BlackRock ETF: A 110% Potential Surge—Why Billionaires Are Investing

Table of Contents

The Allure of BlackRock ETFs: Understanding Their Appeal

BlackRock, the world's largest asset manager, has earned its stellar reputation through decades of experience and market leadership. Their ETFs benefit from this expertise, offering investors access to a diverse range of investment opportunities with unparalleled efficiency. BlackRock ETFs are not just another investment vehicle; they represent a sophisticated approach to portfolio diversification and growth.

-

Market Dominance: BlackRock's sheer size and global reach provide significant advantages. Their extensive research capabilities and market insights allow them to construct well-diversified portfolios that consistently track their target indices.

-

Diversification Benefits: BlackRock offers a wide array of ETFs, enabling investors to diversify across various asset classes, sectors, and geographies. This reduces overall portfolio risk and enhances potential returns. This diversification strategy is particularly appealing to both beginners and seasoned professionals.

-

Types of BlackRock ETFs: The range is vast, encompassing:

- Broad Market ETFs: Tracking major indices like the S&P 500, providing broad exposure to the US market.

- Sector-Specific ETFs: Focusing on particular sectors like technology, healthcare, or energy, allowing for targeted investments.

- International ETFs: Offering exposure to global markets, diversifying beyond domestic investments.

-

Key Advantages of BlackRock ETFs:

- Low Expense Ratios: Significantly lower than actively managed funds, maximizing your returns.

- Transparent Investment Strategies: Clear and readily available information on holdings and investment methodologies.

- Access to a Wide Range of Asset Classes: From stocks and bonds to commodities and real estate, all within a single, easily accessible package.

- Tax Efficiency: Designed to minimize capital gains taxes, further enhancing your overall returns.

The 110% Potential: Analyzing the Growth Projections

The 110% growth projection for certain BlackRock ETFs is not merely speculation. Several factors contribute to this optimistic outlook:

-

Robust Market Analysis: [Cite specific reports and analyses from reputable financial institutions supporting the projection. Include links where possible]. These reports highlight strong growth potential in specific sectors and market trends that favor BlackRock's ETF strategies.

-

Growth Potential in Target Sectors: The projection is often tied to specific ETFs focused on high-growth sectors expected to experience significant expansion in the coming years. [Mention specific sectors and provide brief explanations].

-

Market Factors: Favorable economic conditions, technological advancements, and evolving consumer preferences all contribute to the potential for significant growth. [Elaborate on these factors and their impact].

-

Potential Risks and Mitigation: While the potential returns are significant, it’s crucial to acknowledge inherent market risks. [Discuss potential downsides and explain strategies to mitigate them, such as diversification and dollar-cost averaging].

-

Historical Performance: Comparing the projected growth to the historical performance of similar BlackRock ETFs provides valuable context and strengthens the argument for future potential. [Include relevant comparative data].

Why Billionaires Are Investing: A Look at the High-Net-Worth Investor Perspective

High-net-worth individuals are drawn to BlackRock ETFs for several compelling reasons:

-

Sophisticated Investment Strategies: Billionaires employ complex strategies focused on long-term growth and capital preservation. BlackRock ETFs align perfectly with these objectives.

-

Diversification and Risk Management: Diversification is crucial for managing risk, and BlackRock ETFs offer a highly effective way to achieve this across a global portfolio.

-

Long-Term Growth and Wealth Accumulation: BlackRock ETFs are often viewed as ideal vehicles for long-term wealth accumulation due to their low costs and potential for substantial returns over time.

-

Passive Management Preference: Many billionaires prefer passively managed funds like BlackRock ETFs due to their cost-effectiveness and transparency.

-

Examples: [While specifics are confidential, you can allude to general trends like the prevalence of ETFs in diversified portfolios of high-net-worth individuals].

Investing in BlackRock ETFs: A Practical Guide for Beginners and Experienced Investors

Investing in BlackRock ETFs can be accessible to investors of all levels:

-

Research and Selection: Before investing, thoroughly research different BlackRock ETFs to find those aligned with your investment goals and risk tolerance. Consider factors like expense ratios, asset allocation, and historical performance.

-

Diversification and Risk Tolerance: Diversify your investments across multiple ETFs to mitigate risk. Your risk tolerance should guide your investment strategy.

-

Practical Steps:

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to ETFs.

- Research and Select ETFs: Analyze your investment objectives and choose accordingly.

- Place Your Order: Purchase shares of the selected ETFs through your brokerage account.

- Monitor Your Investments: Regularly review your portfolio performance and make adjustments as needed.

-

Resources and Tools: [Link to relevant resources like BlackRock's website, educational materials, and reputable financial websites].

Conclusion: Unlocking the Potential of BlackRock ETFs

BlackRock ETFs present a compelling investment opportunity with the potential for significant returns, as evidenced by market analysis and the investment strategies of high-net-worth individuals. Their low costs, diversification benefits, and accessibility make them an attractive option for investors seeking long-term growth. Don't miss out on the potential of BlackRock ETFs. Start your research today and unlock the potential for significant returns. Visit [link to BlackRock's website] to learn more.

Featured Posts

-

Could Xrp Etf Approval Generate 800 Million In First Week Inflows

May 08, 2025

Could Xrp Etf Approval Generate 800 Million In First Week Inflows

May 08, 2025 -

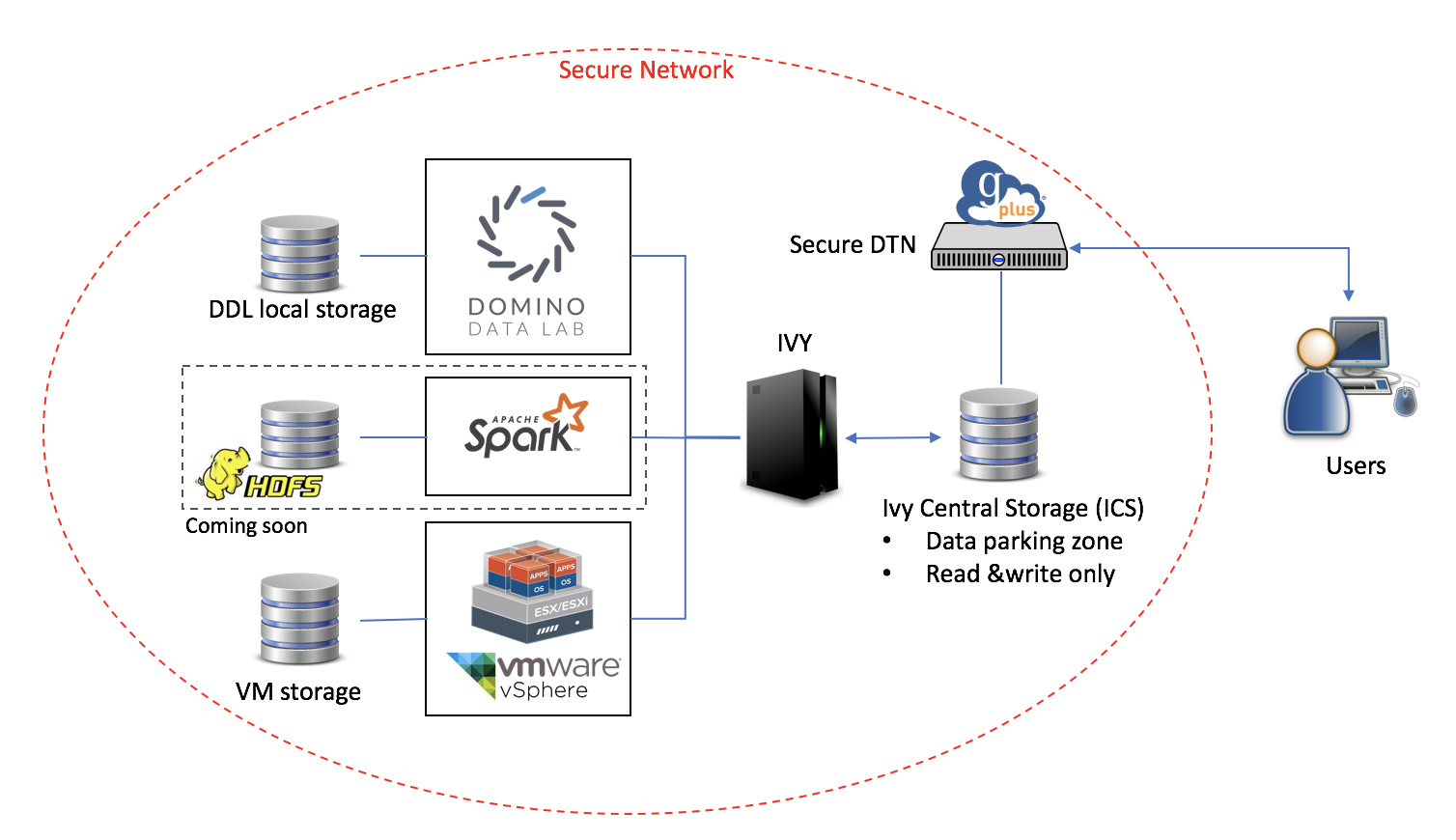

Secure Data Transfer Protecting Sensitive Information

May 08, 2025

Secure Data Transfer Protecting Sensitive Information

May 08, 2025 -

The Trump Xrp Correlation Examining Todays Price Movement

May 08, 2025

The Trump Xrp Correlation Examining Todays Price Movement

May 08, 2025 -

Universal Credit Missing Payments And Potential Refunds

May 08, 2025

Universal Credit Missing Payments And Potential Refunds

May 08, 2025 -

Tatums Wrist Injury A Celtics Coach Update

May 08, 2025

Tatums Wrist Injury A Celtics Coach Update

May 08, 2025