BofA's Take: Are High Stock Market Valuations Really A Worry For Investors?

Table of Contents

BofA's Current Market Assessment and Valuation Metrics

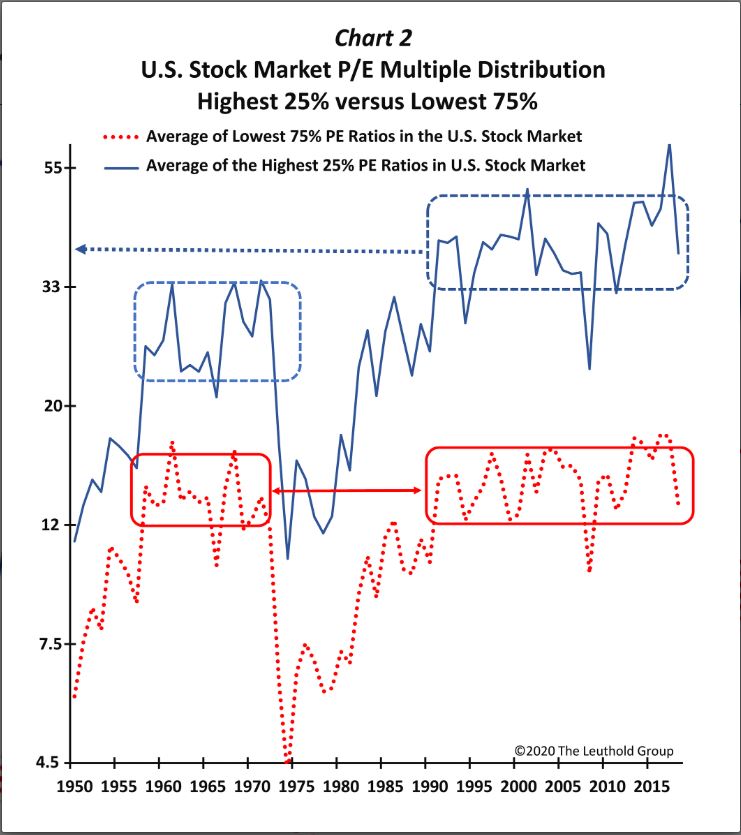

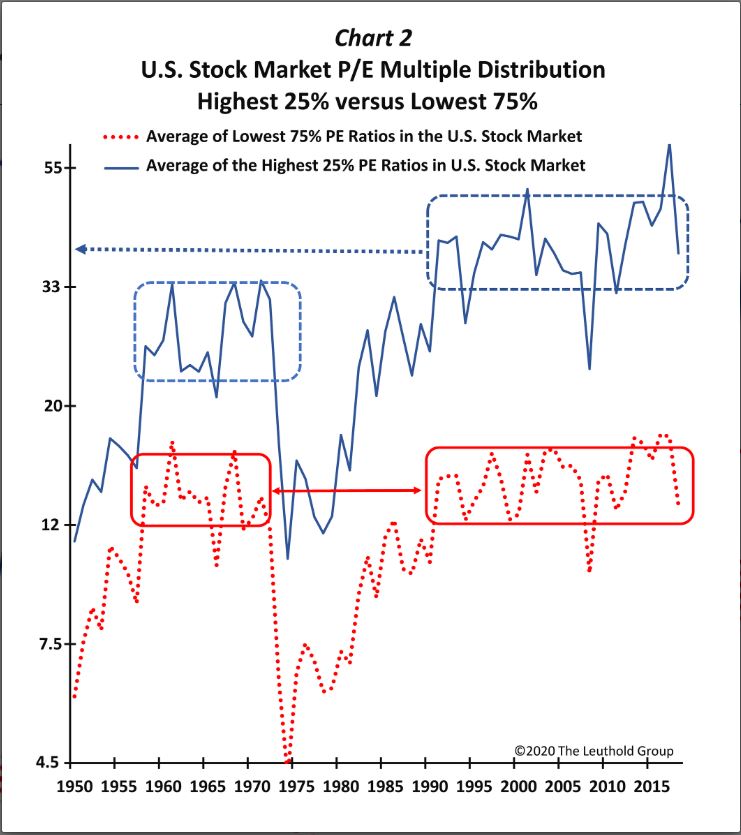

BofA regularly publishes reports assessing the overall health and valuation of the stock market. Their analysis incorporates various stock market valuation metrics to gauge the market's current state relative to historical trends and intrinsic value. Key metrics employed include the price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), and market capitalization, all of which are used to determine valuation multiples. These multiples compare a company's stock price to its fundamentals, offering a perspective on whether the market is overvalued or undervalued.

-

Key findings from BofA's reports: Recent BofA reports often highlight elevated valuation multiples across several sectors, suggesting a potentially expensive market. However, the assessment isn't uniformly negative; some sectors show more reasonable valuations than others.

-

Current valuation levels vs. historical averages: BofA's analysis compares current P/E and P/S ratios to historical averages. This comparison helps determine if current valuations are significantly above or below historical norms, offering insight into potential overvaluation. For example, a comparison might show that current P/E ratios are higher than the average over the past 20 years, signaling potentially higher risk.

-

Sectors with high/low valuations: BofA's reports often pinpoint specific sectors exhibiting exceptionally high or low valuations. This granular analysis provides investors with insights to inform their sector-specific investment decisions. For instance, the technology sector might be highlighted as having particularly high valuations compared to its historical average and other sectors.

Factors Contributing to High Stock Market Valuations

Several economic and market forces contribute to the current high stock market valuations. Understanding these underlying factors is crucial for interpreting BofA's assessment and forming your own investment strategy.

-

Low interest rates: Historically low interest rates make borrowing cheaper for companies and incentivize investors to seek higher returns in the stock market, driving up prices.

-

Robust corporate earnings: Strong corporate earnings, especially in certain sectors, support higher stock prices as investors are willing to pay more for companies demonstrating profitability and growth potential.

-

Technological advancements and innovation: Breakthroughs in technology often fuel significant stock market gains as investors bet on the future growth potential of innovative companies. This is a significant factor in current high valuations for technology stocks.

-

Investor sentiment and confidence: Positive investor sentiment and high levels of confidence often push valuations higher as more investors seek to participate in the market's upward trajectory. Market psychology plays a substantial role in determining stock prices.

Potential Risks Associated with High Valuations

While high valuations can reflect optimism and future growth, they also carry inherent risks. BofA's analysis likely emphasizes these potential downsides.

-

Market correction or crash: High valuations often precede market corrections or crashes. A sudden drop in prices can significantly impact investor portfolios.

-

Increased market volatility: High-valuation markets tend to be more volatile, meaning prices can fluctuate more dramatically in the short term. This volatility increases risk for investors.

-

Inflation and rising interest rates: Rising inflation and subsequent interest rate hikes by central banks can negatively impact stock valuations. Higher interest rates increase borrowing costs for companies and make bonds more attractive to investors, potentially leading to a shift away from stocks.

-

Recession risk: High valuations, coupled with economic uncertainties, increase the risk of a recession. A recession significantly impacts corporate earnings and investor confidence, leading to lower stock prices.

BofA's Recommended Investment Strategies in a High-Valuation Market

Navigating a high-valuation market requires a carefully considered investment strategy. BofA's recommendations might emphasize the following:

-

Diversification: Spreading investments across different asset classes and sectors reduces the impact of a downturn in any single area.

-

Focus on value investing: Value investing prioritizes undervalued stocks with strong fundamentals, offering potential for appreciation while mitigating some of the risks associated with high valuations.

-

Long-term investment horizon: A long-term perspective helps investors weather short-term market fluctuations and benefit from long-term growth.

-

Risk management: Employing appropriate risk management techniques, such as stop-loss orders and diversification, protects against significant losses.

-

Portfolio optimization and asset allocation: Adjusting portfolio allocations to align with individual risk tolerance and long-term goals is critical in a high-valuation environment.

Conclusion

BofA's analysis of high stock market valuations provides crucial context for investors. While strong economic factors and corporate performance contribute to elevated prices, the potential risks associated with these high valuations should not be overlooked. Understanding the various valuation metrics, the underlying economic forces, and potential risks is critical for making informed decisions. BofA likely advocates for a cautious approach, emphasizing diversification, risk management, and a long-term investment strategy. Remember to consult with a financial advisor to develop a personalized investment plan that aligns with your individual risk tolerance and financial goals. Understand your risk tolerance in today's high-valuation market and learn more about managing your investment portfolio in light of high stock market valuations by exploring further resources on BofA's website and other reputable financial sources.

Featured Posts

-

Patra Lista Efimereyonton Iatron Savvatokyriako

May 20, 2025

Patra Lista Efimereyonton Iatron Savvatokyriako

May 20, 2025 -

World Class Striker Headed To Man Utd Agents Arrival Fuels Speculation

May 20, 2025

World Class Striker Headed To Man Utd Agents Arrival Fuels Speculation

May 20, 2025 -

Projet 4eme Pont D Abidjan Tout Savoir Sur Les Delais Le Cout Et Les Depenses

May 20, 2025

Projet 4eme Pont D Abidjan Tout Savoir Sur Les Delais Le Cout Et Les Depenses

May 20, 2025 -

Cote D Ivoire 4eme Pont D Abidjan Delais Cout Et Depenses Expliques

May 20, 2025

Cote D Ivoire 4eme Pont D Abidjan Delais Cout Et Depenses Expliques

May 20, 2025 -

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 20, 2025

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 20, 2025