Bitcoin Price Surge: Is A Major Rebound Underway?

Table of Contents

The cryptocurrency market has witnessed a dramatic upswing recently, with Bitcoin leading the charge. This article delves into the reasons behind this Bitcoin price surge, examining whether it represents a genuine rebound or a temporary blip. We’ll explore key contributing factors, assess market sentiment, and ultimately, attempt to determine if a sustained bullish trend is in the making for the king of cryptocurrencies.

Analyzing the Recent Bitcoin Price Increase

Technical Indicators Suggesting a Rebound

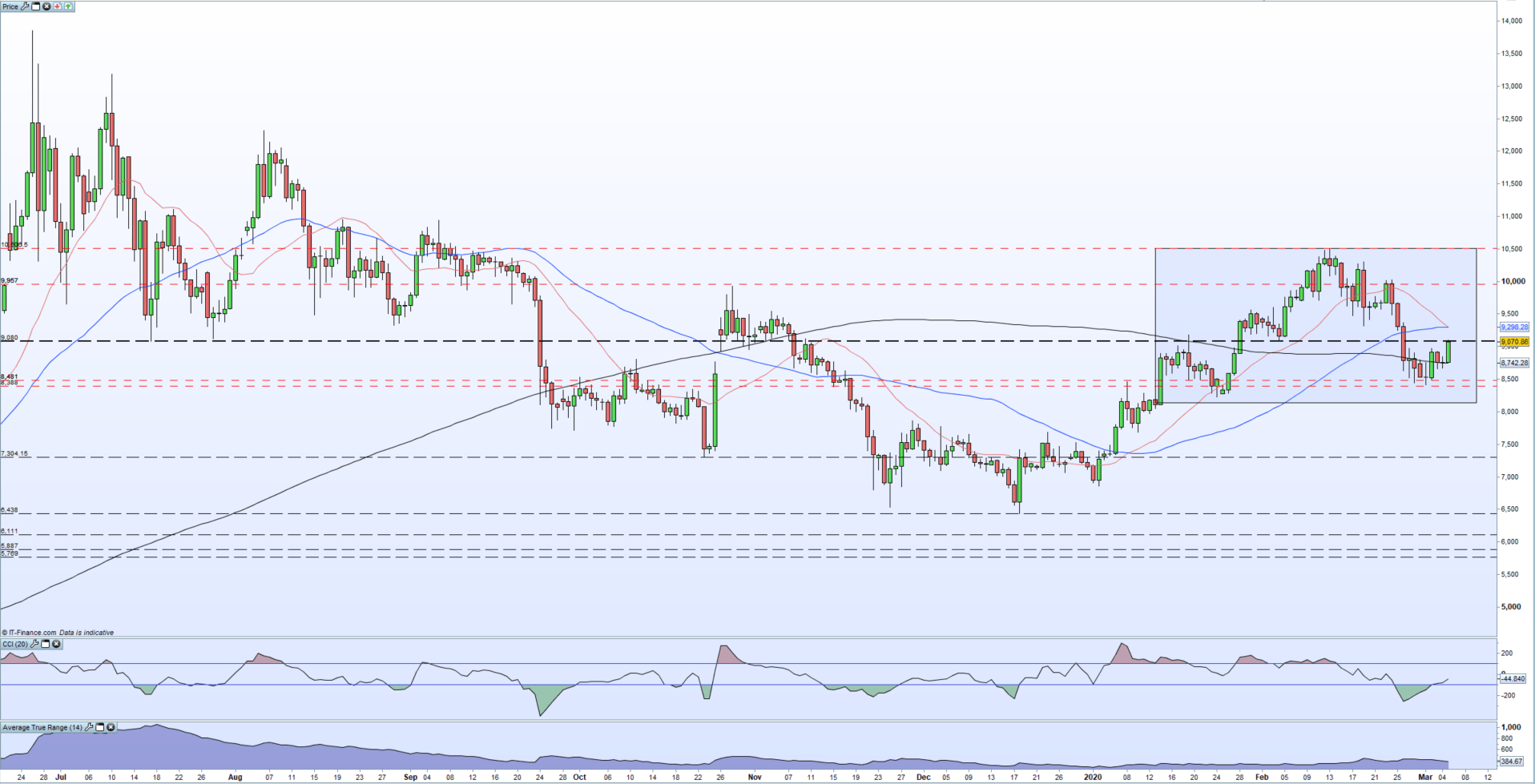

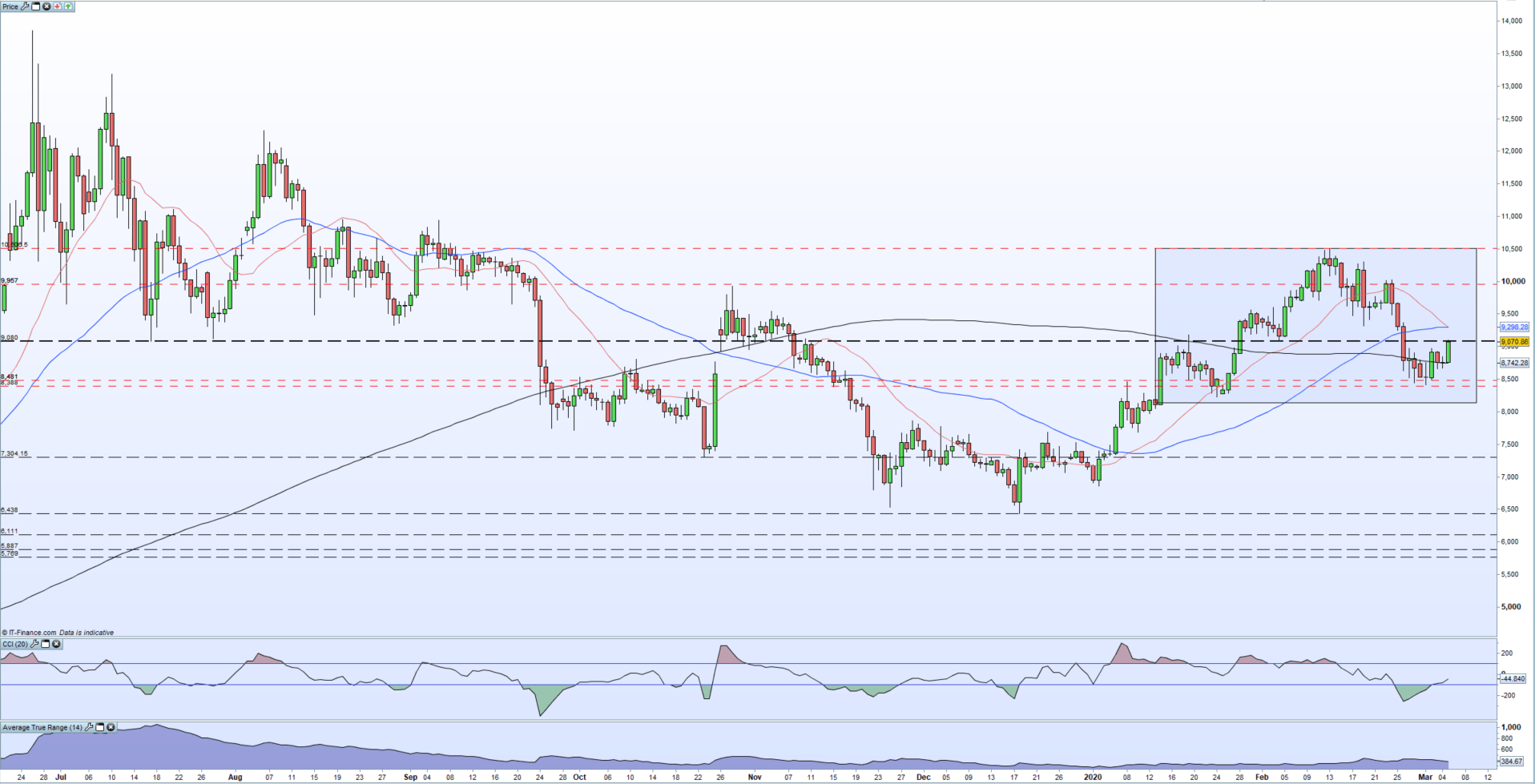

Technical analysis provides valuable insights into potential price movements. Several key indicators suggest a Bitcoin rebound might be underway. For example, the Relative Strength Index (RSI) has moved out of oversold territory, suggesting a potential shift in momentum. Moving averages, such as the 50-day and 200-day moving averages, are showing signs of convergence, a bullish signal for many traders. The MACD (Moving Average Convergence Divergence) histogram is also exhibiting positive momentum.

(Insert chart/graph illustrating RSI, moving averages, and MACD)

- Increased trading volume accompanying the price rise: Higher trading volume confirms the price increase isn't merely driven by manipulation but reflects genuine market interest.

- Breakout above key resistance levels: The recent price surge has pushed Bitcoin above significant resistance levels, suggesting strong buying pressure.

- Golden Cross formation: In some instances, a "golden cross," where the short-term moving average crosses above the long-term moving average, has been observed, strengthening the bullish signal.

Fundamental Factors Fueling the Bitcoin Price Surge

Beyond technical analysis, fundamental factors play a crucial role in driving Bitcoin's price. Macroeconomic conditions, such as persistent inflation and concerns about fiat currency devaluation, have increased the appeal of Bitcoin as a hedge against inflation. Furthermore, growing institutional adoption and regulatory clarity are contributing to increased confidence in the cryptocurrency.

- Increased institutional investment: Large financial institutions are increasingly allocating assets to Bitcoin, demonstrating growing acceptance and legitimacy.

- Growing adoption by businesses: More businesses are accepting Bitcoin as a form of payment, expanding its utility and driving demand.

- Positive regulatory developments in key markets: While regulatory uncertainty remains, some jurisdictions are showing signs of embracing cryptocurrency, reducing uncertainty and potentially boosting investor confidence.

Market Sentiment and Investor Confidence

Positive market sentiment is essential for sustained price increases. Social media discussions and news coverage surrounding Bitcoin have become significantly more bullish in recent weeks. Furthermore, the actions of "whales" – large Bitcoin holders – can significantly impact the market.

- Positive media coverage boosting investor confidence: Favorable news stories and analyses are contributing to a more positive outlook on Bitcoin.

- Increased social media engagement: Increased positive sentiment on platforms like Twitter and Reddit indicates growing interest and confidence.

- Growing retail investor interest: More individual investors are entering the Bitcoin market, fueling demand and price increases.

Potential Risks and Challenges

Despite the recent surge, investors need to remain aware of potential risks and challenges.

Regulatory Uncertainty and Geopolitical Factors

The regulatory landscape surrounding Bitcoin remains complex and ever-evolving. Different jurisdictions have varying approaches, creating uncertainty. Geopolitical events can also significantly influence the cryptocurrency market.

- Potential for stricter regulations in certain jurisdictions: Increased regulatory scrutiny or outright bans could negatively impact Bitcoin's price.

- Impact of global economic instability: Economic downturns or geopolitical tensions can trigger a flight to safety, potentially impacting Bitcoin's price.

- Risk of regulatory crackdowns: Unforeseen regulatory actions could lead to significant price corrections.

Volatility and Market Corrections

Bitcoin is known for its volatility. While price surges are possible, sharp corrections are also common.

- Historical precedent of Bitcoin price volatility: Bitcoin’s history is marked by significant price swings, both upward and downward.

- Potential for short-term price corrections: Even during a bullish trend, short-term corrections or dips are highly likely.

- Importance of risk management for investors: Investors should carefully manage their risk to protect their investment during periods of volatility.

Predicting Future Bitcoin Price Movements

Expert Opinions and Market Forecasts

Predicting future Bitcoin price movements is inherently challenging. However, analyzing expert opinions and various market forecast models can offer some insights.

- Summary of bullish and bearish price predictions: Experts offer a wide range of predictions, with some anticipating further price increases, while others foresee corrections.

- Range of potential price targets: Price predictions typically span a significant range, reflecting the inherent uncertainty in the market.

- Disclaimer regarding the inherent uncertainty of price predictions: It’s crucial to remember that price predictions are not guarantees and should be treated with caution.

Long-Term Outlook for Bitcoin

Despite the short-term volatility, many believe Bitcoin has significant long-term potential.

- Long-term potential for price appreciation: The scarcity of Bitcoin and its growing adoption could lead to long-term price appreciation.

- Factors driving long-term adoption: Increased institutional acceptance, broader adoption by businesses, and improved infrastructure will likely drive long-term adoption.

- Comparison with other investment assets: Bitcoin's long-term potential can be compared to other established investment assets like gold or stocks.

Conclusion

The recent Bitcoin price surge is a complex phenomenon driven by a confluence of technical, fundamental, and sentiment-related factors. While a major rebound appears possible, investors should remain cautious due to inherent market volatility and ongoing regulatory uncertainties.

Call to Action: Stay informed on the latest developments in the Bitcoin market to make informed decisions about your cryptocurrency investments. Continue to research and understand the factors influencing the Bitcoin price surge for a comprehensive understanding of this dynamic asset. Learn more about strategies for navigating the volatile Bitcoin market and developing a robust investment plan.

Featured Posts

-

5 Uber Shuttle Service Launches For United Center Event Attendees

May 08, 2025

5 Uber Shuttle Service Launches For United Center Event Attendees

May 08, 2025 -

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Star Wars Andor Showrunner Reflects On His Career Defining Project

May 08, 2025

Star Wars Andor Showrunner Reflects On His Career Defining Project

May 08, 2025 -

799 Surface Pro A Budget Friendly 12 Inch Tablet

May 08, 2025

799 Surface Pro A Budget Friendly 12 Inch Tablet

May 08, 2025 -

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025