BofA Reassures Investors: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Analysis: Factors Supporting Current Valuations

BofA's positive assessment of current stock market valuations is grounded in several key factors. Their analysis considers a range of economic indicators and corporate performance data to arrive at a cautiously optimistic view. Understanding these factors is crucial for navigating the current market climate and making informed investment decisions regarding BofA's assessment of stock valuations.

Strong Corporate Earnings and Profitability

BofA's analysis highlights robust corporate earnings and profitability as a primary support for current valuations. Many sectors are demonstrating impressive growth, exceeding expectations and contributing to a healthier overall market. This strong performance suggests that current valuations are, to a large extent, justified by underlying fundamentals.

- Corporate earnings growth: BofA points to significant growth in corporate earnings, particularly within the technology, healthcare, and consumer staples sectors.

- Improved profit margins: Many companies have successfully managed to maintain or improve profit margins despite inflationary pressures, showcasing efficient cost management and pricing strategies.

- Sector performance: The energy sector, for example, has experienced a significant boost due to geopolitical events, further contributing to overall market strength. BofA's earnings forecast incorporates these positive trends.

Positive Economic Outlook

BofA's positive outlook on current market valuations is further bolstered by their positive economic forecast. While acknowledging challenges, they anticipate continued, albeit moderated, economic growth. This outlook considers various key economic indicators and their projected trajectory.

- Economic growth: BofA predicts sustained economic growth, albeit at a slower pace than previous years, mitigating fears of a sharp recession.

- Inflation expectations: While acknowledging persistent inflationary pressures, BofA anticipates a gradual decline in inflation rates over the coming quarters, easing concerns about its impact on corporate profitability and consumer spending.

- Interest rate hikes: BofA's analysis incorporates the impact of anticipated interest rate hikes by central banks, suggesting these increases are largely factored into current valuations and that they're not expected to significantly derail economic growth. BofA's economic forecast provides a detailed assessment of these interwoven factors.

Long-Term Growth Potential

Looking beyond short-term market fluctuations, BofA emphasizes the significant long-term growth potential embedded within the current market. This perspective directly addresses investor concerns about potential overvaluation. They highlight several key drivers expected to fuel future market expansion, supporting current valuations in a long-term context.

- Technological advancements: Continued advancements in artificial intelligence, renewable energy, and biotechnology are expected to drive substantial economic growth and create new investment opportunities.

- Emerging markets: The growth potential of emerging markets continues to be a significant driver of long-term market expansion.

- Demographic shifts: Changing demographics, particularly in developing nations, will create new market demands and fuel economic growth. BofA's long-term outlook accounts for these significant growth drivers.

Addressing Investor Concerns: Why the Market Isn't Overvalued (According to BofA)

While acknowledging the validity of some investor concerns, BofA argues that the current market is not overvalued based on various valuation metrics and a comprehensive assessment of economic factors. Their analysis directly addresses key anxieties to provide a more balanced view.

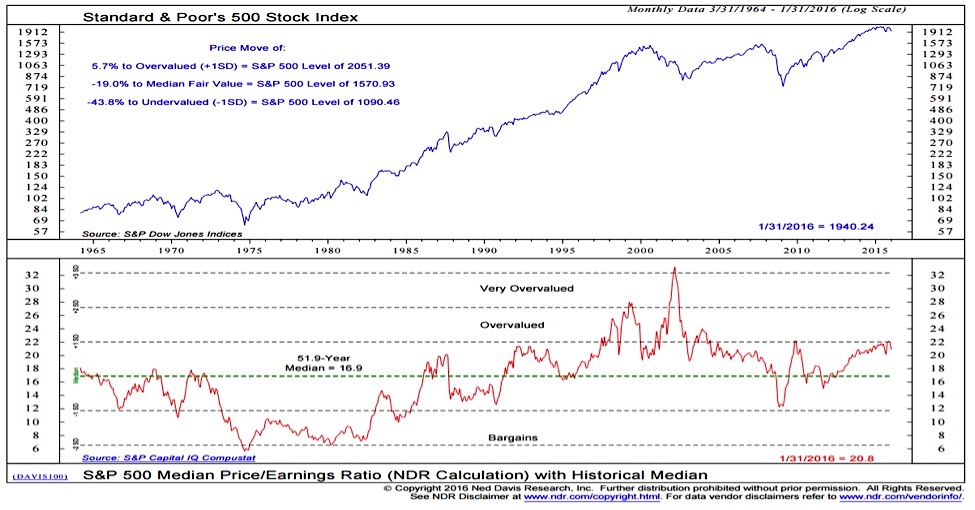

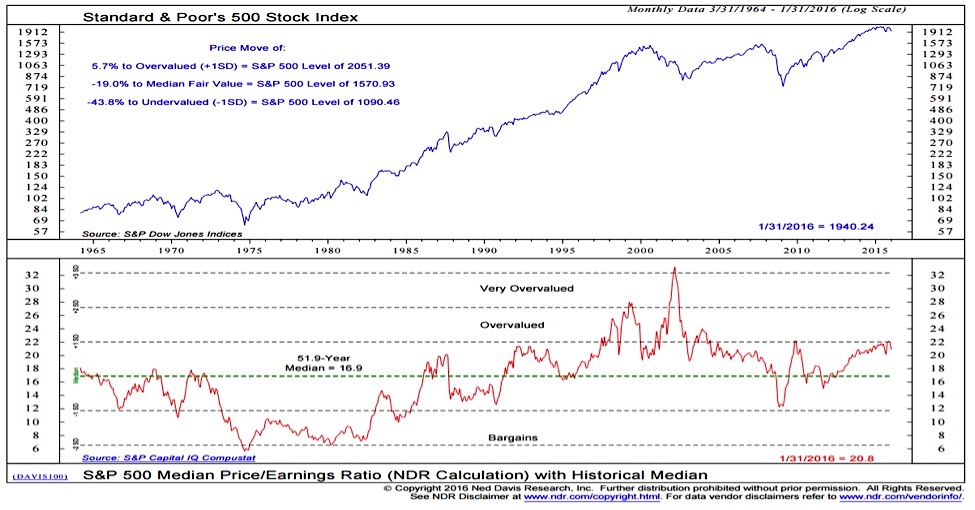

Valuation Metrics & Comparisons

BofA justifies current valuations using a variety of metrics, comparing them to historical data and other market benchmarks. Their findings suggest that current valuations are not excessive when considered in a broader context.

- Price-to-earnings ratio (P/E): BofA's analysis of P/E ratios across various sectors shows that while some sectors might appear expensive, the overall market is not significantly overvalued compared to historical averages, adjusted for prevailing interest rates and economic conditions.

- Market capitalization: When considering overall market capitalization relative to economic output, BofA suggests the market is fairly valued, especially when considering long-term growth prospects.

- Valuation multiples: BofA employs a range of valuation multiples, ensuring a comprehensive assessment of market valuations rather than relying solely on one metric.

Addressing Inflationary Pressures

BofA acknowledges the impact of inflationary pressures but believes their effect on stock market valuations is largely factored in. They also outline strategies for mitigating inflation's impact on investments.

- Inflation risk: BofA's analysis incorporates inflation's impact on corporate earnings and consumer spending. They acknowledge the risk but highlight the resilience of many companies in adjusting to inflationary environments.

- Interest rate sensitivity: BofA assesses the sensitivity of different sectors to interest rate hikes and identifies those less susceptible to changes in monetary policy.

- Inflation hedging strategies: BofA suggests strategies for mitigating inflation risks through diversified portfolio management and investments in sectors less susceptible to inflation. BofA's inflation analysis offers detailed strategies to help investors navigate inflationary pressures.

BofA's View on Stock Market Valuations – A Reason for Confidence?

In conclusion, BofA's analysis suggests that current stock market valuations, while potentially seeming high in the short term, are largely justified by robust corporate earnings, a positive economic outlook, and significant long-term growth potential. By considering various valuation metrics and addressing concerns around inflation, BofA presents a compelling case for a more balanced perspective on the market's current state. The key takeaway is the importance of adopting a long-term investment strategy and avoiding knee-jerk reactions to short-term market fluctuations. To gain further insight into BofA's analysis and perspective on BofA stock market valuations, we encourage you to explore their latest research reports and market commentary. Consider BofA's analysis as you plan your investment strategy.

Featured Posts

-

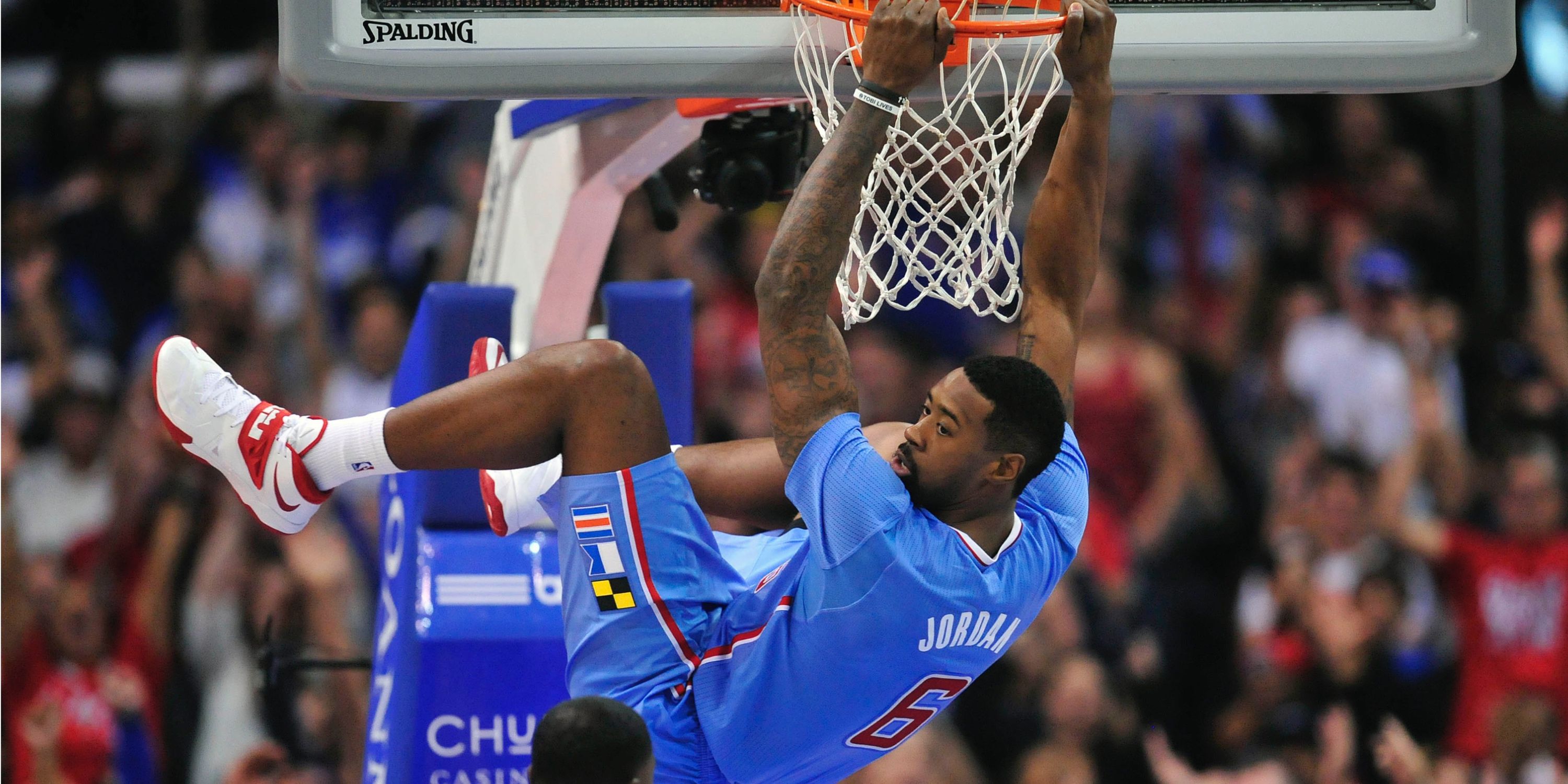

De Andre Jordan Makes Nba History In Nuggets Bulls Game

May 08, 2025

De Andre Jordan Makes Nba History In Nuggets Bulls Game

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025 -

Krachy Pwlys Ky Karkrdgy Pr Swalat Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Ky Karkrdgy Pr Swalat Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025 -

Iznena Enje U Ligi Shampiona Seged Eliminishe Pariz

May 08, 2025

Iznena Enje U Ligi Shampiona Seged Eliminishe Pariz

May 08, 2025