BofA Reassures Investors Amidst Concerns Over High Stock Market Valuations

Table of Contents

BofA's Strategies to Address High Valuations

BofA is employing a multi-pronged approach to address investor concerns stemming from high stock market valuations. This includes emphasizing long-term growth potential, outlining robust risk management strategies, and directly addressing the impact of inflationary pressures and rising interest rates.

Emphasis on Long-Term Growth Potential

Despite current high valuations, BofA is focusing its communication on the long-term growth potential of the market. They believe that focusing on the long game is crucial for weathering short-term volatility.

- Communication Strategies: BofA has utilized various channels to convey this message, including press releases highlighting promising sectors, investor calls emphasizing long-term outlooks, and analyst reports detailing their bullish predictions for specific companies.

- Long-Term Investment Strategies: The bank is emphasizing strategies that focus on sustainable growth, such as investments in renewable energy, technological advancements, and healthcare. They project strong returns over the next decade in these areas.

- Specific Sectors and Companies: BofA analysts have specifically highlighted the technology and healthcare sectors as prime areas for long-term investment, citing specific companies with strong growth potential and innovative products.

Risk Management and Diversification Strategies

BofA is advising investors to actively manage risks associated with high valuations through diversification and risk mitigation strategies. This is crucial for protecting portfolios from potential market downturns.

- Portfolio Diversification: They recommend spreading investments across different asset classes, sectors, and geographies to reduce the overall risk exposure. This includes a mix of stocks, bonds, and alternative investments.

- Hedging Techniques: The bank highlights the use of various hedging strategies, such as options and futures contracts, to protect against potential losses in specific sectors.

- Risk Tolerance Assessments: BofA offers personalized risk tolerance assessments to help investors determine an appropriate investment strategy based on their individual risk appetite and financial goals. This ensures their investments align with their comfort levels. Furthermore, BofA’s own robust risk management practices are a point of emphasis in their communication with investors.

Addressing Inflationary Pressures and Interest Rate Hikes

The impact of inflation and rising interest rates is a key concern for investors. BofA is addressing this head-on by offering clear analysis and practical strategies.

- Economic Forecasts: BofA’s economic forecasts provide insights into the likely trajectory of inflation and interest rates, helping investors understand the potential impact on stock valuations.

- Strategies for Navigating the Economic Environment: The bank advises investors to adjust their portfolios based on these forecasts, potentially shifting towards assets that perform well during periods of inflation or higher interest rates, like certain bonds.

- Executive and Analyst Quotes: BofA executives and analysts have publicly stated their views on the current economic climate and its impact on the market, offering reassurance and guidance to investors. For example, [insert a quote from a BofA executive or analyst regarding inflation and interest rates].

Market Reaction to BofA's Reassurances

The market's reaction to BofA's reassurances has been mixed, but generally positive. Analyzing both immediate and subsequent responses reveals some interesting trends.

Stock Market Performance Following BofA's Statements

- BofA Stock Price: Following BofA's statements, its stock price initially experienced a slight increase, reflecting positive investor sentiment. [Include a chart illustrating the change in BofA's stock price].

- Broader Market Indices: While broader market indices experienced some volatility, the impact of BofA’s statements appeared to have a stabilizing influence, particularly on investor confidence in the financial sector. [Include a chart illustrating the performance of relevant market indices].

- News Articles and Analyst Reports: Many financial news outlets and analyst reports have noted the calming effect of BofA's communication strategy on investor anxiety.

Investor Sentiment and Confidence Levels

While quantitative data on investor sentiment changes is limited immediately following BofA's statements, qualitative indicators suggest a positive shift.

- Surveys and Polls (if available): [Insert findings from relevant investor sentiment surveys or polls, if available].

- Investor Behavior: Anecdotal evidence suggests that investor trading activity, while still volatile, has shown signs of stabilization, indicating a reduction in panic selling.

- Expert Opinions: Financial experts have generally praised BofA's transparent communication and proactive strategies, deeming them effective in mitigating some investor anxieties related to high stock market valuations.

Conclusion: Navigating Investor Concerns with BofA's Guidance on High Stock Market Valuations

BofA's response to investor concerns regarding high stock market valuations has involved a multi-faceted approach emphasizing long-term growth, robust risk management, and transparent communication about inflationary pressures and interest rate hikes. While market reaction has been mixed, the overall effect appears to be a degree of stabilization and increased confidence. The key takeaways are the importance of long-term investment strategies, active risk management techniques, and the value of clear, proactive communication from financial institutions during periods of market uncertainty. Stay informed about navigating high stock market valuations with BofA's expert insights and resources. [Link to BofA's website]

Featured Posts

-

Memilih Motor Klasik Perbandingan Detail Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025

Memilih Motor Klasik Perbandingan Detail Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025 -

Philippe Tabarot Et La Greve A La Sncf Des Revendications Jugees Injustifiees

May 30, 2025

Philippe Tabarot Et La Greve A La Sncf Des Revendications Jugees Injustifiees

May 30, 2025 -

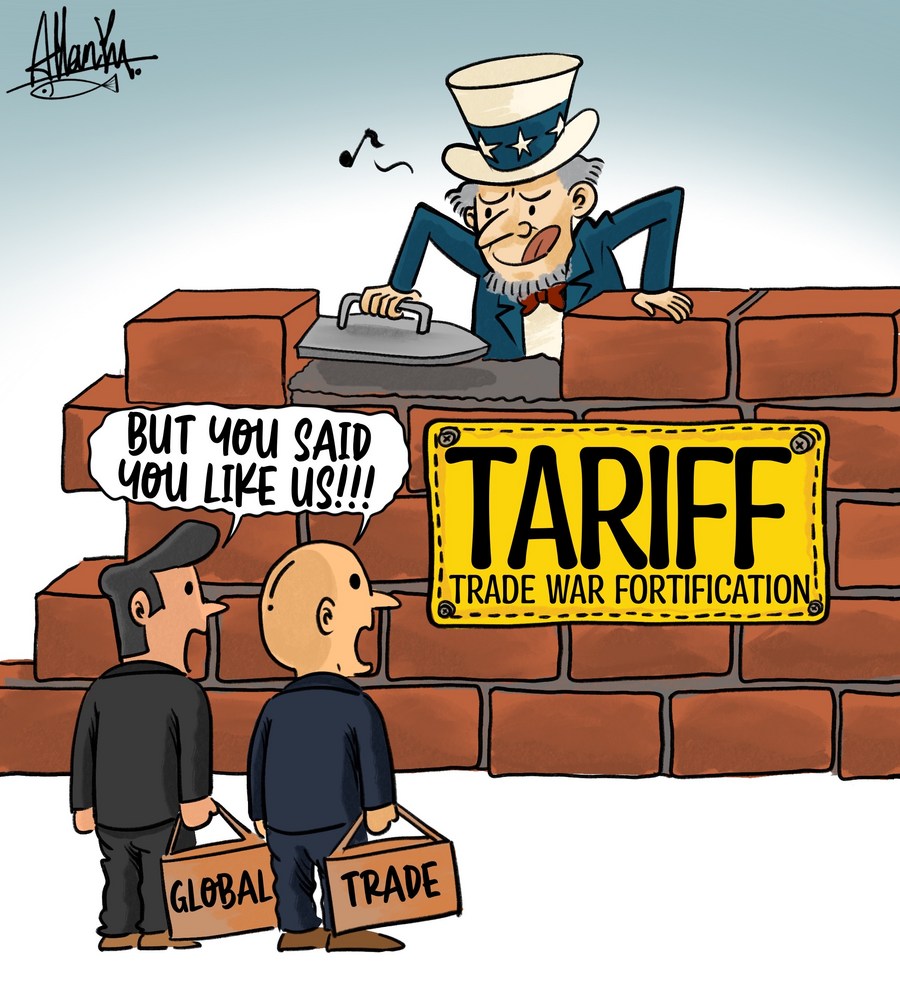

How Trumps Trade War Is Already Affecting Canada 8 Economic Indicators

May 30, 2025

How Trumps Trade War Is Already Affecting Canada 8 Economic Indicators

May 30, 2025 -

Metallicas Hampden Park Gig Glasgow Date Announced For World Tour

May 30, 2025

Metallicas Hampden Park Gig Glasgow Date Announced For World Tour

May 30, 2025 -

Bts 2025 Calendrier Des Epreuves Et Dates De Publication Des Resultats

May 30, 2025

Bts 2025 Calendrier Des Epreuves Et Dates De Publication Des Resultats

May 30, 2025