Bitcoin Rebound: Understanding The Factors Driving The Recovery

Table of Contents

Institutional Investment and Adoption

The growing interest from institutional investors is a significant catalyst in the Bitcoin rebound. Large hedge funds and corporations are increasingly viewing Bitcoin not just as a speculative asset, but as a potential component of a diversified portfolio. The Grayscale Bitcoin Trust, for example, has become a major player, providing institutional investors with a regulated avenue for Bitcoin exposure. Companies like MicroStrategy have made headlines by adding Bitcoin to their balance sheets, demonstrating a growing acceptance of Bitcoin as a store of value and a hedge against inflation.

- Increased regulatory clarity in some jurisdictions: More defined regulatory frameworks are making institutional investors more comfortable with Bitcoin investments.

- Growing acceptance of Bitcoin as a store of value: Bitcoin's limited supply and decentralized nature are increasingly seen as attractive qualities in an uncertain economic climate.

- Sophisticated trading strategies employed by institutions: Institutions are using complex trading strategies to manage risk and capitalize on market opportunities.

Macroeconomic Factors and Inflation

The current macroeconomic environment is playing a significant role in the Bitcoin rebound. High inflation rates and economic uncertainty are driving investors to seek alternative assets that can potentially outperform traditional investments. Bitcoin, with its deflationary nature, is seen by many as a hedge against inflation and a safe haven asset. Quantitative easing and government stimulus packages, while intended to boost economies, have also contributed to inflation, further increasing the appeal of Bitcoin.

- Weakening of the US dollar: A decline in the value of the US dollar can make Bitcoin, priced in dollars, appear more attractive.

- Rising inflation rates globally: High inflation erodes the purchasing power of traditional currencies, making Bitcoin a more compelling investment.

- Investor search for alternative assets: Investors are seeking assets that can potentially outperform traditional investments during periods of economic uncertainty.

Technological Advancements and Network Growth

Technological advancements within the Bitcoin ecosystem are also contributing to its resurgence. The Lightning Network, for instance, significantly improves Bitcoin's scalability and transaction speed, addressing some previous limitations. Ongoing development of new Bitcoin-related technologies and applications expands its utility and strengthens its position in the broader financial landscape. The integration of Bitcoin as a payment method in some sectors is further enhancing its practical use.

- Increased transaction throughput: Improvements like the Lightning Network allow for faster and cheaper Bitcoin transactions.

- Lower transaction fees: Reduced fees make Bitcoin more accessible and attractive for everyday use.

- Development of new decentralized finance (DeFi) applications built on Bitcoin: This expands the potential use cases for Bitcoin, further fueling demand.

Regulatory Developments and Global Adoption

The evolving regulatory landscape is another key factor impacting the Bitcoin rebound. While regulatory uncertainty remains a challenge, increasing clarity and positive announcements from various governments are boosting investor confidence. Several countries are actively exploring ways to integrate Bitcoin into their financial systems, reflecting a growing global acceptance. This increased clarity and growing adoption in developing countries contribute to a positive outlook for Bitcoin.

- Gradual acceptance by governments and central banks: More governments are starting to view Bitcoin as a legitimate asset class.

- Increased clarity on tax regulations: Clearer tax rules reduce ambiguity and encourage greater participation.

- Growing adoption in emerging markets: Adoption in developing countries represents substantial growth potential for Bitcoin.

Analyzing the Bitcoin Rebound and its Implications

The Bitcoin rebound is driven by a confluence of factors, including increased institutional adoption, macroeconomic pressures like inflation, technological advancements enhancing scalability and usability, and evolving regulatory environments showing growing acceptance. Understanding these intertwined factors is essential for any investor. However, it's crucial to remember that the cryptocurrency market remains volatile, and regulatory uncertainty and potential market corrections pose risks. To successfully navigate this dynamic landscape, stay updated on the Bitcoin rebound, learn more about the Bitcoin recovery, and understand the factors driving the Bitcoin price. Conduct thorough research and consider seeking professional financial advice before making any investment decisions. Responsible investing in the Bitcoin market requires careful consideration of both the potential rewards and inherent risks. Don't miss out on understanding the Bitcoin rebound; start your research today!

Featured Posts

-

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 09, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 09, 2025 -

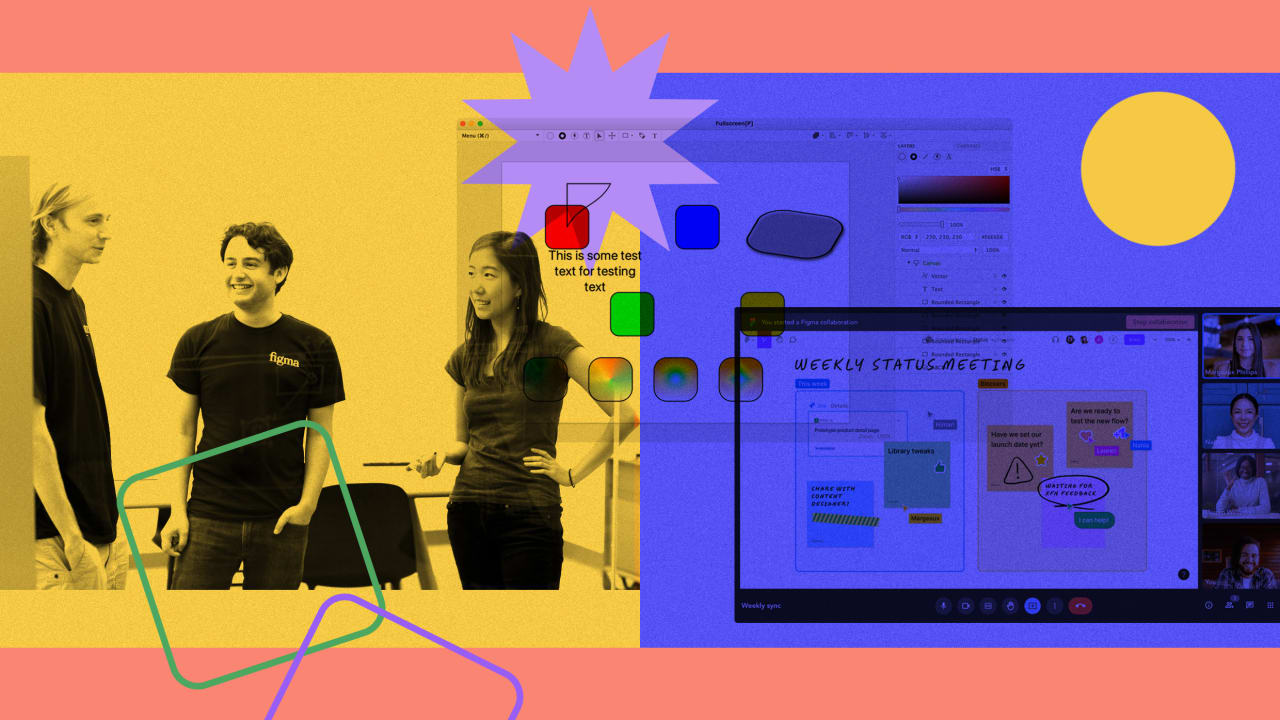

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025 -

Officers Face Misconduct Meeting Nottingham Attacks Probe

May 09, 2025

Officers Face Misconduct Meeting Nottingham Attacks Probe

May 09, 2025 -

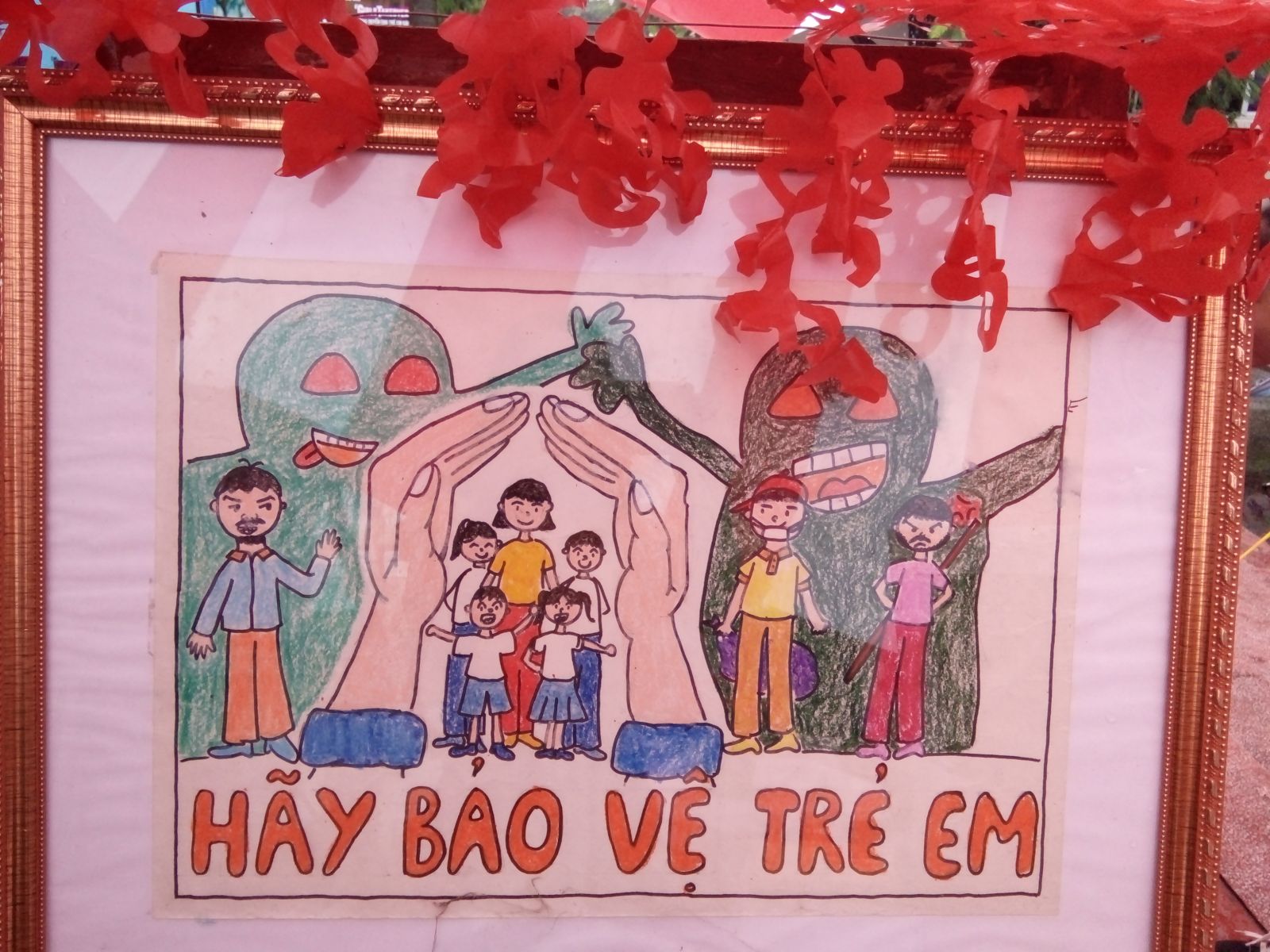

Tranh Cai Vu Bao Hanh Tre Em Tien Giang Giai Phap Nao Cho Van De An Toan Tre Nho

May 09, 2025

Tranh Cai Vu Bao Hanh Tre Em Tien Giang Giai Phap Nao Cho Van De An Toan Tre Nho

May 09, 2025 -

Dakota Johnsons Figure Hugging Dress Steals The Show At Materialists

May 09, 2025

Dakota Johnsons Figure Hugging Dress Steals The Show At Materialists

May 09, 2025