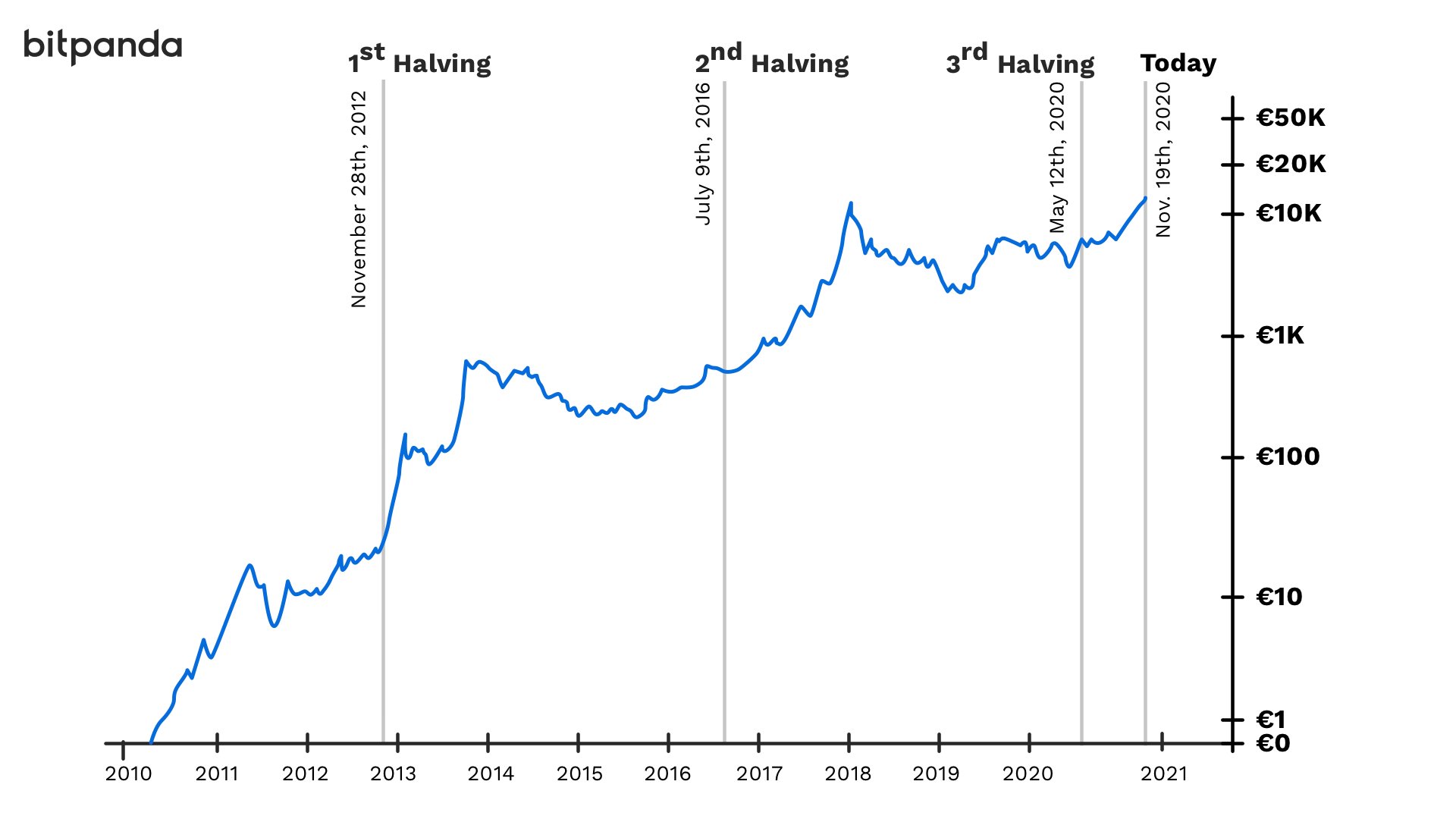

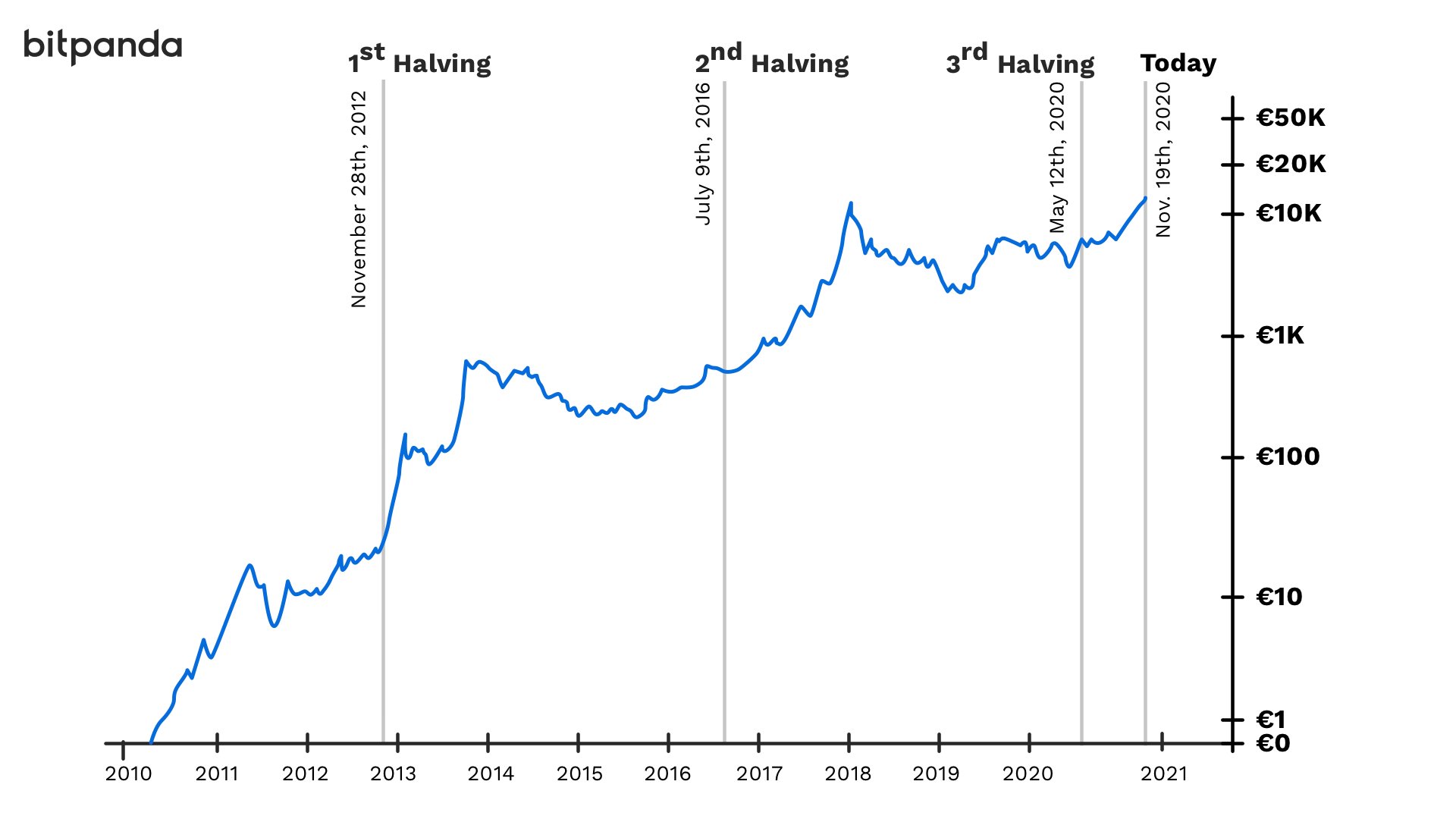

Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Price Rebound

Technical Indicators Suggesting a Potential Reversal

Technical analysis provides valuable insights into potential price movements. Several indicators suggest a possible bullish reversal for Bitcoin:

- Relative Strength Index (RSI): A reading below 30 often signals oversold conditions, suggesting a potential bounce. Recent RSI readings for Bitcoin have shown signs of moving out of oversold territory.

- Moving Average Convergence Divergence (MACD): A bullish crossover of the MACD lines (the fast and slow moving averages) can indicate a shift in momentum towards a bull market. We've seen this pattern emerge in recent Bitcoin price charts.

- Moving Averages: The 50-day and 200-day moving averages are commonly used to identify support and resistance levels. A potential "golden cross" (where the 50-day MA crosses above the 200-day MA) could further strengthen the bullish signal.

- Chart Patterns: Certain chart patterns, such as inverse head and shoulders or double bottoms, can signal a potential price reversal. Observing these patterns on Bitcoin's price chart can offer further clues.

[Insert relevant chart/graph showing RSI, MACD, moving averages, and potential chart patterns]

On-Chain Data and Bitcoin's Fundamentals

Analyzing on-chain metrics provides a deeper understanding of Bitcoin's underlying fundamentals:

- Transaction Volume: Increased transaction volume can indicate growing adoption and demand, potentially supporting a price increase.

- Mining Difficulty: Rising mining difficulty reflects the increased computational power securing the Bitcoin network, suggesting a healthier ecosystem.

- Number of Active Addresses: A higher number of active addresses implies increased user engagement and network activity.

[Reference credible sources for on-chain data, such as Glassnode or CoinMetrics]

Macroeconomic Factors Influencing Bitcoin's Price

Global macroeconomic conditions significantly influence Bitcoin's price:

- Inflation: High inflation can drive investors towards Bitcoin as a hedge against inflation.

- Interest Rates: Rising interest rates can reduce the attractiveness of riskier assets like Bitcoin.

- Global Economic Uncertainty: Periods of economic uncertainty can increase the demand for safe-haven assets, including Bitcoin.

[Link to relevant economic news and analysis from reputable sources like the World Bank or IMF]

Factors That Could Fuel a Bitcoin Bull Run

Institutional Adoption and Investment

Increased institutional investment is a crucial factor for a sustained bull run:

- MicroStrategy: A prominent example of a company with significant Bitcoin holdings.

- Tesla: Elon Musk's company's previous investments have had a strong impact on Bitcoin's price.

- BlackRock: The world's largest asset manager recently filed for a spot Bitcoin ETF, signaling increased institutional interest.

[Mention other relevant news about institutional adoption]

Regulatory Clarity and Positive Government Sentiment

Clearer regulations and positive government sentiment can boost investor confidence:

- Grayscale's legal battle with the SEC: A positive outcome could pave the way for more Bitcoin ETFs.

- El Salvador's adoption of Bitcoin as legal tender: While controversial, it shows a government's willingness to embrace Bitcoin.

[Cite relevant sources for regulatory information]

Technological Advancements and Bitcoin's Utility

Technological upgrades can enhance Bitcoin's utility and scalability:

- The Lightning Network: Improves transaction speed and reduces fees.

- Taproot upgrade: Enhanced privacy and efficiency.

[Link to relevant resources about Bitcoin's technology]

Potential Risks and Challenges

Volatility and Market Corrections

Bitcoin's price remains highly volatile:

- Sharp price corrections are possible, even during a bull run.

- Investors should be prepared for significant price swings.

Regulatory Uncertainty and Government Crackdowns

Regulatory uncertainty poses a significant risk:

- Governments worldwide are still developing their regulatory frameworks for cryptocurrencies.

- Increased scrutiny or crackdowns could negatively impact Bitcoin's price.

- Examples include China's ban on cryptocurrency trading.

Competition from Other Cryptocurrencies

The cryptocurrency landscape is competitive:

- Ethereum and other altcoins pose a challenge to Bitcoin's dominance.

- New innovations in the crypto space could shift market share away from Bitcoin.

Conclusion: Bitcoin Rebound: A Bull Run on the Horizon?

The recent Bitcoin rebound presents a mixed picture. While technical indicators, on-chain data, and potential institutional investment suggest a bullish outlook, macroeconomic uncertainties and regulatory risks remain. The possibility of a new bull run is certainly plausible, but investors should approach with caution, acknowledging the inherent volatility and potential for market corrections. Increased institutional adoption, regulatory clarity, and technological advancements could significantly fuel a sustained bull market. However, the competitive landscape and potential government crackdowns remain considerable challenges.

While the recent Bitcoin rebound is encouraging, it's crucial to stay informed and conduct thorough research before investing in Bitcoin. Stay tuned for updates on the Bitcoin market and explore the potential of this exciting cryptocurrency. Remember to only invest what you can afford to lose and diversify your portfolio.

Featured Posts

-

Biggest Oscars Snubs Of All Time A Definitive List

May 08, 2025

Biggest Oscars Snubs Of All Time A Definitive List

May 08, 2025 -

Ripple Xrp Brazils Etf Approval And Trumps Statement Market Analysis

May 08, 2025

Ripple Xrp Brazils Etf Approval And Trumps Statement Market Analysis

May 08, 2025 -

Ethereum Cross X Signals Strong Buy Institutional Accumulation Fuels 4 000 Price Target

May 08, 2025

Ethereum Cross X Signals Strong Buy Institutional Accumulation Fuels 4 000 Price Target

May 08, 2025 -

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers

May 08, 2025

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers

May 08, 2025 -

Robotaxi Revolution Assessing Ubers Stock Potential

May 08, 2025

Robotaxi Revolution Assessing Ubers Stock Potential

May 08, 2025