BlackRock ETF: A Billionaire Investment Poised For Explosive Growth?

Table of Contents

BlackRock's Dominance in the ETF Market

BlackRock, through its iShares platform, holds an undeniable leadership position in the ETF market. Its massive market share is a testament to its brand recognition, diverse product offerings, and cutting-edge technology. This dominance isn't accidental; it's the result of strategic planning and execution.

- Unmatched Market Share: BlackRock's iShares boasts a significantly large share of the global ETF market, managing assets worth trillions of dollars. This reflects investor confidence and the broad appeal of its ETF lineup.

- Brand Reputation: The iShares brand is synonymous with trust and reliability, attracting both institutional and individual investors. This strong reputation is a major asset in a competitive market.

- Diverse Product Offerings: From broad market index funds like the iShares Core S&P 500 ETF (IVV) to specialized sector-specific ETFs, iShares provides a comprehensive range of investment options catering to diverse investor needs. This diversity is crucial to attracting a large and varied investor base.

- Technological Advantage: BlackRock leverages advanced technology to optimize trading, minimize costs, and enhance the overall investor experience. This technological edge contributes to its efficiency and competitive advantage in the ETF market.

Analyzing High-Growth Potential BlackRock ETFs

Several BlackRock ETFs stand out as having significant growth potential. These ETFs often focus on rapidly expanding sectors or innovative investment strategies:

- iShares Core S&P 500 ETF (IVV): A cornerstone of many portfolios, this ETF tracks the S&P 500, providing broad market exposure with low expense ratios. Its continued growth is tied to the overall performance of the U.S. stock market.

- iShares Global Clean Energy ETF (ICLN): As the world shifts towards renewable energy sources, ETFs like ICLN, focused on the clean energy sector, are expected to see substantial growth fueled by increasing demand and government initiatives. This is a prime example of a sector-specific ETF with high potential.

- Factor-Based ETFs: BlackRock offers ETFs employing factor-based investing strategies (e.g., focusing on value, momentum, or low volatility stocks). These ETFs aim to outperform traditional market-cap weighted indexes by exploiting market inefficiencies.

- ESG ETFs: Environment, Social, and Governance (ESG) investing is gaining traction, and BlackRock offers several ETFs incorporating ESG criteria into their investment process. Growing investor interest in sustainable investing fuels the demand for these ETFs.

The expense ratio for each ETF is a critical consideration, impacting long-term returns. Always check the current expense ratio before investing. Historical performance is not indicative of future results.

Factors Driving BlackRock ETF Growth

Several macro-economic trends and BlackRock's strategic initiatives contribute to the explosive growth potential of its ETFs:

- Passive Investing Trend: The rise of passive investing, where investors opt for index funds and ETFs rather than actively managed funds, significantly fuels ETF growth. BlackRock is a major beneficiary of this trend.

- Low Interest Rates: Low interest rates in many countries encourage investors to seek higher returns in the stock market, leading to increased demand for ETFs.

- Thematic Investing: BlackRock's focus on thematic ETFs (e.g., focusing on specific trends like robotics or artificial intelligence) caters to investors seeking exposure to specific growth sectors.

- Smart Beta Strategies: BlackRock’s incorporation of smart beta strategies, which move beyond traditional market-cap weighting, offers investors sophisticated investment approaches.

- Cost-Effectiveness: Low expense ratios make BlackRock ETFs accessible and attractive to a wide range of investors, contributing to their popularity.

Risks and Considerations

While the growth potential of BlackRock ETFs is significant, investors must acknowledge potential risks:

- Market Volatility: All investments are subject to market risk. ETF values can fluctuate significantly, potentially leading to losses.

- Sector-Specific Risks: Investing in sector-specific ETFs concentrates risk. Poor performance in a specific sector can significantly impact the ETF's value.

- Expense Ratios: While BlackRock's expense ratios are generally competitive, they still impact long-term returns.

- Diversification: It's crucial to diversify your portfolio to mitigate risk. Don't put all your eggs in one basket, even if it's a BlackRock ETF basket.

Thorough due diligence is essential before investing in any ETF, including those offered by BlackRock. Understand your risk tolerance and investment goals before making any investment decisions.

Conclusion: Is a BlackRock ETF Right for Your Portfolio?

BlackRock ETFs have demonstrated impressive growth and hold a dominant position in the ETF market. Factors such as the rise of passive investing, the development of innovative investment strategies, and BlackRock's strong brand reputation all contribute to their success and potential for continued expansion. However, potential investors must carefully consider the associated risks and ensure that any BlackRock ETF aligns with their individual investment strategy and risk tolerance. Start your BlackRock ETF research today and discover if they're the right fit for your portfolio. Learn more about the potential of BlackRock ETFs and find the investment opportunities that could drive your financial growth.

Featured Posts

-

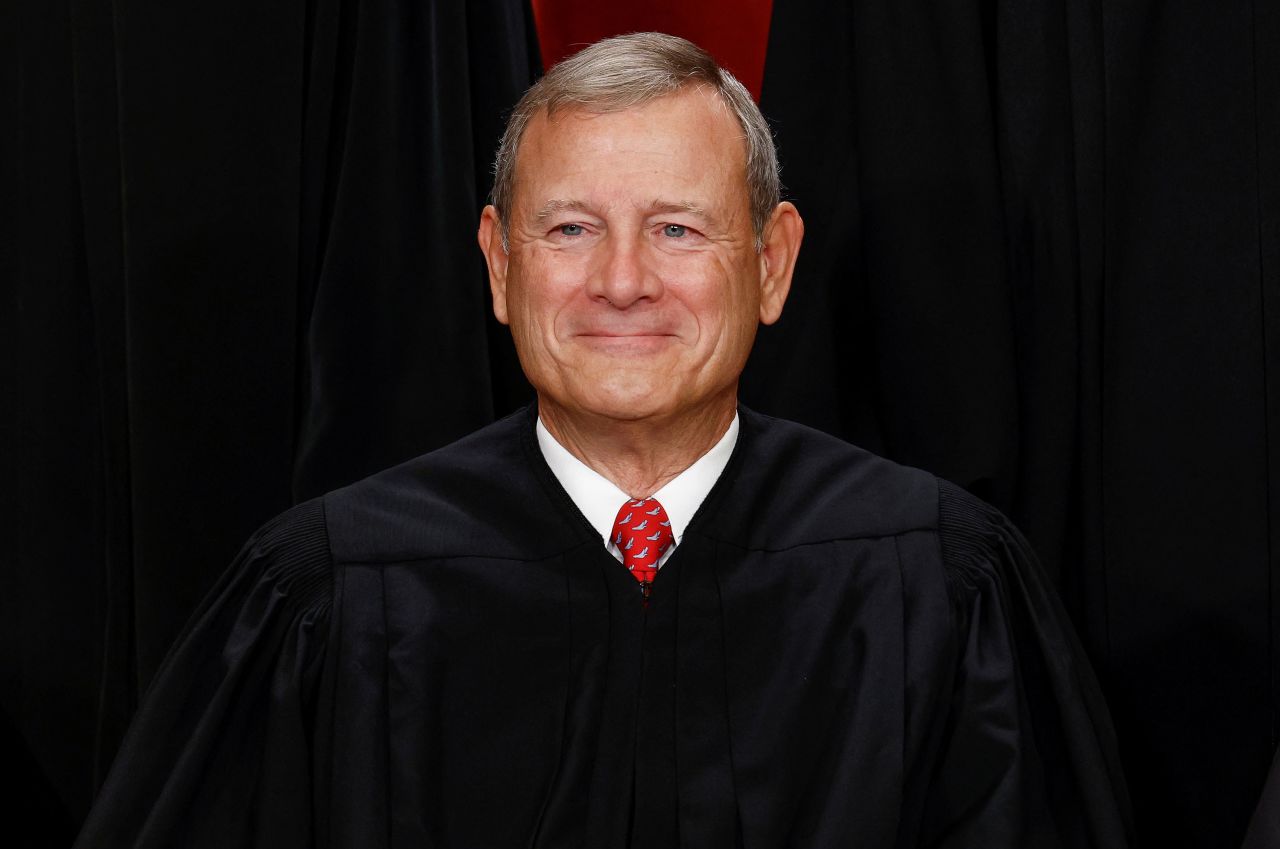

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025 -

X Blocks Turkish Mayors Social Media Opposition Protests Lead To Account Suspension

May 09, 2025

X Blocks Turkish Mayors Social Media Opposition Protests Lead To Account Suspension

May 09, 2025 -

Liga Chempionov 2024 2025 Prognoz Raspisanie I Translyatsii Polufinalov I Finala

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Raspisanie I Translyatsii Polufinalov I Finala

May 09, 2025 -

Ferrari Disqualification Fears Resurface Jeremy Clarksons Proposed F1 Solution

May 09, 2025

Ferrari Disqualification Fears Resurface Jeremy Clarksons Proposed F1 Solution

May 09, 2025 -

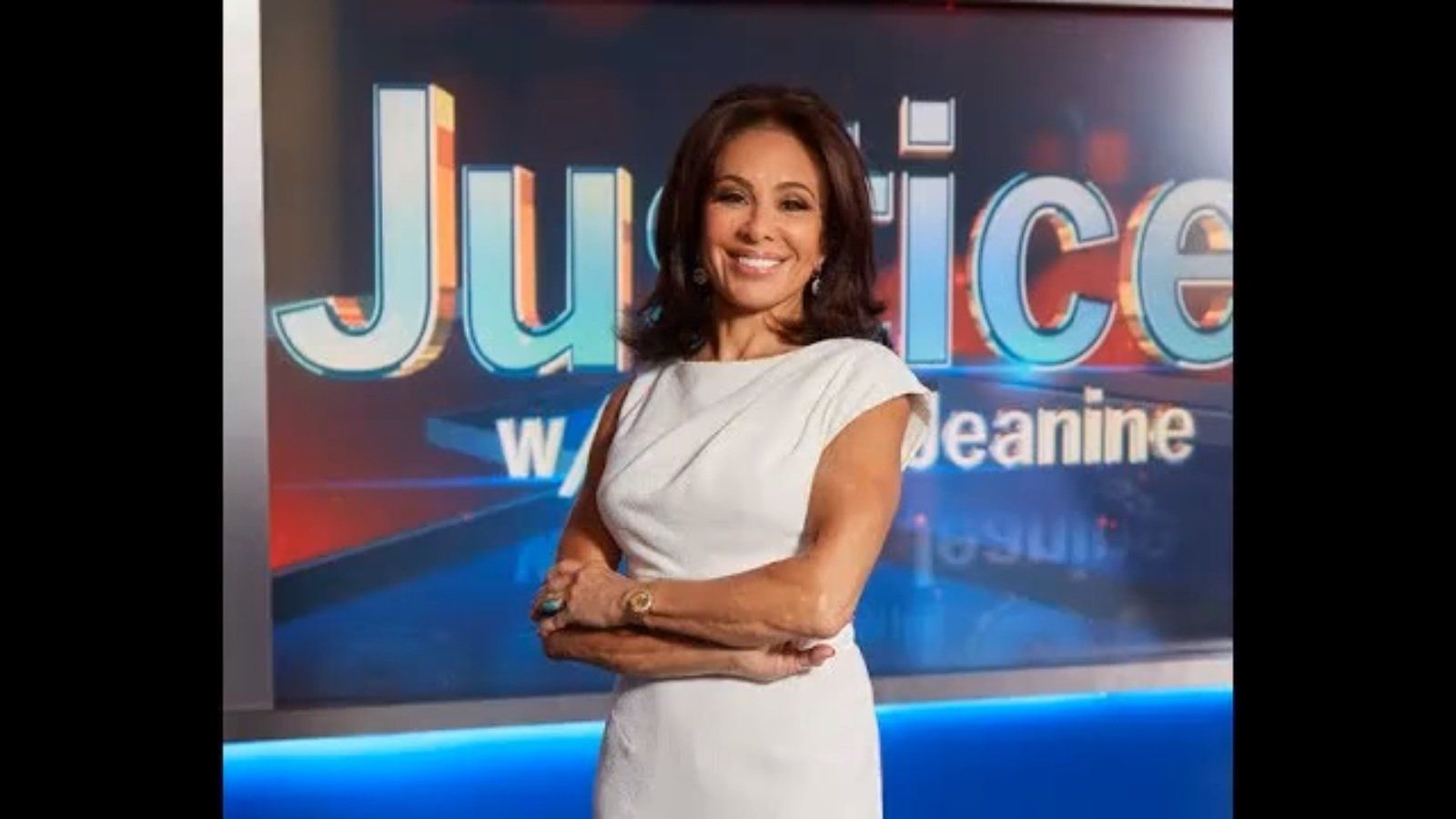

Jeanine Pirros Fox News Career An Inside Perspective

May 09, 2025

Jeanine Pirros Fox News Career An Inside Perspective

May 09, 2025