BofA Reassures Investors: Understanding Current Stock Market Valuations

Table of Contents

BofA's Stance on Current Market Valuations

BofA's recent analysis suggests a cautiously optimistic outlook on stock market valuations. While acknowledging the challenges presented by macroeconomic factors, their analysts believe that the market is not significantly overvalued, especially considering long-term growth prospects. This nuanced perspective moves beyond simple "bullish" or "bearish" labels, recognizing the complexities of the current environment.

- Key arguments supporting BofA's valuation assessment: BofA points to strong corporate earnings, though potentially impacted by inflation, and the resilience of the US economy as key factors supporting their view. They also highlight specific sectors poised for growth, even within a potentially slower economic expansion.

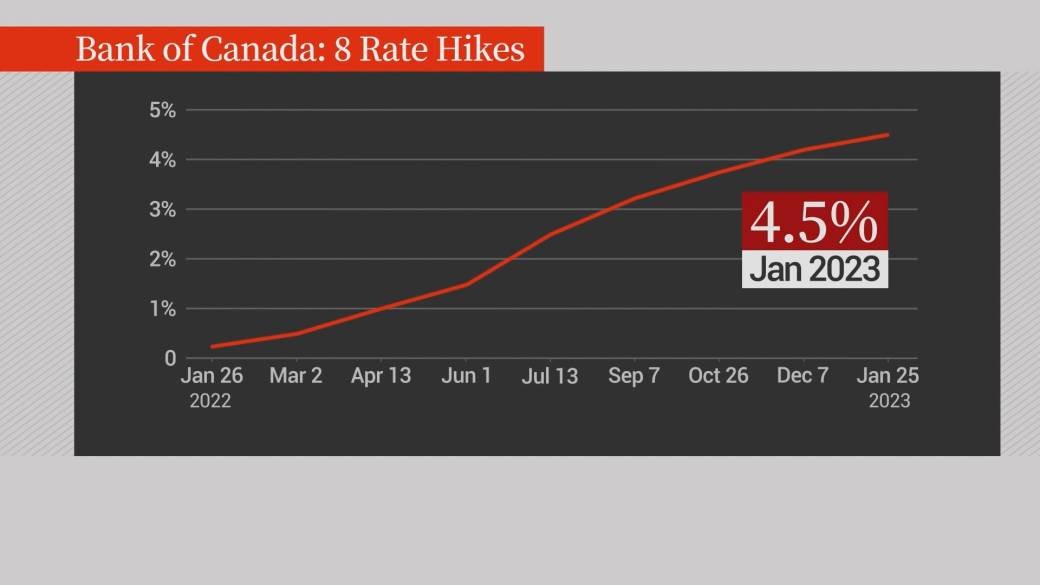

- Factors influencing BofA's perspective: Interest rate hikes, while presenting challenges, are also viewed as a necessary measure to curb inflation. The bank considers the impact of these hikes on various sectors and adjusts its outlook accordingly. Geopolitical risks are acknowledged, but BofA maintains that their overall impact on long-term valuations is likely to be contained.

- Specific sectors or industries BofA highlights: BofA analysts have emphasized the potential of sectors such as technology, healthcare, and certain areas of the consumer discretionary market, while expressing some caution regarding highly leveraged sectors sensitive to interest rate increases. Their reports often detail specific companies within these sectors demonstrating strong fundamentals and growth potential.

Analyzing the Key Factors Driving Market Valuation

Several macroeconomic factors are significantly impacting stock valuations. Understanding these factors is crucial for making informed investment decisions.

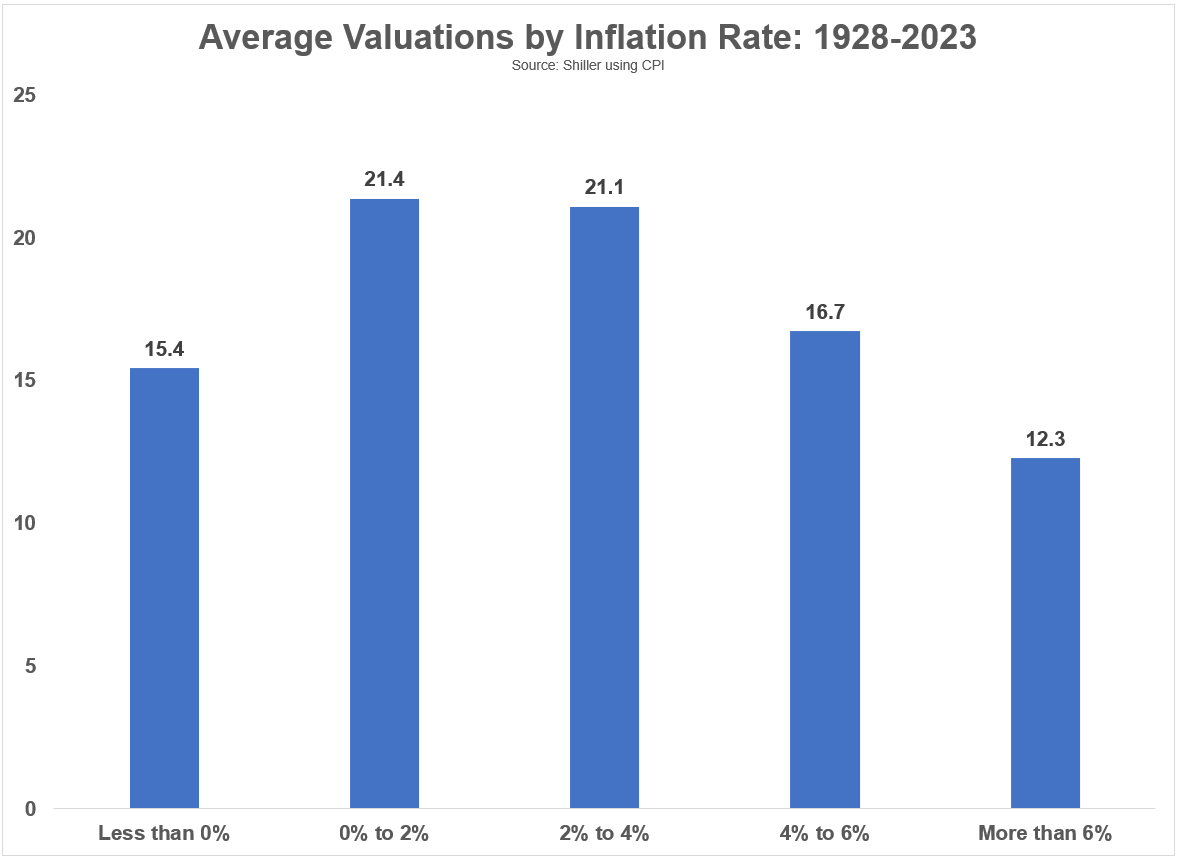

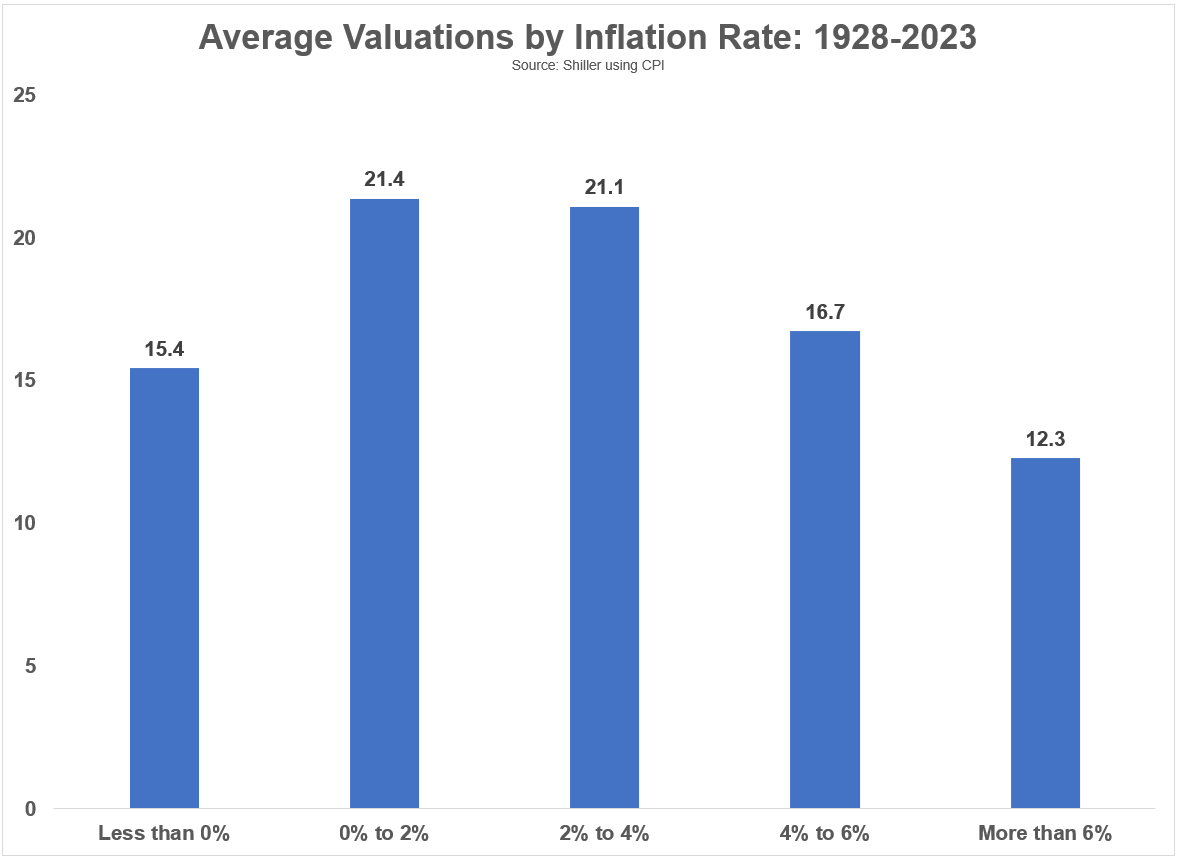

- Inflation and its impact on company earnings: High inflation erodes purchasing power and increases production costs, potentially squeezing company profits. BofA's analysis incorporates projections for inflation to assess its effect on future earnings and subsequent valuation adjustments.

- Interest rate hikes and their effect on investor sentiment: Higher interest rates increase borrowing costs for companies and reduce the attractiveness of equities relative to fixed-income investments. BofA's analysis considers the potential impact of interest rate hikes on various market segments and investment strategies.

- Geopolitical risks and their influence on market stability: Global uncertainties, such as the war in Ukraine and rising tensions in other regions, create market volatility and impact investor confidence. BofA's analysts assess these risks and their potential impact on specific sectors and global markets.

- Supply chain disruptions and their effect on corporate profits: Ongoing supply chain issues continue to affect production and increase costs for businesses. BofA considers the resilience of various supply chains and their implications for company performance when evaluating market valuations.

How Investors Can Navigate Current Market Uncertainty

BofA's analysis, coupled with a broader understanding of market dynamics, informs a strategic approach to investing during uncertain times.

- Strategies to mitigate risks in a volatile market: Diversification across different asset classes, including stocks, bonds, and potentially alternative investments, is crucial. A well-diversified portfolio can help reduce overall risk. Investors may also consider hedging strategies using derivatives or other instruments.

- Importance of long-term investment strategies: Maintaining a long-term perspective is crucial. Short-term market fluctuations should not dictate long-term investment strategies. Investors with a longer time horizon may find opportunities in a downturn.

- The role of professional financial advice: Seeking guidance from a qualified financial advisor is recommended, particularly for investors who lack experience or feel overwhelmed by market complexities. A financial advisor can help tailor a strategy based on individual risk tolerance and investment goals.

Understanding BofA's Investment Strategies and Recommendations

BofA's investment strategies often reflect their overall market assessment. While specific recommendations are usually for their clients, public reports offer clues to their overall approach.

- Summary of BofA's recommended investment sectors or asset classes: BofA typically advises a mix of equities and fixed-income investments, with sector allocations based on their assessment of growth potential and risk.

- Rationale behind their recommendations: Their recommendations usually emphasize companies with strong fundamentals, sustainable growth potential, and reasonable valuations relative to their peers.

- Potential risks and rewards associated with these recommendations: Like any investment, BofA's recommendations carry potential risks. Understanding these risks and weighing them against potential rewards is key to making informed decisions.

BofA Reassures Investors: Taking Action on Market Valuations

BofA's message emphasizes a cautious but optimistic outlook on current stock market valuations. While acknowledging the challenges presented by inflation, interest rate hikes, and geopolitical risks, they highlight opportunities for long-term growth. Understanding these factors and employing effective risk management strategies, such as portfolio diversification, is crucial for investors. By carefully considering BofA's perspective on market valuations, and seeking professional advice where needed, you can develop a robust investment plan to navigate the current market environment successfully. Take action today to understand BofA's perspective on market valuations and assess your investment strategy in light of their reassurances.

Featured Posts

-

Escape To The Country Benefits And Challenges Of Rural Life

May 24, 2025

Escape To The Country Benefits And Challenges Of Rural Life

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025 -

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

May 24, 2025 -

Today Shows Dylan Dreyer Distancing From Co Stars Following Mishap

May 24, 2025

Today Shows Dylan Dreyer Distancing From Co Stars Following Mishap

May 24, 2025

Latest Posts

-

Absence From Today Show Cohosts Reveal Support For Colleague

May 24, 2025

Absence From Today Show Cohosts Reveal Support For Colleague

May 24, 2025 -

Elena Rybakina Itogi Vystupleniya Vo Vtorom Kruge Rimskogo Turnira

May 24, 2025

Elena Rybakina Itogi Vystupleniya Vo Vtorom Kruge Rimskogo Turnira

May 24, 2025 -

Rybakina Prodolzhaet Pobednuyu Seriyu V Rime Proydya V Tretiy Krug

May 24, 2025

Rybakina Prodolzhaet Pobednuyu Seriyu V Rime Proydya V Tretiy Krug

May 24, 2025 -

Potryasayuschaya Igra Rybakinoy Put V Tretiy Krug Turnira V Rime

May 24, 2025

Potryasayuschaya Igra Rybakinoy Put V Tretiy Krug Turnira V Rime

May 24, 2025 -

Indian Wells 2025 Swiatek And Rybakinas Road To The Quarterfinals

May 24, 2025

Indian Wells 2025 Swiatek And Rybakinas Road To The Quarterfinals

May 24, 2025