Bitcoin Price Rebound: Long-Term Outlook And Predictions

Table of Contents

Recent Market Trends and Price Action

Analyzing recent Bitcoin price movements reveals a complex interplay of factors. After a period of significant decline, Bitcoin has shown signs of recovery, bouncing off key support levels. These price rallies and dips significantly impact investor sentiment, often triggering waves of buying or selling pressure.

Charts and graphs clearly illustrate these fluctuations, showcasing the volatility inherent in the cryptocurrency market. Understanding these patterns is critical for identifying potential trends and predicting future price movements.

- Macroeconomic Factors: Inflationary pressures and fluctuating interest rates globally have a considerable impact on Bitcoin's price. Investors often view Bitcoin as a hedge against inflation, increasing demand during periods of economic uncertainty.

- On-Chain Metrics: Analyzing on-chain data, such as transaction volume and network activity, provides valuable insights into Bitcoin's underlying health and adoption rate. Increased transaction volume often indicates growing interest and potential price increases.

- Whale Activity and Institutional Investment: Large Bitcoin holders ("whales") and institutional investors significantly influence price movements. Their buying and selling activities can trigger significant price rallies or dips, highlighting the importance of monitoring these key players.

Technological Advancements and Their Impact

Technological advancements are pivotal in shaping Bitcoin's long-term prospects and influencing its price. The Lightning Network, for example, offers significant improvements in scalability and transaction speed, crucial for wider adoption. Layer-2 solutions further enhance Bitcoin's capabilities, reducing transaction fees and improving efficiency.

Upcoming upgrades and developments also play a crucial role. These improvements directly impact Bitcoin's utility and appeal, attracting new users and investors.

- Improved Scalability and Transaction Speed: Faster and cheaper transactions are critical for mainstream adoption. Technological advancements directly address these limitations, making Bitcoin a more viable option for everyday use.

- Increased Utility and Appeal: As Bitcoin becomes more user-friendly and efficient, its utility expands, leading to increased demand and potentially higher prices.

- Enhanced Security: Ongoing efforts to improve Bitcoin's security bolster investor confidence and contribute to long-term price stability. A robust and secure network is essential for maintaining its value.

Regulatory Landscape and its Influence

The regulatory landscape surrounding cryptocurrencies is constantly evolving and significantly impacts Bitcoin's price. Clear and consistent regulations foster investor confidence, promoting stability and growth. Conversely, regulatory uncertainty can lead to market volatility and price fluctuations.

The stances of different governments play a crucial role. Countries adopting a positive and supportive regulatory framework often see increased Bitcoin adoption and investment.

- Positive Regulatory Developments: Clear guidelines, licensing frameworks, and tax clarity can attract institutional investment and drive price increases.

- Negative Regulatory Developments: Bans, restrictions, and heavy taxation can negatively impact Bitcoin's price and hinder its growth.

- Global Regulatory Frameworks: The emergence of international regulatory standards will play a pivotal role in shaping the future of Bitcoin and its price.

Long-Term Bitcoin Price Predictions and Scenarios

Predicting Bitcoin's future price with certainty is impossible. However, various price prediction models, utilizing different methodologies, offer potential scenarios. These models consider factors such as adoption rates, technological advancements, and overall market sentiment.

Reputable analysts and forecasting firms provide valuable insights, although it's crucial to remember these are predictions, not guarantees.

- Predictions from Analysts: While individual predictions vary, understanding the reasoning behind them offers valuable perspective.

- Adoption Rate and Technological Advancements: Higher adoption rates and significant technological breakthroughs often correlate with price increases.

- Price Scenarios: Considering conservative, optimistic, and pessimistic scenarios provides a balanced perspective, acknowledging the inherent risks and rewards of Bitcoin investment. These scenarios help investors prepare for various outcomes.

Conclusion

This analysis of recent market trends, technological advancements, and the regulatory landscape provides a comprehensive overview of the potential for a sustained Bitcoin price rebound. While predicting the future price with absolute certainty is impossible, several factors point towards a positive long-term outlook for Bitcoin. The interplay between macroeconomic conditions, technological innovation, and regulatory clarity will continue to shape Bitcoin's price trajectory.

Call to Action: Stay informed about the latest developments in the Bitcoin market and continue to monitor the factors influencing its price. Understanding the dynamics of the Bitcoin price rebound is crucial for making informed investment decisions. Learn more about Bitcoin price predictions and strategies for navigating the volatile cryptocurrency market. Keep researching Bitcoin price analysis to stay ahead of the curve.

Featured Posts

-

Dwp Verify Your Bank Account Information For 12 Benefit Payments

May 08, 2025

Dwp Verify Your Bank Account Information For 12 Benefit Payments

May 08, 2025 -

Xrp Price Prediction Assessing The Potential For 5 And Beyond

May 08, 2025

Xrp Price Prediction Assessing The Potential For 5 And Beyond

May 08, 2025 -

Jokic To Sit Nuggets Give Starters Rest Following Tough Double Ot Defeat

May 08, 2025

Jokic To Sit Nuggets Give Starters Rest Following Tough Double Ot Defeat

May 08, 2025 -

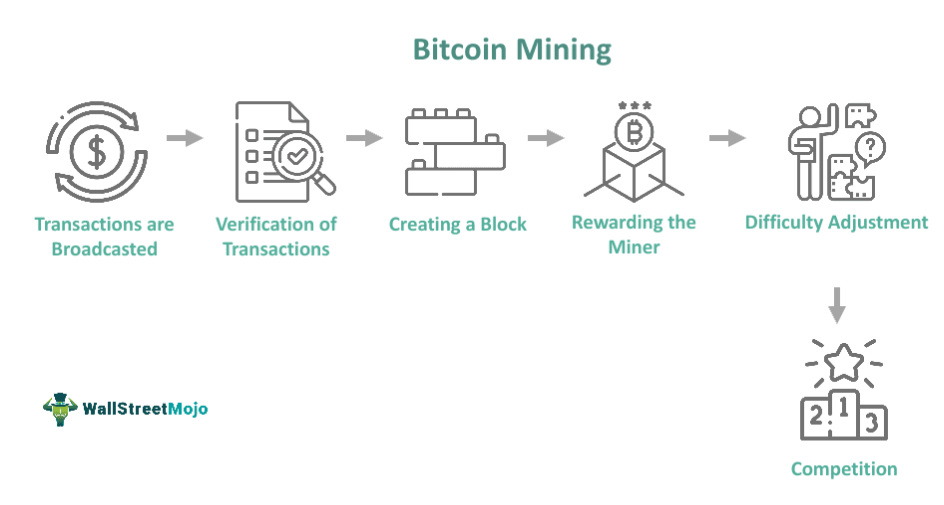

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025 -

Rogues Legacy Gambits Powerful New Weapon

May 08, 2025

Rogues Legacy Gambits Powerful New Weapon

May 08, 2025