BofA's Take: Are High Stock Market Valuations Cause For Concern?

Table of Contents

BofA's Current Stance on Market Valuations

BofA Securities regularly publishes research assessing market health and valuations. Their analysis often incorporates various valuation metrics to gauge whether markets are fairly priced, overvalued, or undervalued. Key metrics include the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation ratios.

- Key findings from BofA's reports: BofA's recent research frequently highlights the elevated levels of the P/E ratio and Shiller PE ratio compared to historical averages. This suggests that, based on these traditional metrics, the market is trading at a premium.

- Specific sectors or indices BofA highlights as overvalued or undervalued: BofA's reports often dissect valuations across sectors. For example, they might identify technology stocks as potentially overvalued while highlighting certain value sectors as relatively more attractive. Specific sectors and the degree of over/undervaluation can fluctuate based on the economic climate.

- BofA's predicted market trajectory based on their valuation analysis: BofA's predictions are nuanced and rarely involve definitive forecasts of crashes or booms. Instead, their projections often consider a range of potential outcomes, factoring in both valuation levels and other macroeconomic indicators. Their recent commentary may include caveats about potential corrections or periods of slower growth, tied to the current high valuations.

Factors Beyond Valuation Metrics

While high valuations raise concerns, it’s crucial to consider macroeconomic factors that can influence market performance independently. These factors can either amplify or mitigate the risks associated with elevated valuations.

-

Interest rate environment and its impact on stock prices: Low interest rates can support higher stock valuations, as investors seek higher returns in the equity market. Conversely, rising interest rates can put downward pressure on stock prices. BofA's analysts regularly monitor the Federal Reserve's monetary policy decisions and their expected effect on market valuations.

-

Inflationary pressures and their effect on company earnings: High inflation can erode corporate profit margins, impacting earnings growth and potentially justifying lower valuations. BofA's analysis closely follows inflation data and its implications for corporate profitability.

-

Global economic growth forecasts and their influence on market sentiment: Robust global growth can support higher stock prices, even if valuations seem high by historical standards. Conversely, slowing global growth can lead to market corrections, regardless of valuation levels. BofA incorporates global economic forecasts into its analysis to gauge the potential impact on market sentiment and stock prices.

-

Specific examples illustrating how these factors might counteract high valuations: For instance, strong corporate earnings growth, driven by technological innovation or global expansion, can justify higher P/E ratios. Similarly, low interest rates can support elevated valuations, even in the face of elevated inflation, if growth continues to be healthy.

-

Counterarguments to the idea that high valuations automatically equal market crash: Historically, periods of high valuations haven't always resulted in immediate market crashes. Factors like strong earnings growth, low interest rates, or positive economic sentiment can prolong periods of elevated valuations.

Investment Strategies in a High-Valuation Environment

Given BofA's analysis and the broader economic context, investors need to adjust their strategies accordingly.

-

Defensive investment strategies: This approach might include increasing allocations to value stocks (companies trading at lower P/E ratios relative to their earnings growth), higher-quality bonds, and dividend-paying stocks for a steady income stream. This reduces exposure to high-growth, potentially overvalued sectors.

-

Growth-oriented strategies: Some investors might still pursue growth opportunities. This could involve identifying undervalued growth stocks within specific sectors, betting on innovative companies that have the potential for high future earnings, or pursuing sector-specific bets within the broader market. This inherently carries higher risk in the context of high overall valuations.

-

The importance of diversification: Diversification across asset classes and sectors is crucial in mitigating risks associated with high valuations. This helps to buffer against potential losses in one area by offsetting gains in others.

-

Specific examples of investment strategies aligned with BofA's perspective: BofA's strategists might recommend overweighting certain sectors they deem less overvalued based on their analysis. This may include, for example, defensive sectors like consumer staples or healthcare.

-

Risk assessment for each proposed strategy: Each strategy carries varying degrees of risk. Defensive strategies generally offer lower risk but potentially lower returns. Growth-oriented strategies offer potentially higher returns but involve higher risk, especially in a high-valuation environment.

-

Recommendations for individual investors vs. institutional investors: Individual investors might benefit from focusing on simpler strategies like broad market diversification, while institutional investors with more resources might employ more complex strategies such as arbitrage or hedging.

Historical Context and Comparisons

Examining past periods of high valuations provides valuable insights.

- Specific examples of historical periods with comparable valuations: The late 1990s dot-com bubble and the period leading up to the 2008 financial crisis are often cited as examples of periods with extremely high valuations followed by significant market corrections.

- Outcomes of those past periods (bull market continuation, correction, or crash): In some cases, high valuations were followed by extended periods of bull markets, while in others, they preceded significant market corrections or crashes.

- Key differences between the current environment and historical parallels: It's crucial to note that each market cycle is unique. Current economic conditions, interest rate environments, and technological advancements might differ significantly from past periods with comparable valuations.

Conclusion: BofA's Perspective on High Stock Market Valuations – What's Next?

BofA's analysis suggests that high stock market valuations present risks, but the extent of those risks depends on various interconnected factors. While elevated valuation metrics raise concerns, macroeconomic factors like interest rates, inflation, and global growth significantly influence market performance. This necessitates a nuanced approach to investment strategies, incorporating both defensive and growth-oriented strategies, and emphasizing the critical role of diversification.

To navigate this environment effectively, investors should conduct their own thorough research, carefully consider BofA's insights and other reputable analyses, and make informed investment decisions aligned with their individual risk tolerance and financial goals. Remember, managing your portfolio effectively in a high stock market valuation environment requires careful planning and regular monitoring. For access to BofA's research and resources, [link to BofA research].

Featured Posts

-

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025 -

Tarik Skubals Dominant Performance 7 Shutout Innings Against Brewers

Apr 23, 2025

Tarik Skubals Dominant Performance 7 Shutout Innings Against Brewers

Apr 23, 2025 -

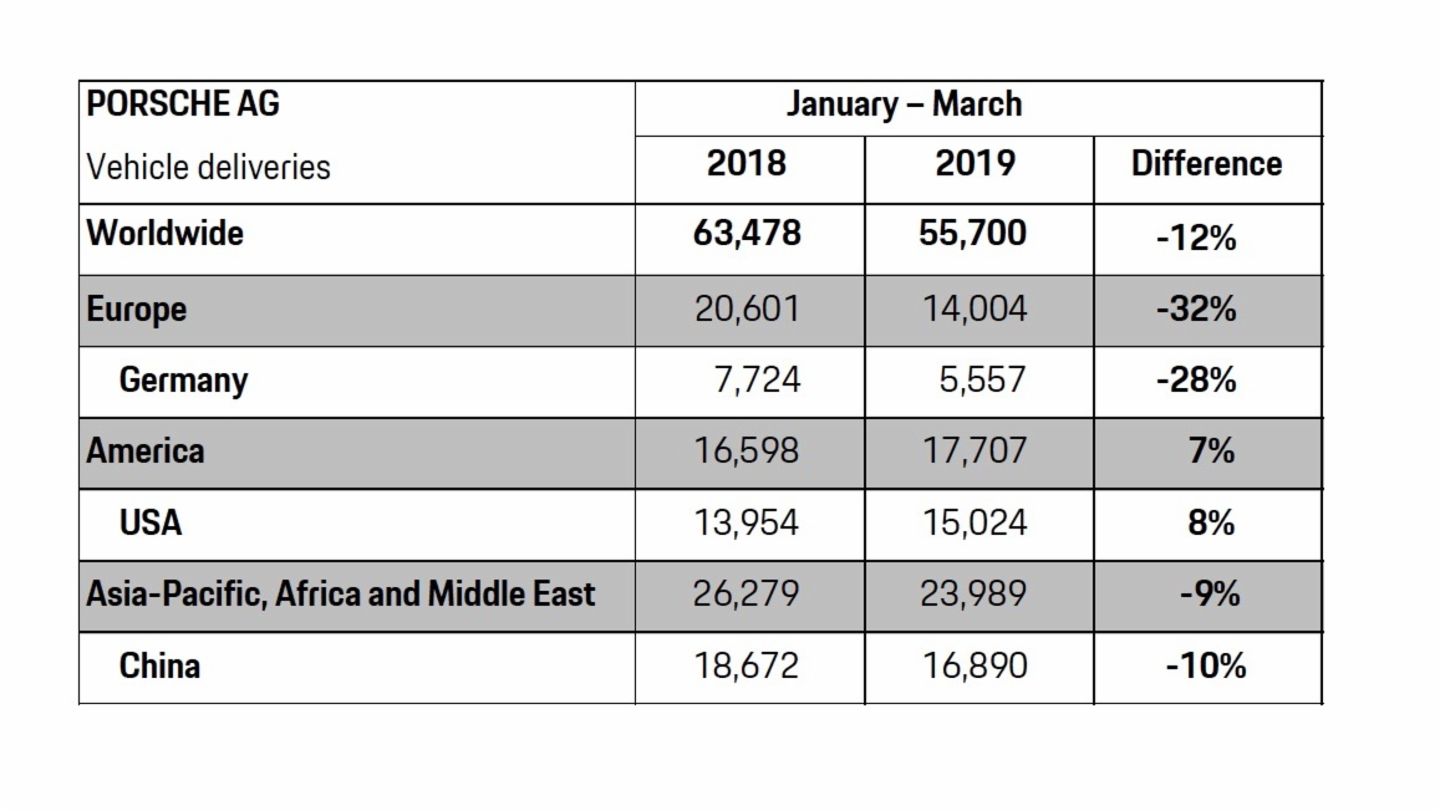

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 23, 2025

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 23, 2025 -

Crushing Victory For Spartak Moscow In Match Against Rostov 23rd Round Of Rpl

Apr 23, 2025

Crushing Victory For Spartak Moscow In Match Against Rostov 23rd Round Of Rpl

Apr 23, 2025 -

Exec Office365 Breach Nets Millions For Hacker Feds Allege

Apr 23, 2025

Exec Office365 Breach Nets Millions For Hacker Feds Allege

Apr 23, 2025