BlackRock ETF: A 110% Growth Prediction And The Billionaire Buying Spree

Table of Contents

The 110% Growth Prediction: Fact or Fiction?

The 110% growth prediction for certain BlackRock ETFs hasn't emerged from a single, universally accepted source. Instead, it's a culmination of various market analyses, expert opinions, and projections based on specific economic forecasts. It's crucial to understand that this isn't a guaranteed return; it's a potential outcome based on several underlying assumptions.

The prediction likely incorporates assumptions about sustained economic growth, continued low interest rates (or a controlled increase), and a positive outlook for specific sectors represented in the targeted ETFs. It's vital to scrutinize these underlying assumptions critically. Are they realistic given current geopolitical landscapes and potential economic headwinds?

Specific BlackRock ETFs mentioned in association with this prediction often include the iShares Core S&P 500 ETF (IVV), a broad market ETF tracking the S&P 500 index, and the iShares Russell 2000 ETF (IWM), which focuses on smaller-cap companies. These choices reflect a strategy focused on both large-cap stability and small-cap growth potential.

- Consider historical performance of similar ETFs: Examining the historical performance of similar ETFs provides a crucial benchmark, though past performance is not indicative of future results.

- Analyze current market trends and their impact on the prediction: Factors like inflation, interest rate hikes, and geopolitical instability directly influence market performance and the validity of the prediction.

- Assess the potential for unforeseen economic events: Unforeseen events, such as unexpected recessions or global crises, can significantly impact the accuracy of any long-term growth prediction.

Billionaire Buying Spree: Who's Investing and Why?

The recent surge in BlackRock ETF purchases isn't just driven by everyday investors; prominent billionaires are heavily involved. While specific investment details are often kept private, anecdotal evidence and market analysis suggests substantial investments from individuals known for their savvy market strategies.

These investors are likely betting on BlackRock ETFs due to several factors: the inherent diversification offered by these ETFs, their relatively low expense ratios compared to actively managed funds, and the ease of access to a broad market exposure. Furthermore, the passive investment strategy of ETFs aligns with some billionaires’ long-term, buy-and-hold investment philosophies.

- Specific examples: While precise investment figures are rarely disclosed publicly, reports suggest significant investments from several well-known billionaires across various BlackRock ETFs.

- Reasons for interest: The appeal lies in the combination of diversification, cost-effectiveness, and market exposure, all appealing attributes for large-scale investors.

- Impact on ETF prices: The sheer volume of billionaire investments undoubtedly influences ETF prices, potentially driving up valuations and contributing to increased market interest.

Factors Driving BlackRock ETF Growth

Several factors converge to contribute to the predicted growth of BlackRock ETFs. Broad market trends, including a shift toward passive investment strategies, play a significant role. BlackRock's ETFs benefit from this trend due to their efficiency and relatively low costs.

BlackRock ETFs are exceptionally attractive to high-net-worth investors due to their inherent characteristics:

- Low expense ratios: Lower fees mean higher returns for investors.

- Diversification: ETFs offer exposure to a diverse range of assets, mitigating risk.

- Ease of access: Trading ETFs is straightforward, making them convenient for large-scale investors.

Technological advancements also play a crucial role. Online brokerage platforms and sophisticated trading algorithms make it easier than ever to buy, sell, and manage large ETF holdings.

- Passive investment strategies: The simplicity and efficiency of passive investing contribute to the popularity of ETFs.

- Advantages of diversification: Spreading investments across various sectors reduces portfolio risk.

- Impact of market volatility: During periods of market uncertainty, the stability of ETFs can be particularly appealing.

Risks and Considerations

Despite the optimistic 110% growth prediction, it's vital to acknowledge the inherent risks associated with investing in BlackRock ETFs or any investment vehicle.

-

Market downturns: Even diversified ETFs are susceptible to market corrections and downturns.

-

Inflation: Inflation can erode the purchasing power of returns.

-

Unforeseen economic events: Geopolitical instability and unexpected economic shocks can negatively affect investment performance.

-

Downsides of sole reliance: Focusing solely on BlackRock ETFs might limit portfolio diversification and expose investors to unnecessary risk.

-

Importance of diversified portfolio: A well-diversified portfolio that incorporates various asset classes is crucial for mitigating risk.

-

Professional financial advice: Consulting a qualified financial advisor is essential before making significant investment decisions.

Conclusion

The 110% growth prediction for certain BlackRock ETFs has certainly captured significant attention, fueled by substantial investment from high-profile billionaires. While the prediction holds potential, it’s crucial to understand the underlying assumptions, market conditions, and inherent risks involved. Thorough research and diversification are paramount. Before making any investment decisions regarding BlackRock ETFs or any other investment vehicle, remember to consult with a qualified financial advisor. Don't miss the opportunity to explore the potential of BlackRock ETFs further – conduct your own due diligence and make informed decisions about your investment strategy. Remember to carefully consider your risk tolerance before investing in BlackRock ETFs.

Featured Posts

-

Montoya Reveals Predetermined Decision On Doohans F1 Career

May 09, 2025

Montoya Reveals Predetermined Decision On Doohans F1 Career

May 09, 2025 -

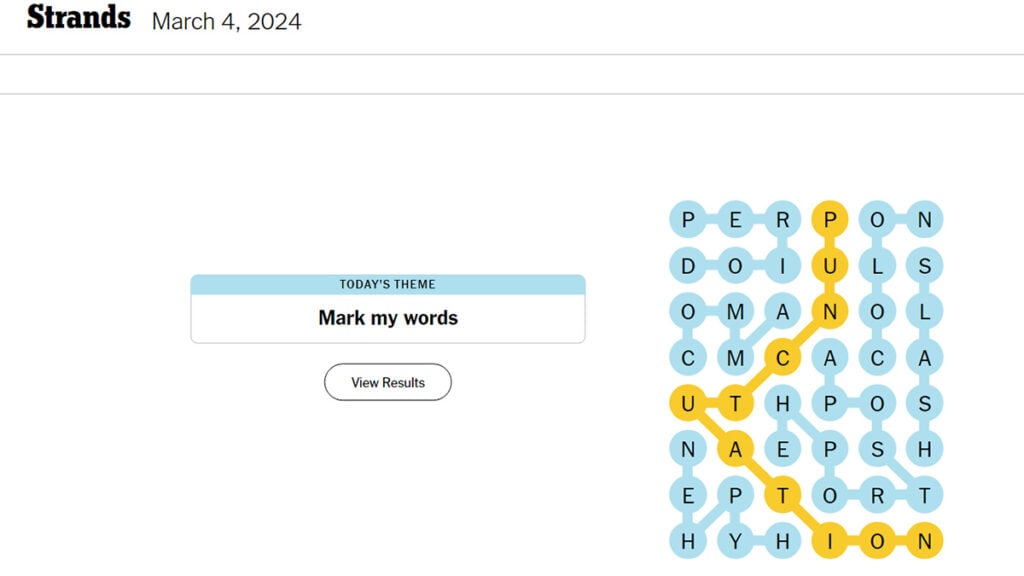

Nyt Strands Friday March 14 Game 376 Answers And Help

May 09, 2025

Nyt Strands Friday March 14 Game 376 Answers And Help

May 09, 2025 -

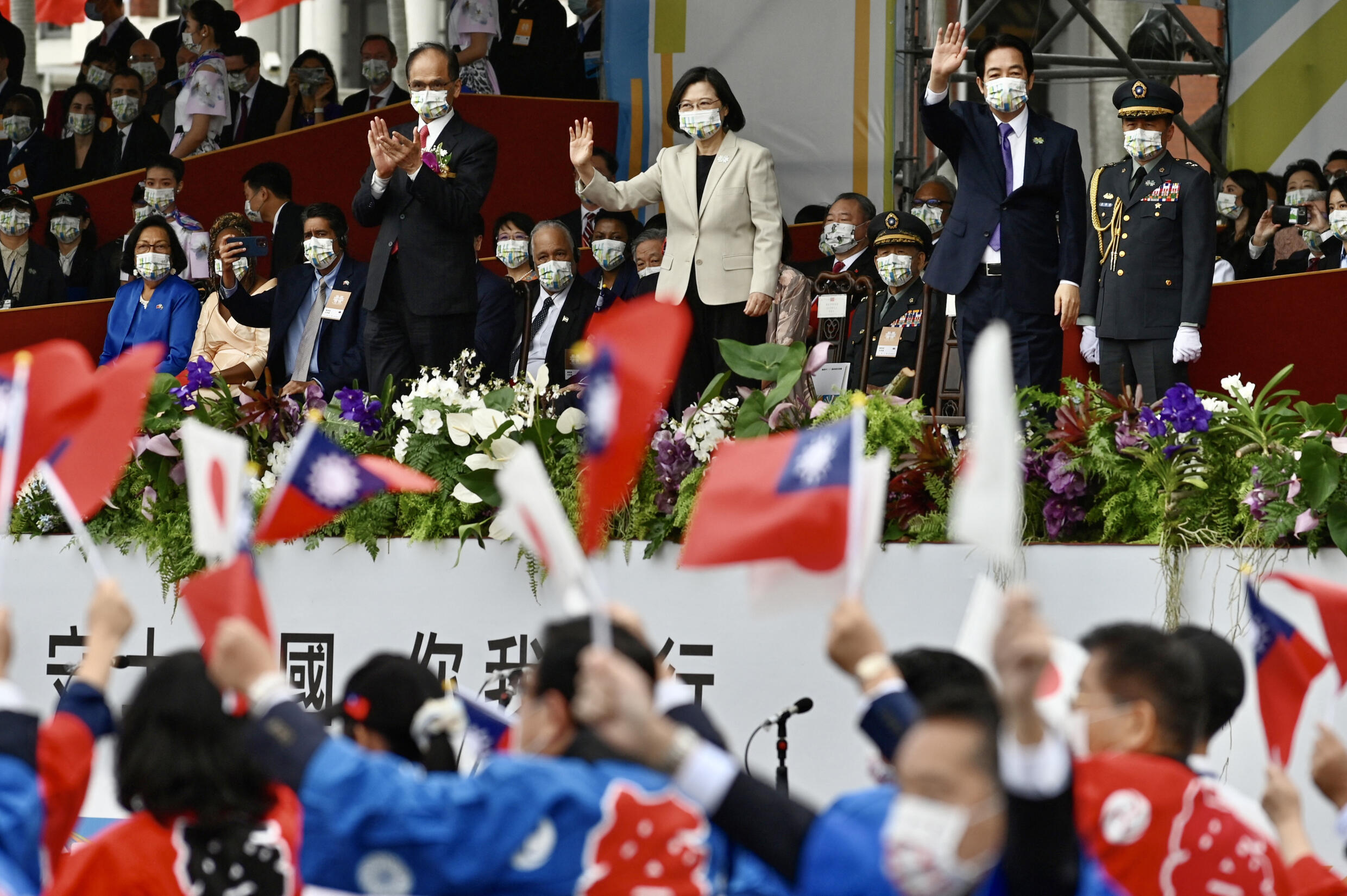

Taiwans Lai Issues Stark Warning About Totalitarianism On Ve Day

May 09, 2025

Taiwans Lai Issues Stark Warning About Totalitarianism On Ve Day

May 09, 2025 -

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 09, 2025

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 09, 2025 -

Alleged Child Rapists Residence Near Massachusetts Daycare Sparks Outrage

May 09, 2025

Alleged Child Rapists Residence Near Massachusetts Daycare Sparks Outrage

May 09, 2025