BlackRock ETF Poised For 110% Growth: Why Billionaires Are Investing

Table of Contents

BlackRock's Dominance in the ETF Market

BlackRock's iShares division is the undisputed leader in the ETF market, commanding a significant portion of global ETF assets under management. Their dominance stems from a combination of factors including a wide range of diverse products, innovative ETF strategies, and a reputation for reliability. BlackRock ETFs offer investors access to a vast spectrum of asset classes and market segments, catering to diverse investment goals.

-

Market Leadership Statistics: BlackRock consistently holds the largest market share globally, often exceeding a significant percentage of the total ETF market. Precise figures vary depending on the reporting period and data source, but their leading position remains unchallenged.

-

Top-Performing BlackRock ETFs: The iShares CORE US Aggregate Bond ETF (AGG) and the iShares CORE S&P 500 ETF (IVV) are prime examples of BlackRock's success. AGG provides broad exposure to the U.S. investment-grade bond market, while IVV tracks the S&P 500 index, offering diversified exposure to large-cap U.S. equities. Both have demonstrated strong long-term performance, attracting substantial investment.

-

Innovative ETF Strategies: BlackRock constantly innovates, introducing new ETFs that tap into emerging market trends and investment strategies. These include thematic ETFs focused on specific sectors like technology, renewable energy, or global healthcare, allowing investors to target their portfolios to specific growth areas.

Underlying Factors Driving Projected 110% Growth

Several macroeconomic trends contribute to the projected 110% growth of BlackRock ETFs. The current economic climate, characterized by factors like rising interest rates and persistent inflation, plays a crucial role. Furthermore, the performance of specific sectors within the economy influences the performance of related BlackRock ETFs.

-

Economic Forecasts and ETF Performance: Analysts predict continued growth in specific sectors, such as technology and healthcare, aligning with BlackRock's offerings in those areas. Inflationary pressures, although presenting challenges, can also drive demand for certain asset classes, benefitting specific BlackRock ETFs.

-

Industry Sectors Driving Growth: Strong performance in technology, healthcare, and potentially other growth sectors directly impacts the performance of BlackRock ETFs tracking these indices or investing in these sectors. This sector-specific growth fuels the overall expansion of BlackRock's ETF assets under management.

-

Market Conditions Favoring BlackRock: BlackRock's diversified investment strategies position them to benefit from various market conditions. Their range of ETFs, covering a spectrum of assets and strategies, enables them to adapt and capture growth opportunities across different economic environments.

Why Billionaires Are Investing in BlackRock ETFs

Billionaires are drawn to BlackRock ETFs for several compelling reasons. Their interest stems from the advantages these funds offer in terms of diversification, cost-effectiveness, and accessibility.

-

Diversification Benefits: BlackRock ETFs provide unparalleled diversification opportunities, allowing investors to spread their risk across numerous assets and sectors, significantly reducing exposure to individual stock volatility. This is especially appealing to high-net-worth individuals.

-

Cost-Effectiveness: BlackRock ETFs are known for their low expense ratios, minimizing management fees and maximizing returns for investors. This is particularly important for large investments where even small percentage differences in fees can significantly impact overall profitability.

-

Access to Diverse Asset Classes: BlackRock provides access to a broad array of asset classes, from U.S. equities and bonds to international markets and specialized sectors, allowing for sophisticated portfolio construction.

-

Reputation and Stability: BlackRock's reputation as a leading global asset manager instills confidence and contributes to the attractiveness of its ETFs. Their size and stability provide a sense of security to high-net-worth investors.

Risks and Considerations

While the potential rewards of investing in BlackRock ETFs are significant, it's essential to acknowledge the inherent risks. Market volatility, sector-specific risks, and the possibility of losses should always be considered.

-

Market Fluctuations: The value of ETFs can fluctuate significantly due to market conditions. While BlackRock ETFs offer diversification, they are not immune to market downturns.

-

Sector-Specific Risks: Investing in sector-specific ETFs concentrates risk within a particular industry. A downturn in that sector can disproportionately impact the value of the ETF.

-

Importance of Diversification: Even within the BlackRock ETF family, diversification across different asset classes and investment strategies is vital to mitigate risk and optimize portfolio performance.

BlackRock ETF Investment Potential and Call to Action

The projected 110% growth potential of BlackRock ETFs, driven by BlackRock's market dominance, favorable macroeconomic trends, and the inherent advantages of ETFs, makes them an attractive investment option for many. Billionaires, with their sophisticated investment strategies, recognize the diversification, low fees, and market leadership offered by BlackRock ETFs. While not financial advice, the potential for growth in BlackRock ETFs is undeniable. Conduct thorough research and consider how integrating these powerful investment tools into your portfolio might benefit you. Explore the world of BlackRock ETFs today!

Featured Posts

-

Gcci Presidents Made In Gujranwala Exhibition Sufians Commendation

May 08, 2025

Gcci Presidents Made In Gujranwala Exhibition Sufians Commendation

May 08, 2025 -

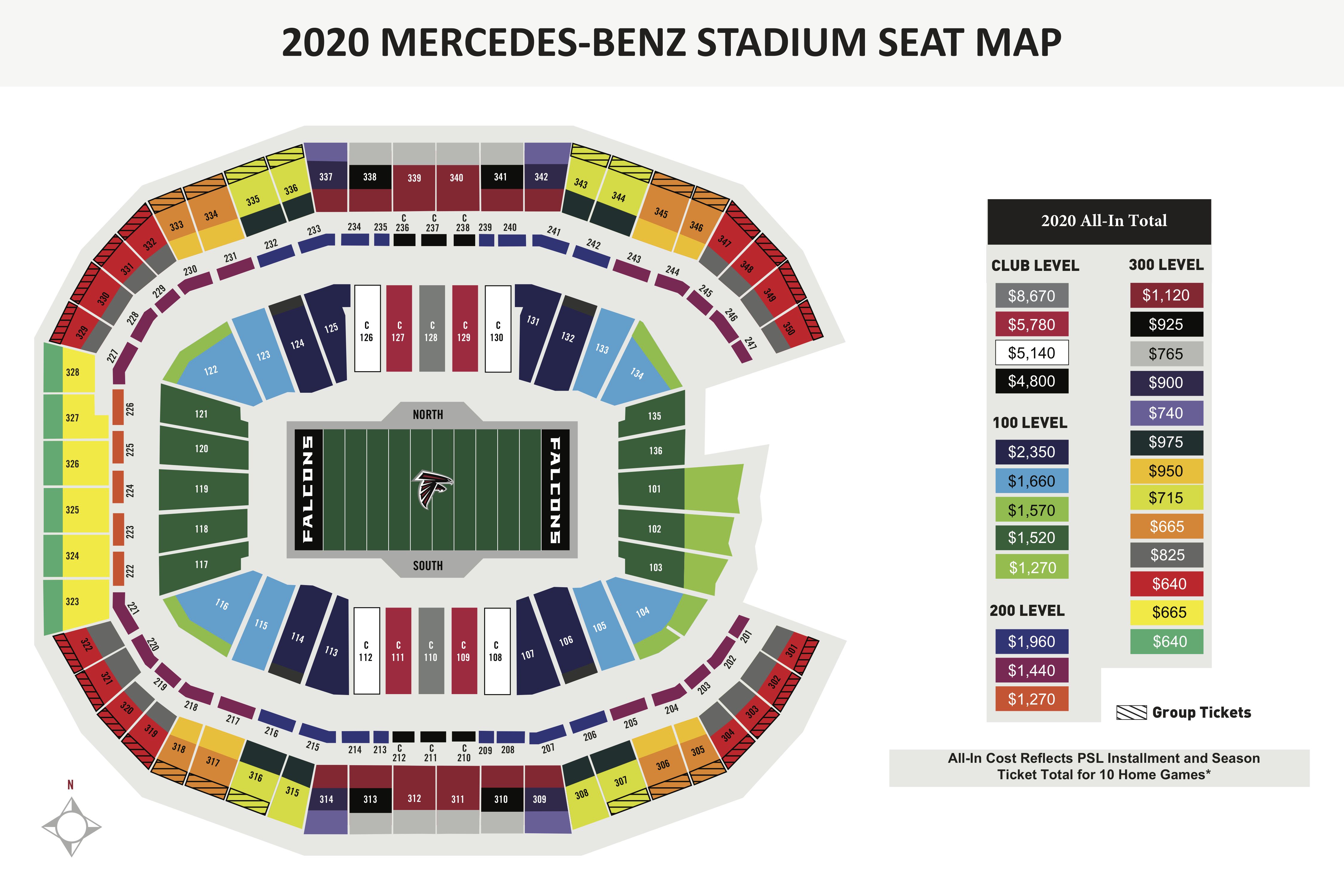

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025 -

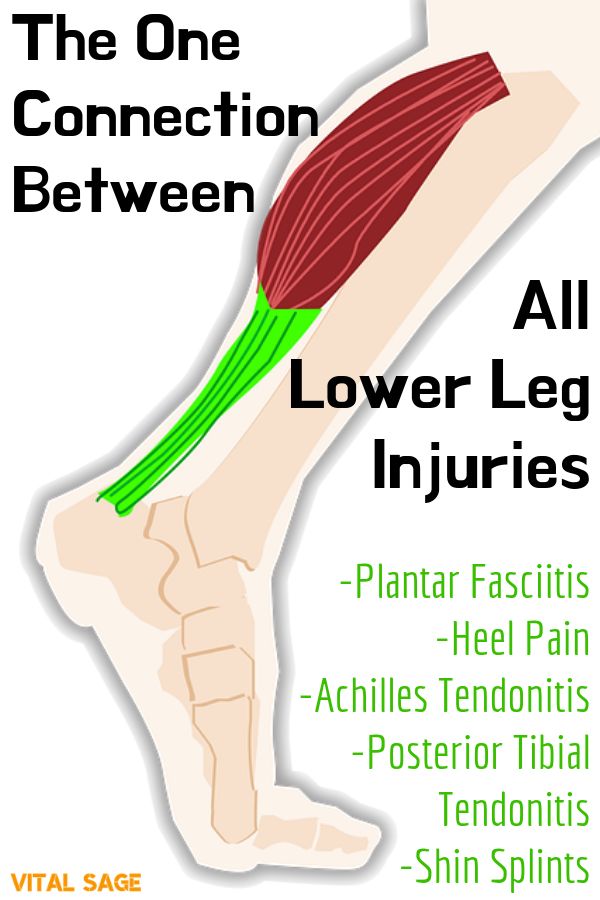

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025 -

Arsenal Vs Ps Zh Barselona Vs Inter Prognozy Na Polufinaly Ligi Chempionov 2024 2025

May 08, 2025

Arsenal Vs Ps Zh Barselona Vs Inter Prognozy Na Polufinaly Ligi Chempionov 2024 2025

May 08, 2025 -

Xrp Etf Approval Analyzing The Potential For 800 Million In First Week Investment

May 08, 2025

Xrp Etf Approval Analyzing The Potential For 800 Million In First Week Investment

May 08, 2025