BlackRock ETF: A Billionaire Investment Poised For 110% Gains In 2025?

Table of Contents

BlackRock, a global investment management corporation, is a titan in the financial world, managing trillions of dollars in assets globally. Their expertise and influence make their ETFs attractive investment vehicles for both seasoned investors and newcomers. This article will delve into the potential of a specific BlackRock ETF, analyzing its projected growth and the factors contributing to—and detracting from—its success.

Understanding BlackRock ETFs and Their Potential

What are BlackRock ETFs?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, much like individual stocks. They offer diversification by investing in a basket of assets, often tracking a specific index (like the S&P 500). BlackRock iShares ETFs are particularly well-known for their low expense ratios and broad range of investment options, making them accessible to a wide array of investors. Popular examples include the iShares Core S&P 500 ETF (IVV) and the iShares MSCI Emerging Markets ETF (EEM). These offer investors diversified exposure to large segments of the global market.

BlackRock's Track Record

BlackRock boasts a remarkable track record of successful ETF management. Their experience spans various market sectors, and they consistently strive to innovate in ETF product development. This expertise contributes significantly to the potential success of their funds. Here are some key achievements:

- Consistently outperforming market benchmarks in specific sectors.

- Managing trillions in assets globally, demonstrating investor confidence.

- A history of innovation in ETF product development, leading to diverse and efficient investment options.

Identifying the Target BlackRock ETF

For the purpose of this analysis, we'll focus on the iShares Global Clean Energy ETF (ICLN). ICLN invests in companies involved in clean energy technologies, a sector experiencing rapid growth driven by increasing global demand for renewable energy sources and supportive government policies. Its investment strategy aligns with long-term sustainable growth trends, making it a potentially lucrative investment for 2025 and beyond. The selection is based on its significant growth potential within a rapidly expanding market sector.

Factors Contributing to the Projected 110% Gain

Market Trends and Predictions

The global clean energy market is projected to experience significant expansion in the coming years. Reports from reputable sources like the International Energy Agency (IEA) predict substantial growth in renewable energy installations, driven by factors such as climate change concerns, government incentives, and technological advancements. This positive market outlook is a primary driver of ICLN's projected gains.

Company Performance and Growth Potential

ICLN holds a diversified portfolio of companies involved in various clean energy sectors. Many of these companies show strong revenue growth projections and are on the cusp of significant technological breakthroughs. This creates a synergistic effect, boosting the overall potential of the ETF. Key factors driving growth include:

- Strong revenue growth projections for key holdings based on robust order books and expansion plans.

- Technological innovations, such as advancements in battery technology and solar panel efficiency, are driving sector growth.

- Favorable regulatory changes, including substantial government investments in clean energy infrastructure, are further fueling the sector's expansion.

Economic Factors and Geopolitical Influences

While economic uncertainty and geopolitical instability can impact any investment, the growing global consensus on the need for clean energy provides a degree of resilience. Government policies promoting renewable energy are likely to persist, even amidst economic fluctuations. Although interest rate hikes and inflation could impact short-term performance, the long-term outlook for clean energy remains robust.

Risks and Considerations

Market Volatility and Uncertainty

Investing in ETFs, even those with strong potential, inherently involves risk. Market volatility can significantly impact performance, and unforeseen events could lead to unexpected losses. The clean energy sector, while promising, is not immune to market fluctuations.

Potential Downsides

Several factors could negatively impact ICLN's performance:

- An economic downturn could reduce investment in clean energy projects.

- Changes in government regulations or policies could impact the sector's growth trajectory.

- Competition from established energy companies could limit the market share of ICLN's holdings.

Diversification and Risk Management

It's crucial to remember that diversification is key to managing risk. Investing in ICLN should be part of a broader, well-diversified investment portfolio. Consult with a financial advisor to determine an appropriate allocation based on your individual risk tolerance and financial goals.

Conclusion

The potential for a 110% return on a BlackRock ETF like ICLN by 2025 is driven by the strong growth projections within the clean energy sector, supported by favorable market trends and company performance. However, it's essential to acknowledge the inherent risks associated with any investment. Market volatility, economic downturns, and regulatory changes can all impact performance.

While a 110% return on a BlackRock ETF by 2025 is a compelling prospect, remember to conduct thorough due diligence and consider your individual risk tolerance before investing. Learn more about BlackRock ETFs and explore their potential for your investment strategy. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025 -

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025 -

Dwp Update Action Needed For 12 Benefit Payments And Bank Accounts

May 08, 2025

Dwp Update Action Needed For 12 Benefit Payments And Bank Accounts

May 08, 2025 -

Py Ays Ayl Ky Wjh Se Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025

Py Ays Ayl Ky Wjh Se Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025 -

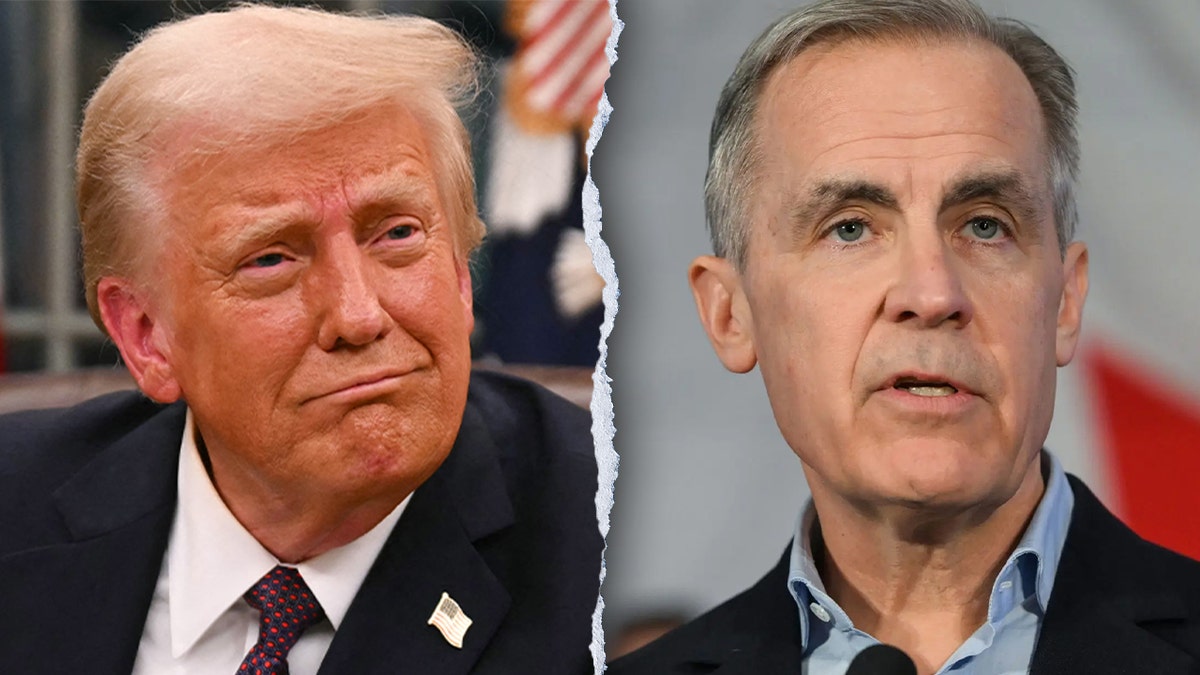

Carney Defends Canadian Sovereignty In Trump Meeting

May 08, 2025

Carney Defends Canadian Sovereignty In Trump Meeting

May 08, 2025