BofA On High Stock Market Valuations: A Reason For Investors To Stay Calm

Table of Contents

BofA's Perspective on Current Market Conditions

Understanding BofA's Market Analysis

BofA's assessment of market valuations isn't based on gut feeling; it's a meticulously researched analysis using a range of established metrics. They leverage their extensive research capabilities and consider a multitude of economic indicators to paint a comprehensive picture. Their reports, often available to clients and accessible through financial news outlets, detail their methodology and findings.

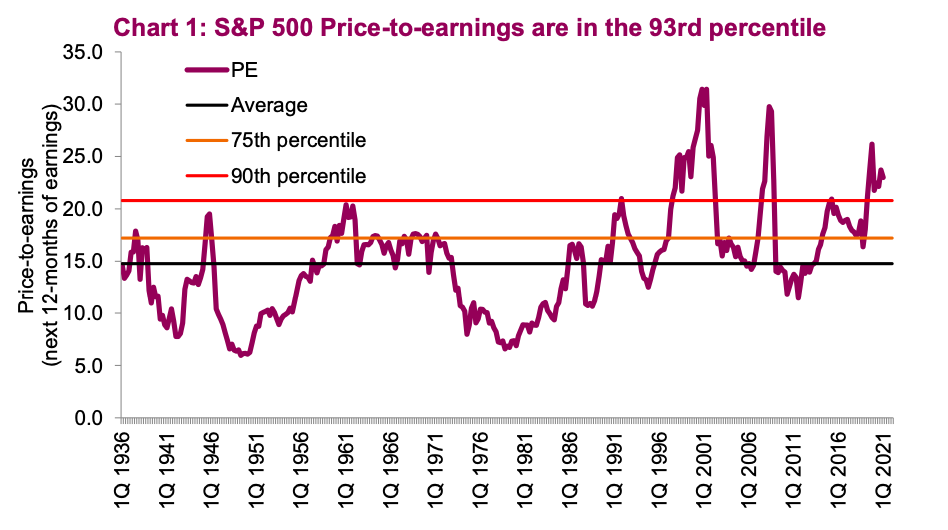

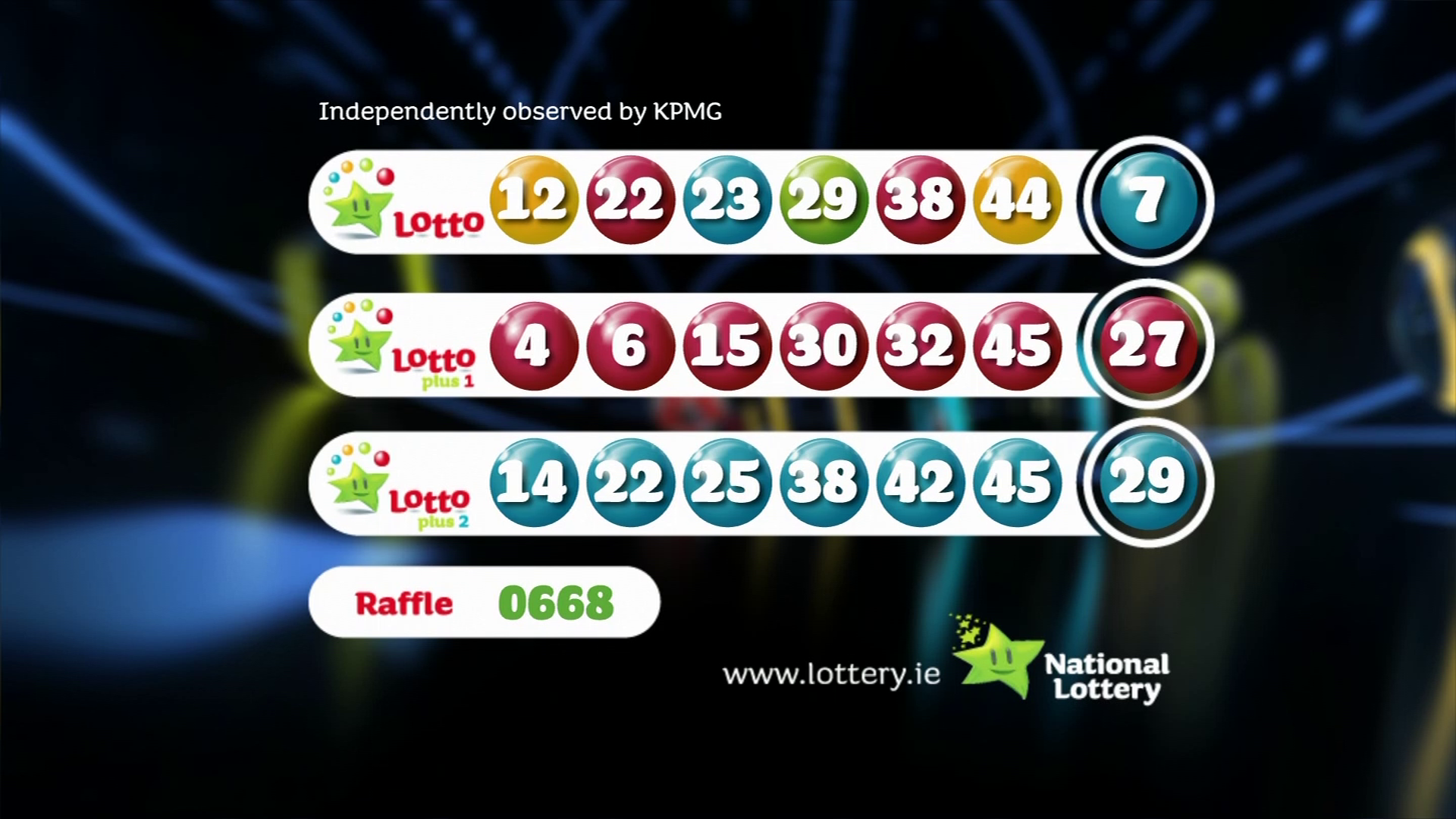

- Summary of BofA's Stance on Current Valuations: While acknowledging the elevated levels, BofA doesn't necessarily view current valuations as inherently unsustainable. Their analysis suggests that several underlying factors contribute to these levels, and these factors need to be carefully considered before jumping to conclusions.

- Key Metrics BofA Uses to Assess Valuations: BofA employs various metrics, including the widely used price-to-earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE), to gauge valuations across different sectors and the market as a whole. These ratios are compared to historical averages and industry benchmarks to identify potential overvaluation or undervaluation.

- BofA's Consideration of Interest Rates and Their Impact on Valuations: Interest rates play a crucial role. Low interest rates, a common phenomenon in recent years, can stimulate borrowing and investment, thus pushing up asset prices, including stocks. BofA carefully weighs the impact of current and projected interest rate changes on market valuations.

- Specific Sectors or Industries BofA Highlights: BofA's reports often highlight specific sectors or industries that they believe are relatively overvalued or undervalued based on their analysis. This granular perspective helps investors make more informed decisions about sector allocation within their portfolios.

Factors Contributing to High Valuations

The Role of Low Interest Rates

For years, central banks globally implemented policies of low interest rates and quantitative easing (QE). These measures, intended to stimulate economic growth, had the side effect of making borrowing cheaper and pushing investors towards higher-yielding assets, including stocks. This influx of capital increased demand and consequently, prices.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and optimistic future growth forecasts significantly support higher stock prices. Many companies have demonstrated resilience and strong performance, justifying, to some extent, the current valuations. This positive sentiment contributes to investor confidence and willingness to pay higher prices.

- Impact of Inflation on Valuations: Inflation erodes the purchasing power of money, influencing investor behavior and potentially driving asset prices higher as a hedge against inflation. BofA incorporates inflation expectations into their valuation models.

- Role of Technological Advancements and Innovation: Technological breakthroughs and innovation drive economic growth and create new investment opportunities. These factors can contribute to higher valuations in technology and related sectors.

- Geopolitical Factors Influencing Market Valuations: Global geopolitical events and uncertainties can impact investor sentiment and market valuations. BofA accounts for these factors in its analysis, assessing their potential short-term and long-term consequences.

Why Investors Shouldn't Panic

Long-Term Investment Strategy

The key to navigating market volatility is a long-term investment strategy. Focusing on short-term fluctuations can lead to emotional decision-making and potentially poor investment outcomes. A well-defined long-term plan, aligned with personal financial goals, allows investors to weather market storms more effectively.

BofA's Recommendations for Investors

BofA generally advises a measured approach. This might involve:

-

Diversification: Spreading investments across different asset classes and sectors to mitigate risk.

-

Sector Selection: Focusing on sectors perceived as less overvalued or possessing strong growth potential.

-

Strategic Asset Allocation: Adjusting asset allocation based on risk tolerance and market conditions.

-

Benefits of Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount regularly regardless of market prices, can mitigate the risk of investing a lump sum at a market peak.

-

Importance of Risk Tolerance and Diversification: Understanding your risk tolerance is critical. Diversification across asset classes, geographies and sectors is key to managing risk effectively.

-

Historical Context of Market Corrections and Recoveries: History shows that market corrections and recoveries are a normal part of the investment cycle. Maintaining perspective and sticking to a long-term plan is crucial during these times.

Alternative Investment Strategies for High-Valuation Markets

Exploring Value Investing Opportunities

Even in a high-valuation market, opportunities exist for value investors. Identifying companies trading below their intrinsic value requires thorough research and understanding of fundamental analysis. This approach focuses on undervalued assets with strong potential for future growth.

Diversification Beyond Equities

Diversification is crucial, especially in high-valuation markets. Consider allocating a portion of your portfolio to alternative assets:

-

Bonds: Offer stability and fixed income, providing a counterbalance to the volatility of equities.

-

Real Estate: Can offer diversification and potential for long-term appreciation.

-

Commodities: Act as a hedge against inflation and offer diversification benefits.

-

Sectors Offering Better Value: Specific sectors, less exposed to the current hype, could present better value propositions. Thorough research is essential.

-

Advantages and Disadvantages of Alternative Investment Strategies: Each alternative investment has its own set of advantages and disadvantages, requiring careful consideration of risk tolerance and investment goals.

-

Seeking Professional Financial Advice: Consulting a financial advisor is highly recommended to create a personalized investment strategy aligned with your individual circumstances and risk tolerance.

Conclusion

BofA's analysis of high stock market valuations provides a valuable perspective for investors. While acknowledging the elevated price levels, their assessment suggests several underlying factors justifying, to some degree, these valuations. The key takeaway is the importance of a long-term investment strategy that incorporates diversification and risk management. Don't panic; instead, focus on developing a robust plan aligned with your financial goals. Consider further research into BofA's reports and consulting a financial advisor to create a personalized plan to manage your investments effectively, even amidst concerns about high stock market valuations. You can remain calm despite high stock market valuations, thanks to informed strategies informed by BofA's insights.

Featured Posts

-

Understanding Fortune Coins A Path To Financial Success

May 18, 2025

Understanding Fortune Coins A Path To Financial Success

May 18, 2025 -

April 12th Saturday Lotto Draw Winning Numbers Announced

May 18, 2025

April 12th Saturday Lotto Draw Winning Numbers Announced

May 18, 2025 -

Kanye West Bianca Censori And Julia Fox Fashion Feud Sparks Debate

May 18, 2025

Kanye West Bianca Censori And Julia Fox Fashion Feud Sparks Debate

May 18, 2025 -

3 Dendam Israel Ke Paus Fransiskus Mengapa Mereka Boikot Pemakaman

May 18, 2025

3 Dendam Israel Ke Paus Fransiskus Mengapa Mereka Boikot Pemakaman

May 18, 2025 -

Live Tv Fiasco Snl Audience Swears On Air 103 5 Kiss Fm

May 18, 2025

Live Tv Fiasco Snl Audience Swears On Air 103 5 Kiss Fm

May 18, 2025