BofA On Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's recent report on stock market valuations provides a nuanced view of the current market climate. Let's examine their key findings and the underlying factors driving their assessment.

Moderate Valuation Levels

BofA's analysis suggests that current stock market valuations are, on the whole, at moderate levels. They do not believe the market is significantly overvalued, a conclusion that contrasts with some more pessimistic analyses. While certain sectors might show higher valuations, the overall picture painted by BofA is one of relative balance.

-

Key Valuation Metrics: BofA utilized several key metrics in their assessment, including:

- Price-to-Earnings ratio (P/E): A comparison of a company's stock price to its earnings per share.

- Shiller PE ratio (CAPE): A cyclically adjusted price-to-earnings ratio, which smooths out earnings fluctuations over a longer period (typically 10 years).

- Dividend yield: The annual dividend payment relative to the stock price.

-

Sector-Specific Analysis: While BofA didn't deem the overall market wildly overvalued, their analysis did pinpoint specific sectors that are seen as relatively more attractive based on their valuations, and others that appear comparatively less so. These sector-specific assessments are crucial for investors to consider when building a portfolio.

Factors Contributing to BofA's Assessment

BofA's valuation assessment wasn't reached in a vacuum. Several key factors contributed to their relatively calm outlook:

- Interest Rate Expectations: BofA factored in expectations for future interest rate adjustments by central banks. While higher rates can impact valuations, their forecasts appeared to incorporate a relatively moderate increase.

- Economic Growth Forecasts: BofA's economic growth projections, while acknowledging some challenges, did not predict a significant downturn, impacting their valuation calculations positively.

- Corporate Earnings Estimates: The analysts at BofA considered projected corporate earnings, which, although perhaps not exuberant, were deemed robust enough to support current valuations in many sectors.

These factors, combined and analyzed through sophisticated valuation models, informed BofA's overall perspective on the stock market.

Implications for Investors Based on BofA's Analysis

What does BofA's analysis mean for individual investors? Let's examine both the opportunities and risks it presents.

Opportunities and Risks

BofA's analysis suggests both opportunities and potential challenges:

-

Investment Opportunities: Based on their findings, BofA hints at several potential strategies:

- Sector Rotation: Concentrating on sectors that BofA's analysis suggests are undervalued, while simultaneously reducing exposure to those deemed overvalued.

- Focus on Value Stocks: Investing in companies with strong fundamentals and low valuations relative to their earnings potential.

- Dividend Investing: Focusing on high-dividend yielding stocks to generate income.

-

Potential Risks: BofA's report doesn't entirely eliminate risk. Market volatility remains a possibility, particularly given macroeconomic uncertainties. They emphasize the importance of careful monitoring of economic data and global events.

Maintaining a Balanced Portfolio

In light of BofA's findings, the importance of maintaining a well-diversified investment portfolio cannot be overstated. A diversified portfolio spreads risk, cushioning potential losses while participating in growth opportunities.

- Diversification Strategies: Consider diversifying across different asset classes (stocks, bonds, real estate), sectors, and geographies.

- Risk Tolerance: It's crucial to assess your personal risk tolerance and adjust your portfolio accordingly. BofA's analysis provides a valuable perspective, but it shouldn't dictate individual investment choices without considering personal circumstances.

Comparing BofA's View with Other Market Analyses

It's essential to remember that BofA's analysis is just one perspective among many. Let's briefly compare and contrast it with other views.

Divergent Opinions

Other financial institutions may hold different opinions on current stock market valuations. Some might present more pessimistic outlooks, emphasizing potential risks and predicting a market correction. These differences often stem from variations in methodologies, underlying assumptions, and interpretations of economic indicators.

The Importance of Independent Research

It's crucial not to rely solely on one source, including BofA. Conducting thorough, independent research is paramount:

- Reputable Sources: Consult a variety of sources, including financial news outlets, research reports from other reputable financial institutions, and economic data from government agencies.

- Understanding Risk Tolerance: Before making any investment decisions, ensure you have a strong understanding of your personal risk tolerance.

Conclusion

BofA's analysis of stock market valuations suggests that, while risks exist, the market isn't significantly overvalued. This provides a degree of reassurance for investors. Their findings highlight opportunities for strategic portfolio adjustments, emphasizing the importance of sector rotation, value investing, and maintaining a diversified portfolio. However, independent research and understanding your own risk profile remain crucial. To stay informed and make well-informed investment decisions, understand BofA's stock market valuations and learn more about their reports. Assess your investment strategy based on BofA's perspective on stock market valuations and conduct your own thorough research.

Featured Posts

-

Us Researcher Exodus How Countries Are Competing For Talent After Funding Cuts

Apr 29, 2025

Us Researcher Exodus How Countries Are Competing For Talent After Funding Cuts

Apr 29, 2025 -

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

Apr 29, 2025

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

Apr 29, 2025 -

Pwcs Withdrawal From Nine African Countries Impact And Analysis

Apr 29, 2025

Pwcs Withdrawal From Nine African Countries Impact And Analysis

Apr 29, 2025 -

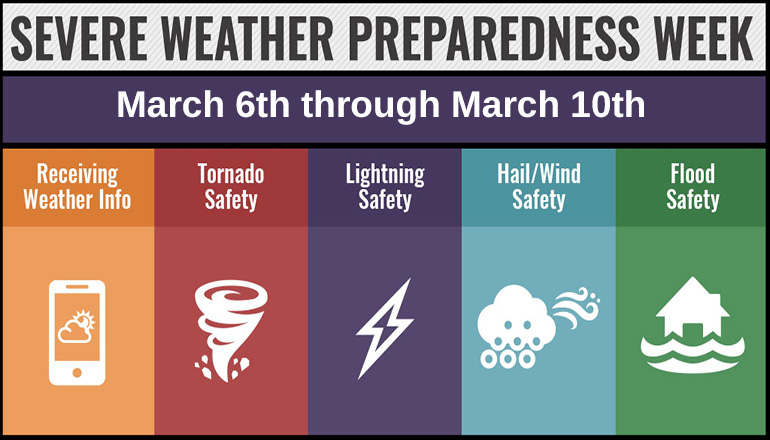

Kentucky Severe Weather Awareness Week Nws Preparedness Efforts

Apr 29, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness Efforts

Apr 29, 2025 -

Nyt Strands Puzzle April 3 2025 Answers And Spangram

Apr 29, 2025

Nyt Strands Puzzle April 3 2025 Answers And Spangram

Apr 29, 2025