BofA's Reassurance: Why Current Stock Market Valuations Aren't A Problem

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

BofA's recent reports and statements have struck a decidedly optimistic tone regarding current stock market valuations. They suggest that despite headline risks, several underlying factors point towards continued, albeit potentially moderated, growth.

Factors Supporting BofA's Optimism

BofA's optimism stems from a confluence of factors:

- Strong Corporate Earnings Growth: Despite inflationary pressures, many companies have demonstrated resilience, reporting strong earnings growth. This suggests pricing power and adaptability in the face of economic headwinds. This robust earnings growth is a key component in justifying current valuations.

- Resilient Consumer Spending and Employment: Consumer spending remains relatively robust, indicating a healthy economy and supporting corporate revenue streams. Low unemployment figures further bolster this positive outlook, indicating consumer confidence and spending power.

- Potential for Future Interest Rate Cuts: BofA anticipates that the Federal Reserve may eventually pivot towards interest rate cuts, a move that could stimulate economic activity and further support market valuations. This expectation is predicated on a successful taming of inflation.

- Positive Long-Term Growth Prospects: BofA highlights several sectors poised for significant long-term growth. This includes sectors like technology, benefiting from ongoing digital transformation, and healthcare, driven by an aging population and advancements in medical technology. For example, BofA points to the continued growth in cloud computing as a major driver in the tech sector’s valuation.

- Specific Examples: BofA cites specific companies and sectors showing strong performance and future potential, often detailing their projected growth rates and market share. These examples are carefully chosen to support their overall bullish narrative.

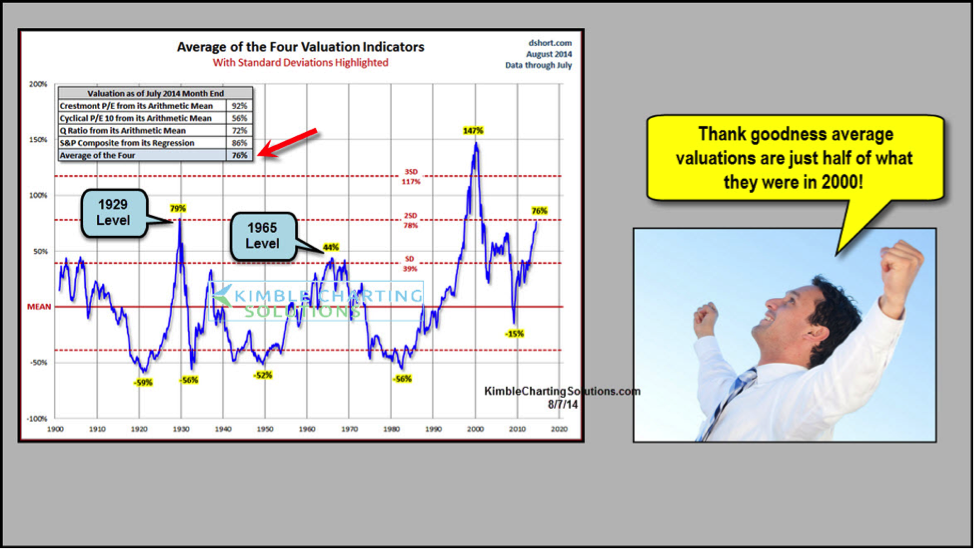

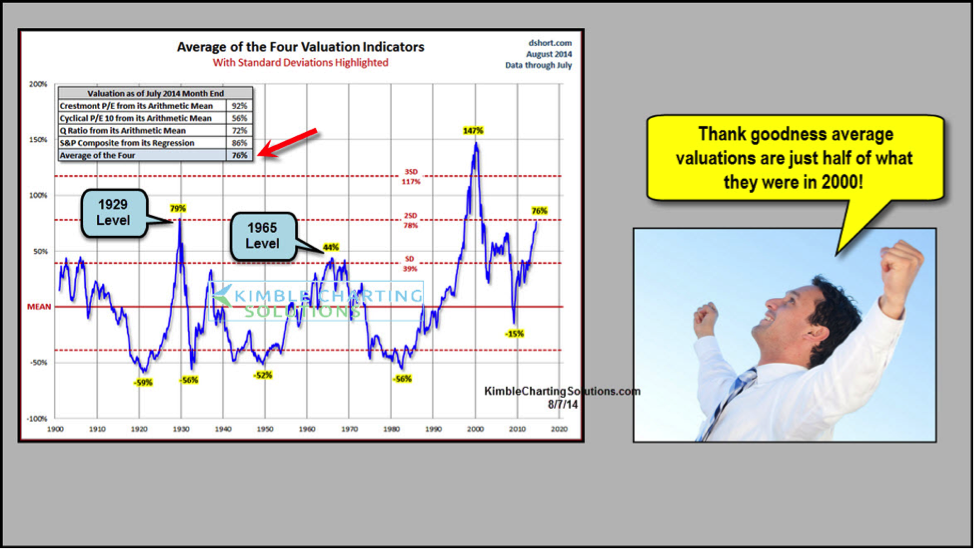

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

A common concern revolves around high price-to-earnings ratios (P/E ratios), which can suggest overvaluation. BofA addresses this by emphasizing the sustainability of earnings growth.

- Sustainability of Earnings Growth: BofA argues that the current earnings growth is not merely temporary and that future earnings will support current valuations. They highlight the resilience of many companies in the face of inflation.

- Historical Context: BofA provides comparisons to historical P/E ratios, contextualizing current levels within a longer-term perspective. They highlight periods of similar high P/E ratios followed by periods of market growth.

- P/E Ratio Adjustments: BofA acknowledges that different adjustments to the P/E ratio (e.g., considering future earnings growth) paint a different picture, indicating that a simple P/E ratio comparison isn’t the complete story.

Analyzing the Underlying Economic Factors

Understanding the broader economic landscape is crucial to evaluating BofA's assessment of stock market valuations.

Inflation's Impact and BofA's Perspective

BofA closely monitors inflation's trajectory, acknowledging its influence on valuations.

- Inflation's Impact on Valuations: BofA anticipates that inflation will gradually cool down, reducing its negative pressure on market valuations. They acknowledge that unexpected inflationary surges could negatively impact the markets.

- Predictions and Forecasts: BofA provides detailed predictions and forecasts for inflation, typically basing their analysis on economic indicators and Federal Reserve policies. These forecasts are central to their evaluation of the stock market.

- Federal Reserve's Actions: BofA assesses the Federal Reserve's policy responses and their likely effects on inflation and market valuations. This incorporates an understanding of monetary policy and its influence on economic growth and asset prices.

Growth Potential and Sector Analysis

BofA's analysis identifies specific sectors exhibiting strong growth potential.

- High-Growth Sectors: BofA highlights sectors like technology (particularly artificial intelligence and cloud computing), healthcare (biotechnology and pharmaceuticals), and renewable energy as possessing significant growth drivers.

- Rationale for Sector Selection: BofA provides detailed rationales for favoring these sectors, analyzing their long-term trends, technological advancements, and regulatory environments.

- Data Points: The analysis is supported by robust data points, including industry reports, company performance data, and market projections to strengthen their arguments.

Alternative Perspectives and Cautions

It's essential to acknowledge alternative viewpoints and potential risks.

Potential Risks and Counterarguments

While BofA presents a positive outlook, several counterarguments exist:

- Economic Slowdowns: Unforeseen economic slowdowns or recessions could significantly impact corporate earnings and market valuations, dampening the positive outlook presented by BofA.

- Criticisms of BofA's Analysis: Some critics argue that BofA's analysis is overly optimistic and overlooks potential risks, such as geopolitical instability or supply chain disruptions.

- Market Vulnerabilities: Certain market vulnerabilities, such as high levels of corporate debt or potential asset bubbles in specific sectors, might not be fully accounted for in BofA's assessment.

Conclusion

BofA's analysis suggests that current stock market valuations are not necessarily a cause for immediate concern. Their positive outlook is grounded in strong corporate earnings, resilient consumer spending, the potential for future interest rate cuts, and the long-term growth potential of specific sectors. However, it’s crucial to acknowledge potential risks such as economic slowdowns and unforeseen events. Understanding BofA's perspective on current stock market valuations is crucial for informed investment strategies. Conduct thorough research and consult a financial advisor before making any investment decisions based on this analysis of stock market valuations.

Featured Posts

-

Strained Ties Examining The Growing Rift Between The U S And China

Apr 22, 2025

Strained Ties Examining The Growing Rift Between The U S And China

Apr 22, 2025 -

Rallies Against Trump Citizen Voices From Across The Us

Apr 22, 2025

Rallies Against Trump Citizen Voices From Across The Us

Apr 22, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025 -

Googles Monopoly Why Breakup Talk Is Louder Than Ever

Apr 22, 2025

Googles Monopoly Why Breakup Talk Is Louder Than Ever

Apr 22, 2025 -

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025