BofA On Stock Market Valuations: Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Methodology and Key Findings

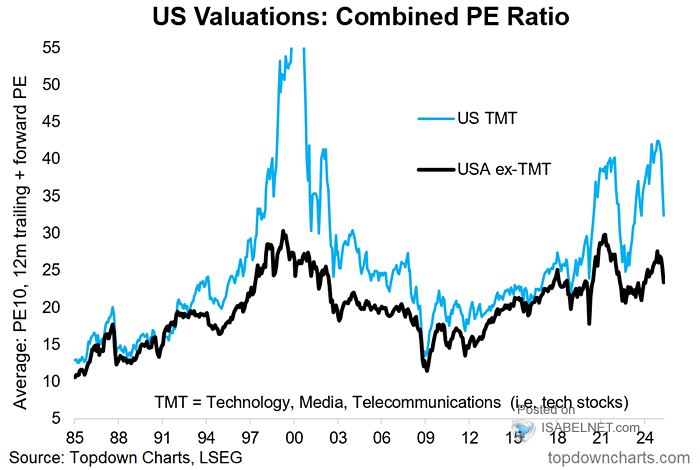

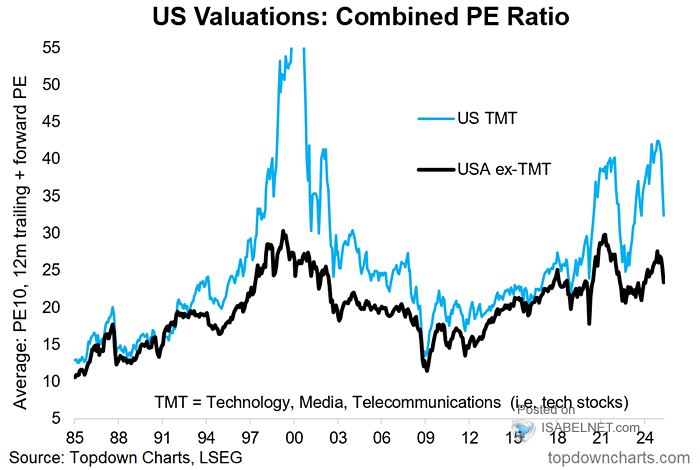

BofA employed a robust methodology to assess current stock market valuations, incorporating various valuation metrics and comparing them to historical data. Their market analysis involved a comprehensive review of Price-to-Earnings (P/E) ratios, discounted cash flow analysis, and other key indicators. This rigorous approach to market analysis provides a solid foundation for their conclusions.

BofA's key finding suggests that while current valuations are elevated compared to historical averages, several factors contribute to this, making them less alarming than they might initially appear. The report acknowledges higher valuations but contextualizes them within the broader economic landscape.

- Specific valuation metrics: BofA's analysis likely included a detailed examination of current P/E ratios across various sectors, comparing them to long-term averages and industry benchmarks.

- Comparison to historical data: The report compared current valuations against historical data, identifying periods of similar valuation levels and their subsequent market performance.

- Specific sectors highlighted: The report likely highlighted specific sectors or industries where valuations are relatively more or less elevated, providing a nuanced picture of the market.

The Impact of Interest Rates and Inflation

Rising interest rates and persistent inflationary pressures are significant factors affecting stock valuations. Higher interest rates increase the cost of borrowing, potentially impacting corporate investment and slowing economic growth. Inflation erodes purchasing power and can squeeze corporate profit margins. However, BofA's analysis likely suggests that these factors are already, at least partially, priced into the market.

- Relationship between interest rates and valuations: Higher interest rates typically lead to lower present values of future cash flows, thus reducing stock valuations. BofA's analysis likely accounts for this relationship.

- BofA's perspective on future rates: The report likely includes BofA's forecast for future interest rate movements, influencing their assessment of the impact on valuations.

- Inflation's impact on earnings: BofA's analysis would likely incorporate an assessment of how inflation might affect corporate earnings, considering factors like pricing power and input costs.

Long-Term Growth Prospects and Future Earnings

BofA's analysis likely focuses on the long-term growth prospects of the economy and corporate earnings, arguing that these prospects justify current valuations. The report likely identifies key sectors poised for significant growth and provides forecasts for future corporate earnings growth.

- Key sectors driving future growth: BofA may point to sectors such as technology, renewable energy, or healthcare as key drivers of future economic expansion.

- BofA's forecast for earnings growth: The report likely contains specific forecasts for corporate earnings growth over the next few years, underpinning their valuation conclusions.

- Technological advancements: BofA's analysis will likely incorporate the influence of technological advancements on productivity and long-term economic growth.

Addressing Investor Concerns and Alternative Perspectives

Acknowledging that some investors remain concerned about overvaluation, BofA's report likely addresses these concerns head-on.

- Common investor concerns: These might include fears of a market correction, concerns about high P/E ratios compared to historical averages, or worries about the sustainability of corporate earnings growth.

- BofA's response: The report likely provides data and analysis to counter these concerns, emphasizing the long-term growth potential of the market.

- Caveats and limitations: BofA likely acknowledges any limitations or caveats to their analysis, promoting transparency and responsible investment strategies.

Conclusion: BofA's Reassuring View on Stock Market Valuations

BofA's report provides a reassuring perspective on current stock market valuations. While acknowledging higher-than-average valuations, the analysis suggests that several factors, including the potential impact of interest rates and inflation already being priced in, along with robust long-term growth prospects, mitigate the risks. The report emphasizes the importance of considering long-term growth potential when assessing valuations. Investors shouldn't be overly concerned, but should maintain a balanced and diversified portfolio. To gain a deeper understanding of BofA's comprehensive stock market valuation analysis and its implications for your investment strategy, review their full report and consider consulting with a financial advisor to develop a responsible investment strategy aligned with your risk tolerance and financial goals. This will allow you to make informed decisions based on BofA's market outlook and other relevant factors.

Featured Posts

-

Ajax Trainerspositie Van Hanegems Aanbeveling

May 29, 2025

Ajax Trainerspositie Van Hanegems Aanbeveling

May 29, 2025 -

Live Nation Acquires 356 Entertainment Group Expanding Into The Maltese Market

May 29, 2025

Live Nation Acquires 356 Entertainment Group Expanding Into The Maltese Market

May 29, 2025 -

Indianola And Norwalk Students Shine At Lhc Art Show

May 29, 2025

Indianola And Norwalk Students Shine At Lhc Art Show

May 29, 2025 -

Dont Miss Out Nikes Best Selling Court Legacy Lift Sneakers On Sale

May 29, 2025

Dont Miss Out Nikes Best Selling Court Legacy Lift Sneakers On Sale

May 29, 2025 -

Cnh Capital Names Vater Machinery New Holland Dealer Of The Year

May 29, 2025

Cnh Capital Names Vater Machinery New Holland Dealer Of The Year

May 29, 2025