David And Morgans Vulnerability

May 09, 2025 -

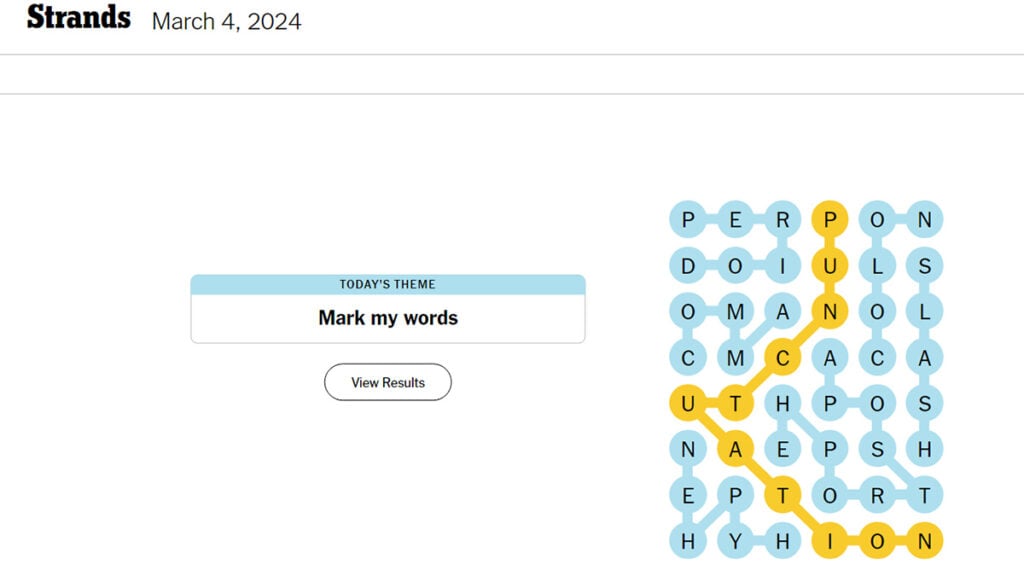

Thursday April 10th Nyt Strands Answers Game 403

May 09, 2025

Thursday April 10th Nyt Strands Answers Game 403

May 09, 2025 -

Fyraty Fy Qtr Thlyl Ladae Allaeb Me Alerby Bed Alahly

May 09, 2025

Fyraty Fy Qtr Thlyl Ladae Allaeb Me Alerby Bed Alahly

May 09, 2025 -

Indias Global Power Ranking And Implications

May 09, 2025

Indias Global Power Ranking And Implications

May 09, 2025 -

Netflix Adaptira Klasika Na Stivn King

May 09, 2025

Netflix Adaptira Klasika Na Stivn King

May 09, 2025