BlackRock ETF: A 110% Growth Forecast And The Billionaire Buying Spree

Table of Contents

The 110% Growth Forecast: Fact or Fiction?

Analyzing the Forecast

The 110% growth forecast for specific BlackRock ETFs isn't plucked from thin air. Several factors contribute to this bold prediction. Leading financial analysts, such as [Name specific analyst firms or individuals and cite sources], point to several key drivers: the increasing popularity of passive investment strategies, the continued growth of the global economy, and the strategic focus of specific BlackRock ETFs on high-growth sectors like technology and renewable energy.

- Specific market predictions: Analysts predict sustained growth in [mention specific sectors like technology, healthcare, etc.] driving increased demand for BlackRock ETFs focused on these areas. This is fueled by ongoing technological advancements and the increasing global adoption of sustainable energy solutions.

- Potential risks and limitations: It's crucial to acknowledge that any growth forecast carries inherent risks. Unforeseen geopolitical events, economic downturns, or shifts in investor sentiment could impact the projected growth. Furthermore, past performance is not indicative of future results.

- Comparison to historical growth rates: While a 110% growth forecast is ambitious, comparing it to the historical performance of similar BlackRock ETFs and the broader market can provide valuable context. [Insert data comparing historical growth rates of relevant ETFs, citing sources].

- Specific BlackRock ETFs: This forecast specifically applies to [mention specific BlackRock ETF tickers, e.g., iShares CORE US Aggregate Bond ETF (AGG), iShares CORE S&P 500 ETF (IVV)], which benefit from their underlying asset exposure.

Billionaire Buying Spree: Who's Investing and Why?

Identifying Key Investors

High-profile investors and major investment firms are increasingly allocating significant capital to BlackRock ETFs. [Name prominent billionaires or firms and cite reliable news sources, e.g., Bloomberg, Reuters]. Their substantial investments underscore the growing confidence in BlackRock's management and the potential for significant returns.

- Reasons behind their investments: Billionaire investors are attracted to BlackRock ETFs for various reasons. These include the diversification benefits offered by ETFs, the ability to gain exposure to specific market sectors with minimal transaction costs, and the potential for long-term capital appreciation.

- Investment strategies: Many billionaires employ a long-term, buy-and-hold strategy with BlackRock ETFs, leveraging their passive investment nature to minimize trading fees and maximize returns.

- Impact of large investments: The influx of capital from these high-profile investors can create a positive feedback loop, driving further demand and potentially influencing the ETF's performance.

The Psychology of Billionaire Investment

The involvement of billionaires also highlights the influence of the herd mentality and the fear of missing out (FOMO). When prominent investors make large purchases, it can trigger a cascading effect, attracting other investors and potentially fueling further price appreciation.

- FOMO factor: The perceived success of these investments can lead to a rush of capital into BlackRock ETFs, potentially driving prices beyond their intrinsic value.

- Potential for market manipulation or bubbles: While unlikely with ETFs as diversified as those offered by BlackRock, the concentrated buying pressure from high-net-worth individuals warrants careful monitoring for any signs of market manipulation or the formation of speculative bubbles.

Understanding BlackRock's ETF Strategy

BlackRock's Market Position

BlackRock holds a dominant position in the global ETF market. Their extensive product offerings, robust technology, and sophisticated data analysis capabilities enable them to create and manage a diverse range of ETFs catering to various investor needs and risk profiles.

- Key ETF offerings: BlackRock offers a vast array of ETFs, spanning various asset classes, sectors, and geographies. This breadth allows investors to build highly diversified portfolios tailored to their individual objectives.

- Technological advantages: BlackRock's investment in technology and data analytics gives them a competitive edge, enabling them to optimize portfolio construction and risk management.

- Fee structure: The expense ratios of BlackRock ETFs are generally competitive within the market, influencing investor returns.

Risks and Considerations for Investors

Potential Downside

While the 110% growth forecast is compelling, it's essential to understand the inherent risks associated with any investment, including BlackRock ETFs.

- Market volatility: Market fluctuations can significantly impact the performance of ETFs, potentially undermining the 110% growth projection. Economic downturns or unexpected market events can lead to substantial losses.

- Diversification strategies: Diversification across multiple asset classes and ETFs is crucial to mitigate risk. Reliance on a single ETF or a limited number of ETFs exposes investors to concentrated risk.

- Due diligence: Before investing in any BlackRock ETF, conducting thorough due diligence is paramount. Understand the ETF's investment objective, its underlying assets, its expense ratio, and potential risks.

Conclusion

The projected 110% growth forecast for certain BlackRock ETFs presents a compelling investment opportunity, fueled by both market trends and the confidence of prominent billionaire investors. However, this prediction isn't a guarantee. BlackRock's dominance in the ETF market, coupled with their strategic focus, contributes to the optimism, but inherent market risks and potential for volatility must be carefully considered. Understanding BlackRock's ETF strategy, conducting thorough due diligence, and employing effective diversification strategies are crucial for making informed investment decisions. Ready to explore the potential of BlackRock ETFs? Conduct thorough research, consider your risk tolerance, and make informed investment choices. Visit the BlackRock website for more information. [Link to BlackRock Website]

Featured Posts

-

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025 -

Your March 2024 Ps Plus Premium And Extra Games Lineup

May 08, 2025

Your March 2024 Ps Plus Premium And Extra Games Lineup

May 08, 2025 -

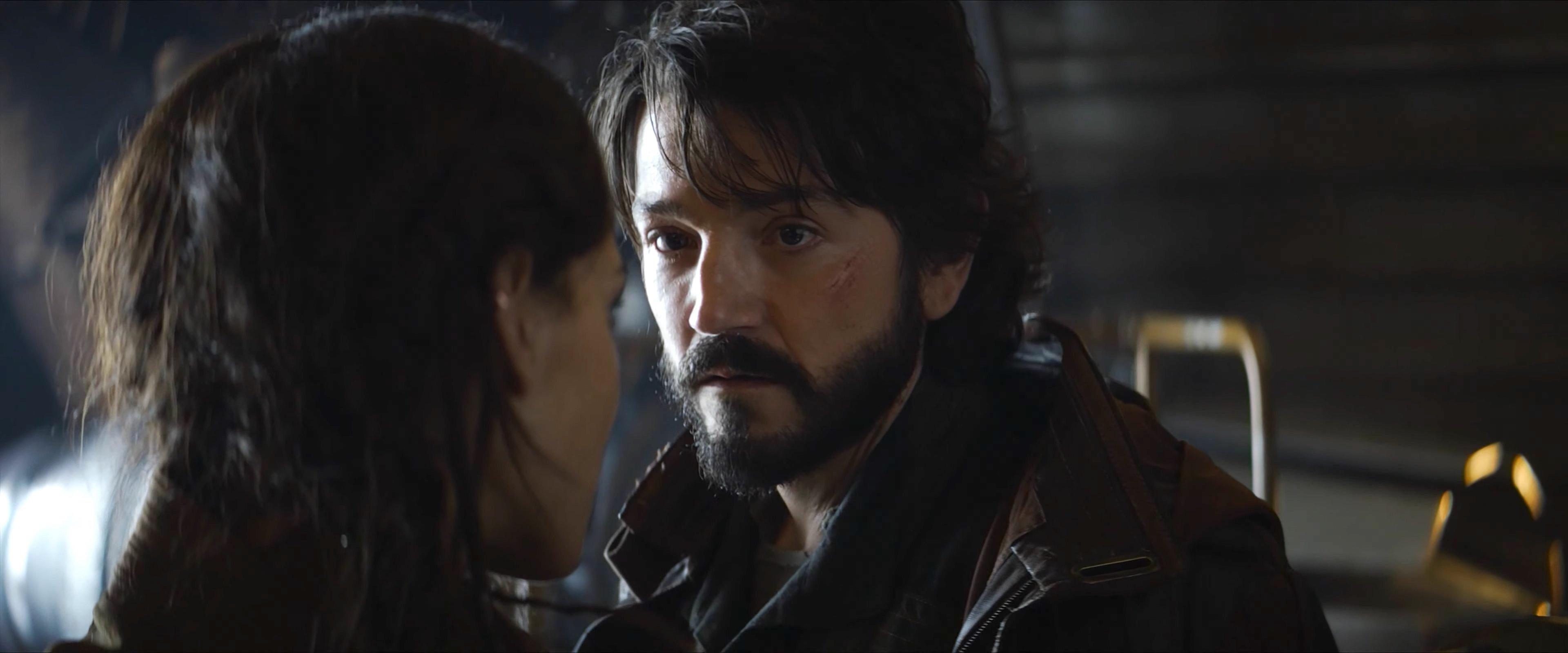

When Is Andor Season 2 Released Trailer Plot And More Details

May 08, 2025

When Is Andor Season 2 Released Trailer Plot And More Details

May 08, 2025 -

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025 -

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025