BofA On Stock Market Valuations: Reasons For Investor Confidence

Table of Contents

BofA's Positive Outlook on Long-Term Growth

BofA's positive assessment of stock market valuations rests heavily on its projections for long-term economic growth. This optimistic outlook isn't based on blind faith but on a careful analysis of several key economic indicators. This positive view on long-term growth is a major factor in BofA's relatively bullish stance on stock market valuations.

-

Strong GDP Growth Projections: BofA's analysts cite robust GDP growth projections for the coming years, suggesting a healthy and expanding economy. These projections factor in various economic models and consider factors such as technological innovation, consumer spending, and government investment.

-

Controlled Inflation Forecasts: While acknowledging the lingering effects of inflation, BofA forecasts a gradual return to more stable price levels. This controlled inflation, they argue, will create a more predictable environment for businesses and investors, fostering further investment and growth.

-

Promising Sectors: BofA specifically highlights several sectors poised for significant growth, including technology, renewable energy, and healthcare. These sectors are seen as driving forces behind future economic expansion, supporting their positive assessment of long-term growth. These sectors demonstrate significant resilience and growth potential, even amidst economic uncertainty.

-

Sustainable Growth Drivers: The foundation of BofA's confidence in sustainable growth lies in a confluence of factors. These include advancements in technology, increasing global interconnectedness, and a growing global middle class. These factors create a strong foundation for continuous economic expansion.

Analysis of Current Market Valuations by BofA

BofA employs a multi-faceted approach to evaluating stock market valuations, moving beyond simplistic metrics. Their analysis incorporates a range of factors and indicators to build a comprehensive understanding of the current market landscape and the implications of BofA Stock Market Valuations.

-

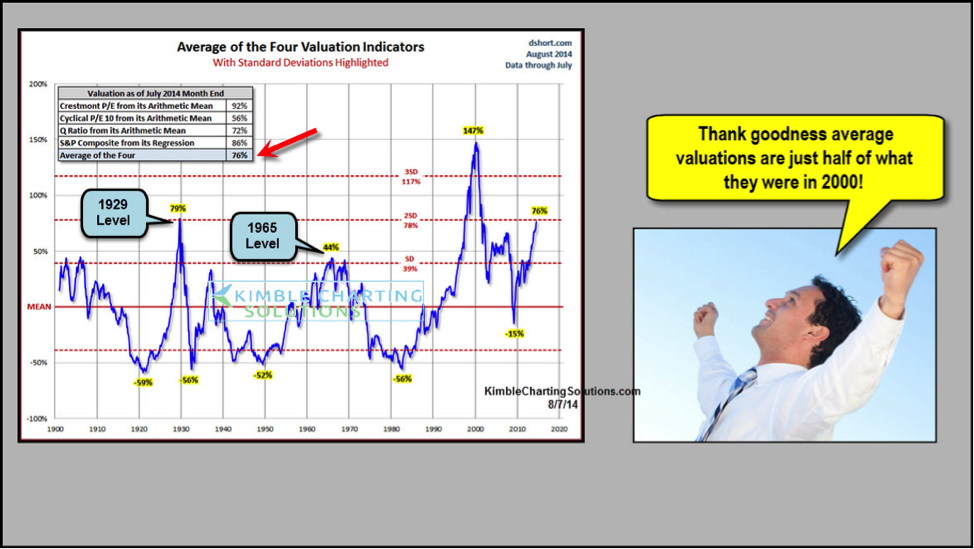

Key Valuation Metrics: BofA utilizes several key metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and dividend yields, to assess the relative value of stocks. By comparing these metrics across different sectors and industries, BofA gains a more detailed picture of the market's overall valuation.

-

Historical Comparisons: A crucial part of BofA's analysis involves comparing current valuations to historical averages. This allows them to determine whether current valuations are inflated or represent a genuine reflection of underlying growth potential. This historical context is essential for determining whether current valuations are sustainable.

-

Valuation Justification: BofA's conclusion that current valuations are largely justified is supported by their long-term growth projections. They argue that the projected expansion of the economy and specific sectors justifies the current pricing of many stocks. However, it is important to note that this is a high-level assessment and individual stock valuations will require further analysis.

Factors Contributing to Investor Confidence According to BofA

BofA's analysis identifies several key factors underpinning investor confidence despite market volatility. These factors show a level of optimism that is driving investment decisions, despite the uncertainty in the overall global economy.

-

Strong Corporate Earnings: Positive corporate earnings reports contribute significantly to market sentiment. BofA highlights the better-than-expected results from numerous companies across various sectors, bolstering investor confidence in the market's underlying strength.

-

Interest Rate Influence: While acknowledging the impact of rising interest rates, BofA suggests that the current trajectory of monetary policy is manageable and will not derail economic growth. This measured approach, combined with other supportive factors, is contributing to investor confidence.

-

Geopolitical Stability (Relative): BofA acknowledges ongoing geopolitical challenges but notes that the situation is relatively stable compared to recent historical periods. This relative calm, coupled with efforts towards de-escalation in some regions, supports market stability and investor confidence.

-

Technological Advancements: BofA points to the continued rapid advancement of technology as a major driver of growth and innovation. This technological dynamism is fueling further investment and fueling positive sentiment in certain sectors.

Addressing Potential Market Risks (Counterpoint)

While BofA maintains a relatively positive outlook, they acknowledge potential risks that could impact market performance. This balanced perspective is crucial for informed investment decisions.

-

Inflationary Pressures: BofA warns that persistent inflationary pressures could erode corporate profits and investor confidence. They stress the importance of monitoring inflation trends carefully.

-

Recessionary Risks: Although BofA does not forecast a recession, they recognize the possibility of a slowdown in economic growth. This risk warrants caution and highlights the importance of diversification in investment strategies.

-

Geopolitical Uncertainty: The ongoing geopolitical instability remains a potential wildcard that could negatively impact markets. BofA recommends that investors remain informed and adapt their strategies as needed based on evolving geopolitical landscapes.

-

Risk Mitigation Strategies: BofA emphasizes the importance of diversification and robust risk management strategies to mitigate potential losses. They suggest investors carefully consider their risk tolerance and adjust their portfolios accordingly.

Conclusion

BofA's analysis of stock market valuations presents a cautiously optimistic picture. Their positive outlook on long-term growth, coupled with a measured assessment of current valuations, supports the confidence of many investors. While acknowledging potential risks, BofA's analysis emphasizes the importance of understanding and adapting to market dynamics. The key factors driving investor confidence, as identified by BofA, include strong corporate earnings, a manageable interest rate environment, relative geopolitical stability, and continued technological innovation. To stay informed on BofA's stock market valuations and understand the factors influencing their analysis, it is crucial to follow their research and publications. Learn more about BofA's perspective on stock market valuations and make informed investment decisions. (Insert link to relevant BofA resources here)

Featured Posts

-

Nyt Strands Wednesday April 9 Game 402 Complete Solution Guide

May 10, 2025

Nyt Strands Wednesday April 9 Game 402 Complete Solution Guide

May 10, 2025 -

China Re Evaluates Canola Supply Sources After Canada Relations Sour

May 10, 2025

China Re Evaluates Canola Supply Sources After Canada Relations Sour

May 10, 2025 -

Official Confirmation Young Thug Missing From Blue Origin Passenger List

May 10, 2025

Official Confirmation Young Thug Missing From Blue Origin Passenger List

May 10, 2025 -

Unprovoked Killing Family Demands Justice After Racist Hate Crime

May 10, 2025

Unprovoked Killing Family Demands Justice After Racist Hate Crime

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025