BofA's Take On Stretched Stock Market Valuations: A Reason For Investor Confidence

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's surprisingly positive outlook rests on several key pillars. They argue that while valuations are high compared to historical averages, several factors mitigate the risks associated with these elevated levels.

Strong Corporate Earnings and Profitability

BofA points to robust corporate earnings and profitability as a primary justification for their bullish stance. Their analysis indicates that many companies are exceeding earnings expectations, demonstrating resilience in the face of economic uncertainty. For example, BofA cites data showing a significant increase in S&P 500 earnings per share (EPS) growth in the past quarter, outpacing previous forecasts. This strong performance, they argue, supports the current valuations, at least partially.

- Key Data Point: BofA's research highlights a X% increase in S&P 500 EPS compared to the same period last year (replace X with actual data if available).

- Industry Examples: Strong earnings growth is particularly evident in the technology and healthcare sectors, which are key drivers of overall market performance.

Low Interest Rates and Continued Monetary Support

The persistently low interest rate environment, coupled with potential further monetary easing by central banks, plays a significant role in BofA's analysis. Low interest rates make borrowing cheaper for businesses, supporting investment and growth. Furthermore, they make bonds less attractive relative to stocks, driving capital towards equities. BofA's projections (if available) for interest rate movements should be included here, indicating the expected duration of this supportive monetary policy.

- Impact on Valuations: Lower interest rates reduce the discount rate used in valuation models, leading to higher present values of future earnings, thus justifying higher stock prices.

- Monetary Policy Influence: BofA's analysis should include commentary on the likelihood of further quantitative easing or other supportive monetary measures.

Technological Innovation and Long-Term Growth Prospects

BofA's assessment also considers the transformative power of technological innovation and its influence on long-term growth prospects. They argue that emerging technologies, such as artificial intelligence and renewable energy, are creating new markets and driving significant growth in specific sectors. This long-term growth potential, they suggest, partially justifies the current premium valuations.

- Innovative Sectors: Examples of sectors benefiting from technological innovation include cloud computing, e-commerce, and biotechnology.

- Long-Term Growth: BofA's outlook should incorporate projections for long-term GDP growth, highlighting the impact of technological advancement on these projections.

Analyzing BofA's Methodology and Underlying Assumptions

While BofA's analysis offers a compelling narrative, it's crucial to critically examine their methodology and underlying assumptions. A thorough evaluation is needed to gauge the robustness of their conclusions.

Data Sources and Reliability

Understanding the data sources used by BofA is critical in assessing the reliability of their conclusions. Are the data sets comprehensive and unbiased? What are the potential limitations in their accuracy or completeness? Transparency in this regard is vital for evaluating the validity of their findings.

- Data Transparency: The article should assess the transparency of BofA's data sources.

- Potential Biases: Consider whether any inherent biases might exist in the data collection or analysis process.

Economic Projections and Their Impact on Valuations

BofA's valuation models are significantly influenced by their economic projections. How accurate and plausible are these forecasts? The impact of even slight variations in these projections on the resulting valuations should be evaluated.

- Sensitivity Analysis: The article should ideally include a discussion of the sensitivity of BofA's conclusions to changes in their economic assumptions.

- Alternative Scenarios: Exploring alternative economic scenarios, and their implications on valuations, would add to the analysis.

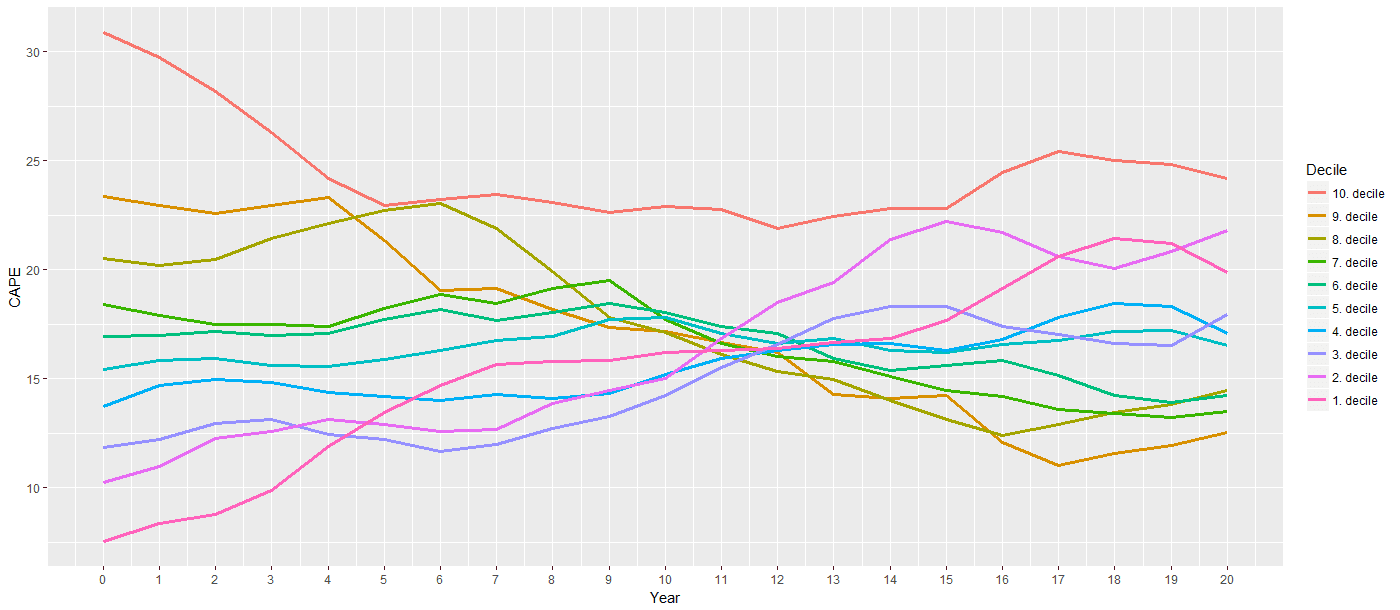

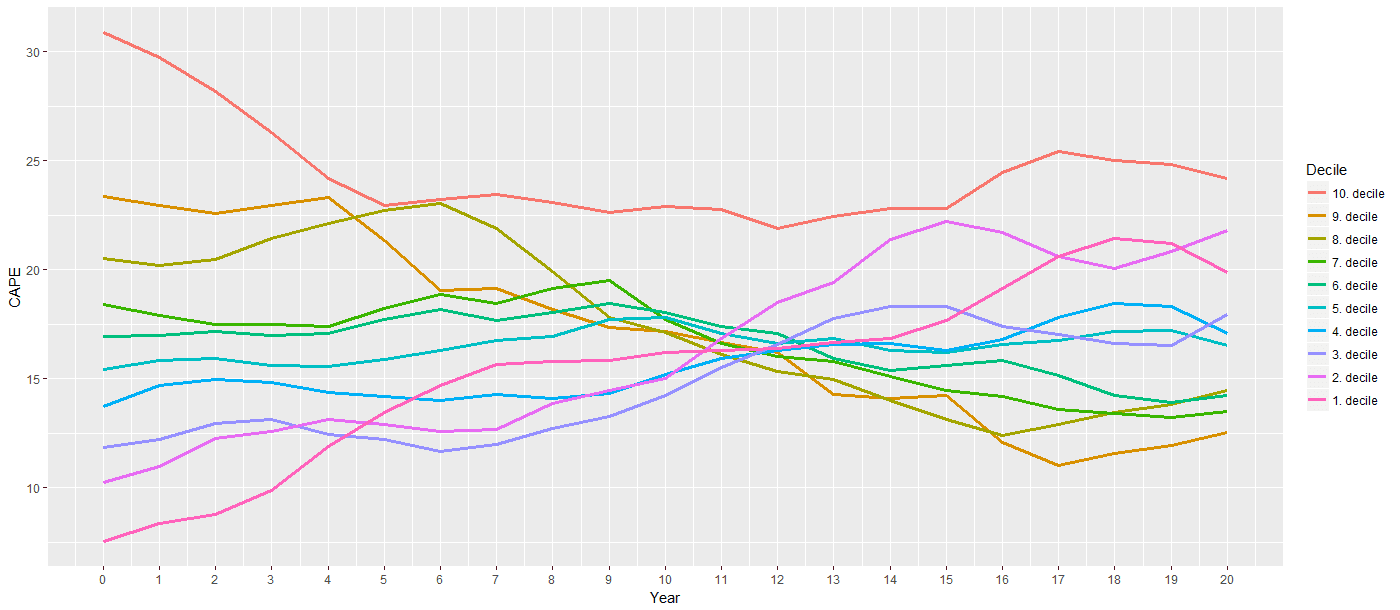

Comparison to Historical Valuations

Comparing current valuations to historical precedents provides crucial context. BofA's analysis likely includes such comparisons. However, it's important to evaluate the extent to which these historical comparisons are truly relevant in today's unique economic landscape, given factors like low interest rates and technological disruption.

- Historical Context: Referencing historical valuation multiples (e.g., Price-to-Earnings ratio, Price-to-Sales ratio) and comparing them to current levels is essential.

- Key Differences: Highlight the key differences between the current market environment and past periods with comparable valuations.

Counterarguments and Potential Risks

Despite BofA's optimistic outlook, acknowledging potential counterarguments and market risks is crucial for a balanced perspective.

Inflationary Pressures and Their Impact on Stock Prices

Rising inflation poses a significant threat to corporate profits and market valuations. Inflation erodes purchasing power, potentially dampening consumer spending and impacting corporate earnings growth. BofA's analysis needs to account for the potential impact of inflation on their projections.

- Inflationary Expectations: Discuss the current market consensus on future inflation rates and their potential impact on stock prices.

- Fed Response: Analyze the potential response of central banks to rising inflation, and its effect on stock markets.

Geopolitical Uncertainty and Market Volatility

Geopolitical events and increased market volatility can significantly disrupt market trends. Unforeseen international conflicts, trade wars, or political instability can negatively impact investor sentiment and lead to market corrections. BofA's analysis must consider these potential risks.

- Geopolitical Risks: Discuss specific geopolitical risks that could impact the market, and their potential severity.

- Market Volatility: Analyze historical data on market volatility in response to geopolitical events.

Potential for a Market Correction

The possibility of a market correction, even a significant one, must be acknowledged. While BofA expresses confidence, the likelihood and potential severity of such a correction, and its impact on valuations, are crucial points to consider.

- Market Correction Triggers: Identify potential triggers for a market correction, such as rising interest rates, unexpected economic slowdown or major geopolitical events.

- BofA's View on Corrections: Include any commentary from BofA regarding the likelihood and potential impact of a market correction.

Conclusion: Weighing BofA's Perspective on Stretched Stock Market Valuations

BofA's analysis presents a compelling case for continued investor confidence, despite high stock market valuations. They highlight strong corporate earnings, supportive monetary policy, and the transformative potential of technological innovation as key factors mitigating the risks associated with stretched valuations. However, it's crucial to remember the potential counterarguments. Inflationary pressures, geopolitical uncertainties, and the ever-present risk of a market correction remain significant concerns. Therefore, while BofA's perspective offers valuable insights, investors should not solely rely on their analysis. Conduct your own thorough research, considering your personal risk tolerance and understanding of the broader economic and geopolitical landscape before making any investment decisions. Seek professional financial advice if needed to fully grasp BofA's take on stretched stock market valuations and its implications for your portfolio.

Featured Posts

-

2025 Paris Roubaix Innovative Gravel Bike Technology And Tyre Solutions

May 26, 2025

2025 Paris Roubaix Innovative Gravel Bike Technology And Tyre Solutions

May 26, 2025 -

F1 Legends Over 40 Analyzing Their Post Prime Performance

May 26, 2025

F1 Legends Over 40 Analyzing Their Post Prime Performance

May 26, 2025 -

Enquete Sur Le Nouveau Siege De La Rtbf La Ministre Galant Intervient

May 26, 2025

Enquete Sur Le Nouveau Siege De La Rtbf La Ministre Galant Intervient

May 26, 2025 -

Best Nike Running Shoes For 2025 A Comprehensive Guide

May 26, 2025

Best Nike Running Shoes For 2025 A Comprehensive Guide

May 26, 2025 -

Review Of The Best Nike Running Shoes Available In 2025

May 26, 2025

Review Of The Best Nike Running Shoes Available In 2025

May 26, 2025